BIL: Stop Giving Banks Your Interest

Summary

- Liquidity and solvency issues facing banks may be much larger than most insiders are willing to admit publicly.

- As the M2 money supply declines and bank deposits fall, investors with cash or "near-cash" may be in a highly advantageous position.

- Uninsured bank deposits have an objectively higher risk than T-Bills, but pay almost no return as banks keep profits on loans.

- While government default could temporarily impair T-Bill ETFs like BIL, the potential impact on bank deposits and other financial assets is likely much more significant.

- BIL is essentially the lowest-risk asset in the financial system and pays a 4.5% yield, much better than CDs and savings accounts.

bymuratdeniz/E+ via Getty Images

With financial markets strained by many challenges, it is a difficult time for investors to find strong "risk-reward" investments. Many stocks and bonds are at "depressed" prices following the recent slide; however, with turmoil in banks, the economy slowing, and inflation remaining persistent, most assets have a significantly elevated risk profile today. I believe many "discounted" stocks and bonds will likely be "value traps" as asset devaluations spur knock-on financial difficulties. That said, investors with a strong cash position may find themselves among the few able to purchase discounted assets months from now. As banks struggle to maintain liquidity, investors with ample liquidity may likely find themselves in an advantageous position.

"Cash is King" as Liquidity Troubles Mount

Crucially, the economy's total amount of "cash" is falling today due to the Federal Reserve's tightening policy. US commercial banks currently have ~$23T in assets but just $3T in cash assets, so if deposits decline and banks need to sell assets, they're highly unlikely to receive sufficient cash. Although a bank's use of the "discount window" may temporarily restore bank liquidity, it is not a long-term solution and only lasts 90 days. Eventually, when the Federal government's debt ceiling is raised, the Treasury will need to sell the significant debt to recoup depleted funds rapidly, likely further exacerbating the bank's liquidity strains (since they're a primary Treasury buyer).

Today, the M2 continues to decline while bank deposits falter on abnormally low personal savings levels (due to falling real wages). Many individual investors have decent cash reserves; however, many have seen cash levels decrease over recent months. Individual investor cash levels also remain below the 2000s normal range. See below:

The overall liquidity environment in the financial system is precarious. Government guarantees and efforts have partially calmed fears in the market. While I do not believe fear is advisable, I firmly believe banks' potential challenges are more significant than many believe. As one example, last November, I wrote "Credit Suisse: Bank Failure Is Not Off The Table," Many readers thought this notion was ridiculous; however, the stock has lost nearly all its value since.

I believe fear and panic are not avoided by denying reality but by making reasonable and sensible efforts to reduce risk. If there is a liquidity crisis, matched with a slowing economy and ongoing supply-side inflation, the Federal Reserve's capabilities to maintain stability are limited. For example, a $25-$100B+ liquidity or "backstop" program is doable, but more $500B-$2T+ QE programs are doubtful, as that could make inflation much worse.

Indeed, the ongoing inflation issue is mainly caused by doubling the money supply in 2020 to stimulate the economy. For decades, quantitative easing (since 2008) and immense Federal deficits (for much longer) have been a way to "kick the (debt) can down the road," causing public debt (and private leverage) levels to rise to offset strains from existing debt. Considering the last wave of stimulative efforts caused inflation, I doubt those strategies will continue to work in the event of another financial or economic challenge.

