Corus Entertainment: The Bottom Is Yet To Come

Summary

- Corus Entertainment’s core business (TV advertising) faces challenges and will continue to see structural decline in the years ahead.

- The structural decline and the risk of an FCF cliff imply a poor risk-reward setup for long-term investors seeking a stable and growing yield.

- While near-term dividend coverage remains ample, capital allocation will continue to focus on deleveraging and "growth" investments aimed at prolonging its FCF tail.

- We believe the "growth" investments have had limited success thus far in offsetting the decline in its legacy business, and will likely disappoint as competition in FAST/Digital channels remains fierce.

skynesher

Investment Thesis

Despite a handsome yield of 7.4% with ample free cash flow coverage, Corus Entertainment (OTCPK:CJREF) is a name long-term investors should avoid due to the high probability of a future dividend cut. The secular market decline in its core business of TV advertising faces dampened demand from advertisers and ever-increasing competitions such as streaming/FAST players as well as retail media platforms, accelerating topline decline.

While management is actively investing in its digital platforms and partnerships to capitalize on its programming rights and content, there has been limited success in diversifying its revenue base against a relatively fixed cost structure. As the trend of cord cutting persists, another round of dividend cut could be on the horizon in the next few years, particularly as leverage remains high for a declining business.

Business Overview

Corus Entertainment is a Canadian media and entertainment company focused on the creation, production, and distribution of media content. The company operates television networks, radio stations, and digital media platforms and owns content production studios.

Corus Entertainment's television assets include a variety of specialty channels focused on kids, lifestyle, and news. Some of its television networks include Global TV, Food Network Canada, HGTV Canada, and YTV. Corus Entertainment also operates a number of radio stations across Canada. Its content production companies, including Nelvana and Corus Studios, create television shows and movies. While there is in-house-created content, Corus relies heavily on broadcasting deals with major broadcasting owners such as Disney for programming.

