Williams-Sonoma: Resilient Profit Margins Means Shares Are Clearly Undervalued

Summary

- Williams-Sonoma's solid guidance in their recent earnings call shows resilience despite the headwinds facing the retail industry.

- The company believes their profit margins have structurally improved due to better inventory management, ad cost optimization, improved pricing power, higher e-commerce sales, and a focus on profitable locations.

- Williams-Sonoma's low valuation presents an attractive opportunity for investors, with shares trading significantly below our estimated fair value.

Evrymmnt/iStock via Getty Images

We were very reassured by what we heard on Williams-Sonoma's (NYSE:WSM) most recent earnings call. Guidance was solid despite the well-known headwinds the company and most retailers are facing, including supply chain issues, high inflation, consumers shifting spending towards experiences and away from products, a weakening economy and cooling housing market, etc. These headwinds are expected to be present during FY2023, which is why we were reassured that the company provided solid guidance despite these issues. In particular we were listening carefully for comments regarding the sustainability of current profit margins.

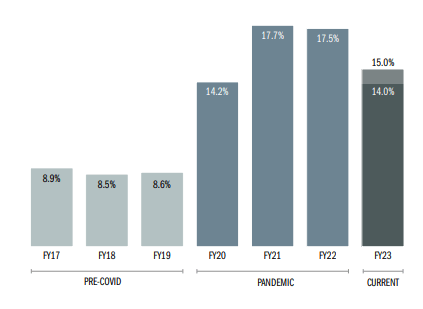

We believe the only explanation for the severe undervaluation in the shares is that many investors believe current operating margins to not be sustainable, and that they are worried the company will return to the pre-Covid operating margins that were below 10%. For this reason it was great to hear that the company is setting itself a target of maintaining at least a 15% operating margin once the economic environment improves, and an operating margin of between 14% and 15% for FY2023, despite the headwinds. Williams-Sonoma provided several reasons why it believes its operating margin has structurally improved, and why it should remain resilient going forward.

For 2022 the company delivered solid results despite the external environment being far from ideal too. The business grew ~5% and significantly outperformed the US home furnishings industry, which only grew ~1%. This means the company is taking market share during a difficult period from weakened rivals. This helped full year 2022 revenue come in at $8.67 billion, roughly 6.5% higher compared to the previous year. This led to diluted earnings per share of $16.54, about 11% higher compared to the previous year. Just in Q4 the company generated diluted earnings per share of $5.50.

While Williams-Sonoma's long-term guidance is for mid to high-single-digit top line growth, given the macroeconomic uncertainty this year, the company expects revenue growth to moderate to -3% to +3%, and the operating margin to be between 14% and 15%. In other words, the company will likely see some earnings deterioration compared to 2022, but it should remain well above pre-Covid sales and margins. If the company delivers on this guidance it would be very difficult to argue that shares are not significantly undervalued.

Resilient Profit Margins

The critical factor affecting Williams-Sonoma's valuation is the resiliency of its profit margins. At current prices the market appears to believe operating margins will revert back to pre-Covid levels, but the company insists that they have been structurally improved for a number of reasons.

Williams Sonoma Investor Presentation

These include better inventory management, ad cost optimization, improved pricing power, higher e-commerce sales, and focusing on its most profitable locations. This was explained in detail during the earnings call by CFO Jeff Howie, including the company's commitment to avoid site-wide promotions.

We see six key drivers underpinning this 15% operating margin floor. First is our supply chain efficiency. Like I’ve been talking to, our first half headwinds will become tailwinds that will sustain our gross margin over the long term. Second is our ad cost optimization. Our in-house model with first-party data and our own hands on the keyboard allows us to continue to optimize ad spend. Second is our -- third is our pricing power. Our in-house design, proprietary products, command a higher price point in the market, and enable us to forgo site-wide promotions. And I'll mention that we remain committed foregoing site-wide promotions as an ongoing basis. Fourth, our cost and inventory reductions. Our results speak to our financial discipline and cost controls. Next is our e-commerce sales mix where we continue to drive growth in the higher contribution channel of the e-commerce. And finally is our retail optimization strategy, which we've spoken to, where we're targeting fewer and more profitable stores. The key point here is our operating margin is sustainable at 15% and could even go higher with more leverage from higher revenues.

