FS KKR Capital: Discounted BDC With 16% Yield On Sale

Summary

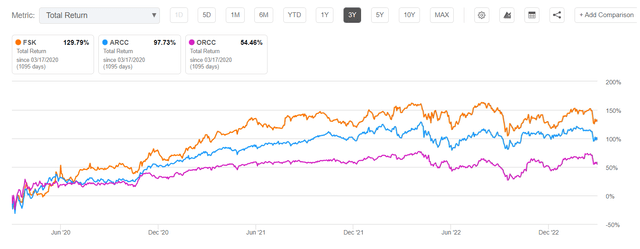

- Over the past 3 years, FSK has outperformed 2 of its largest peers, ARCC and ORCC, based on total return.

- At a current discount of nearly -30% to book value, FSK yields 16% annually and raised the base dividend by about 5% in February.

- The portfolio is shifting new investments into safer, less risky holdings such as senior secured loans and asset based financing in anticipation of heightened market volatility in 2023.

Lemon_tm/iStock via Getty Images

In the March madness of the stock market, exacerbated by the failures of several banks, many other stocks that are not directly tied to those banks have also seen their share prices drop. For example, several BDCs (Business Development Companies) have been impacted by the financial sector fallout. One BDC that I wrote about back in September, Cion Investment (CION), has seen its share price drop nearly -13% in the last month despite a very good Q422 earnings report on March 16. Another BDC that recently dropped nearly -12% in the past month is Oaktree Specialty Lending (OCSL). Both of those are Buys in my opinion with yields exceeding 12% and in the case of CION, a discount to book value of -40%.

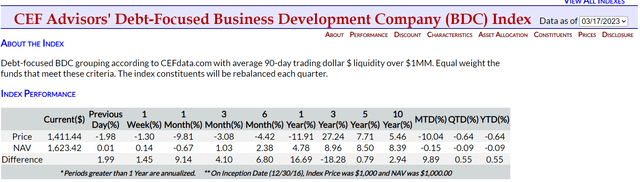

In fact, according to CEFdata.com, a website that tracks current information about the BDC universe, the Debt-focused BDC index consisting of 31 different BDCs that are tracked based on the index criteria has lost nearly -10% in the past month. The average NAV or book value of the BDCs has not declined by anywhere close to -10% though, so an opportunity presents itself to purchase shares of several quality BDCs at rock bottom prices.

CEFdata.com

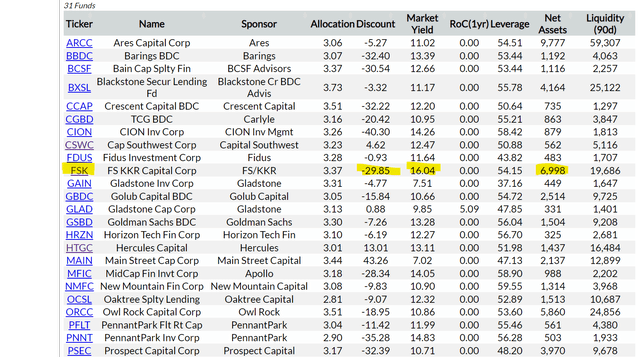

One such quality BDC that offers what I consider to be a most attractive opportunity at current prices is FS KKR Capital Corp. (NYSE:FSK). At the closing market price on March 17 of $17.46 it pays a distribution yield exceeding 15% and trades at a nearly -30% discount to NAV. There may be other BDCs in the 31 tracked by the CEF Advisor’s index that are also strong buys at current prices but I wanted to focus this article on FSK due to its larger than normal discount and higher than usual yield. FSK is also one of the larger BDCs based on net assets and has more 90-day liquidity than most of the others (except ARCC, BXSL, and ORCC), as shown below in the snippet from CEFdata.com.

In general, unless BDCs have specific exposure to any of the affected banks such as Silicon Valley Bank (SIVB), their business should not be negatively impacted, and could in fact lead to an increase in funding opportunities for BDCs that may offer an alternative to bank lenders, particularly to upper middle market companies.