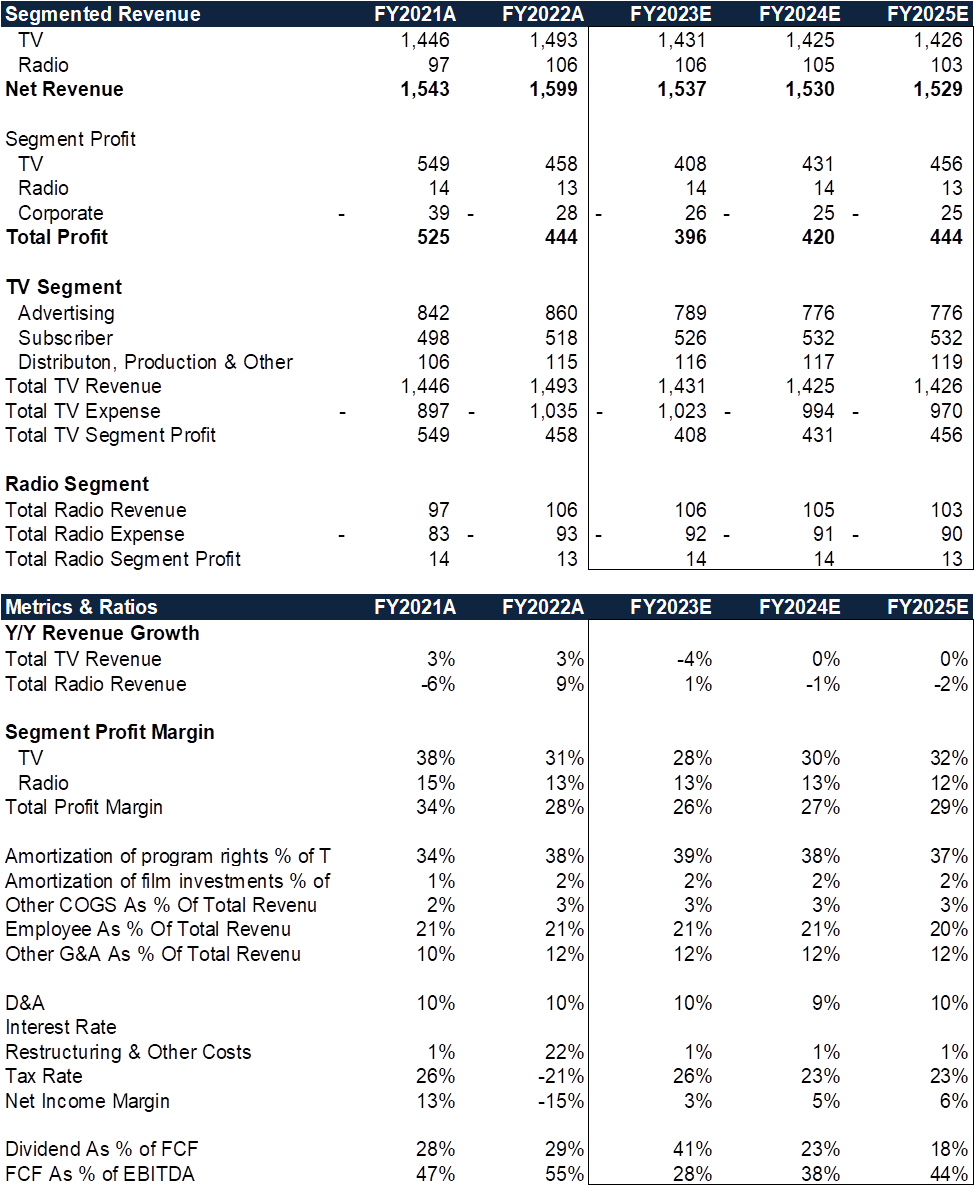

Key Financial Metrics

TV: 93% of LTM total revenue

Radio: 7% of LTM total revenue

-

LTM EBITDA margin profile: 25% on corporate level

TV: 28% segmented EBITDA

Radio: 12% segmented EBITDA

Historical Average FCF Conversion From EBITDA: 50-55%

Corus Entertainment - Financials (Author)

Why Are We Looking At Corus Now?

Given the heavy retail ownership of Corus Entertainment Class B Shares (primarily for attractive distribution yield), we delve into the quality of the business, near-term cash flow generation, and outlook for the dividend. It has been a tough few quarters for Corus Entertainment. The company first issued a negative operational update on September 9, 2022, amid a deteriorating advertising market that guided down its FQ4/22 revenue, sending the stock down 8%. And in January of this year, as it reported yet another quarter of double-digit Y/Y advertising revenue decline, the board announced the deferral of its dividend decision until March 15, 2023.

It announced an amendment to its credit agreement with its bankers (dated Feb 17, 2023), revising the maximum total debt to cash flow ratio higher (temporarily through November 30, 2023) given a challenging advertising market dampening its topline. What spooked the market (sending the stock down more than 12% on the following Tuesday) was the negative covenant restricting distribution should the leverage ratio exceed a certain level. And on March 6, 2023, Corus announced that its quarterly dividend would be reduced to $0.03 per Class B share, down 50% from the $0.06 level it has maintained since December 2018. But the market has already priced in a cut as the dividend yield was close to 13%.

Corus’s share price performance has significantly diverged and underperformed its subsector average by more than 30%, and the stock is now more than 68% off its 52-week high, posing challenges for shareholders who plan to hold the stock for the long term. We contend that Corus shares are not a good investment despite the apparently generous dividend yield (even if it looks de-risked given the latest cut).

The baseline business is in structural decline, while the growth strategies have had limited success in offsetting the legacy business revenue decline. This is not a stock investors should rely on for long-term growing streams of dividend payments, as the newly set dividend level could again run into issues in a few years' time. For short-term investors who are nimble, Corus could provide a potential recovery play once the advertising market thaws out in late 2023 or early 2024. But we believe the timing is premature, and the recovery play would heavily rely on a broader market recovery for consumer demand, which we view as unlikely.

Industry Outlook

The linear TV segment is experiencing secular decline, although cord cutting is not as severe in Canada compared to the US. In Canada, the Canadian Radio-television and Telecommunications Commission (OTCPK:CRTC) noted that the broadcasting distribution undertaking (BDU) sector continues to suffer Y/Y revenue declines of 3.3% in 2021, driven by loss of subscribers. This is in line with the historical TV subscription declines of 3-5% recorded here in Canada (the highest was 5.5% cord-cutting experienced in 2019).

