SCHD: Returns, Volatility And Maybe A Dividend Growth Benchmarking Tool

Summary

- SCHD is a strong dividend growth ETF.

- Compared to five well-known dividend growth companies, it also performed quite well in terms of total return and volatility.

- SCHD could possibly become a cornerstone of your portfolio, but at a minimum, it could effectively serve as a benchmarking tool.

MRBIG_PHOTOGRAPHY/iStock via Getty Images

Where To Begin

I've been investing now for more than 30 years. In my early days, I was investing small amounts into various high fee mutual funds. Then, I thought I got smart, speculated on some options, and lost hundreds of dollars. I pivoted again, buying index funds, specifically the Vanguard Small Cap Index Fund (VSMAX) and second the Vanguard 500 Index Fund Admiral Fund (VFIAX). However, mostly I've been buying dividend growth stocks, with some funds also flowing into various big growth plays, such as Alphabet (GOOGL) (GOOG), Meta (META), Amazon (AMZN), and small growth plays, like Palantir (PLTR).

Above all, there have been two huge lessons. First, buying and holding works. Specifically, time in the market is your best friend, especially when you're holding onto to great companies. Yes, buying matters, and timing helps, but it's the holding that is most critical. Let time do the heavy lifting. Second, it's very difficult to get an edge. There are ways to beat the market, but it's very rare and even impossible to always to beat the market. Said another way, the market itself is a dull lumbering beast and it's extremely hard to do better, even when you're working hard to win. You better love the Colosseum.

Adding this all up, I've done well with my investments. However, it's far less about my genius or excellent stock picking skills. It's been about relentlessly buying, adding, holding, and reinvesting in winners. Keep the money working.

That brings us to the here and now. Once again, there is turmoil. There is fear. So, does it make sense to invest right now? Probably. Then again, with a long enough timeframe, it's almost always a good time to invest. That's because you're piggybacking on the hard work of other people, inside the companies you're slowly acquiring via buying shares.

In the rest of this article, my specific goal is to provide a big picture view of Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) because maybe it's better to invest this way, instead of stock picking. Let's start from the top.

What's SCHD?

Let's start high level. SCHD is an exchange-traded fund that seeks to track the performance of the Dow Jones U.S. Dividend 100 Index. The index is designed to measure the performance of high dividend yielding US stocks with a history of consistently paying dividends.

SCHD invests in a diversified portfolio of US large-cap stocks that pay consistent and stable dividends. The fund's objective is to provide investors with exposure to high-quality dividend-paying companies while seeking to provide long-term capital appreciation. In other words, you get stock price appreciation but also high quality dividends.

SCHD provides investors with the benefits of diversification, professional management, and low fees associated with it. In fact, the 0.06% management fee is extremely low and it's one of the reasons I kept looking, looking and looking some more. Like most investors, I hate taxes and fees.

Picking Five Great Companies

I'm invested in over 60 stocks. What I'm going to do is cherry pick five of my best performing dividend stocks, that I've owned for at least five years. The idea here is that these are some of my winners, and I want to show you how they did compared to SCHD. Now, here's the list:

Again, I've owned all of these for at least five years. They all pay dividends. So, we'll see how SCHD did against these stocks. This isn't going to be perfect, but it will give us a great high level view of success or failure. Or, perhaps something in the middle.

Looking at Total Return

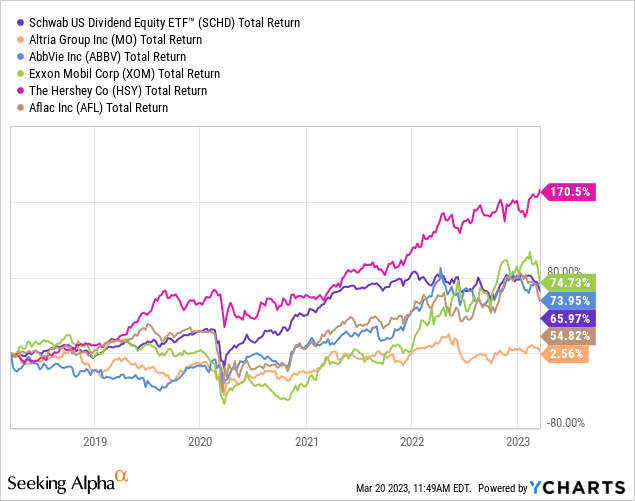

Let's take a look at all five stocks and SCHD.

