Kornit Digital: No Near-Term Catalysts But Upgrading To 'Hold' On Bargain Valuation

Summary

- Last month, the company reported mediocre fourth quarter results and provided a cautious outlook for 2023.

- With key system sales expected to remain weak, overall revenue is likely to be down for the second year in a row.

- While management has implemented cost-cutting measures including a 10% workforce reduction, Kornit is unlikely to return to profitability this year.

- Discussing recent changes to the company's forward guidance approach.

- While the stock is lacking a near-term catalyst, I am upgrading Kornit Digital's shares from "Sell" to "Hold" due to the company's pristine balance sheet and bargain valuation.

genkur

Note:

I have covered Kornit Digital Ltd. (NASDAQ:KRNT) previously, so investors should view this as an update to my earlier articles on the company.

Twelve months ago, leading digital textile printing solutions provider Kornit Digital Ltd. or "Kornit" shocked investors with disappointing first quarter 2022 results and a weaker-than-expected Q2 outlook due to slower customer demand and competitive pressures.

Things got even worse in July when the company issued an ugly warning for Q2 and indicated an equally disappointing Q3.

Not surprisingly, investors headed for the exits for most of the past year with the recent market turmoil causing shares to drop to new multi-year lows.

Last month, Kornit reported mediocre fourth quarter results and provided muted Q1 guidance.

On the conference call, management remained cautious with regards to the outlook for this year:

Some customers and prospects continue to take a wait-and-see approach on making meaningful investments, including adding production capacity to their existing fleet. As such, we continue to expect system sales to remain challenging in 2023 and expect to see growth for consumables and services.

With system sales expected to remain weak, overall revenue is likely to be down for a second year in a row.

While management has implemented cost cutting measures including a 10% workforce reduction, Kornit is unlikely to return to profitability this year.

That said, management projected improvements for the second half of the year:

(...) Given the decisive actions we have taken over the past several quarters to adjust our operations, we see breakeven on an Adjusted EBITDA and operating margin basis at a quarterly revenue run rate of approximately $70 million with gross margins in the mid 40% range, obviously, depending upon mix and OpEx in the mid 30s.

(...) We expect to turn the corner during the second half of this year and approach breakeven and later on move to profitability, again on both an Adjusted EBITDA and operating margin basis.

Looking out, we continue to believe substantial long-term growth drivers remain fully intact and that we can achieve our long-term financial objectives as overall markets improve, capacity utilization increases and as we penetrate several new markets.

Moreover, the relationship with key customer Amazon (AMZN) appears to be intact:

Our long-term partnership with our largest global strategic customer remains very strong. Relative to the market, they continue to grow nicely, contributing to the increase in our consumables and services revenues this quarter. Looking at 2023, we expect this customer to have new sites operational with added capacity driven by the systems we sold in 2022.

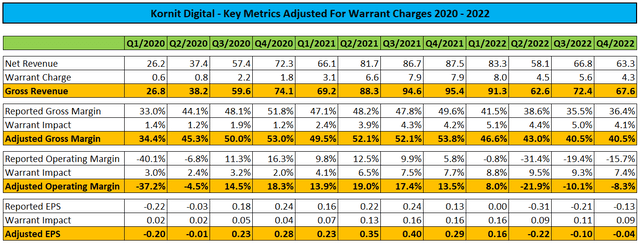

Investors should note that the company's forward guidance now includes anticipated negative top- and bottom line impact from warrants issued to Amazon in recent years.

In addition, Kornit is now providing a range for Adjusted EBITDA margin expectations rather than for non-GAAP operating margin:

To be better aligned with our reported financials, we have therefore decided to provide guidance net of the warrants impact on revenues and profitability going forward, starting with the first quarter of 2023.

We are also providing a guidance range for adjusted EBITDA margin expectations going forward, instead of a range for non-GAAP operating margin. In this regard, depreciation expense has materially increased after the completion of our new ink manufacturing plant. As such, we believe adjusted EBITDA margin is a more useful financial metric, instead of non-GAAP operating margin to measure the performance of our business.

After recording $45.2 million of negative cash flow from operations in 2022, Kornit ended the year with cash, cash equivalents, short-term bank deposits and marketable securities of approximately $650 million and no debt.

Going forward, I expect cash usage to decline significantly so liquidity won't be an issue for the time being.

Admittedly, with an enterprise value of just $300 million and expected 2023 revenues of approximately $250 million with non-GAAP gross margins in the 40% range, Kornit's shares are trading at bargain levels but absent a return to growth and sustained profitability, I do not expect this to change anytime soon.

Bottom Line

With 2023 likely to be the second consecutive year of negative growth for Kornit Digital, it's hard to get excited about the company's prospects at this time.

While shares are clearly lacking a near-term catalyst, investors should closely monitor the company's progress in the second half of the year as management expects results to move closer to profitability going into 2024.

Due to its pristine balance sheet, Kornit Digital has ample resources to weather the storm but shares are likely to remain range-bound as market participants are waiting for signs of renewed growth in the business.

That said, with shares now changing hands at just 1.2x EV/Revenue, I am upgrading Kornit Digital's stock from "Sell" to "Hold".

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.