Ryanair Keeps Delivering

Summary

- Ryanair Holdings plc had a strong quarter with revenue growth exceeding cost growth.

- Ryanair Holdings plc sees strong demand for Easter and Summer flights.

- The airline is operating above pre-pandemic levels, expanding its market share and that should help Ryanair Holdings plc going forward.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

Bradley Caslin /iStock Editorial via Getty Images

Ryanair Holdings plc (NASDAQ:RYAAY) is one of the airlines I like. It is by no means a glamorous airline; the airline takes you from points A to B at the lowest fare possible that also allows them to make a profit in the process. It does so by carefully keeping track of costs and optimizing ancillary revenue streams. That cost-conscious approach is paying off for the company. In this report, I will be analyzing the Q3 2022 results and look at the stock price performance.

Ryanair Stock Is Up

Seeking Alpha

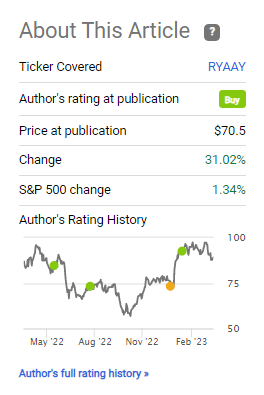

In July, I published a report where I continued marking Ryanair Holdings plc stock a buy despite a fragile profit pressured by fuel prices. Since then the stock has gained 31% compared to a 1.3% for the S&P 500 (SP500), showing strong market outperformance, which is what I looking for in stocks I have a Buy rating on.

Ryanair Indicators Surge On All Levels

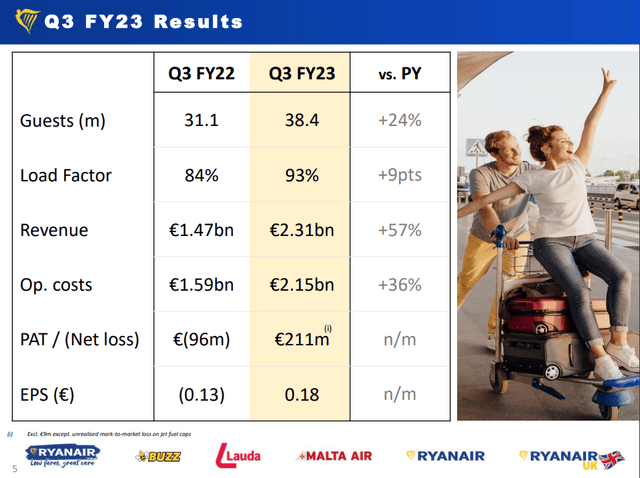

Year-over-year, the number of passengers grew 24% but more importantly, traffic exceed pre-pandemic levels by 7%, with fares being 14% higher. Together with strong ancillary revenues accounting for 37% of the revenues, the revenues grew by 57%. We also see continued strong demand with a 93% load factor, which even for a low-cost carrier is very strong. Furthermore, we see that revenue growth outpaced costs growth which certainly is not something that all airlines are seeing.

The result is that Ryanair generated a profit of €211 million indicating a margin of 9% in an off-peak quarter. For comparison, pre-pandemic profits for the same quarter was €88 million on a €1.91 billion revenue or a 4.6% margin. In 2019, Lauda operations pressured the margins due to intense competition with Lufthansa Group airlines. That is absent now, and we see that despite capacity constraints which reduce planned airplane deliveries, Ryanair is one of the airlines that has used the pandemic to grow beyond its pre-pandemic footprint while also benefiting from the price premium that customers are currently paying.

