Weatherford: Set To Benefit From E&P CapEx Upcycle After Weathering The Storm

Summary

- Weatherford looks set to benefit from an upswing in E&P CapEx spending after years of underinvestment.

- New products have helped the company do well in the offshore market.

- The stock trades at a discount to large, international rivals.

Vladimirovic

Weatherford International (NASDAQ:WFRD) looks like a solid way to play an eventual E&P Capex cycle, led by some strong offshore product offerings.

Company Profile

WFRD is energy services company with a presence in 75 countries and 350 operating locations.

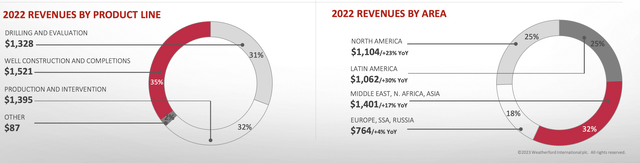

The company's products and services span the lifecycle of a well from Drilling & Evaluation (DRE), to Well Construction & Completions (WCC), and Production & Intervention (PRI). Within DRI, it offers managed pressure drilling, drilling services, wireline, and drilling fluids. Within WCC, it offers tubular running services, cementation products, completions, liner hangers and well services. And for PRI, it has intervention service and drilling tools, artificial lift, production automation & software, sub seas intervention, and pressure pumping.

The company emerged from bankruptcy in December 2019.

Opportunities and Risks

WFRD is a global operator, and thus global drilling activity is one of the biggest drivers of its business. Drilling activity is generally influenced by energy prices, although in places like the Middle East high prices is not the sole factor driving drilling, as OPEC+ likes to try to keep supply/demand somewhat in balance if it can. Activity in North America, where WFRD derives about a quarter of its revenue, tends to be more price dependent. Overall, strong energy prices, particularly oil prices, have helped drive WFRD's results.

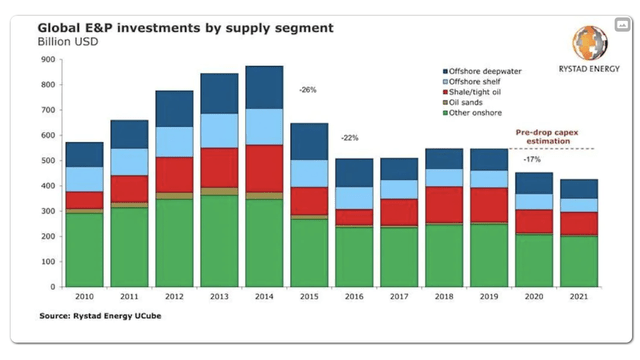

WFRD should also benefit from years of underinvestment in the E&P sector. E&P Capex peaked at nearly $900 billion in 2014, and has been under $600 billion since 2016. As such, energy industry Capex should eventually begin to be on the upswing.

E&P CapEx (Rystad (Oil & Gas Journal))

On its Q4 earnings call, the CEO of rival Baker Hughes (BKR) said:

With years of underinvestment now being amplified by recent geopolitical factors, global spare capacity for oil and gas has deteriorated and will likely require years of investment growth to meet forecasted future demand. For this reason, we continue to believe that we are in the early stages of a multiyear upturn in global activity and are poised to see a second consecutive year of solid double-digit increases in global upstream spending in 2023. In addition to strong growth in traditional oil and gas spending we also believe that the Inflation Reduction Act in the U.S. and potential new legislation in Europe will support significant growth opportunities in new energy in 2023 and beyond."

Oilfield service companies have also benefited from general labor shortages. This combined with cost inflation should help drive revenue growth as well, particularly in North America. Lower nat gas prices might hinder some North America activity in natural gas basins, and there are still some infrastructure constraints in places like the Permian. However, there has also been a bit of an inflection in offshore Gulf of Mexico activity.

For its part, WFRD is most excited about the Middle East and to a lesser extent Latin America, which was a very strong performer in 2022.