Creating Portfolio Resiliency

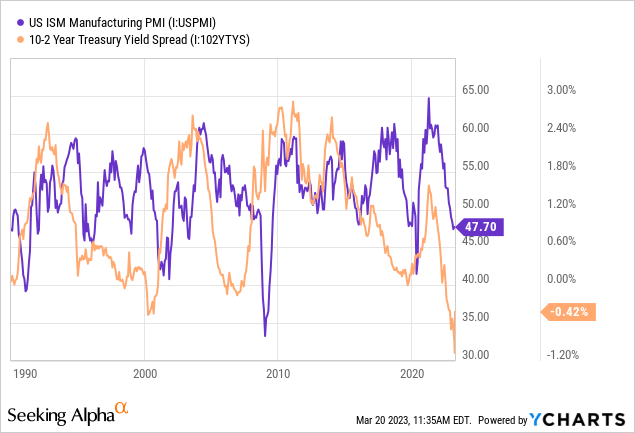

In the current environment, I believe investors seeking to preserve capital would be wise to choose assets that are not dependent on stability in the banking system. Unfortunately, this excludes most stocks and bonds due to corporate debt levels and refinancing needs today. Highly solvent companies with robust cash flows and strong operating positions may still be feasible (some miners, energy, healthcare, consumer staples, etc.). However, investors should brace for a prolonged and material slowdown in the economy, with the yield curve facing near-record inversion levels and the manufacturing PMI signaling contraction. See below:

Today's immense yield curve inversion appears to be bottoming after the recent decline in short-term bonds as the Federal Reserve interest rate outlook fell during the SVB collapse. Historically, yield curve inversion signals a recession, but recessions rarely occur until the curve has re-steepened significantly (or when the interest rate outlook declines). We're finally starting to see this happen today, creating a strong immediate warning signal for stocks and corporate bonds.

I believe three assets are strong targets in the current environment: precious metals, short-term Treasuries, and inflation-indexed Treasuries. A portfolio mix of these three should secure investors from inflation and credit risks as long as the financial system itself remains afloat. A substantial crisis such as hyperinflation, prolonged government default, and a total bank failure would likely impair "paper" precious metals and short-term Treasuries. However, these are essentially "non-Hedgeable" risks (apart from physical metals and potentially cryptocurrencies), so for any liquid portfolio, short-term Treasuries may be the best bet today. A cheap and easy way to invest in "T-Bills" is with the SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (NYSEARCA:BIL), which has a 4.4% SEC yield today (forward yield after expense ratio).

Stop Giving Banks Your Interest with BIL

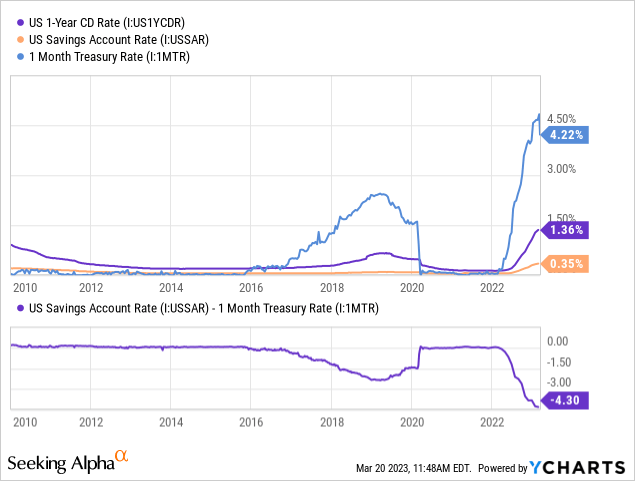

Banks are finally starting to compete for deposits by increasing rates on deposited money. The current average 1-year CD rate is 1.36%, and the average savings account rate is 0.35%. While this is much better than zero, as in recent years, it is far below returns found on Treasury bills. Indeed, the spread between "T-Bill" rates and savings account rates have never been as large as today. See below:

Which is riskier? Putting money in a savings account or T-Bills? In my view, ultimately, they have the same risk as long as deposits are below the FDIC limit. If you buy T-Bills, the only "risk" is a default on government debt. The ongoing political drama regarding the debt ceiling could lead to a default by summer. A default could lead to some interest in BIL being delayed, but hypothetically, there is no risk the US government can become insolvent since it can create its own money.

Further, if the US government did enter a prolonged default, then "FDIC-insured" deposits would not be protected, and most banks would fail as the Treasury (and derivatives) market would break down. This potential is unreasonable and unlikely but illustrates that bank deposits are at least as risky as T-Bills, if not more so. Of course, T-Bills and insured bank deposits are the least risky liquid assets in the financial system.

I believe investors today have no reason to prefer bank deposits over T-Bills, such as ETFs like BIL. However, average individual investors have around 20% of their portfolio assets in bank deposit cash. For those with less than $250K in cash, BIL offers a ~4.5% return with the same risk. For investors over the insured limit, it may be wise to move excess money out of bank deposits into assets like BIL to reduce risk (and increase returns) if banks continue to face difficulties.

