Oracle: TikTok Savior With Security Cloud Tailwinds

Summary

- Oracle has positioned itself as a niche provider of Cloud infrastructure solutions to satisfy data sovereignty requirements.

- TikTok has chosen Oracle as its cloud infrastructure partner as it aims to avoid a ban in the U.S. over data residency concerns.

- Oracle bought back 1.8 million shares for a total of $150 million in Q3,FY23, and has a forward dividend yield of 1.88%.

Justin Sullivan

Oracle (NYSE:ORCL) is a legacy technology company that is most known for its databases, its back office software, and ERP (Enterprise resource planning) applications. However, over the past few years, the company has been through a renaissance as it focuses on becoming the next major cloud provider, with a solid niche in the data residency space. So far, the company has built out 41 public cloud regions, with 8 under construction, as it invested $2.6 billion in CapEx to aggressively expand in Q3,FY23. I believe this is a solid strategy given the hybrid cloud industry is forecast to grow at a 21% compounded annual growth rate [CAGR] up until 2028. In February 2023, Oracle announced a major deal with Uber (UBER) for its cloud infrastructure, which is a testament to its differentiation from the major hyperscalers. In this post, I'm going to break down the financials of Oracle and its cloud tailwinds, before revealing my valuation for the company; let's dive in.

Solid Financials

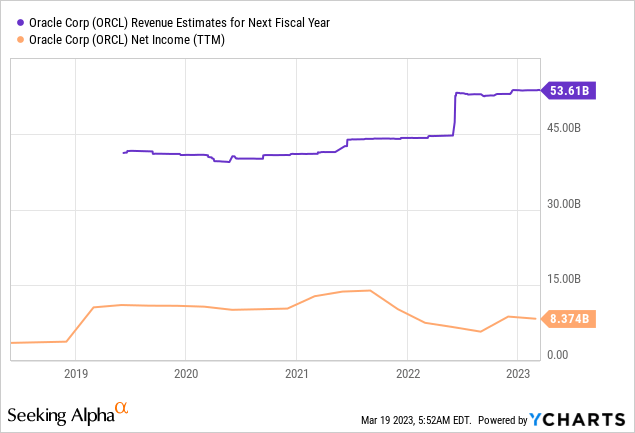

Oracle reported solid financial results for the third quarter of the fiscal year 2023. Its revenue was $12.4 billion, which increased by 17.93% year over year, despite missing analyst forecasts by $26.59 million.

Core Cloud Growth and TikTok Ban

The top line was driven by exceptional cloud revenue of $4.1 billion, up 48% year over year on a constant currency basis. If we exclude Cerner (which I will discuss later), Oracle reported $3.5 billion in cloud revenue, which increased by a rapid 28% on a constant currency basis. This does not surprise me given Oracle is known for being a specialist provider of secure cloud solutions, which help satisfy data sovereignty requirements. For example, in Germany, companies that capture financial, healthcare, or telecommunications data on citizens must keep the data within their borders. Many other countries have similar rules, including China, Russia, Brazil, India, Australia, Turkey, Egypt, etc. In addition, many of these countries (such as Turkey and Egypt) don't have an AWS (AMZN) region (the world's largest cloud provider).

Therefore, companies in these countries must adopt an on-premise solution for certain data applications. Luckily, Oracle solves this major challenge with its "Dedicated Region" Cloud. This effectively means all public cloud services can be deployed easily to a customer's on-premises data centers, which is a more robust solution than competitor products such as AWS Outposts. A notable example where this solution could be make or break for a company is with regards to TikTok, one of the fastest-growing and most controversial platforms in the world. In a New York Times Event Interview, TikTok CEO Shou Zi Chew announced plans to "fully pivot" to Oracle cloud servers located in the U.S. for its data storage. This has still not quashed legislator concerns completely as many fear TikTok's parent company ByteDance (BDNCE) could be forced to hand over U.S. citizen data by the Chinese government. The U.S., U.K., and New Zealand have already announced a TikTok ban on government phones. This is because studies indicate that TikTok's app can access other phone data such as its calendar, contacts, and even the sim card serial number. For a government official, this data could be a security threat. Banning TikTok on all U.S. devices has also been considered recently after bipartisan legislation was introduced.

Either way, all these concerns are highlighting the highly-regarded position of Oracle in the cloud data residency industry. In one scenario, Oracle would effectively "wall off" U.S. citizen data to prevent the transfer to China. This may even include the monitoring of TikTok's algorithms for content related to the Chinese government. On March 23, TikTok CEO aims to testify at the congress, this is important as if TikTok is banned, this would likely impact Oracle's stock price negatively, which is a risk. However, if the platform is not banned (which I believe it won't), then Oracle would be poised to cement itself as a leader in data residency. There have also been talks that Oracle and Walmart (WMT) could acquire TikTok, which could be extremely lucrative for the company.