Debt-focused BDC index – partial list of constituents (CEFdata.com)

FSK Overview

Because this is my first time covering this particular BDC, I like to start with an overview and summary of the company. From the fund’s website, FSK is one of the largest BDCs and is a partnership between FS Investments and KKR Credit.

FS/KKR serves as the investment adviser to FS KKR Capital Corp. [NYSE: FSK], a publicly listed BDC. The Advisor manages a total of $16.1 billion in assets under management as of December 31, 2022. FS/KKR seeks to leverage its size, scale and market reach to invest primarily in upper middle market companies. FS/KKR and its affiliates have significant experience in private lending and private equity investing, and have developed an expertise in using all levels of a firm’s capital structure to produce income-generating investments while focusing on risk management.

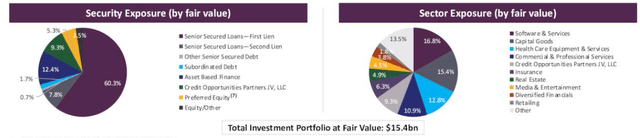

The company portfolio consists of 197 portfolio companies as of 12/31/22, with about 89% of debt instruments that are floating rate. About 69% of the portfolio is invested in senior secured debt, with a weighted average annual yield of 11.4% on accruing debt investments, with a 2.4% non-accrual rate based on fair value. The median portfolio company has an EBITDA of $114M. Sector exposure is diversified with the largest allocations to software and services, capital goods, healthcare equipment and services, and Other as shown in the slide from the Q422 investor presentation.

FSK Q422 presentation

One big positive regarding FSK in light of the recent bank meltdown is the capital structure. FSK has no debt maturing before 2024 and lowered the net debt to equity ratio from 1.19x in September 2022 to 1.18x at the end of December. FSK is rated Investment Grade (Baa3) by Moody’s and BBB- by Fitch. Only 54% of drawn leverage is unsecured and liquidity stood at $3 billion as of 12/31/22.

FSK has a joint venture with the South Carolina Retirement Systems Group Trust that is called Credit Opportunities Partners, LLC. That secondary portfolio consists of about $3.6 billion in primarily senior secured assets with 94% floating rate debt instruments. According to the top holdings in FSK as shown on CEFdata.com, the JV represents about 9% of the total portfolio holdings.

CEFdata.com

Q422 Earnings Highlights

On February 28, 2023, the fourth quarter earnings report included a slight drop in NAV to $24.89 per share compared to $25.30 as of September 30. But the NII improved to $0.81 Q4 adjusted net investment income, which beat analysts’ consensus by $0.07 and improved from the $0.73 reported on September 30. New investment fundings in the quarter amounted to $863 million. The investment mix in the quarter leaned more toward first lien senior secured loans (about 74%) and asset-based financing (about 23%). In general, there was lower net investment activity in 2022 compared to 2021 but shifting toward lower risk investments.

FSK Q422 presentation

On the earnings call, Co-Chairman and CIO, Daniel Pietrzak, addressed the shift in strategy based on expected market volatility in 2023.

In terms of the market and economic environment, as we enter 2023, we continue to expect above average levels of volatility over the near term. While we continued exercise caution with respect to new originations, we believe the increased volatility and economic uncertainty has created compelling investment opportunities for us and other large scale private debt investors. Sponsors continue to turn to large stable direct lending platforms as alternatives to the more volatile syndicated debt markets.

Another interesting comment from the CIO was that about 70% of new originations came from opportunities and companies previously invested in by KKR. The company did experience a small net realized loss of about $53 million in the quarter and an unrealized loss of about $100 million, so that is one thing to keep an eye on for future quarters. The non-accruals in the quarter rose to 4.9% on a cost basis and 2.4% on a fair value basis, and that is another reason for caution, although non-accruals declined slightly from September when it was at 5% on a cost basis and 2.5% on a fair value basis.

