DSL: Possible Impending Distribution Cut, But Still A Good Fund

Summary

- Inflation continues to run hot, meaning that people need growing amounts of income simply to maintain their lifestyles.

- DSL invests in a portfolio of bonds and then applies leverage to boost the overall yield.

- The fund looks like a pretty good way to improve international exposure since foreign bonds account for the majority of the portfolio.

- The 11.59% yield is very attractive but it does not appear to be sustainable as the fund's assets are declining quickly.

- The current valuation is reasonably attractive.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

Marat Musabirov

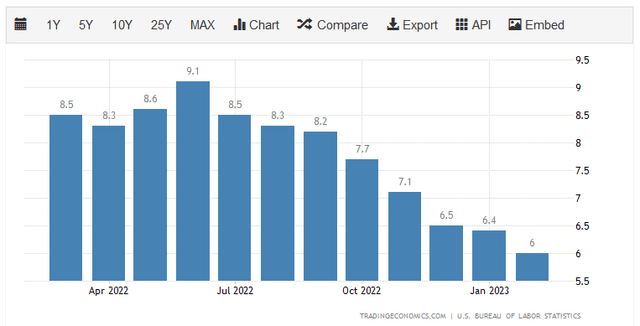

Without a doubt, the most challenging issue facing most Americans today has been the incredibly high rate of inflation that is driving up the price of everything in the economy. Although it has started to come down in the past few months, there has still not been a single month in which the consumer price index was not at least 6% higher than it was in the previous year:

As a result of this, many people have been forced to take on second jobs or enter the gig economy simply to maintain their standard of living. I discussed this in a recent blog post as it may be one reason why the jobs market continues to be so strong despite the massive layoffs that we have seen in the technology sector and a few others.

Fortunately, as investors, we do not necessarily need to resort to taking on additional employment simply to make ends meet. This is because we have the ability to make our money work for us and generate income. One of the best ways to do this is to purchase shares of a closed-end fund that specializes in the generation of income. These funds are not exactly very well followed by the investment media, which is a shame since they do offer a lot for investors. In short, these funds provide an easy way to obtain a diversified portfolio of assets with one simple trade that can, in many cases, deliver a higher yield than any of the underlying assets actually possesses.

In this article, we will discuss the DoubleLine Income Solutions Fund (NYSE:DSL), which is one fund that can be used to generate income. As of the time of writing, the fund yields an impressive 11.59%, which is certainly enough to boost the income produced by a portfolio of any size. However, as I have observed before, any fund whose yield gets this high could be at risk of a distribution cut since the market believes that the distribution is not sustainable. We will naturally be sure to take a look at the fund's finances as part of our analysis today. As some readers may recall, I have discussed this fund before but several months have passed since that time so obviously, numerous things have changed. This article will focus specifically on these changes as well as provide an updated analysis of the fund's finances.

About The Fund

According to the fund's webpage, the DoubleLine Income Solutions Fund has the stated objective of providing its investors with a high level of current income. This is not particularly surprising considering the name of the fund. The fund is generally considered to be a bond fund, although strictly speaking that is not entirely correct. Here is what the webpage states about the fund's investment strategy:

The Fund will seek to achieve its investment objectives by investing in a portfolio of investments selected for their potential to provide high current income, growth of capital, or both. The Fund may invest in debt securities and other income-producing investments anywhere in the world, including in emerging markets.

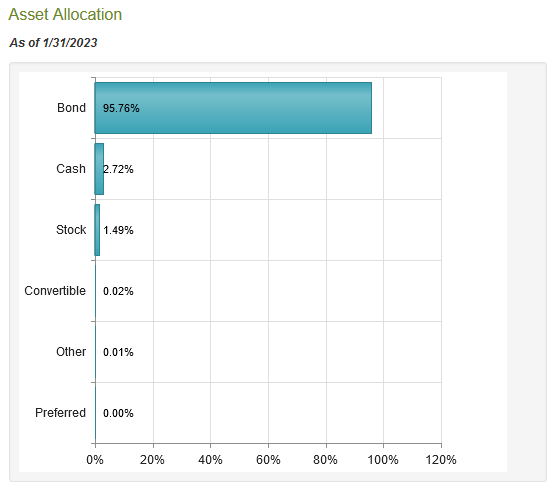

This implies that the fund may include debt securities as well as dividend-paying stocks, or even other closed-end funds and real estate investment trusts. However, currently, the fund's portfolio consists almost entirely of bonds:

CEF Connect

As such, it is not especially surprising that the fund's objective would center around current income. This is because bonds and other fixed-income securities provide the overwhelming majority of their investment return through direct payments made to investors, with only a limited potential for capital gains. That makes sense since bonds have no direct link with the growth and prosperity of the issuing company. After all, a company will not increase the amount of money that it pays to its bondholders simply because its income improved.