Cerner Healthcare Opportunity

I have calculated approximately $600 million of Oracle's revenue was driven by digital healthcare provider Cerner. This company was acquired in June 2022 for a staggering $28 billion and is part of Oracle's plan to digitize the lucrative (but challenging) healthcare market, with a focus on digital healthcare records. The U.S. electronic medical records market was valued at a substantial $12.3 billion in 2023. Oracle already has an advantage in this space, as Cerner's database was already provided by Oracle (pre-acquisition). Moving forward, the company has major plans to move Cerner patient data to the Oracle OCI cloud. The goal of the migration is to increase security, reliability, and lower cost, as Oracle's OCI cloud has greater efficiency than Cerner's own data centers.

This is a positive sign as often pre-acquisition, it is vital to identify "synergies" such as cost savings, which sometimes can be vague, but in this case, it is very clear. Since the acquisition, Cerner has also increased its contract base by a staggering $5 billion. This was driven by major wins, including the U.S. Department of Veterans Affairs, the DoD, and multiple hospitals across Canada and the U.K. I believe the U.K. offers a major opportunity as it has the single biggest payee healthcare system in the world, the National Health Service [NHS], therefore, deals with this organization can result in lucrative contracts. For example, software company Palantir (PLTR) has been bidding on an NHS data contract worth nearly half a billion dollars. Cerner already has its product deployed in NHS hospitals such as Princess Alexandra and Sheffield teaching hospitals in the U.K., which had adopted the full Cerner Suite. I believe Cerner (and Oracle) can use these case studies to "land and expand" across more hospitals in the U.K.

In terms of product synergies, Oracle's healthcare suite includes a plethora of end-to-end solutions such as the below:

- Healthcare Cloud Computing

- Healthcare Analytics

- Digital Patient Outreach

- Policy Administration and Claims Management

- Health Insurance Revenue Management

- Healthcare Finance and Operations

- Healthcare HCM

- Digital Patient Customer Service

- Healthcare Analytics

- Digital Patient Outreach

- Healthcare Cloud Computing

Therefore, the potential for upsells or cross-sell is vast, as Oracle can expand into existing client partnerships.

Margins and Balance Sheet

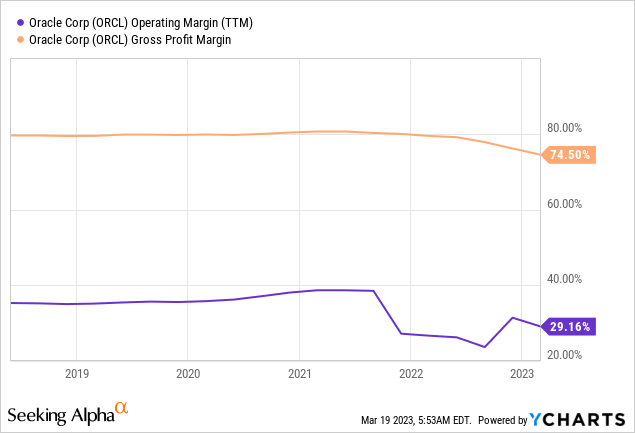

Moving onto margins, Oracle reported a gross margin of 79% for its cloud and license businesses. Interestingly, as Oracle expands its cloud infrastructure, the company has reported higher margins due to scale efficiencies, which is a positive sign. The company also reported a non-GAAP operating income of $5.2 billion, which rose by 11% year over year, while its non-GAAP earnings per share [EPS] was $0.68, which missed analyst estimates by negative $0.12.

The acquisition of Cerner has also helped drive an operating margin increase of 5% over the past three quarters, which is a positive sign of cost synergies with greater margin improvements expected to be derived moving forward.

Moving onto the balance sheet, Oracle reported $8.769 billion in cash and short-term investments. The company does have a high debt of $91.8 billion, but the positive is the majority ($86.4 billion) is long-term debt and thus manageable.