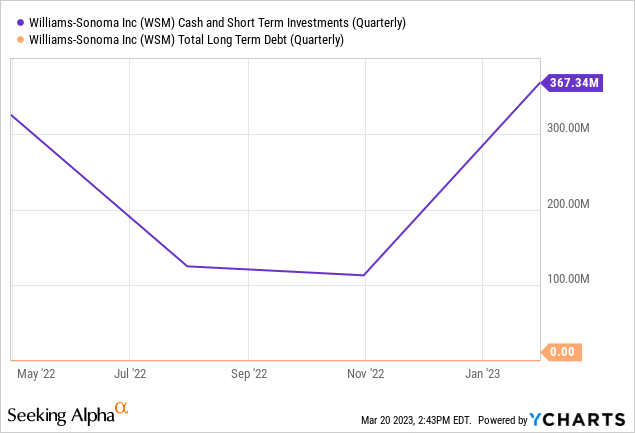

Strong Balance Sheet

One thing we certainly appreciate with Williams-Sonoma is its extremely strong balance sheet, which ended the quarter with a cash balance of ~$367 million and no debt outstanding. This gives the company the option to continue returning a very significant percentage of its earnings to shareholders in the form of dividends and share buybacks without compromising its financial health.

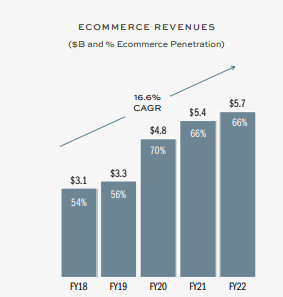

E-Commerce Juggernaut

Given its low valuation, it is clear that the market is valuing Williams-Sonoma as a brick-and-mortar retailer, rather than as a fast growing e-commerce business. This is despite the fact that the company is the 22nd largest e-commerce retailer in the US, and that ~66% of its revenue is generated online and growing at a ~16% CAGR.

Williams Sonoma Investor Presentation

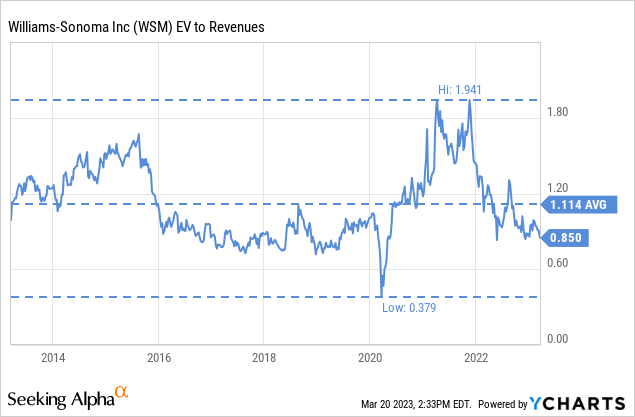

Attractive Valuation

Despite operating margins having improved substantially in the last few years, shares are trading with an EV/Revenues below their ten year average. Given the solid profitability the company is delivering we believe an EV/Revenues multiple of 0.85x to be too low. Looking at other retailers we see Amazon (AMZN) is trading with an EV/Revenues multiple of ~2x, and RH (RH) at ~1.7x.