What do banks do with your cash deposits? They make risky loans at 7-12X leverage, earning very high net-interest-margin cash-flows and giving depositors back pennies on the dollar. For example, Wells Fargo (WFC) earned a 5.13% yield on its loans last quarter and had an average deposit cost of just 46 bps. If some of those loans fail, uninsured depositors will face losses. Considering we are seeing banks fail without a recession, what will happen when a recession occurs? In that situation, I doubt the US government likely cannot continue to backstop the total ~$8T in uninsured deposits.

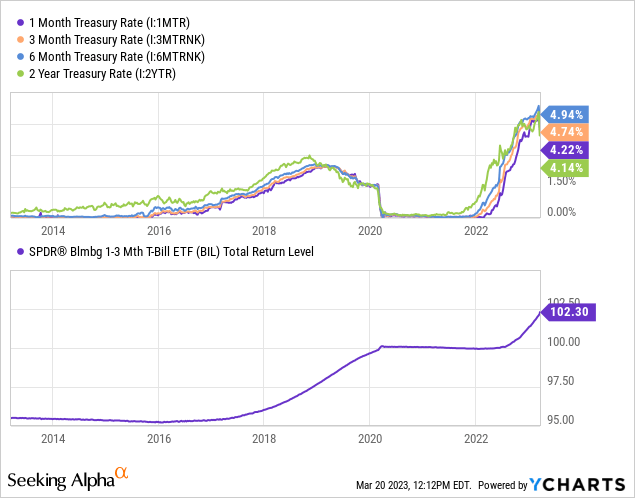

BIL currently offers its highest yield in years, and its dividend is expected to rise to ~5% over the coming six months. With the yield curve as inverted as it is, the short end of the yield curve offers the best opportunity it has had in decades. Further, BIL's high yield is expected to remain above 4% for at least two years. See below:

Today's short-term interest rates are currently pricing in an interest rate hike of 25 bps this week, followed by a rise to 4.75-5% over the coming months. While the ongoing banking liquidity crisis has caused the outlook to falter, the Federal Reserve has no strong reason to reduce interest rates until unemployment rises and inflation declines back to near 2%. I expect the Federal Reserve to relax its "discount window" rules further to supply liquidity. Still, it has no mandate to bail out the banks, and I believe it is unlikely to dramatically reduce interest rates when inflation is running around 5%. Of course, if a recession occurs and inflation slows sufficiently, then interest may be cut, but BIL offers a solid yield until then and has no duration risk exposure (unlike longer-term Treasuries).

The Bottom Line

I believe BIL ETF is a superior asset today, offering a higher yield than most stocks and long-term bonds, with essentially no risk. Few investors own these securities today, with most preferring traditional bank deposits and risk assets. Over recent years, when interest rates were near zero, there was no reason to choose BIL over bank deposits strongly, and economic and financial risk was low enough that stocks and long-term bonds appeared more sensible. However, today banks give depositors meager returns while asking them to finance potentially tremendous risk.

Even for those investors not concerned about the safety of deposits, BIL remains superior due to its higher return than virtually all deposit banks. Indeed, banks that offer 4-5% deposit returns are likely making riskier loans or have negative net-interest margins and elevated deposit risk exposure. Hypothetically, US government default is a negligible risk to BIL, but there are likely no liquid assets with any protection if that occurs.

Still, I prefer BIL because it allows investors a low-risk way to reduce exposure to challenges in bank deposits. Based on my own research regarding bank balance sheet health over the past year (1, 2, 3, 4, 5, 6, 7, 8), I firmly believe the depth of this issue is more considerable than most are willing to grasp. The fact that some senators are calling for censorship of information regarding bank challenges should be a red flag to the public. I do not say this to cause alarm but to provide the facts that may allow readers a means to reduce their asset risk exposure. While BIL is not a "perfect asset," I believe it is far better than bank cash deposits and most stocks and bonds due to its higher yield and lowest risk profile of all fiat-currency assets.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of BIL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.