SCHD did just fine. Clearly, HSY has been a big winner. XOM and ABBV both beat SCHD, but SCHD beat AFL and MO. Interestingly, if we average HSY and MO total returns, we end up doing better than SCHD but not by some wild and crazy amount. In fact, the average total return of these five stocks is about 75%, whereas SCHD is about 66%. At the same time, without HSY, the average total return of MO, ABBV, XOM and AFL is about 52%.

It's easy to see that without HSY the concentration risk here would be real. Similarly, MO dragged down performance, even with a high dividend. The key point is diversification doesn't exist here, which means you've got to be smart or lucky with your picks. On the other hand, SCHD is naturally diversified. While it's not literally "The Market" it's highly diversified, at least compared to these five stocks. I think I'd also add here that the five companies I've selected are all high quality, if not very high quality.

What About Volatility?

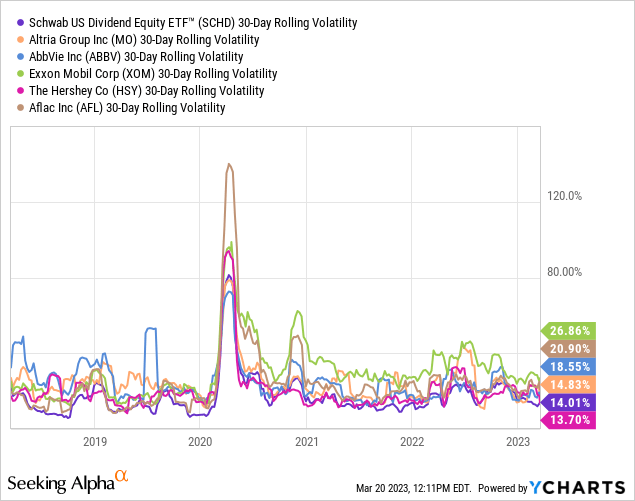

We can start by "squinting" at 30-Day Rolling Volatility.

The current numbers are interesting but not as important as the actual trends. When I'm using this data, I generally look for relative differences. In this analysis, it's very clear that ABBV was the most volatile in 2018 and 2019 whereas XOM has been the volatility winner since 2020 through today. At the same time, SCHD has been there at the bottom. HSY and AFL are down there too. But, SCHD edges AFL out too, at a glance.

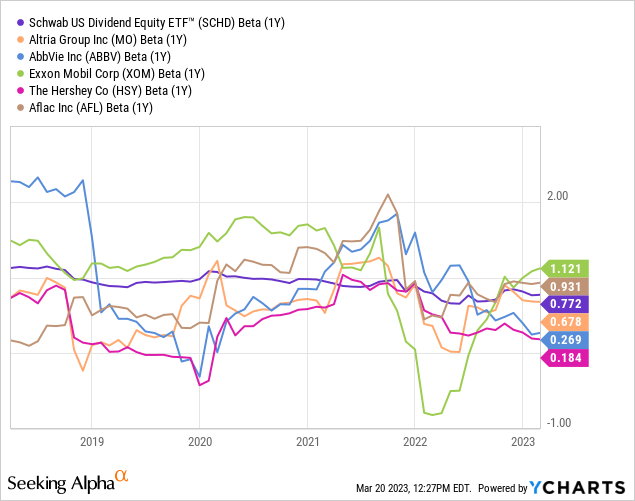

That's interesting, but how about Beta? As a matter of definition, Beta represents the sensitivity of a stock's returns to changes in the returns of a benchmark. I don't consider Beta as a great measure of inherent risk. However, I do use it to better understand how hard it is to hold a stock when the price drops. Low Beta stocks are easier to hold than high Beta stocks, at least in my experience. In any event, Beta measures volatility.

Seems weird, right? That's because all five stocks and SCHD are being measured against the S&P 500 Total Return as the benchmark. In a sense, this is good news for all these stocks and SCHD, because while they are all a bit volatile, they have spent a lot of time below 1.0, including right now, except for XOM.

More importantly, it appears that HSY, AFL, MO and SCHD have all spent the most time below 1.0, with HSY really being the stalwart of stability. XOM and ABBV have whipped up and down far more, often being red hot or ice cold.