Dividend Raised and Covered

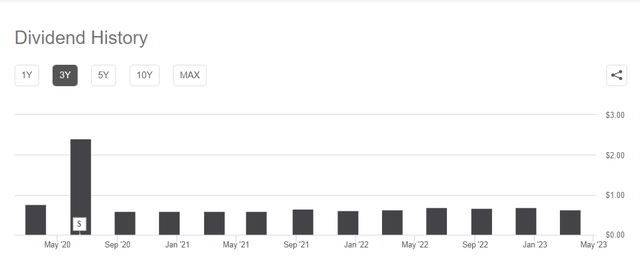

While reporting strong results for Q4 in terms of adjusted NII of $0.81, FSK announced an increase in the distribution to $0.70 from $0.68 previously. In addition, the base dividend was raised to $0.64, and the $0.06 supplemental dividend was also declared and is expected to be paid each quarter in 2023 as well, as indicated by CEO Michael Forman on the earnings call. Therefore, investors should expect to receive a minimum of $0.70 per share each quarter for the remainder of 2023, and possibly beyond. At the current market price that distribution amount represents a 16% annual yield. That is one of the highest yields of the 31 included in the index described above (only RWAY is higher at 16.14%).

While the distribution has been relatively steady over the past 3 years and generally growing, the dividend history chart is a bit misleading because of the 1 for 4 stock split that occurred in 2020 and the supplemental dividends that are not properly accounted for on the bar chart (for example, the $0.06 supplemental is not accounted for on the bar for Q1 2023).

Seeking Alpha

Recent Past Performance and Comparison

Often when writing about, or trying to decide between different BDC investment opportunities, there is often the question of which is the “best” BDC. In fact, another SA author, whose opinions I respect, recently published an article on the Best of Breed BDCs, and it generated considerable discussion and a wide range of comments and opinions. Some BDCs are compared against each other based on size. Using that criteria, I compared FSK total return over the past 3 years with its 2 largest peers – Ares Capital (ARCC) and Owl Rock Capital (ORCC). What I learned is that FSK far outperformed over the past 3 years but is just about neck and neck over the most recent 6 months.

Seeking Alpha

As an income investor primarily, I am also very interested in the dividend yield (higher is better), coverage (FSK is excellent), and history of raises or cuts. While the price of the stock is a factor in when to buy, or possibly trim some shares or even sell, the future distribution potential is what I am most attracted to, and the ability to continue to grow the distribution over time.

While FSK went through a transition period in 2018 when KKR got involved in managing the portfolio, and then further increased the company size by merging FSK with FSK II in 2021, they have proven their ability to weather the Covid storm and continue to pay a steady and mostly increasing distribution. The FSK of 2023 is nothing like the previous incarnation as recently as 5 years ago, so attempting to look farther back in history to judge performance is meaningless. Nonetheless, there is some value in comparisons with other similar investments.

I own several BDCs including some of the ones mentioned in this article and a couple of others that are not. I am of the belief that we will likely see a recession this year (even though we experienced a brief recession in 2022) but that it is not likely to be as deep or severe as the 2008/2009 recession that I lived through. The housing market is adjusting and even starting to show signs of stabilizing. The job market is still relatively hot although shifting away from high paid tech jobs to lower paid service and unskilled labor types of jobs. The banking debacle is another symptom of high inflation and rapidly rising rates but if interest rates suddenly start to level off or even get reduced by the Fed later this year, that could lead to a sudden change in market sentiment to the benefit of BDCs and other financial stocks.

Meanwhile, I am not waiting around for a better price. I like FSK at the current price/yield and am buying more as I have cash available. Opportunity is knocking if you have the guts to go after it (and can afford to lose some capital if things do not work out the way I expect).

This article was written by

Disclosure: I/we have a beneficial long position in the shares of FSK, CION, OCSL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.