Pangaea Logistics Solutions: Defensive Dry Bulk Shipping Play With Solid Dividend Coverage - Buy

Summary

- Pangaea Logistics Solutions ("Pangaea") is a somewhat unique dry bulk shipping company with a diversified strategy and stronghold in the ice class niche.

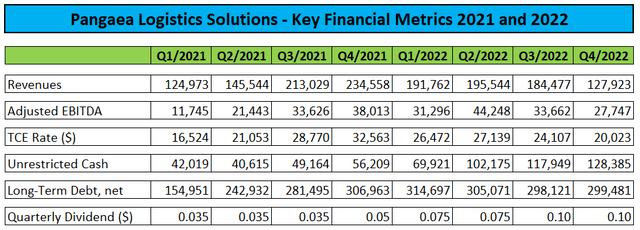

- Last week, Pangaea reported respectable fourth quarter and full-year 2022 results with strong profitability as well as decent cash generation.

- While Q1 will be impacted by seasonally weaker charter rates, the company should remain solidly profitable with expectations for improvement in subsequent quarters.

- After last week's sell-off, the company's annualized dividend yield has increased to 7.7%. Unlike many peers, the company is paying a fixed quarterly dividend of $0.10 per share.

- Investors with some faith in China's reopening and western central banks' ability to deal with the fallout of their own monetary policy moves should consider scaling into Pangaea Logistics Solutions shares at current levels.

richard johnson/iStock Editorial via Getty Images

Pangaea Logistics Solutions (NASDAQ:PANL) or "Pangaea" is a Bermuda-based dry bulk shipping company with somewhat unique characteristics.

Unlike most of its peers, Pangaea doesn't exclusively focus on voyage or time charters but also on so-called "Contracts of Affreightment" ("COAs").

COAs are agreements providing for the transportation between specified points for a specific quantity of cargo over a specific time period but without designating specific vessels or voyage schedules, thereby allowing flexibility in scheduling since no vessel designation is required. COAs can either have a fixed rate or a market-related rate. The company’s COAs typically extend for a period of one to five years, although some extend for longer periods.

In addition, the company focuses on backhaul cargoes to reduce ballast days and increase expected earnings for well-positioned vessels.

Moreover, Pangaea is a leader in the ice class niche. Ice class trading includes service in ice-restricted areas during both the winter (Baltic Sea and Gulf of St. Lawrence) and summer (Arctic Ocean). Trading during the ice seasons has provided superior profit margins, rewarding the company for its investment in specialized vessels and the expertise it has developed working in harsh environments.

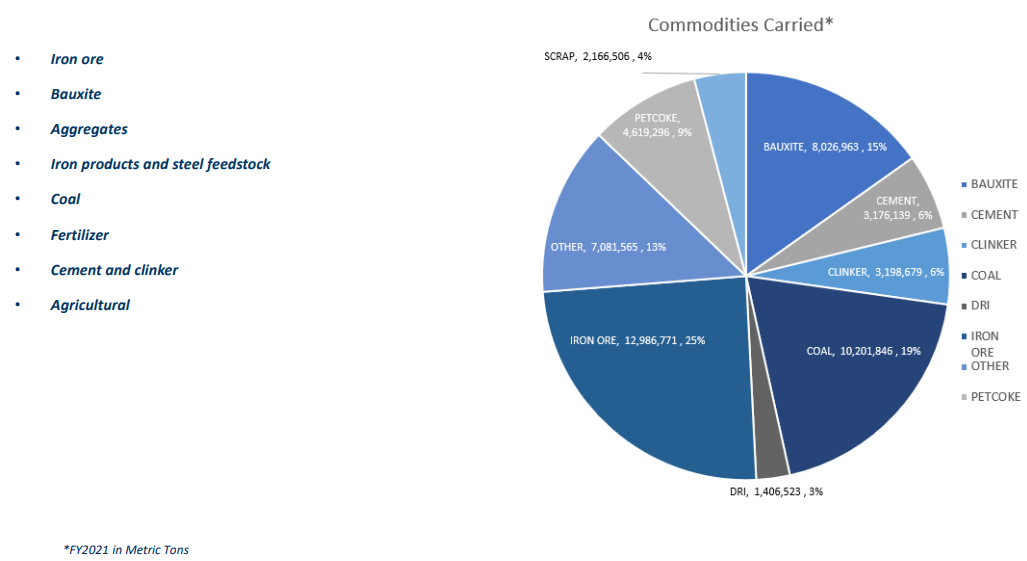

Other than most of its peers, the company carries a wide variety of commodities:

Company Presentation

Pangaea is employing an asset-light strategy with a substantial part of the fleet chartered-in on short-term contracts to allow for quick adoption to changes in the market environment.