Let's put this all together. If you want lower volatility, then you're probably going to have to leave out XOM and ABBV. But, that would only leave you with MO, AFL and HSY. You would have seen lukewarm results MO and AFL, although HSY would have been a winner. However, in contrast, with SCHD, you'd enjoy lower-than-average volatility, while getting the diversification and total return.

Spinning this just a bit, investors with a trigger finger might have a difficult time holding XOM and ABBV, selling on huge drops. Also, buying, holding and reinvesting in constantly winning winners, like HSY, could feel very difficult. You'd rarely feel like you're getting a great deal.

The deep point here is that without a proper mindset, even investing in a small pool of high quality companies might prove to be very challenging, especially compared to SCHD. Remember, SCHD was shown above to be consistently less volatile than the S&P 500. It could be argued that holding SCHD is even easier than holding "The Market" via the S&P 500 Trust ETF (SPY). Plus, with SCHD, you're collecting higher dividends, seeing the cash pour into your account.

Benchmarking

Keeping this simple, all investors ought to have something to measure against. You don't just measure things as an investor. It's all about measuring one thing in relation to another.

As I've explained, I am predominately a dividend growth investor. For years I've been turned off by many dividend growth ETFs for different reasons. For example, ProShares S&P 500 Dividend Aristocrats ETF (NOBL) sports a 0.35% expense ratio. Vanguard High Dividend Yield ETF (VYM) is interesting but the dividend growth appears to be lower than SCHD plus price performance isn't quite as good. I could go on, and I could mention more ETFs. NOBL, VYM, and the others are generally "good" but SCHD seems to be better, in almost all ways. I'd love to hear what you think, and if there's something that's obviously better, but I digress.

SCHD enjoys a solid track record, low expenses, relatively high dividends, high dividend growth and more. And sure, if the market takes a hit, SCHD will take a hit, but given what we know about its volatility, perhaps it will not be as painful, plus we'll be collecting higher dividends along the way.

Come in close for the most important point. SCHD can probably replace the majority of the stocks in a dividend growth portfolio. This is a profound insight when you add up all the benefits:

- High starting yield

- High dividend growth

- Acceptable diversification

- Low volatility

- Modest fees

Here's a quick story. I was talking to a friend who is an intense investor. We were comparing our styles. He was talking about spending hundreds of hours studying a pile of stocks, only to pick 1-2 every quarter. His results have been good and sometimes excellent. But, his time investment is tremendous. Then it struck me that even my own modest time investment studying individual stocks would be radically decreased just by putting money into SCHD.

The lesson might be very simple and almost too obvious. Dividend growth investors might want to seriously consider using SCHD as their benchmark. Can your new pick beat SCHD? Is your new pick growing faster than SCHD? Is the starting yield higher along with the dividend growth?

I'm certainly not lazy about my stock analysis. But, I like the idea of having a rather strong benchmark, or at a minimum, something that can faithfully stand in as a benchmark. I very much like SCHD as an opportunity for reflection but also as an actual investment.

Wrap Up

We've looked at SCHD versus five of my best individual stock investments. We specifically saw that SCHD did just fine in terms of total return with lower volatility. Although I didn't get deep into the yields, SCHD has a good starting yield and excellent dividend growth. I also didn't get into macro factors, such as inflation. But, SCHD appears to be at least treading water, but perhaps it's doing much better depending on your time horizon.

At this point in time, SCHD is down about 6% in 2023. Over a one year period, it's down about 10%. Over five years, it's up about 42% and that includes the big drop in 2020 and the pain in 2022. In other words, if you're buying now, you a certainly not buying at the top.

SCHD's starting yield is around 3.6% which is excellent. It was higher in 2022 for a short while, and in 2020, it went above 4% for a bit. However, looking back over 10 years, SCHD's starting yield is quite acceptable:

SCHD Starting Yield (10-Year View) (Seeking Alpha)

I believe we are in the Buy zone right now. Anything below $72 is rational. And, although I doubt we'll see it, anything down around $66 turns SCHD into a Strong Buy. If you get nothing else from this, just be sure to think about SCHD and use it when you're looking at individual dividend growth stocks. You might be quite surprised that SCHD comes out ahead.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SCHD,MO,ABBV,XOM,HSY,AFL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.