Carvana: Drowning In Debt With Deteriorating Gross Margins

Summary

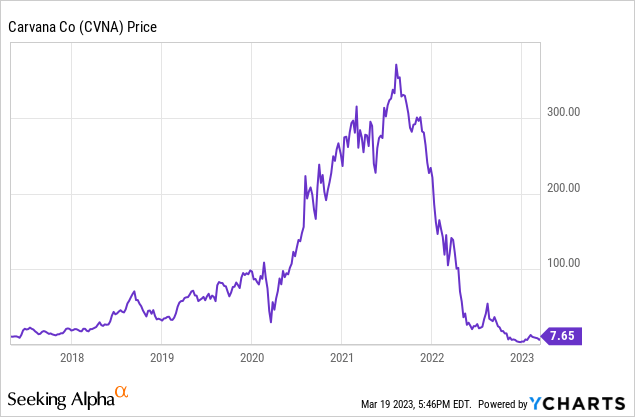

- Carvana has rallied tremendously in 2023, but is still well below the highs.

- The company has rapidly declining sales volumes and compressing margins.

- Their massive debt pile hangs over the company. This is more of an issue than normal given how closed capital markets are at the moment.

- If Carvana is unable to quickly fix their operations or restructure their debt load, I believe the company may be taken out at a much lower price or go bankrupt.

- We see no fundamental reason to own the stock here.

Joe Raedle

Thesis

Despite Carvana's (NYSE:CVNA) massive selloff, we do not believe that now is a time to buy the dip. This is a difficult environment for used car sales. On top of that Carvana has declining gross margins, meaningfully negative net margins, and a massive debt pile. We think investors would do well to stay far away from this company.

Declining Volumes in a Difficult Environment

In Carvana's fourth quarter shareholder letter the company states:

"After the pandemic, snarled automotive supply chains and historically rapidly rising interest rates combined to dramatically impact the affordability of used cars."

As well as:

"This led to markedly lower volumes than we had positioned for and, as a result, we have been carrying excess costs."

As the automotive supply chain has gradually improved, interest rates have continued to remain high and dent affordability, which negatively impacts demand.

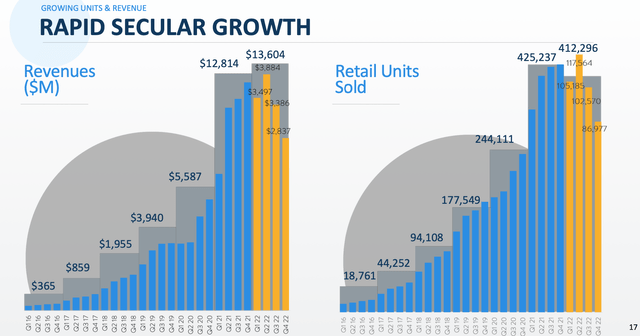

In their fourth quarter Carvana reported retail units sold of 86,977, a decrease of 23% YoY and revenue of $2.837 billion, a decrease of 24% YoY. This deceleration in volume was accompanied by gross margin compression.

According to Automotive News, demand for used cars is likely to decline further in 2023, which if true would mean Carvana's business will continue to be challenged this year.

Declining Gross Margins and Negative Net Margins

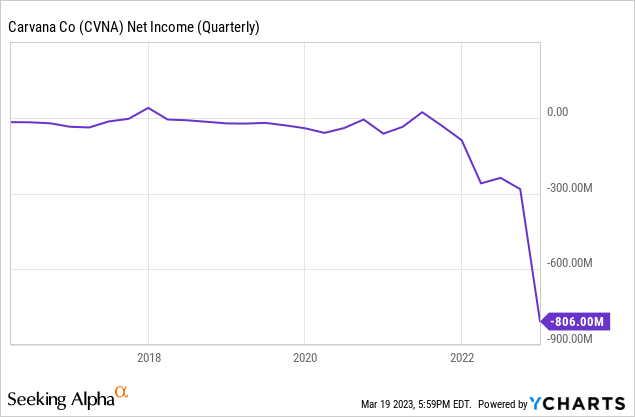

After years of growing gross profit per unit Carvana experienced a steep decline in this operating metric during 2022. In 2021 the company had gross margins of 15%, but in 2022 their gross margins shrank to 9%. This in turn caused their net income margin to collapse all the way to -21.3%.

In their younger days this normally would not have been an issue, but due to the scale that Carvana currently has the company cannot afford to sustain deeply negative net margins for very long in my view.

Carvana Feb 2023 Investor Presentation

Their net losses are made much worse by the fact that they have a massive debt pile that will eventually need servicing, and they are currently unable to service that debt through earnings.

Massive Debt Pile

The current state of capital markets mean that unprofitable companies are having difficulty raising capital, especially those that already have a lot of debt. Carvana has a total debt pile of $8,309 million. With negative stockholder's equity of over $1 billion the situation looks bleak for equity holders.

I think Carvana will either need to quickly fix their operations or restructure their debt in order to avoid bankruptcy in the coming years. If the company is unable to do this they may be acquired for a low-ball amount or simply go bankrupt.

Declining revenue, declining margins, and a massive debt pile seem like they could be a major issue for a company. In this case these factors may very well be what dooms Carvana.

Price Action

Carvana had a meteoric rise and an equally drastic fall and is now trading for just a fraction of the price it was just two years ago. We do not believe that this is an opportunity to buy the dip because of how bleak the fundamentals are for the company.

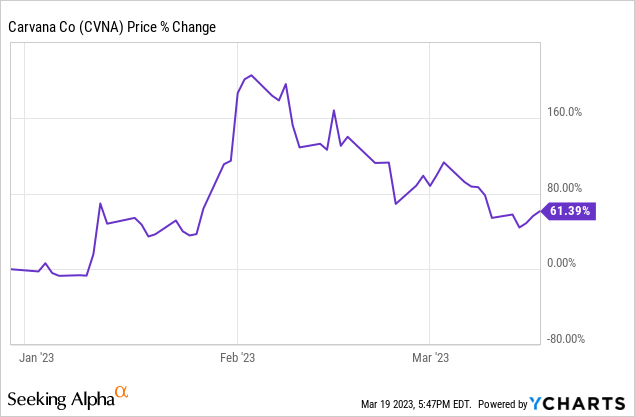

Carvana has had a blistering 61% rally in 2023, and we view this as an opportunity to take profits. This rally is likely fueled by short covering. While a continued short squeeze could take place, it doesn't seem worth the risk of holding this fundamentally challenged company.

Valuation

Carvana has massive net losses with no sign of stopping anytime soon. Since they make no profits, it is impossible to value them on this metric. Using price to sales is also difficult because one dollar of revenue results in much less gross profit than businesses that are typically valued on a price to sales basis (such as software).

Given their massive debt load and lack of profitability it seems best for investors to stay away until the fundamental picture improves significantly (if ever).

I believe bankruptcy or a low-ball takeover is definitely in the cards here.

Risks

A risk to this bearish thesis is if Carvana is able to right-size their operations while also restructuring their debt on favorable terms. While both of these seem unlikely, if they are able to pull it off the bear case for the stock becomes much weaker.

Another way Carvana can outperform expectations is if consumers begin to prioritize the convenience that their service provides. This much needed boost in sales volume could be enough to bridge them until another potential capital raise.

We find it unlikely that management will be able to turn the ship around. We view the risk/reward as being horrendous and don't see any reason to step in and buy shares.

Key Takeaway

Given their challenged financial situation we do not believe that investors should consider buying shares in Carvana. The company has declining gross margins, deeply negative net margins, and a massive debt pile. We think investors would do well to stay far away from this company.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.