Sysco: Foodservice Giant Valued Appropriately

Summary

- Sysco Corporation is a food distribution company.

- The foodservices industry is being impacted by greater demand for sustainable and vegetarian foods. Sysco looks to be transitioning well and gaining market share.

- Sysco's profitability profile is attractive relative to peers but with a NI margin of 2%, it leaves a lot to be desired.

- The company may reach unsustainable levels of debt in the coming years based on how cash is utilized.

- Sysco looks appropriately valued based on a DCF and relative valuation.

JHVEPhoto/iStock Editorial via Getty Images

Company description

Sysco Corporation (NYSE:SYY) is a food distribution company. The company is divided into four segments, U.S. Foodservice Operations, International Foodservice Operations, SYGMA, and Other segments. Sysco distributes various food products such as frozen, canned, dry, fresh meat, seafood, dairy products, beverages, and fresh produce. It also provides non-food items.

Sysco's customer base includes hospitals, nursing homes, schools, restaurants, hotels, and other foodservice venues. It operates in various countries including the United States, Canada, the United Kingdom, and France.

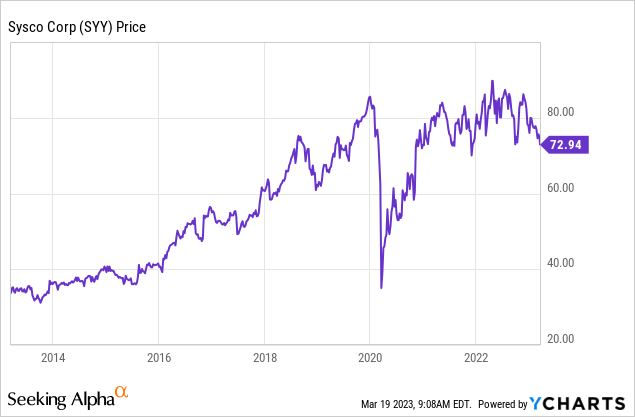

Share price

Sysco's share price has performed incredibly well in the last decade, returning investors 110% with little volatility. This has been driven by gradual growth with little variability. COVID-19 caused uncertainty around the business, due to lockdowns impacting their clients in the hospitality space. Since then, the business has bounced back, in line with the economy, but its share price has remained below its pre-pandemic level.

Investment thesis

The objective of this paper is to assess the quality of Sysco and whether it is an attractive investment. On paper, the company looks to be a great bet on economic prosperity, with exposure to multiple different industries, and consumers in general, the largest contributor to GDP.

In order to assess Sysco, we will consider the current trends in the food distribution business, opportunities and threats they are facing, and an assessment of Sysco's financials. This will assist with quantifying a valuation.

Foodservice industry

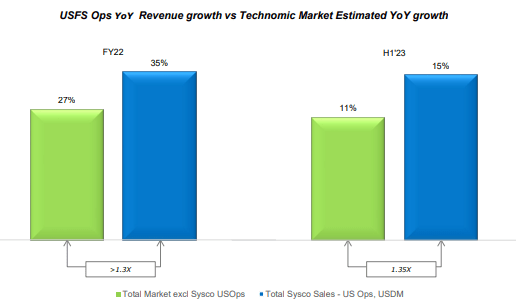

The foodservices industry Sysco operates within is estimated to be $300B (Source: Q2-23 investor pack) and is projected to grow at a CAGR of 2.82% in the coming 7 years. This will be driven by changes in consumer spending habits, with more individuals looking for ready-to-eat foods and greater food options. The desire for ready-to-eat meals is driven by a host of factors, including a greater number of people within households working, the price differential between home cooking and RTE closing, and greater healthy options. One of Sysco's largest segments is supply restaurants and other food establishments, which are expected to drive this trend. Sysco is estimated to have a 17% market share, being the largest company in the foodservices industry. This gives the company scale benefits, while also allowing for greater marketing ability and the impact of compounding. This has allowed Sysco to outperform its peers, with superior growth in both FY22 and H1'23.

Revenue growth (Sysco)

Sustainable and healthy

The other consumer spending change is toward healthy and sustainably-sourced foods. With a greater understanding of a healthy eating and the impact of certain diets, consumers are becoming more health-conscious and environmentally aware, contributing to greater demand for plant-based and organic products. Based on the Alliance For Science's findings, roughly 10% of Americans over the age of 18 consider themselves to be Vegan or Vegetarian as of early 2022. To meet this demand, Sysco has been expanding its product offerings in these categories and has also implemented sustainable practices in its operations, such as reducing waste and energy consumption, as the below caption shows.

Sysco's sustainability effort (Sysco)

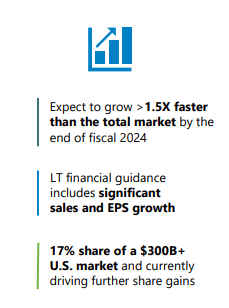

The question is how this impacts the financial profile of the business. Firstly, Sysco has not seen a material decline in operating margins by investing within this segment and building out its supply chain. Further, all data suggests consumers are willing to vote with their wallets in order to ensure they are only consuming sustainable goods, at a minimum, but also healthy foods. Newfoodmagazine has found that 65% of respondents believe healthy food is too expensive but 43% of them are willing to pay for it. Also, 47% of respondents would change food selections in order to be more sustainable. This presents real pressure on restaurants and other institutions to source foods that meet a specific sustainability requirement. Therefore, for Sysco, this is an opportunity to build out a superior sustainable supply chain compared to its peers in order to take market share. Sysco is confident of this occurring.