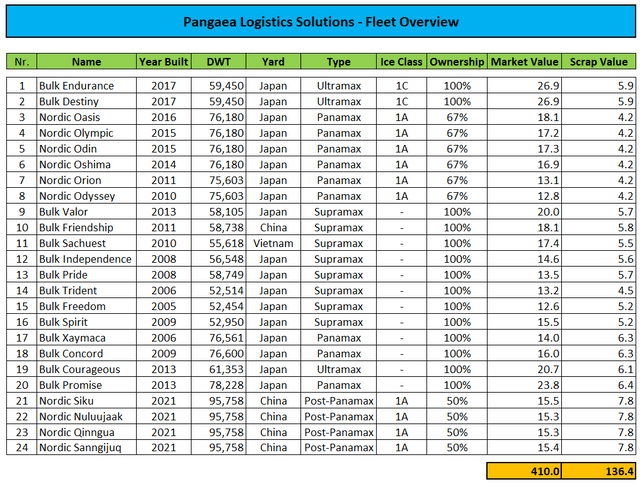

That said, the company has increased its owned fleet in recent quarters by adding a number of secondhand vessels as well as taking delivery of four 50%-owned newbuild Post-Panamax ice class carriers:

Company SEC-Filings / MarineTraffic.com

Please note that the company consolidates two joint ventures owning the company's Panamax and Post-Panamax ice class carriers with the company's respective stake incorporated in the table above. Consequently, only the vessel values attributable to Pangea are included in the fleet value estimate above.

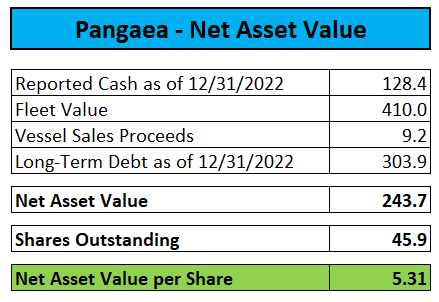

In contrast, as the company does not break out debt attributable to the company's joint venture partners, I decided to conservatively include all consolidated debt into my net asset value ("NAV") estimate:

Company SEC-Filings / MarineTraffic.com

Assuming $10 million of debt per Panamax- and Post-Panamax ice class vessel being attributable to the company's respective joint venture partners, NAV would be closer to $7.30 per share.

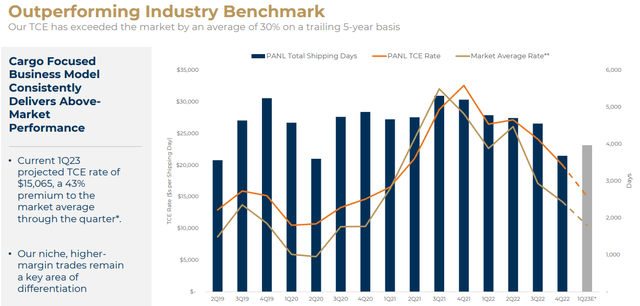

Moreover, judging by the company's outperformance in time charter equivalent ("TCE") rates relative to the industry benchmark, additional value should be attributed to the company's COAs.

That said, the somewhat defensive nature of the company's long-term COAs usually results in Pangaea outperforming the market by wide margin in times of weakness while the company tends to slightly underperform spot market-focused competitors during rallies in charter rates.

Last week, Pangaea reported respectable fourth quarter and full-year 2022 results with strong profitability and operating cash flow generation. The average Q4 daily TCE rate of $20,023 represented a more than 40% premium to prevailing market rates.

Due to the recent seasonal weakness in dry bulk charter rates, Q1/2023 TCE rates will decline significantly from Q4 levels but are still expected to outperform market averages by a wide margin again.

Even at the preliminary $15,065 daily Q1/2023 TCE rate, the company should remain solidly profitable and based on current forward freight agreement ("FFA") rates, Q2 and Q3 should see substantial improvements in the daily TCE rates albeit nowhere near the levels experienced in the second half of 2021 and most of 2022.

As usual, much will depend on China, particularly with recent turmoil in the banking sector increasing the likelihood of a near-term recession in the U.S. and Europe.

After outperforming dry bulk peers in recent quarters, Pangaea's shares have taken a major hit following last week's earnings release which I would attribute to the reported substantial year-over-year declines in revenue and average TCE rate as well as the company's preliminary outlook for the seasonally weak Q1.

While the increased likelihood of a hard landing for western economies has caused me to become more cautious on the shipping industry as a whole, a somewhat defensive dry bulk stock with a solid and well-covered dividend yield like Pangaea Logistics Solutions is looking increasingly attractive after the recent setback.

Bottom Line

There's a lot to like about Pangaea's strategy of serving higher-yielding niches of the dry bulk shipping markets in a flexible manner without being entirely dependent on certain key commodities like iron ore or coal.

While the company's near-term performance will be impacted by the seasonal drop in dry bulk charter rates, Pangaea should still generate decent cash flow from operations, thus increasing NAV further going forward.

Particularly in times of market weakness, the company tends to outperform dry bulk shipping peers by a wide margin.

While Pangaea's annual dividend yield of approximately 7.7% doesn't look overly impressive in the current interest environment, particularly when compared to market leaders like Star Bulk Carriers (SBLK) or Golden Ocean Group (GOGL), investors should note that these companies pay variable dividends while Pangaea's quarterly distribution is unlikely to be reduced anytime soon.

Investors with some faith in China's reopening and western central banks' ability to deal with the fallout of their own policy moves, should consider scaling into Pangaea Logistics Solutions' shares at current levels.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.