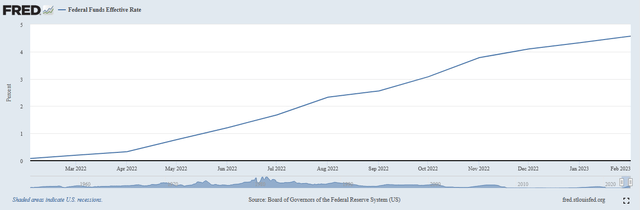

There will certainly be some readers that point out that it is possible to get capital gains off of bonds. In fact, there has been a bull market in bonds for the past four decades. This comes from the fact that bond prices tend to trade based on changes in interest rates. It is an inverse correlation, so basically when interest rates go up, bond prices go down and vice versa. That is relevant today as the Federal Reserve has been very aggressively raising rates over the past year. In February 2022, the federal funds rate was at 0.08% but today it sits at 4.57%:

Federal Reserve Bank of St. Louis

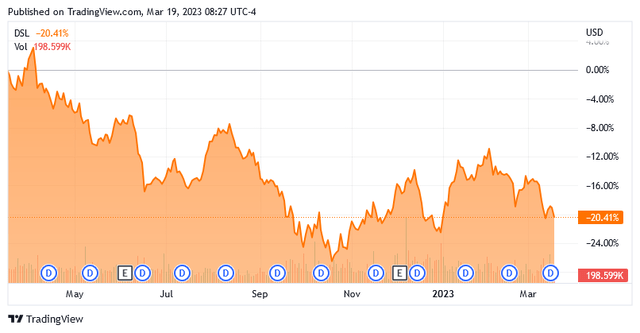

This is an attempt by the central bank to combat the incredibly high rate of inflation that was mentioned in the introduction to this article. As was just explained, this has had the effect of pushing down bond prices over the period. The reason for this is that newly-issued bonds will carry an interest rate that correlates to the federal funds rate at the time of its issuance. Thus, brand-new bonds will have a higher yield than a bond issued a year ago. When we consider that the federal funds rate is currently at the highest level that it has been in more than ten years, we can conclude that nobody will want to purchase a bond that is more than a few months old because they can get a better yield from a brand-new bond than from an existing one. As such, the price of the existing bonds needs to decline so that they deliver the same yield to maturity as an otherwise identical brand-new bond. The fact that bond prices have been declining shows up in the market performance of the DoubleLine Income Solutions Fund. As we can see here, the fund's share price has declined by 20.41% over the past twelve months:

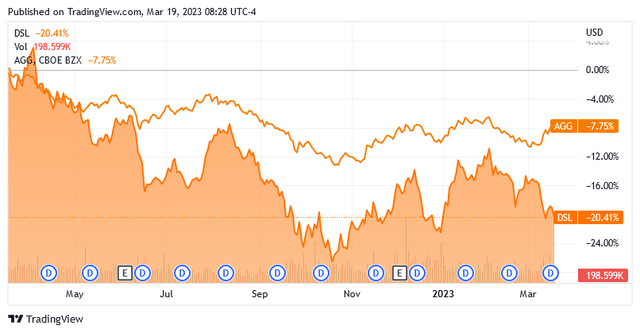

This is much worse than the 7.75% decline of the Bloomberg U.S. Aggregate Bond Index (AGG) over the same period:

Although the DoubleLine Income Solutions Fund does have a significantly higher yield than the index, that was insufficient to close the gap and overall this fund did deliver a lower total return than the index over this time period.

