Smith-Midland Is Overvalued Even Under Optimistic Assumptions (Rating Upgrade)

Summary

- Smith-Midland manufactures precast building materials.

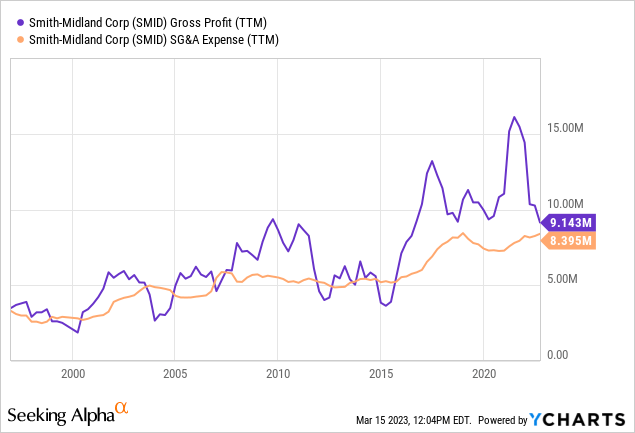

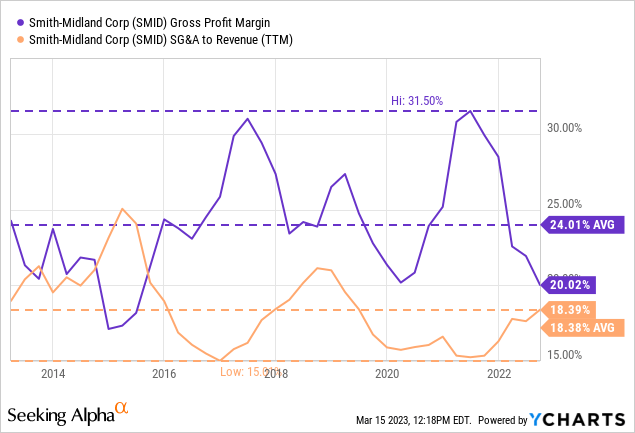

- The company's market is competitive, but SMID has been able to generate a profit quite consistently. Profits are volatile because its gross margins are volatile.

- The main bull thesis is that SMID will benefit from government spending from the Infrastructure Bill.

- Although this could prove true, current stock prices already discount very optimistic conditions, like record high gross margins, record low SG&A expenses, and record high revenues.

- If these conditions materialize, SMID stock is fairly priced, otherwise, it is not. Therefore, it does not represent an opportunity.

Anze Furlan / psgtproductions/iStock via Getty Images

Smith-Midland Corp (NASDAQ:SMID) manufactures precast building materials, particularly architectural walls, sound barriers, and impact-protection barriers.

I wrote an article about the company in September, considering it was trading at an excessive valuation. Although I liked some aspects of the company (and disliked some aspects of its industry), it was a valuation problem. Since then, the stock has lost 30% of its share price.

In this review, I believe the company continues to trade at a valuation that does not represent an opportunity. However, since current prices imply a significant revenue increase, albeit under optimistic cost assumptions, I change the rating from 'Sell' to 'Hold'.

Note: Unless otherwise stated, all information has been obtained from SMID's filings with the SEC.

Recap

A complicated market: SMID manufactures precast components used in construction. The company's core products are architectural walls and sound and impact barriers. The latter two are almost exclusively used in transportation projects (highways).

I do not like this industry because it is project-based, which requires significant SG&A expenses; bid-based, which promotes profitability-destroying competition; and geographically constrained by logistic costs, which precludes growth.

An ingenious player: However, SMID has done relatively well for a company in the industry.

First, it has patented ingenious inventions like J-J Hooks for impact barriers. This hook type reduces mounting time. For other products, it has tried to create a brand. That is the case of the architectural Slender Wall, which does not enjoy a specific technical advantage.

These products enjoy some moat because the company has licensed their commercialization in 56 U.S. states and several countries abroad (enjoying royalties for almost $3 million yearly).

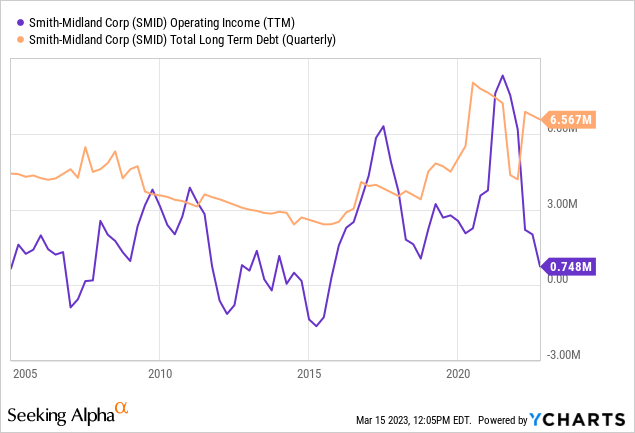

Second, although selling costs in the industry are high and margins are low, the company has rarely generated operating losses and has not accumulated debt.