Valuation and Forecasts

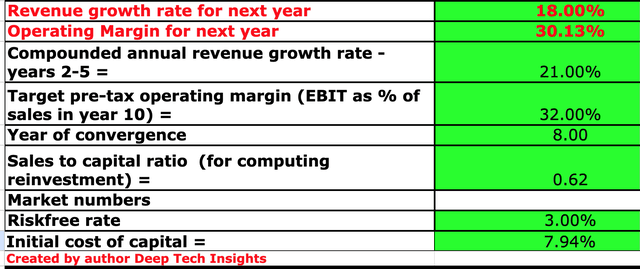

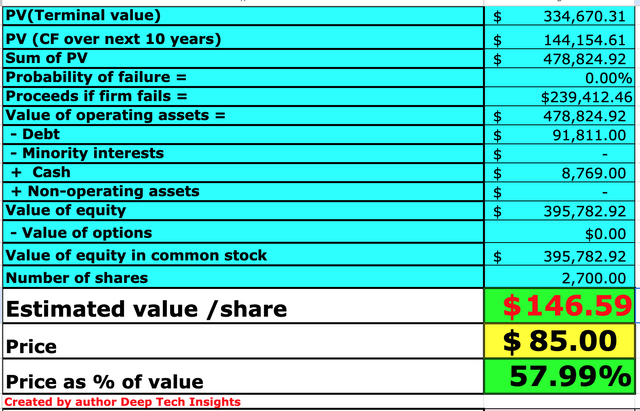

In order to value Oracle, I have plugged its latest financial data into my discounted cash flow valuation model. I have forecasted 18% revenue growth for "next year" or the next four quarters in my model. This is based upon an extrapolation of the midpoint of the 17% to 19% growth rate guided for Q4,FY23. For years 2 to 5, I have forecast a faster growth rate of 21% per year. I forecast this to be driven by strong growth in the cloud, its data residency offering, and Cerner healthcare solutions. The deal cycles in these areas are likely to be sped up as economic conditions improve, which I have forecast.

Oracle stock valuation 1 (created by author Deep Tech Insights)

In order to increase the accuracy of my model, I have capitalized R&D expenses, which has boosted net income. I have also forecast a pretax operating margin of 32% over the next 8 years, as the company continued to scale its cloud infrastructure and benefit from improved operating leverage as a result.

Oracle stock valuation 2 (Created by author Deep Tech Insights)

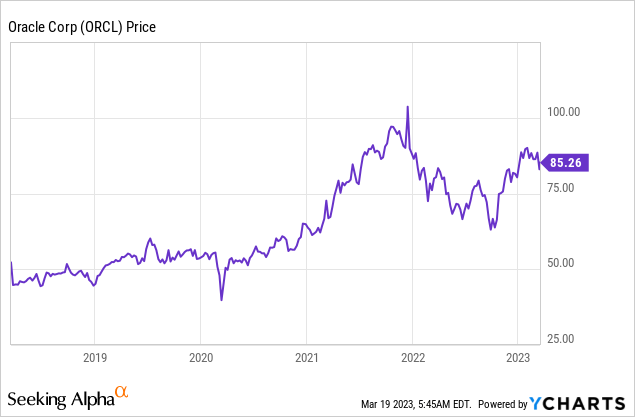

Given these factors, I get a fair value of $147 per share. ORCL stock is trading at ~$85 per share at the time of writing, and thus it is ~58% undervalued.

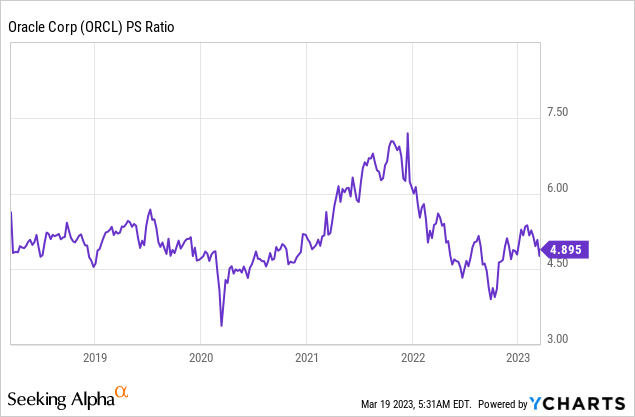

As an extra data point, Oracle trades at a price-to-sales [P/S] ratio = 4.77, which is ~6% cheaper than its 5-year average.

Risks

TikTok Ban/Competition

As discussed prior, a ban on TikTok would likely impact Oracle's stock price and result in lost revenue, which is a risk. Then, of course, we have the major competition in the cloud infrastructure industry such as the big three, AWS, Azure (MSFT), and Google Cloud (GOOG, GOOGL). These providers and organizations have substantially greater scale and more "dry powder" to continue to eat market share and compete with Oracle, which is a risk.

Final Thoughts

Oracle is currently going through a period of transformation and reinvention. I believe its niche as a Cloud data residency specialist could be immensely lucrative, given this is a hot topic right now with companies such as TikTok. Its healthcare company (Cerner) also offers a huge opportunity to disrupt an entire industry. Given my valuation model indicates the stock is undervalued at the time of writing, this could be a great long-term investment.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.