Enterprise Products Partners: Buy The Dip Hand-Over-Fist

Summary

- EPD is arguably the best high yield equity buy in the market today.

- The latest pullback in the unit price is a great opportunity to boost your passive income.

- We discuss three reasons why EPD is a great buy today and the big risk to monitor moving forward.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

MarsBars

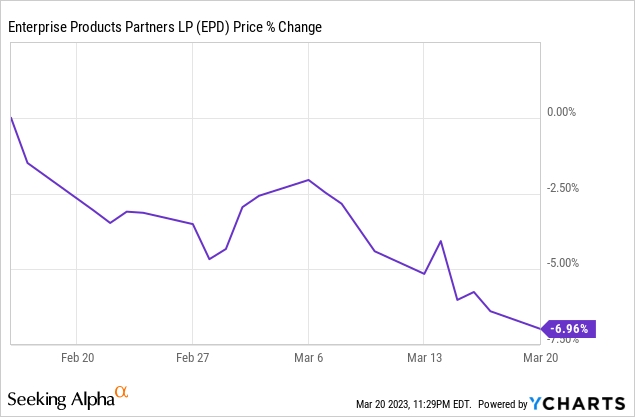

Enterprise Products Partners (NYSE:EPD) is arguably the best high yield equity buy in the market today. As a result, we view the latest pullback in the unit price as a great opportunity to boost your passive income:

In this article, we discuss three reasons why EPD is a great buy today and the big risk to monitor moving forward.

Reason #1: Big Fat Yield That Is Covered 1.8x With Accelerating Growth

EPD has an extremely impressive track record of growing its distribution through thick and thin. While many peers such as Energy Transfer (ET), Kinder Morgan (KMI), and Plains (PAA)(PAGP) have slashed their payouts in the past during energy market declines, EPD has continued to grow its payout year after year for a quarter century.

When you combine this exceptional track record with the very strong distributable cash flow coverage of the current distribution (~1.8x based on 2023 consensus analyst estimates for DCF) and the partnership's world-class asset portfolio that has generated remarkably stable cash flow through energy sector cycles, the distribution is very safe.

On top of that, the distribution's growth rate is also accelerating, thanks to the balance sheet being very conservatively positioned and the retained cash flows reaching a point where management has extra cash leftover after fully internally funding capital expenditures. Between 2018 and 2021, the distribution grew between 1.1%-2.5% each year, serving more as token increases rather than meaningful growth. However, last year the distribution grew at a mid-single digit rate and management recently indicated that this would likely be the new normal moving forward. On the Q4 earnings call, management elaborated on this, stating:

I think over the last, call it the last 18 months, we've shown -- we've sort of completed that pivot to go from an externally funded model to an internally funded model. And we had slowed distribution growth there for about three years or so. And over the last, call it 18 months, we've taken that distribution growth back up to about 5% area. So we have increased the pace of distributions. And then the buybacks, we continue to do that opportunistically. So we feel like we're in good shape to execute on opportunities that come to us in 2023, 2024. So we feel like we're sort of checking the box of returning capital and all of the above and also maintaining lower leverage at the same time.

Reason #2: Very Low Balance Sheet Risk

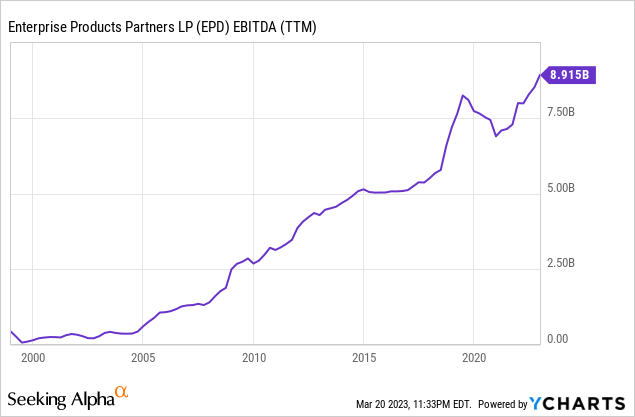

Between continuing to grow its EBITDA while also reducing net debt thanks to substantial amounts of retained cash, EPD's already low leverage ratio continues to drop.

EPD's net debt to EBITDA ratio decreased from 3.1x at the end of Q3 to 2.9x at the end of Q4, giving them more flexibility than their previous target range of 3.25x-3.75x. The management has now reduced their target range to 2.75x-3.25x, making EPD's leverage ratio significantly lower than their BBB+ rated peers like Enbridge (ENB) and Magellan Midstream (MMP), making their balance sheet arguably the most conservatively positioned in the sector.

Management elaborated further on their reasoning behind this move on their Q4 earnings call:

To support our financial goals to responsibly grow the partnership and provide our limited partners with a growing and resilient stream of cash distributions over the long term, we believe we have entered into a new era in which it is wise to have a stronger balance sheet than historical norms in the energy industry. We are seeing our customers in the E&P, refining and petrochemical sectors do likewise. As a result, we are lowering our target leverage ratio from 3.5 times to 3.0 times, plus or minus a quarter of a turn. That is a range from 2.75 times to 3.25 times. And as we've noted earlier, our leverage for 2022 we ended at 2.9 times. So we're in good shape with regard to this new target.

