London Stock Exchange: A Strong Company With Great Potential For The Future

Summary

- London Stock Exchange is a company with a gross profit as high as that of technology companies.

- Coupled with a moat-like business, as the industry is dominated by a few players in each region.

- And they have good growth prospects with their analytics business.

Evening Standard/Hulton Archive via Getty Images

Thesis

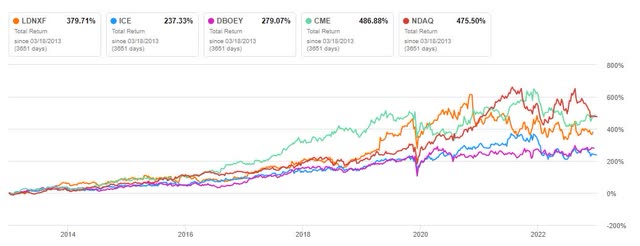

Stock exchanges have produced fabulous returns in the past and there is a case to be made that they can continue to do so. The London Stock Exchange (OTCPK:LDNXF) is one of them. Great gross margins and improving earnings year on year have been the reason for this. The latest results show that they are still on the right track. So you could be looking at a return that should be in the low double digits, even if you pay the premium price that is currently being asked. And it could be argued that even at this valuation, returns in the high teens are achievable.

Analysis

The London Stock Exchange met its targets in 2022, and they even raised their target for synergies next year because they delivered faster than they thought they would. FCF of $1664m, representing an FCF yield of 2.79%, was used to increase the dividend by 12.6%, buyback 300m shares and make 4 acquisitions. According to their Q4 earnings call, they aim to buy back $1 billion of shares in 2023.

The acquisition of TORA improved order execution and management capabilities and helped create a more efficient workflow. Last year they formed a partnership with Microsoft (MSFT), in which Microsoft also took a 4% stake in the exchange, to develop new products for data and analytics, or perhaps even create a new market for modelling and analytics as a service. Their Workspace product has received ~200 updates in the last year and is likely to improve even more in the coming years due to the deal with Microsoft.

As the 4 acquisitions last year were relatively small, they plan to make larger acquisitions as part of their strategy because they are the same work as the small ones. Total income for 2023 is expected to exceed the growth rate of 2022, as they forecast an increase of 6-8%.

As you can see in the picture above, they are the world leader in real-time data and many people think that data is like the new oil and they are also a top 3 index provider which is a big and growing industry. So they are more of an analytics company than an exchange, which you can see in the really strong gross margin of 85%+.

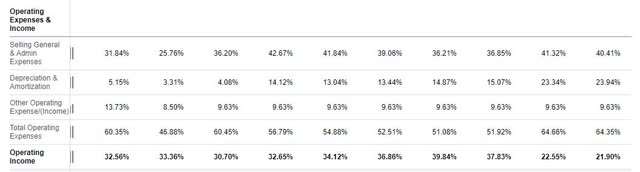

Operating margins, which have been in the low 20% range for the last two years, which is still pretty good, have come down from really strong numbers in the 30% range as operating expenses have gone up.

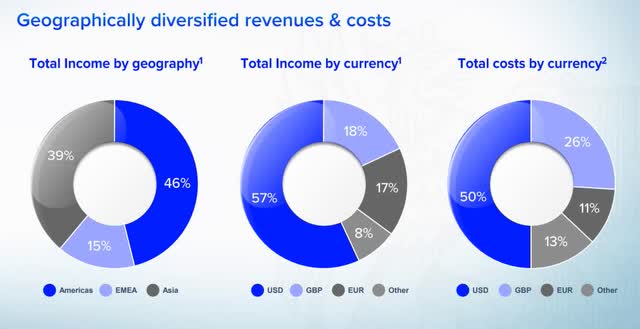

While the name may lead many to believe that the majority of income will come from Europe, this is not the case. 85% of incomes come from Asia and the Americas, and 57% of revenues are in USD, which presents a currency risk.

The reverse DCF is based on diluted EPS of $2.81 and a terminal multiple of 32. This implies a share price growth rate of around 11% over the next 10 years, which is in line with historical EPS growth. A large share buyback program could lead to even higher EPS growth. The $1bn planned for 2023 represents 2% of the market cap. So it looks like the shares are fairly valued if you believe that the future growth rate will be in line with the historical one. If you think that the Microsoft deal + buyback program will boost the EPS growth rate even more, you could argue that the shares are undervalued.

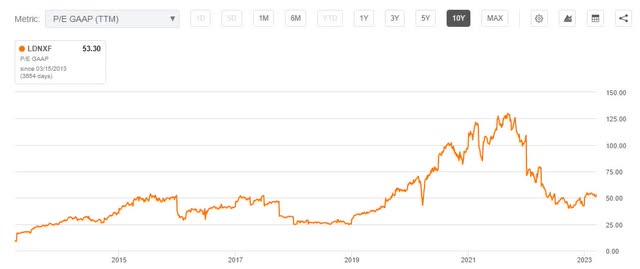

Classical financial ratios such as a GAAP P/E of ~50 and an EV/EBIT of ~28 paint a contrasting picture of an expensive company.

Conclusion

The London Stock Exchange is by no means a bargain, but as with everything in life, you have to pay for quality. And this is a company that is never really cheap, but still managed to outperform the market by a wide margin.

Take advantage of periods when the market is willing to offer this company at a lower P/E ratio in the 20s. This should lead to really good returns if they can continue to perform as they have in recent years. And with the new Microsoft deal and plans to return cash to shareholders, this should be possible.

To achieve a 10% CAGR over the next 10 years, they need to grow EPS by 11% over that period. For a quality compounder like this, that is quite doable. And with one or two players dominating the market in each region, they are protected from too much competition.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.