IYG: Bank Runs Make This ETF A Lot Cheaper, And Closer To A Buy Zone

Summary

- IYG invests in financial stocks across the United States.

- Medium-term economic recovery could put banks and credit card companies responsible for moving the needle.

- The recent collapse of some banks sent share prices plummeting, creating a treacherous near-term situation for financials. That risk limits my rating to Hold.

ismagilov

iShares U.S. Financial Services ETF (NYSEARCA:IYG) is attractive to me on a long-term fundamental basis right now, as I believe it has many high-quality holdings at currently reasonable prices. However, the financial sector's rather treacherous condition following the recent collapse of several banks lead me to give this ETF a Hold.

I don't believe the recent crisis involving a few of the nation's larger regional banks will negatively impact the long-term returns of this ETF. However, I believe that there are too many considerations and too much market speculation at the moment to rate this ETF a Buy.

IYG's top holdings are mainly centered on investment banks and credit card companies. Given my long-term bullish view on the financial sector and the U.S. economy's recovery, IYG could be an attractive option. However, this is not the case just yet.

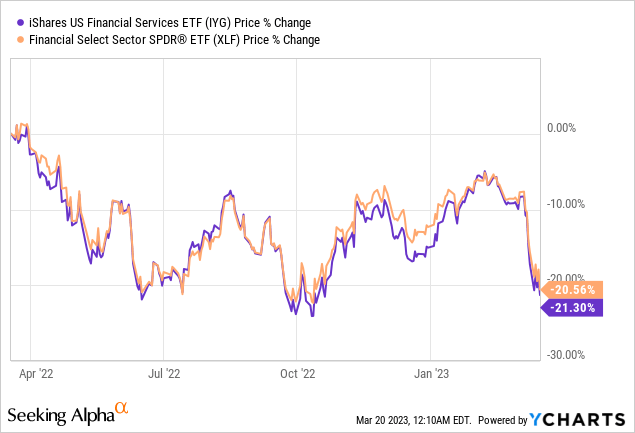

IYG has experienced a sharp decline similar to the Financial Select Sector SPDR ETF (XLF) and many other financial ETFs. However, buying activity is increasing, especially among banking insiders. This may display how though events last week warranted panic, one should still consider the long-term growth propensities of IYG and similar ETFs.

Strategy

IYG tracks the DJ US Financial Services TR USD Index and uses a representative sampling technique. Holdings with greater market capitalization therefore account for a larger portion of total holdings. With this composition, this ETF could potentially expose investors to the individual industries with the greatest impact on the overall financial sector. IYG invests in growth and value stocks solely within United States public equity markets.

Holdings Analysis

IYG invests solely in financial stocks within the United States. These stocks include those of banks, credit card companies, and mortgage companies. This specific sector and geographical focus may provide investors with deeper exposure to the United States financial sector.

The top 10 holdings in this ETF account for 58% of total holdings and the top 25 comprise 81% in a fund of 108 securities, making IYG rather top-heavy. I see ETFs as a surrogate for owning the stocks directly, but with some diversification effect. I also feel like I know better what I own with an ETF whose top 25 holdings matter, due to their size. I can also track those holdings more easily versus an ETF with hundreds of small weightings to individual stocks.

Strengths

The lengthy measures which the government recently took to ensure depositors' compensation after SIVB's crash reflects the government's strong support of the financial sector. Therefore, IYG's investments in financial enterprises could enhance investor confidence even amid the possibility of additional crisis situations.

This ETF's heavy allocations to Mastercard Inc. (MA) and Visa Inc. (V) also make it potentially profitable. Both MA and V are capitalizing on trends like payment digitalization and virtual cards, which could be a profitable movement for both companies alike. The United States virtual cards market is expected to grow to over $60B by 2030 at a rate of 20%. Therefore, similar developments in large credit enterprises like the ones held in IYG could move the needle in this ETF in the long term. Investing in IYG versus individual stocks may also allow investors to hedge the effects of any competition between MA and V.

Weaknesses

IYG is very pro-cyclical and therefore vulnerable to market sentiment and crowd psychology surrounding the performance of banks. Though I don't believe the recent bank stock panic will hurt this ETF in the long-term, investors may experience several bearish periods before ultimately reaping profits. Such susceptibility also manifests in IYG's elevated standard deviation and annualized volatility, which exceed that of the broader market by 22% and 11% respectively.

Opportunities

IYG could potentially profit from an imminent price rebound as many seek to attain financial ETFs at lower prices.

In addition to the government's ability to bail out banks, banks have also displayed willingness to bail out each other. For example, shortly after its stock declined, First Republic Bank (FRC) received $30B in deposits from leading banks like JPMorgan (JPM), Bank of America (BAC), and Citigroup Inc. (C).

Economic recovery could enhance the long-term profits of holdings in IYG, especially investment banks and credit card companies. Possible reinstatement of mergers and acquisitions (M&A) activity within the next year could direct investors towards the higher-weighted stocks in IYG. Furthermore, increased spending and better creditworthiness among clients could increase the profits of credit card companies held in IYG.

Threats

Prolonged inflation could potentially increase the number of delinquencies and worsen the creditworthiness amid clients of credit card companies held in IYG. This could hurt both these companies' profits and public image alike. Simultaneously, further delaying M&A reinstatement and corporate activity could also hurt the banks held in this ETF.

Banks held in this ETF are also clearly vulnerable to the effects of other banks' failures. Though it's often their unique problem, one specific bank failing has before created destructive waves across the financial sector. Therefore, similar events stemming from what has already started could hurt the returns of this ETF.

Conclusions

ETF Quality Opinion

In the long-term, this ETF is structured to benefit from an improving level of U.S. economic health and a more optimistic broad market outlook. From the investment banks to the credit card companies, IYG has a potentially strong portfolio which is centered around industries that may be well-positioned for long-term growth and profit. I want to be ready to own this ETF when the emotion dies down and the long-term fundamental case can be supported by a lower-risk entry situation.

ETF Investment Opinion

The time to buy is likely not right now. This is a high-risk high-reward situation, but not one I would jump into immediately. I rate IYG a long-term Hold given the current aura of faithlessness surrounding financial securities, despite my overall bullish view of financial companies.

Growth in banks and credit card companies could move the needle in this ETF during the next 3-5 years, regardless of the momentary effects of recent events. Investing may still require a certain amount of patience and resilience to crises fueled by market speculation and fear. Each investor has to determine for themselves how much risk they want to take to get that long-term reward.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.