Hawaiian Electric: Don't Sweat The Bank, But The Stock Is Pricey

Summary

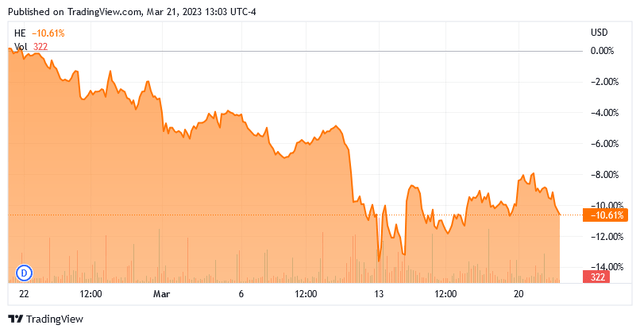

- Hawaiian Electric Industries, Inc. has seen its stock price demolished this month, probably due to its banking sector exposure.

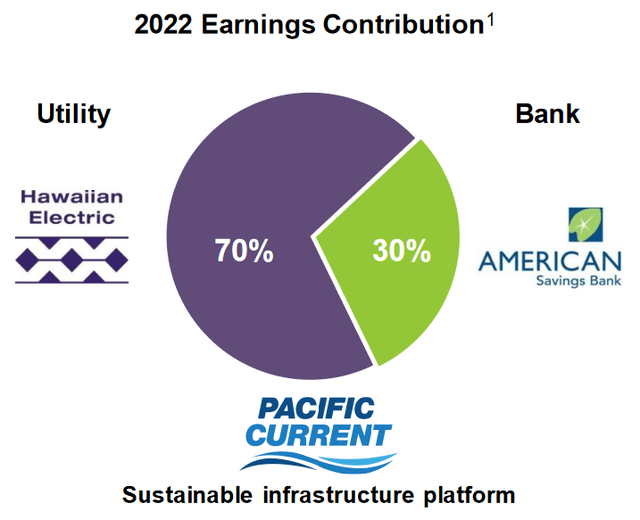

- Only 30% of the company's earnings come from the American Savings Bank, so it should be thought of as a utility.

- The bank will probably prove to be much more stable than its mainland peers through the current industry crisis.

- The company's current 3.78% dividend yield appears to be sustainable.

- Hawaiian Electric Industries stock looks rather expensive so it might make sense to see if the banking crisis pulls down the price before buying in.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

fermate/iStock via Getty Images

Hawaiian Electric Industries, Inc. (NYSE:HE) is a regulated electric utility serving the island state of Hawaii. The company also owns the third-largest bank in the state, American Savings Bank. The utility sector in general has long been a favorite of conservative investors, such as retirees, due to its remarkably stable cash flows and high yields. These are characteristics that Hawaiian Electric Industries also possesses, despite the fact that Hawaii might not be the first state that conservative utility investors think of buying a company in. The fact that the company does own a large bank though appears to be causing it some problems in the stock market, as shares of Hawaiian Electric Industries are down 10.61% over the past month:

This is a much bigger decline than other utility peers have experienced over the period and considering that there have been no major news stories about this company over the period, we can only conclude that this market decline is being driven by fears of bank runs following the collapse of Silicon Valley Bank. There are some reasons to think that the fears here might be somewhat overstated though, as Hawaii’s isolation might help prevent some of the problems that are plaguing other banks. In addition, as I pointed out in my previous article on this company, the bank is more stable than many of its peers in terms of cash flow so that only adds to the possibility that the market is currently overstating the risks here. Unfortunately, Hawaiian Electric Industries looks rather expensive despite the steep share price decline over the past month so it is uncertain whether or not a real opportunity exists to take advantage of the market’s fear.

About Hawaiian Electric Industries

As stated in the introduction, Hawaiian Electric Industries is primarily a regulated electric utility that serves the island state of Hawaii. The company also owns the American Savings Bank, which is the third-largest bank in the state. However, approximately 70% of the company’s earnings come from the utility:

As such, Hawaiian Electric Industries should be thought of as a regulated electric utility and not as a bank. This is something that could prove quite appealing to more conservative investors, which is a description of most people that have traditionally invested in the utility sector. The primary characteristic of utilities is that they enjoy remarkably stable cash flows regardless of conditions in the broader macro environment. The reason for this is quite simply that these companies provide a service that is generally considered to be a necessity for our modern way of life. After all, how many of us do not have electric service in our homes and businesses? As such, most people will prioritize paying their electric bills ahead of discretionary expenses during periods in which money gets tight. This is something that is especially important during recessions, as many people get more stressed financially during such events. That could be especially relevant for the state of Hawaii, considering that the state is highly dependent on the tourism industry and tourism tends to slow down substantially during recessions. We saw this occur back in 2020 in response to the pandemic, although the lockdowns also played a role in that. I previously mentioned the importance of this industry to the customers of Hawaiian Electric Industries in my first article on this company. While the economy is not currently in a recession, there are signs that the American consumer is getting increasingly financially stressed so the fact that Hawaiian Electric Industries is a utility means that it will likely see its earnings and cash flows hold up much better than a company that depends on consumer discretionary spending, such as most tourism companies.