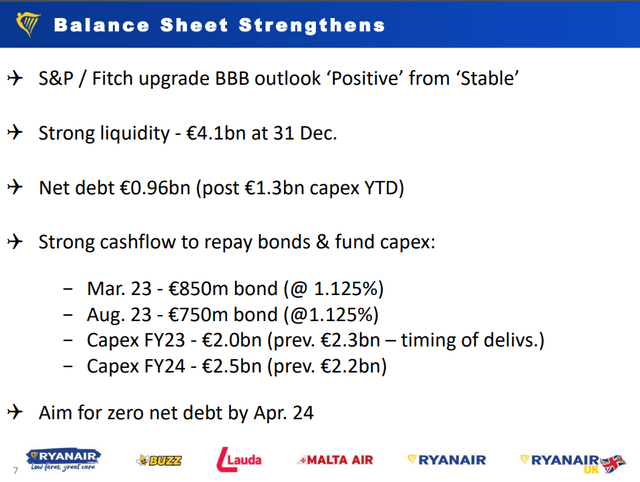

Ryanair currently has a liquidity of €4.1 billion, which allows them to easily repay the bonds due March 2023 and August 203 as well as the CapEx for FY 2023 (which ends 31st of March 2024) and Capex FY24. Adding the numbers up results in a funding need that exceeds the liquidity, but it should be kept in mind that the Capex for FY23 are largely expensed already with €730 million remaining in the final quarter. Ryanair’s operating cash flow was €1.7 billion for the nine months ended and approximately the same for H1. Most of the cash generation happens in Q1, so there is a strong liquidity and forward cash generation to be expected that covers the funding needs and we see that Capex has reduced due to timing of deliveries where €300 million in the coming years is sliding to the right.

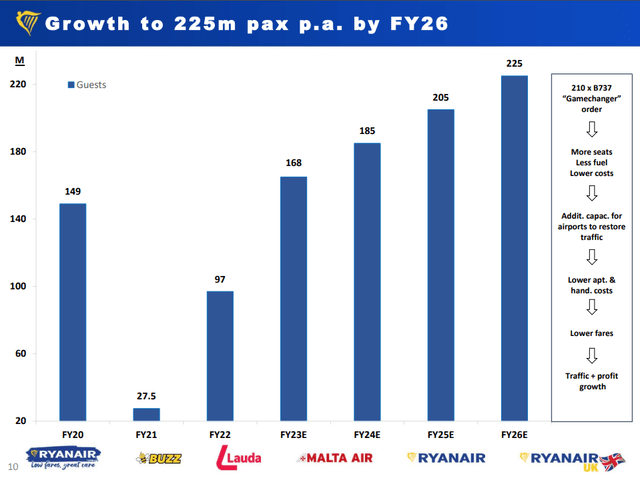

Long-Term Ryanair Targets Remain

For the full year, Ryanair is maintaining the guidance issued in January for FY2023 increasing the expected profit from a range of €1 billion to €1.2 to €1.325 billion to €1.425 billion, which indicates that for Q4 a loss of €157 million to €257 million can be expected. More interesting is the trajectory over the longer term that remains intact despite Boeing deliveries slipping. Obviously, if slips continue, Ryanair will have a problem, but they also have been seeing improvements in the stability of production, and The Boeing Company (BA) is opening a new assembly line by the end of 2024, which should further help increase and streamline deliveries and support customer fleet plans.

Are Ryanair shares a good buy?

Dhierin-Perkash Bechai

I believe Ryanair shares remain attractive. The company is operating above pre-pandemic levels, meaning that the company together with low cost carriers has eroded the market share of the legacy carriers in Europe. Going forward, international re-openings and the associated impact on travel within Europe should also fuel Ryanair’s European network.

Conclusion: Ryanair Stock Remains Attractive

Ryanair Holdings plc Q3 2023 results did not contain anything unexpected. Ryanair doesn’t guide one quarter ahead, so we don’t know whether this is the profit they expected, but I think they will be happy with the Q3 performance - and I certainly am. Q4 as guided will be loss-making, but Ryanair already had guided for that, and it maintained its previously guided range, which was an improvement over prior profit estimates. Travel trends are changing somewhat, with bookings being placed closer to the date of travel, but overall we are seeing strong results for Ryanair. However, with Asian and North American tourists returning, the company sees robust demand for Easter and summer flights.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.