Sysco expected outperformance (Sysco)

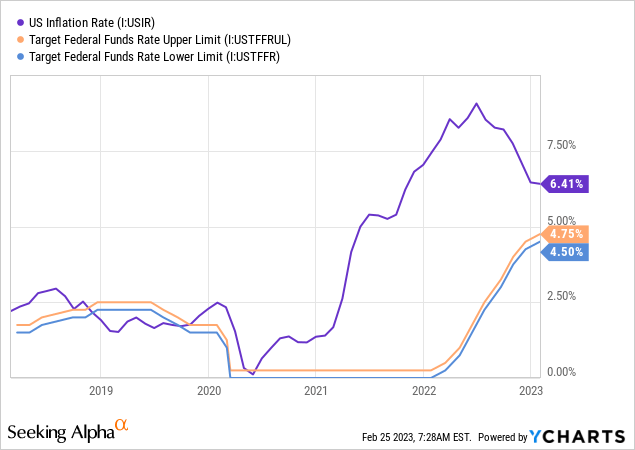

Economic consideration

With inflation high and interest rates used as a response, consumers have faced tightening finances for over a year. Many have cut back on unnecessary spending and have sought higher-paying jobs. With inflation coming down slowly, we may see the end of this in the coming year, however, this will not be easy. The most recent decline in inflation was only marginal, which could mean greater rate hikes are required.

This will likely mean economic demand will decline, impacting industries that Sysco services, such as Restaurants. This has the potential to contribute to lower demand for foods. Sysco has yet to feel the negative financial impact of this but the coming months may change. So far, the business has seemingly achieved parity, with revenue up based on inflation-led price increases, but a corresponding increase in costs. The net impact is flat margins.

Sysco's financial performance

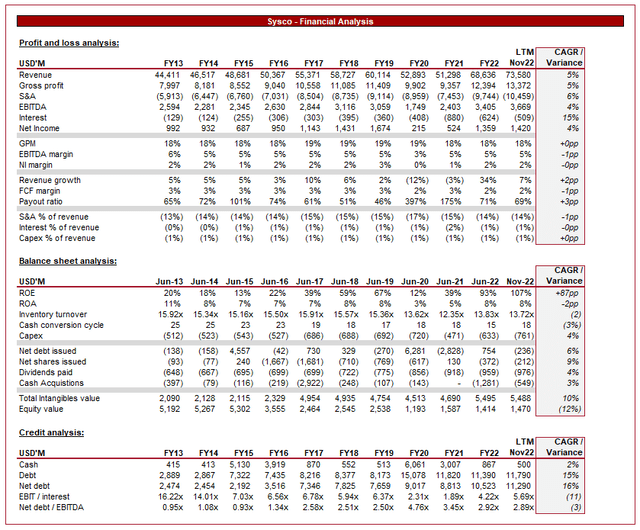

Sysco Financials (Tikr Terminal)

Sysco's financial performance can be described by its stability and resilience.

Revenue has grown at a CAGR of 5%, driven by economic prosperity encouraging greater consumer spending. Much of this growth has occurred in the second half of the period, with post-COVID demand and inflation driving greater sales.

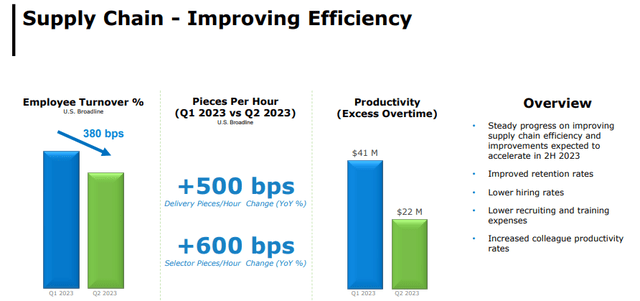

Management has remained steadfast in ensuring operational efficiency, with GPM remaining flat across the historical period. With the pressures of inflation and supply-side disruptions, this is very impressive to see. This translates to S&A expenses also, with the EBITDA margin remaining equally as flat. This allows the business to achieve equal bottom-line growth with all additional revenue. Management communications suggest their focus is on an employee level, with consideration of productivity. With over 71k employees, this is a fantastic approach to looking at the business.

The only issue we have with the business is that it is operating with slim margins. The operational excellence assists with this but a 2% NI/FCF margin does not leave much margin for error when considering outside factors. Further, this reduces any benefits from compounding as there are few accretive gains from growth.

Moving onto the balance sheet, Sysco has achieved an impressive increase in ROE, driven by a sustained buyback effort.

Inventory turnover has marginally ticked down across the historical period, suggesting the company is taking longer to sell its stock. This is not too much of a concern as the business still maintains a good CCC.