Valuation and thesis recap

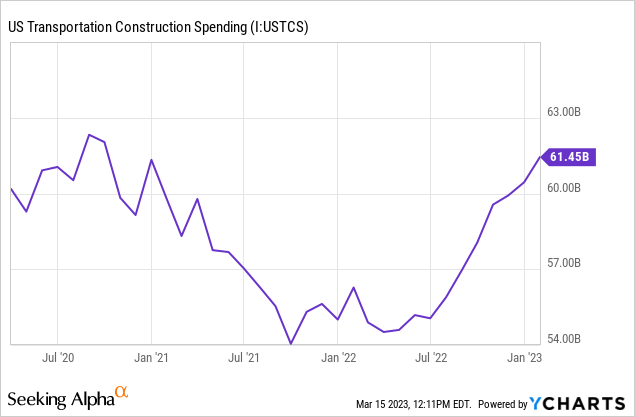

Infrastructure bill: The main argument behind the bull thesis is that the new Infrastructure Bill signed into law will substantially increase the company's revenues. Indeed, the bill has increased spending on transportation infrastructure construction (including airports or railroads and not only highways, though).

The price is still too high: Even if the argument was correct, how much of that increase is already discounted on SMID's current share price?

Using average figures from previous cycles and making some optimistic assumptions like lower than current SG&A expenses (in relation) to revenue, I find that the share price already discounts.

For example, to generate a minimum 10% earnings yield (minimum because it would be enjoying a cycle upward leg and therefore the yield asked should be much higher), at a market cap of $85 million, SMID has to generate $8.5 million in net income.

Assuming taxes of 25% (21% federal, 2.5% North Carolina, 6% Virginia), that leads to $11.5 million in pre-tax income.

Now for operating profit, we can use two sets of assumptions. One is the average of 24% gross margin and 18% SG&A to revenue, leading to a 6% operating margin. On the other hand, we can use the much more optimistic cycle highs and bottoms of 31.5% for gross margins and 15% for SG&A to revenue, leading to an operating margin of 16.5%.

Under the average scenario, the company needs to generate revenues of $191 million to generate a net income of $8.5 million. That is a 324% increase in revenue from the current TTM figure.

Under the optimistic scenario, revenue has to grow to $70 million, or a 55% increase from the TTM figure. The current share price already discounts maximum historical gross profit margins, minimum historical SG&A expenses (as a percentage of revenue), and revenues 55% above current levels. Further, the price discounts show that the situation can be maintained permanently, while the company's historical operations show that the maximum figures are cyclical peaks.

Risks

I am not recommending selling the stock, but rather not purchasing it.

As mentioned, the bullish thesis is sustained on the idea that SMID has a superior product, and that the increased expenditure on infrastructure will benefit it. Because the company has significant fixed costs (the factories and qualified employees above all), an increase in revenue multiplies through the income statement in the form of operating leverage.

This possibility exists indeed, and SMID has won infrastructure projects in the last fiscal year. The combination of revenue increasing while margins also grow (an effect of operational leverage) could lead to multiple growth and further stock price appreciation.

Another bullish point is that infrastructure spending should also increase during a financial crisis or economic recession because the government steps in to increase aggregate spending. Therefore, SMID could increase the resilience of a portfolio to recessions.

In my opinion, the problem with both theses is that current prices already include these benefits. In the valuation section, I compared the stock's price with an enormous improvement in business conditions (margin expansion and revenue increase). Even under those conditions, the stock would not return a yield of 10%.

Further, both types of infrastructure spending increases (the Infrastructure bill or an economic recession) should be temporal. The market will probably price that in, reducing the multiple on future SMID's earnings. This is common among cyclical, where the multiple on earnings actually decreases as the company is improving all of its business metrics.

Conclusions

SMID's valuation is today much lower (30% lower) than six months ago. Although the company is not in the extremely overvalued terrain anymore, it trades at an excessive multiple of average and optimistic earnings.

The company might be benefited from government spending in infrastructure from the Infrastructure Bill signed in 2021, but most of that improvement is already discounted on the stock's price.

Therefore, SMID stock does not represent a buying opportunity.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.