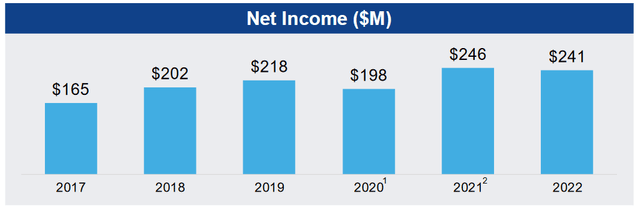

We can see the company’s overall stability quite clearly by looking at its net income. Here is Hawaiian Electric Industries’ net income in each of the past six years:

As we can clearly see, the company’s net income did not vary a whole lot over time, although there was a bit of a decline in 2020. This was probably caused by the fact that tourism to the state of Hawaii declined a lot due to the pandemic and considering that a sizable proportion of the state’s population is directly or indirectly dependent on that industry, there were probably some people that fell behind on their electric bills. This occurred in a number of other states that are not so dependent on tourist travel, too. We can still see that despite the pandemic though, the company’s profits were still higher than in 2017, which was generally a pretty strong year for the economy all around.

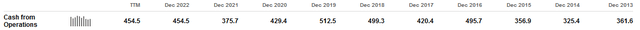

Here are the company’s annual operating cash flows in each of the past ten years:

Here we also do not see much variation, despite the fact that a lot of macroeconomic events and changes occurred over that period. This only reinforces the fact that this company enjoys a great deal of stability regardless of the broader climate. Once again, this is something that anyone can appreciate given today’s volatile economic climate.

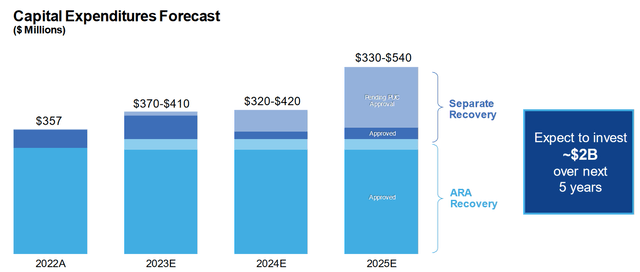

However, as investors, we are not satisfied with mere stability. We would like to see a company that we are invested in providing us with growth. As a regulated utility serving a relatively small island state, Hawaiian Electric Industries’ opportunities for growth are admittedly somewhat limited. However, the company does still have some opportunities. The most significant of these is that the company can increase its rate base. A utility’s rate base is the value of its assets upon which regulators allow it to generate a specified rate of return. As that rate of return is a percentage, any increase to the rate base allows the company to increase the prices that it charges its customers in order to earn that specified rate of return. The usual way for a utility to increase its rate base is by investing money into upgrading, modernizing, or possibly expanding its utility-grade operations. Hawaiian Electric Industries is planning to do exactly this as the company currently has a $2 billion capital budget for the 2022 to 2026 period:

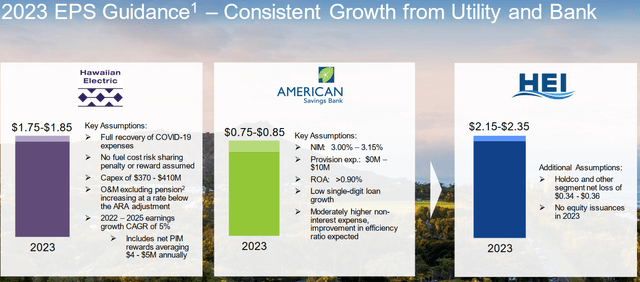

Admittedly, it would be nice to see how much the company plans to spend in 2026 and 2027 since some of Hawaiian Electric Industries’ peers have provided this information. With that said though, the higher end of the ranges provided above put the company very close to its $2 billion target already so that would result in very low capital spending in 2026. The low end of the provided ranges, meanwhile, results in a 2026 budget of pretty close to the 2025 number. So, at the moment it is a bit uncertain how the company’s $2 billion will be spent in the final years and we may even see it adjust that figure upwards as time progresses. Regardless, the company expects that this will drive earnings per share growth upward at a 5% compound annual growth rate over the 2022 to 2025 period. It is important to note though that the company states that this is for the electric utility specifically, not for the bank that accounts for about 30% of its earnings:

The one thing that I immediately note here is that the company’s management has not provided any earnings guidance for either the bank or for the company as a whole past 2023. It is reasonable to assume that the two will grow at a reasonably consistent rate, especially if the bank’s portfolio is expected to grow at low single-digit rates. Wall Street analysts expect the company’s earnings per share to grow at just over 3% over the next five years, so that implies somewhat slower growth for the bank. That could thus result in the electric utility accounting for a greater proportion of the company’s profits in a few years, which may appeal to those investors that like the utility but are nervous about holding the bank given the fact that the banking sector seems to have problems about every fifteen to twenty years (the Savings & Loan Crisis, the Great Financial Crisis, and today).

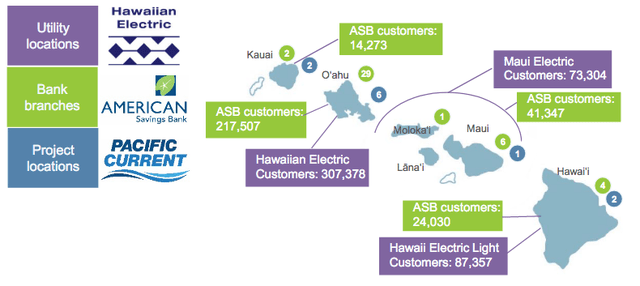

In the introduction, I stated that the bank may have some advantages that make it a bit safer than banks such as Silicon Valley Bank which are at the heart of the current crisis. One of the biggest of these is its geography. American Savings Bank only operates on the five major Hawaiian Islands:

It is quite possible that few people outside of the state have even heard of this bank. The fact that it is a local bank that specifically operates in the state may make its deposits a bit stickier than a mainland bank that is simply one of a dozen or so on the same street. In addition, the bank mostly provides mortgages for people that live in Hawaii. In fact, 83% of its portfolio is invested in Hawaiian mortgage-backed loans. This could make people less likely to take their deposits elsewhere since they are storing their money and financing their homes through the same bank. In some ways, this is the same situation that credit unions have, and we haven’t heard much about credit unions running into trouble. Finally, the fact is that people in Hawaii have fewer choices for banks, particularly people that are not comfortable with online banking. That could also make the bank’s deposits stickier than those of mainland banks. Thus, there is probably not much of a reason to worry about this particular bank, although it is still going to be riskier than the utility company.

Financial Considerations

It is always important to analyze the way that a company is financing its operations before making an investment in it. This is because debt is a riskier way to finance a business than equity because debt must be repaid at maturity. That is usually accomplished by issuing new debt and using the proceeds to repay the existing debt. This can cause a company’s interest expenses to increase following the rollover in certain market conditions. That is something that is especially relevant today as the Federal Reserve has been rapidly increasing interest rates throughout the economy and, as of yet, shows no signs that it is going to stop doing so. In addition to interest rate risk, a company must make regular payments on its debt if it is to remain solvent. As such, an event that causes a company’s cash flows to decline could push it into financial distress if it has too much debt. Although utilities like Hawaiian Electric Industries tend to have remarkably stable cash flows, this is still a risk that we should not ignore as bankruptcies have occurred in the sector.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio essentially tells us the degree to which a company is financing its operations with debt as opposed to wholly owned funds. It also tells us how well the company’s equity can cover its debt obligations in the event of a liquidation or bankruptcy event, which is obviously more important.

As of December 31, 2022, Hawaiian Electric Industries had a net debt of $3.2281 billion compared to $2.2368 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.44 today. Here is how that compares to some other electric utilities:

Company | Net Debt-to-Equity Ratio |

Hawaiian Electric Industries | 1.44 |

DTE Energy (DTE) | 1.85 |

Eversource Energy (ES) | 1.45 |

Exelon Corporation (EXC) | 1.61 |

Otter Tail Corporation (OTTR) | 0.60 |

Entergy (ETR) | 2.02 |

Admittedly, this is not a perfect comparison because none of the company’s peers own a bank. However, as 70% of the bank’s earnings come from the electric utility and that figure may grow over the coming years, it seems better to compare the firm to regulated electric companies rather than banks. As we can see, Hawaiian Electric Industries generally compares pretty well to its peers, with the notable exception of Otter Tail Corporation. However, Otter Tail Corporation also owns a number of manufacturing companies that require the company to keep its leverage down. Overall, we can conclude that the company’s debt is probably nothing that we need to be overly concerned about as it does not appear that it is using too much of it in the financing of its operations. With that said though, the company’s net debt-to-equity ratio has increased substantially over the past year so we will want to keep an eye on it and make sure that it does not continue to increase.