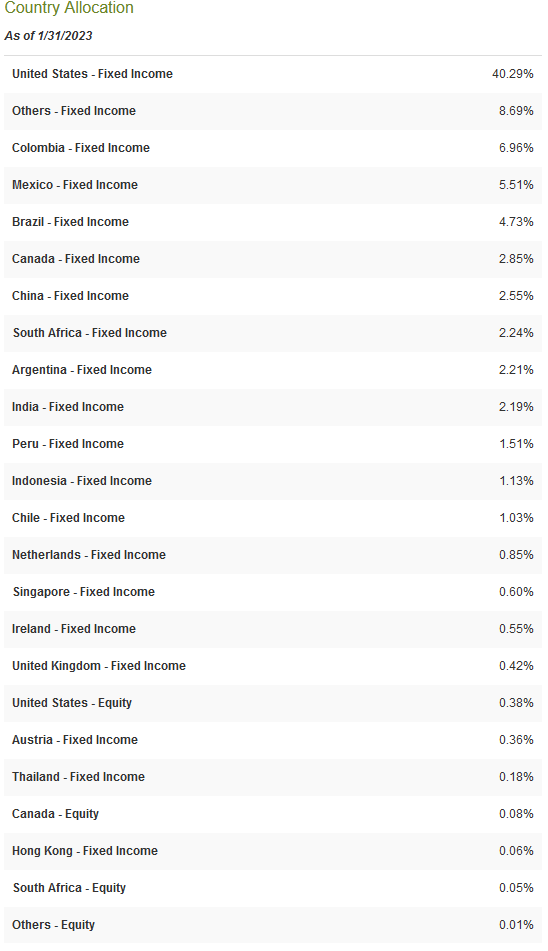

However, the U.S. Aggregate Bond Index is not a perfect benchmark for the DoubleLine Income Solutions Fund. As was noted earlier, the fund's sponsor specifically states that this fund can invest in foreign securities, including securities issued by emerging nations. In fact, right now only 40.29% of the issuers whose fixed-income securities are represented in the fund's portfolio are from the United States:

CEF Connect

This is one of the few global bond funds that have such low exposure to the United States. As I have noted in numerous previous articles, it is common for a global fund to have 60% to 70% of its assets allocated to this nation. However, the low American exposure, in this case, is certainly not a bad thing. One of the biggest reasons for this is that it provides us with a certain amount of protection against regime risk. Regime risk is the risk that some government or other authority will take an action that has an adverse impact on a company that we are invested in. The only real way to protect ourselves against this risk is to ensure that only a limited percentage of our portfolios is invested in any individual country. This fund is certainly doing that, which could make it useful to include in a fund. This is because most American investors are very heavily invested in the United States. That is especially true for bond investors since it can be difficult to get non-American bonds in the United States. As most Americans also earn their incomes in the United States, that results in even greater exposure to the economy of this one nation. Thus, including this fund in a portfolio, which contains lesser American exposure than most other bond funds, could actually reduce one's overall exposure to the United States across the entire portfolio. This is certainly a good thing, particularly considering the very high level of government and private debt in the United States.

In a few recent articles, we have seen that some bond funds engage in substantial trading activities in an attempt to generate capital gains. The DoubleLine Income Solutions Fund does not appear to be one of them. We can see this in the fact that the fund only had a 24.00% annual turnover during its most recent fiscal year, which is not particularly high. This is something that is nice to see because it costs money to trade bonds or other assets and these expenses are billed directly to the shareholders of the fund. That creates a drag on the portfolio's performance and generally makes management's job more difficult. This is because management must generate sufficient returns to cover these additional expenses and still deliver a return that is acceptable to the fund's investors. This is a task that very few management teams manage to accomplish consistently, which is one big reason why actively managed funds usually underperform their benchmark indices. As we just saw, the DoubleLine Income Solutions Fund failed to beat the Bloomberg U.S. Aggregate Bond Index over the past year, at least in terms of market returns. However, it has fared much better against the Bloomberg Global Aggregate Index:

As we can clearly see, the fund managed to outperform the index during most, but not all, of the above periods. That is particularly true in terms of market price, which highlights one major feature of closed-end funds. Unlike an exchange-traded fund or a typical mutual fund, a closed-end fund might have significantly different price performance in the market than that of the underlying portfolio. This allows investors to sometimes acquire the fund's assets for significantly less than they are actually worth. We will discuss this more later in the article when we get into the valuation. The important takeaway right now is that the fund usually managed to outperform its benchmark index during a given period. That is undoubtedly going to be appealing to most investors, although there is no guarantee that this will continue to be the case going forward.

Leverage

In the introduction to this article, I stated that closed-end funds like the DoubleLine Income Solutions Fund have the ability to produce higher yields than any of the underlying assets actually possesses. One of the methods that are employed by this fund in order to accomplish that is the use of leverage. In short, the fund borrows money and then uses that borrowed money to purchase bonds or other income-producing assets. As long as the purchased assets have a higher yield than the interest rate that the fund needs to pay on the borrowed money, the strategy works pretty well to increase the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, that will usually be the case.

However, the use of debt in this fashion is a double-edged sword because leverage boosts both gains and losses. This could be one reason why the fund fell so much more than the U.S. bond market over the past year. As such, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I do not generally like to see a fund's leverage exceed a third as a percentage of its assets for this reason. Fortunately, the DoubleLine Income Solutions Fund satisfies this requirement. As of the time of writing, the fund's levered assets comprise 29.82% of the fund's portfolio. Thus, this fund appears to be striking a reasonable balance between risk and reward.