Reason #3: Attractive Valuation

Last, but not least, EPD remains a compelling bargain. Despite having a vastly superior balance sheet to peers like MPLX (MPLX) and a better balance sheet and track record relative to KMI, EPD is as cheap if not cheaper than both:

| Security | P/DCF | EV/EBITDA |

| EPD | 7.1x | 9.0x |

| MPLX | 7.0x | 9.4x |

| KMI | 7.7x | 9.2x |

As the table above shows, EPD's EV/EBITDA - the most widely used and recognized valuation metric in the midstream sector - is clearly lower than both MPLX's and KMI's. Meanwhile, its P/DCF is in a virtual tie with MPLX's and well below KMI's.

When you combine EPD's potential for additional valuation multiple expansion, it's very sustainable and likely to grow ~8% forward distribution yield and expected mid-single digit annualized per unit DCF and distribution CAGR in the coming years, the path to 13-15% annualized total returns over the next half decade looks quite clear.

Risk To Consider

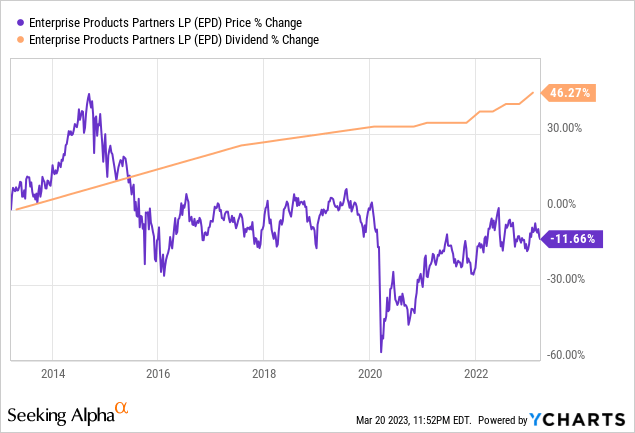

The main risk facing EPD is that its valuation multiple will continue to contract and that the unit price will refuse to increase despite continued growth in distributable cash flow and distributions per unit. EPD has grown its distribution by over 46% over the past decade, yet today its unit price is 11.66% below where it was at the start of that time period:

Why is this? It is a combination of three major factors:

- The MLP sector has lost its luster over that time period due to the original business model going bust in a major way thanks to massive cuts at businesses like KMI. As a result of the business model's failure to generate consistent income growth for investors (though of course EPD was an exception to this), it has largely fallen out of favor and has yet to regain its attraction to most would-be buyers.

- The ESG movement has devastated hydrocarbon business' cost of equity capital. Furthermore, fears (misperceptions, perhaps?) about the long-term viability of the oil and even natural gas/NGL industries also weigh on EPD's valuation (though don't tell the bond market, which is lending money to EPD and some of its peers multiple decades out into the future at very attractive rates).

- Interest rates have risen sharply over the past year, weighing on all equity valuations.

Until at least some of these overhangs on the equity valuation are lifted, EPD will likely continue to experience underwhelming valuation multiple performance, regardless of how consistently it continues to grow its underlying intrinsic value. That said, the good news is that its yield is now high enough that it merely has to tread water in its valuation multiple moving forward to generate attractive risk-adjusted double-digit total returns when combining the expected growth with the ~8% distribution yield.

Investor Takeaway

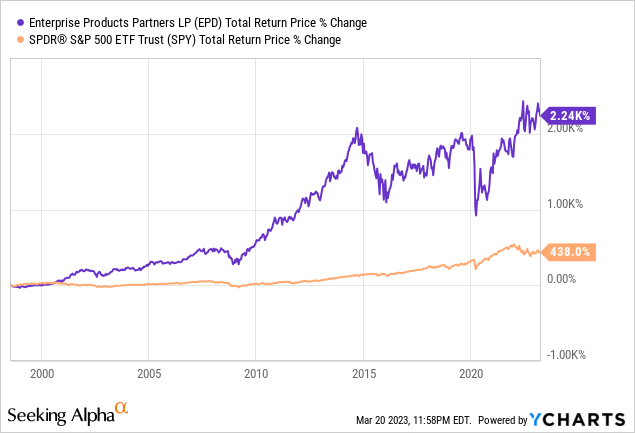

EPD has crushed the market over the long-term despite the last decade largely being a lost one for the partnership:

Today, it is well-positioned to continue delivering market-crushing total returns alongside a very low risk profile. Furthermore, its high yield and accelerating distribution growth make it a very attractive investment option for retirees and passive income investors in general.

As a result, we hold a large position in our Retirement Portfolio and may buy more units in the near future if the unit price remains down from recent highs.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

SAVE $251 BY SIGNING UP TODAY!

For a Limited-Time - You can join Seeking Alpha’s #1 community of high-yield investors at just $148 for your first year!

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews from happy members who are already profiting from our real estate strategies.

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews from happy members who are already profiting from our real estate strategies.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

(Limited to only 50 spots!)

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Disclosure: I/we have a beneficial long position in the shares of EPD, ET, PAA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.