Dividend Analysis

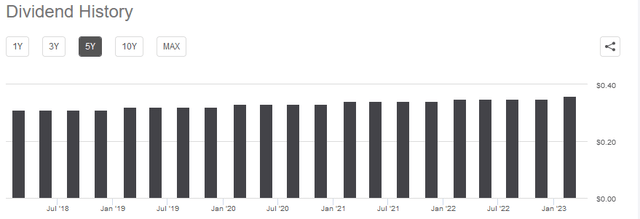

As stated earlier in this article, one of the reasons that investors purchase shares of utility stocks is the relatively high yields that they typically possess. This is due to the fact that these companies tend to have slow growth so their potential for capital gains is limited. As a result, they pay a large proportion of their profits out to investors and, since the market does not usually give their stock a high multiple, these dividends end up being a significant percentage of the stock price. Hawaiian Electric Industries is certainly not an exception to this as the stock yields 3.78% at the current price. The company has a long history of increasing its dividend annually as well, including in the most recent quarter:

The fact that Hawaiian Electric Industries typically increases its dividend annually is something that is quite nice to see. This is especially true during inflationary periods, such as the one that we are experiencing today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. That can make it feel as though we are getting poorer and poorer with the passage of time. The fact that the company increases the amount of money that it pays us helps to offset this effect and maintains the purchasing power of the dividend.

Naturally, though, we want to ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to be forced to cut the dividend since that will reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we judge a company's ability to afford its dividend is by looking at its free cash flow. The free cash flow is the amount of money that is generated by a company’s ordinary operations and is left over after it pays all of its bills and makes all necessary capital expenditures. During the twelve-month period that ended on December 31, 2022, Hawaiian Electric Industries reported a negative levered free cash flow of $400.8 million. That is obviously not enough to pay any dividends, but the company still paid out $153.2 million over the period. At first glance, this may be concerning.

However, it is not uncommon for a utility company to finance its capital expenditures through the issuance of equity and debt. The company then pays its dividend out of operating cash flow. This is necessary because otherwise, the extremely high costs of constructing and maintaining utility-grade infrastructure over a wide geographic area would otherwise prevent the company from ever paying a dividend. During the full-year 2022 period, Hawaiian Electric Industries reported an operating cash flow of $454.5 million. That was sufficient to cover the $153.2 million dividend with quite a bit of money left over that could be used for other purposes. Overall, this dividend is probably reasonably safe.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a sure-fire way to earn a suboptimal return on that asset. In the case of a utility company, we can value it by looking at the price-to-earnings growth ratio. This ratio is a modified version of the familiar price-to-earnings ratio, but it takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that a stock may be undervalued relative to its forward earnings per share growth and vice versa. However, there are very few companies that are undervalued in today’s still richly valued market. This is particularly true in the utility sector, which tends to be very low growth. As such, the best way to use this ratio is to compare a stock’s valuation with its peers and see which stock offers the most attractive relative valuation.

According to Zacks Investment Research, Hawaiian Electric Industries will grow its earnings per share at a 3.08% rate over the next three to five years. This is not really out of line with other projections, so we can use it for our purposes. This gives the stock a price-to-earnings growth ratio of 5.52 at the current price. Here is how that compares to some of the company’s peers:

Company | PEG Ratio |

Hawaiian Electric Industries | 5.52 |

DTE Energy | 2.91 |

Eversource Energy | 2.68 |

Exelon Corporation | 2.67 |

Otter Tail Corporation | NA |

Entergy | 2.64 |

As we can clearly see, Hawaiian Electric Industries looks very expensive relative to other utilities. This is largely due to the company’s very low growth rate, but admittedly it is difficult to see this company growing much faster given its geographic constraints. Thus, this is a stock that should be bought for stability rather than anything else. Personally, though, I would like it a whole lot more at a lower price point.

Conclusion

In conclusion, Hawaiian Electric Industries, Inc. is a rather unique electric utility considering that it also owns one of the largest banks in the island state. Although the banking sector as a whole is experiencing some turmoil right now, it does not appear that the company’s ownership of one is cause for alarm even though it has apparently driven down the stock price. This company still appears to be remarkably stable regardless of what might happen in the economy. My only real concern here is that Hawaiian Electric Industries, Inc. stock looks quite expensive today, so it might be best to wait and see if the troubles in the banking industry pull it down more than they already have.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.