On average, the trend in cord cutting is expected to persist in the low single digit range. In contrast, streaming services (both paid and free formats) continue to gain traction, and free, ad-supported television (FAST) has become the hotbed of activities as of late. Corus is trying to keep up with the times by leveraging its owned content in new digital channels (websites, apps, streaming partnerships) to extend its FCF tail.

TV CPM has effectively seen double-digit price inflation given cord cutting, and the risk of CPM decline could further exacerbate earnings should the ad recession prolong (dampening not only volume but also pricing). We are wary of Corus’ ability to manage its cable-related advertising. One thing to point out is Corus’ exposure to top-of-the-funnel marketing focused on brand awareness. This sits on the opposite end of the spectrum from the bottom-of-the-funnel market focused on sales generation, which tends to be more recession-resistant.

As recession fears loom large with increasing probabilities of a "no-landing" scenario, top-of-the-funnel advertising channels could see continued weakness. The rise of retail media, combined with FAST channels, introduces new advertising inventory, introducing an additional layer of supply risk not observed in the previous downturn. For example, the Standard Media Index continues to track a double-digit Y/Y decline in H2/22 for TV advertising, while out-of-home media investments are seeing rapid growth.

While FAST channels are rapidly growing, it is unclear how the economics are divided between the US partners and Corus. The overall digital subscription business, while flat or growing single digit on a year-over-year basis, hinges on conversion from trial subscribers. As consumers continue to dial back on discretionary spending, budgets around subscription service payments could be under scrutiny. Consumers currently spend 2.5x more than estimated on subscriptions per C+R Research, suggesting room for rationalization as times get difficult. A second-tier product would easily fall out of favor in such a scenario.

Leverage & Debt Covenants Assessed

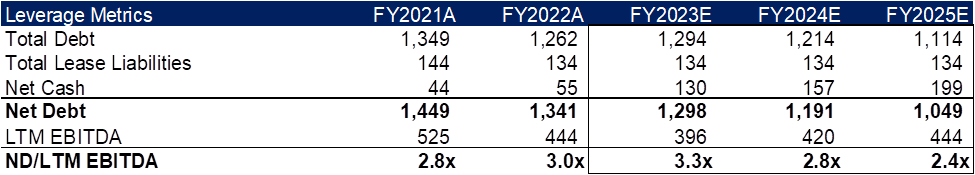

The revised credit facility covenant stipulates that the total debt to cash flow ratio ceiling is capped at 4.5x through September 2023 and lowers to 4.25x from December 2023. According to our calculation, we do not foresee the covenant being triggered throughout our forecast horizon. Combined with the fact that the revised dividend is less than 40% of FCF generation, we deem the current capital structure and allocation strategy as fair without significant near-term risk.

But Corus’ leverage will remain elevated through FY2024E (as defined above 2.5x), according to our forecast, and will only fall below 2.5x in FY2025E. This is assuming the free cash flow tail does not suffer any substantial decline driven by either macroeconomic weakness or accelerated cord cutting. Despite the reduced dividend payout, structurally lower cash flow from operations in the coming years suggests that management’s hands are somewhat tied despite its desire to delever.

Corus Entertainment - Leverage (Author)

Risks

It is important to understand Corus’s origin and its relationship with the Shaw family. In January 2016, Corus Entertainment acquired Shaw media for $2.65B, and in exchange Shaw Communications took a 39% stake in Corus. In September 2019, Shaw sold its entire stake (80.63 million Class B shares) through a secondary offering priced at $6.80. While the Shaw family is now out of the picture, there may be a chance Corus could be privatized given its large FCF generation. In addition, should there be a recovery in advertising demand, Corus stands to benefit in the near term as a way to play such a recovery.

Conclusion

We are of the view that Corus Entertainment stock is at risk of having its dividend cut again in a few years as the TV business continues to decline. Despite the underlying business generating ample cash flow at first glance, the decline of the legacy business combined with a relatively fixed cost basis translates to negative operating leverage. There remains an imbalance in the risk-reward equation for long-term investors seeking yield.

At the newly rightsized DPS of $0.03 per quarter (7.4% dividend yield as of March 17, 2023), we estimate a conservative 38% FCF payout ratio, which is sustainable for now. The only question remaining for potential investors to answer is how long they believe the FCF tail will last.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.