On its Q4 call, WFRD CEO Girishchandra Saligram said:

The momentum of our international markets continues to gain traction and support the multiyear up-cycle view across all segments and markets. Middle East and Latin America activity continue to be robust, and there will be incremental opportunities as activity further ramps up.…

"Latin America, if you look at just on a numbers basis, it was our most robust region, grew 30% last year. We are still continuing to be excited about Latin America, but that will again taper down a little bit. We got the bulk of our growth. And so this year, we will be building on that and driving margin expansion. Middle East is probably the area we're the most excited about, as I've referenced multiple times on the call. We think the Middle East growth will be head and shoulders above all of the other regions, and will really spearhead the overall company growth and should be high teens to 20-plus percent just on a stand-alone basis"

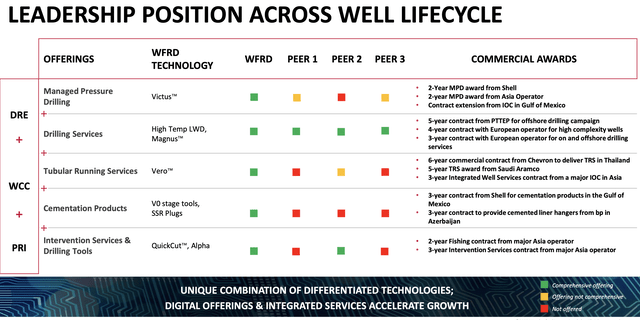

Innovation will also continue to be key, and on that front WFRD has been offering a number of new products. The company is particularly excited by its intelligent managed pressure drilling (MPD) product Victus, and its tubular running services product Vero. Both of these products have been showing strength, especially in deepwater drilling.

Saligram talked about WFRD's MD opportunity at a Goldman Sachs conference last year, saying:

So for MPD, what is really interesting about this product line for us in this business is it's really not about us chasing the market or us chasing volume or trying to grow share, but it's an adoption game. So less than 10% of the wells drilled globally today utilize MPD. So for us, the way we think about this, it is about customer education. It is about providing precedents theory. It's going and doing analysis on a customer-by-customer, basin by basin basis and showing them the importance and the impact of what MPD can bring. ..

Now look, you asked about switching costs, for example. If you look at it at a purely discrete basis, yes, MPD adds cost into your drilling programs. But when you look at it on the overall total cost in terms of the risk management effect of it and what it saves you in terms of managing hazards, overall, it is a better economic value proposition for customers, and that's something that we've been able to prove in multiple situations."

When looking at risk, drilling activity and energy prices are still at the top of the list. The company went bankrupt previously during an energy price downturn, and there was even talk it would have to file "Chapter 22" bankruptcy after it emerged from its first bankruptcy.

That said, the balance sheet is now in much better shape, with leverage down to 1.4x, the lowest it's been for the company in 15 years. In addition, the company has been FCF for 3 straight years.

Geopolitical uncertainty around Russia-Ukraine, as well as China; labor inflation; and supply chain disruptions are other potential headwinds. The company does have some exposure to Russia, which will be a drag on results.

Valuation

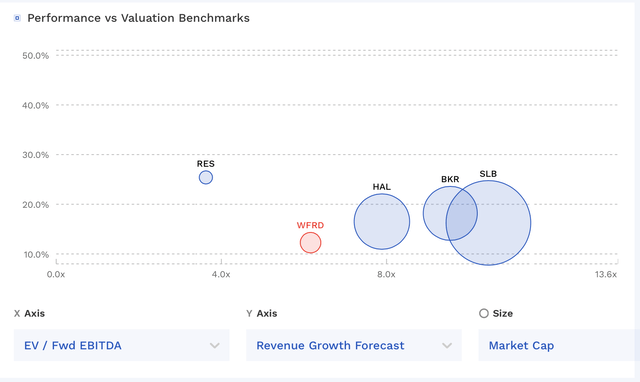

WFRD currently trades around 5.5x the 2023 consensus EBITDA of $987.6 million and 4.8x the 2024 consensus of $1.13 billion.

It trades at a forward PE of 15x the 2023 consensus of $3.66.

Analysts expect the company to grow revenue by 12% in 2023.

WFRD trades at discount to large international rivals BKR, Halliburton (HAL), and Schlumberger (SLB). Given its past issues, this is not a surprise.

WFRD Valuation Vs Peers (FinBox)

Conclusion

WFRD is a solid play on the theme of the need for increasing Capex in the oil patch. Meanwhile, it has won some nice contracts the last couple of years and its newer products are gaining traction, particularly in the offshore space, which has been seeing an upturn.

The stock trades at a nice discount to larger international rivals given its past bankruptcy issues, but the balance sheet is much improved and this is a new management team from those days.

Place a 6x '25 EBITDA multiple on the stock and you have a nearly $80 stock, while 7x will get you to around $95.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.