The company has been increasing its debt balance across the historical period, driven by the funds required to service the company's numerous activities. The company is buying back shares, undertaking acquisitions, paying dividends, and funding the business on a slim FCF margin. Net debt to EBITDA has ballooned to 2.9x from 0.9x 10 years ago. This is about the ceiling of what we think is a moderate level, beyond this we would begin to grow concerned. The company's interest ratio has also declined to a level we are not overly comfortable with. Moody's has given the company a Baa1 rating, which means "Obligations rated Baa are subject to moderate credit risk. They are considered medium-grade and as such may possess speculative characteristics."

Speaking of dividends, the company has achieved an impressive 53 years of dividend growth. Sysco's current payout ratio is 69%, which is comfortable but also leaves the business susceptible to changes in profitability. Our view would be that dividend growth will be tame in the coming period.

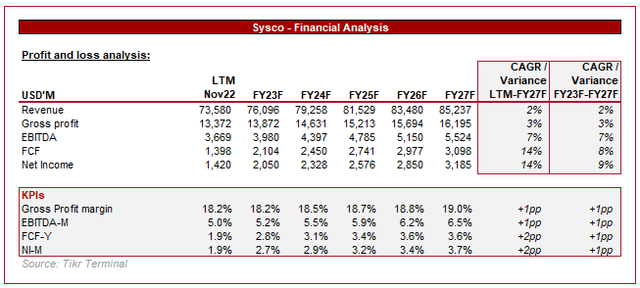

Outlook:

Analyst projections (Tikr Terminal)

Analysts are currently projecting 2% revenue growth, with much of the gains coming from the bottom line. We currently struggle to see how this will be achieved. The company has been impacted by the current macro conditions but it has only shown 1 period with a NI margin in excess of 2%. It seems optimistic that this can be achieved from FY23 onwards. The L6M data shows the company is currently achieving a NI margin of 1.7% and a lower level in the L3M. Our view on the business would be consistent top-line growth of c.2-3%, with NI breaking into the 3% mark beyond FY24F, with it very unlikely to go beyond this.

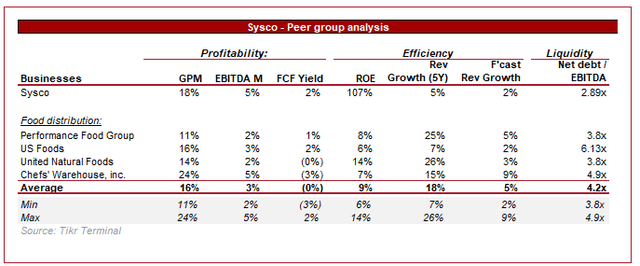

Relative performance

Peer group comparison (Tikr Terminal)

Sysco reflects its market-leading position in its financial metrics, achieving superior profitability to all of its key peers. This is driven in large part by its scale advantage, which is very important when operating in an industry with tight margins. For those investors thinking long-term, the lower solvency risk does not go without highlighting, as the peer average is 4.2x, which in our view has speculative characteristics.

Valuation

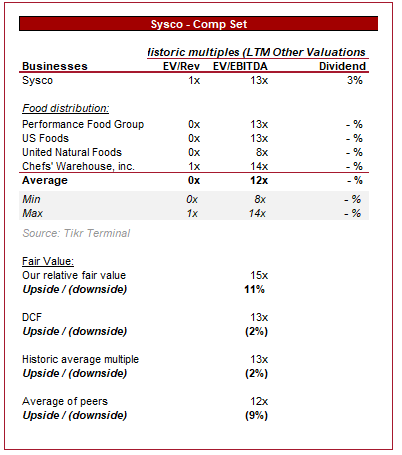

Sysco valuation (TIkr Terminal)

Presented above is the trading valuation of Sysco's peers.

As Sysco is operating at a premium to its peers and is the only dividend-paying option. We have assigned a premium valuation to the business. Based on a relative valuation, we derive an upside of 11%, similar to what analysts are forecasting at 11%.

However, we have also conducted a DCF valuation. The key assumptions we have made are:

- Revenue growth between 2-3%, EBITDA margin of 5%, and an FCF conversion increasing from 2% to 3%.

- Exit multiple of 13x and a perpetual growth rate of 2.25%. The multiple contraction is attributable to our belief that either the business will need to deleverage, or pose a greater risk to investors thus reducing market cap.

- A discount rate of 8%.

Based on this, we see a downside of 2%.

Given the headwinds ahead in the coming year and the lack of a positive catalyst, we would lean toward a conservative view, suggesting single-digit upside.

Conclusion

Sysco is a well-run business achieving market-leading growth and profitability. Management has a keen eye for operational efficiency and has managed to navigate economic conditions well so far. The only real threat to the industry is the movement toward sustainable foods and Sysco looks to have transitioned well.

The key risks to the business we see are its debt levels, which need to remain at the current level, rather than increase further. Based on how the company is utilizing its cash, this feels unlikely or potentially, unachievable.

Sysco's current valuation looks about right, it might be slightly undervalued but this only reflects the risks faced in the next 12 months.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.