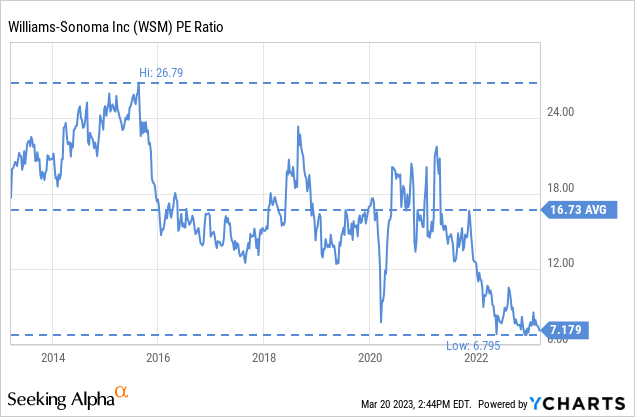

At current prices around $119 the trailing twelve months price/earnings ratio is ~7.2x. This is less than half the ten year average. Clearly the market is pricing profit margins moving back closer to pre-Covid levels. While the operating margin is expected to suffer a slight deterioration in FY2023, the forward p/e ratio remains quite undemanding at ~8.5x.

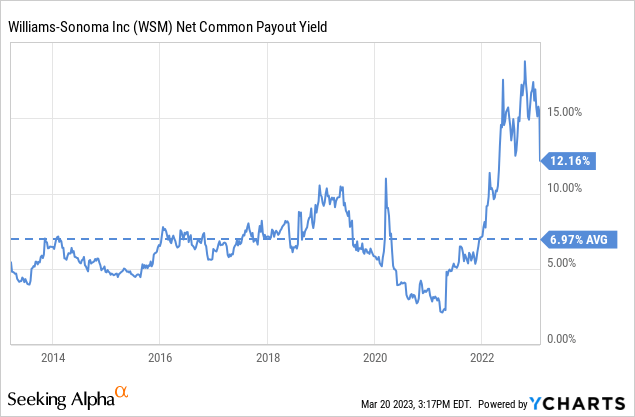

Another sign that shares are currently trading at a very attractive level is the enormous net common payout yield, which combines the dividend yield and the buyback yield. By itself the dividend yields ~3%, but the company is currently returning significantly more through share repurchases.

Based on our estimates for future earnings we calculate a net present value of ~$222 per share. We therefore believe shares to be trading at an almost 50% discount to their fair value. The key assumption is that operating margins remain resilient with a ~15% floor.

| EPS | Discounted @ 10% | |

| FY 23E | 13.69 | 12.45 |

| FY 24E | 14.35 | 11.86 |

| FY 25E | 14.80 | 11.12 |

| FY 26E | 18.19 | 12.42 |

| FY 27E | 19.10 | 11.86 |

| FY 28E | 20.05 | 11.32 |

| FY 29E | 21.06 | 10.81 |

| FY 30E | 22.11 | 10.31 |

| FY 31E | 23.22 | 9.85 |

| FY 32E | 24.38 | 9.40 |

| FY 33E | 25.60 | 8.97 |

| Terminal Value @ 2% terminal growth | 319.94 | 101.94 |

| NPV | $222.31 |

Risks

We see two big risks for shareholders of Williams-Sonoma. The first one is a potential recession that drastically reduces discretionary spending in the US, resulting in revenue and margins missing the company's guidance. Longer-term we see Amazon as the biggest potential risk given their history of aggressive pricing. So far the company has proven it can successfully and profitably compete with Amazon and other e-commerce giants, but the competition could intensify in the future forcing the company to reduce prices and become more promotional.

Conclusion

While FY2023 is looking like a complicated year for Williams-Sonoma, we were reassured by the company's commitment to maintaining a 15% operating margin floor longer-term. There are good reasons to believe the company's profitability has been structurally improved. We believe shares are trading with a significant margin of safety, at what we estimate is an almost 50% discount to fair value. It would appear the market believes profit margins will revert to pre-Covid levels. The market is also not willing to value the company as a thriving e-commerce business. While there are some risks to consider, shares look attractive for long-term investors. After reviewing the most recent earnings results we are maintaining our 'Strong Buy' rating.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of WSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.