Distribution Analysis

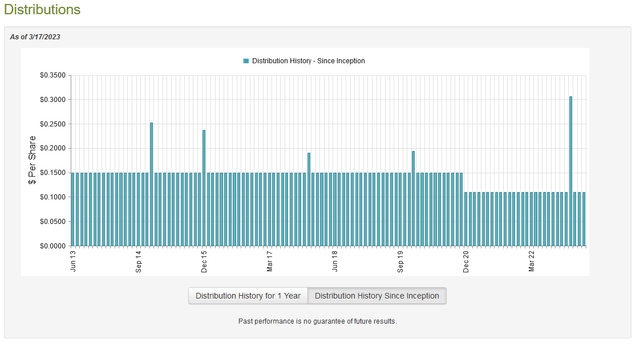

As stated earlier in this article, the primary objective of the DoubleLine Income Solutions Fund is to provide its investors with a high level of current income. In order to accomplish this goal, the fund invests primarily in bonds and other fixed-income assets and then applies a layer of leverage to boost the effective yield. Since some bonds, particularly emerging market bonds, have a very high interest rate to begin with, we can assume that the fund itself will also have a fairly high yield. This is certainly the case as it currently pays out a monthly distribution of $0.11 per share ($1.32 per share annually), which gives it an 11.59% yield at the current price. This fund has been remarkably consistent about this distribution over time, with only one change over its entire lifetime:

The fact that the fund had to cut back in December 2020 may be discouraging to those investors that are seeking a stable and consistent source of income to use to pay their bills or otherwise finance their lifestyles. However, this is a much better track record in terms of consistency than most other fixed-income funds have managed to achieve. Anyone that has read some of my recent articles on other bond funds can attest to this. When we consider how low interest rates were in December 2020 and how much excess liquidity there was in the financial system, it is hardly surprising that the fund would have to make a cut at this time. However, the fund's past is not the most important thing for anyone purchasing the shares today. This is because an investor today will receive the current distribution at the current yield. Thus, the most important thing is how well the fund can maintain its current distribution.

Fortunately, we do have a somewhat recent document that we can consult for this purpose. The most recent financial report for the DoubleLine Income Solutions Fund corresponds to the full-year period that ended on September 30, 2022. While this report will not include any data about the past six months or so, it will still give us a pretty good idea of how well the fund handled the early stages of the Federal Reserve's monetary tightening cycle, which is when the bond market received the biggest shock. During the full-year period, the DoubleLine Income Solutions Fund received $183,883,174 in interest and $6,228 in dividends from the assets in its portfolio. This gives the fund a total investment income of $183,889,402 during the period. It paid its expenses out of this amount, which left it with $149,787,677 available for investors. That was unfortunately not nearly enough to cover the $176,556,509 that the fund actually paid out in distributions during the period. At first glance, this may be concerning, as the fund's net investment income is not enough to cover its distributions. Generally speaking, we do like to see net investment income be greater than distributions in the case of a fixed-income fund.

There are other ways for a closed-end fund to obtain the money that it needs to cover its distributions besides net investment income. For example, the fund might be able to earn capital gains that it can pay out to the shareholders. As might be expected given the difficult conditions for the bond market during the period in question though, the DoubleLine Income Solutions Fund generally failed to accomplish this. The fund reported net realized losses of $27,909,681 and had another $582,510,041 net unrealized losses during the period. Overall, the fund's assets declined by $637,188,554 over the one-year period after accounting for all inflows and outflows. That is unfortunate since it is a clear sign that the fund is failing to maintain its distribution. The fund did have a much better investment during the previous year, but overall its assets were still down over the two-year period that ended on September 30, 2022. Thus, the fund may be forced to cut its distribution at some point in the near future. This is probably the reason for the double-digit yield at present.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way of generating a suboptimal return on that asset. In the case of a closed-end fund like the DoubleLine Income Solutions Fund, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of all the fund's assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund's assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of March 16, 2023 (the most recent date for which data is available as of the time of writing), the DoubleLine Income Solutions Fund had a net asset value of $11.77 per share but the shares currently trade for $11.39 per share. That gives the fund's shares a discount of 3.23% at the current price. That is substantially better than the 1.50% premium that the shares have averaged over the past month. As such, the price certainly looks acceptable today.

Conclusion

In conclusion, there are certainly several things to like about the DoubleLine Income Solutions Fund today. In particular, the fund enjoys a significant amount of international diversity that could provide American investors with a way to reduce their exposure to the American bond market and economy. The fund also has delivered a very respectable performance over time as it has consistently beaten the Bloomberg Global Aggregate Bond Index. The fact that the shares are currently trading at a discount is also nice to see. Unfortunately, it appears that the fund may be forced to cut its distribution in the near future as net investment income is insufficient to cover the expense of its current payout and the fund's assets are down over both the trailing one-year and two-year periods. It could still be worth buying if you are willing to accept that you may not be receiving an 11.59% yield-on-cost for much longer, though.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.