American Tower's Expansion In Data Center Propels Growth, Shares Slightly Overvalued

Summary

- AMT has expanded its footprint by acquiring companies that own and operate data centers, broadening its reach in the fast-growing cloud computing and digital infrastructure sectors.

- AMT's growth prospects are driven by the increasing wireless data usage, network densification, and the emergence of 5G technology.

- The current share price is a bit inflated, with a downside risk of around 2% to 5%.

shaunl/E+ via Getty Images

American Tower Corporation (NYSE:AMT) is a REIT that owns and operates a global portfolio of wireless and broadcast communications sites. AMT's core business is leasing space on its towers to wireless carriers, broadcasters, and other tenants, providing critical infrastructure for their networks. In recent years, AMT has expanded its footprint by acquiring companies that own and operate data centers, broadening its reach in the fast-growing cloud computing and digital infrastructure sectors.

While AMT has a strong competitive position and attractive growth prospects, I believe the shares are slightly overpriced. Despite the recent market turbulence caused by the COVID-19 pandemic, AMT has demonstrated resilience and stability and maintained its dividend payments. In this article, I will analyze AMT's business model, growth prospects, financial health, and valuation.

Business Model

AMT's business model is straightforward and highly effective. The company owns and operates a global network of wireless and broadcast communications sites, including macro towers, rooftop sites, and small cell sites. These sites provide critical infrastructure for wireless carriers, broadcasters, and other tenants, enabling them to deliver voice, data, and video services to their customers. In return, AMT earns recurring revenue from lease payments, which are typically long-term contracts with built-in escalators. As of the end of 2022, AMT had more than 225,000 communications sites in 19 countries, making it one of the largest tower companies in the world.

AMT's core business has significant competitive advantages. I think that the company's scale, global footprint, and customer relationships provide a strong moat that protects its market share and pricing power. In addition, AMT's towers are strategically located in high-density urban areas and along major transportation routes, making them highly desirable locations for wireless carriers and other tenants. AMT's focus on network densification, which involves increasing the number of cell sites and the number of equipment on each tower to improve network capacity and coverage, has also created a strong tailwind for its business. As wireless data usage continues to grow, carriers are increasingly reliant on tower companies like AMT to provide the infrastructure they need to meet customer demand.

Growth Prospects

AMT's growth prospects are attractive, driven by the secular trends of increasing wireless data usage, network densification, and the emergence of 5G technology. I expect these trends to drive sustained demand for tower infrastructure, as wireless carriers invest in their networks to deliver faster speeds, lower latency, and improved coverage. In addition, AMT's expansion into the data center sector provides a new avenue for growth, as the shift to cloud computing and digital transformation drives demand for data storage and processing.

AMT's recent acquisition of CoreSite Realty represents a strategic move into the data center sector. The acquisition expands AMT's portfolio to include 28 data centers across North America totaling over 4.7 million square feet, providing the company with a new growth platform and complementary capabilities to its tower business. While the integration of the two businesses will take time, I believe that the combination of tower and data center assets has the potential to create significant synergies by creating a complementary fit between data centers and AMT's existing communication sites.

Expanding its Data Center Footprint through Acquisitions

AMT has been actively expanding its presence in the data center industry through the acquisition of companies that own and operate data centers. In 2021, AMT acquired CoreSite, a data center management company, in a deal worth $10.1 billion, and DataSite, an owner-operator of data centers, adding two new locations to its already impressive portfolio of collocation facilities.

Furthermore, in 2019, AMT also acquired Colo Atl, a colocation and interconnection provider in Atlanta, Georgia. In addition in 2022, AMT has recently entered into a strategic partnership with Stonepeak, a leading alternative investment firm that specializes in infrastructure and real assets.

These acquisitions and partnerships demonstrate AMT's commitment to expanding its data center portfolio and providing world-class collocation facilities to its customers. With its growing presence in the data center industry, AMT is poised to be a major player in the global data center market.

Financial Health

AMT has a record of profitability and manageable debt levels. This has helped them achieve consistent and steady revenue and cash flow growth over time thanks to its recurring revenue model and long-term contracts. AMT’s revenues have grown from 3.4 billion in 2013 to 10.7 billion in 2022. Over the same period, their AFFO grew from 1.5 billion to 4.5 billion.

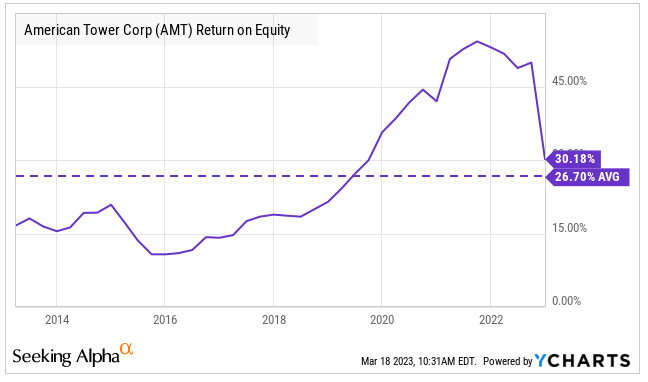

AMT has been able to achieve an average ROE of 27% over the last decade. This shows that they have been consistently successful in using shareholder funds to generate profits.

Ycharts

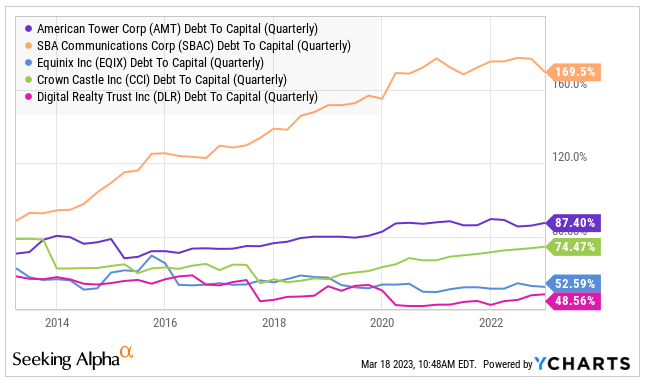

However, the move into data centers has increased the firm's financial risk. The leverage is still lower than SBA Communications' (SBAC). AMT’s net leverage is 9.5x AFFO while SBA’s is 11.5x.

Ycharts

Valuation

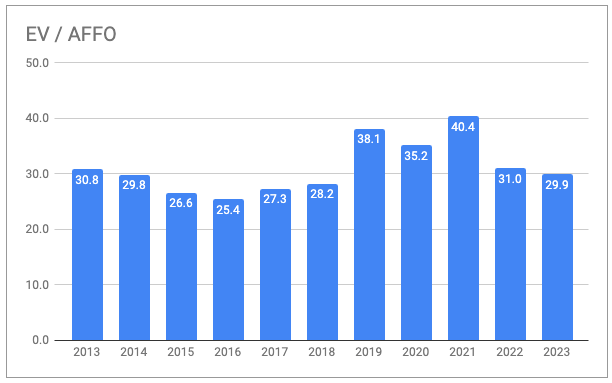

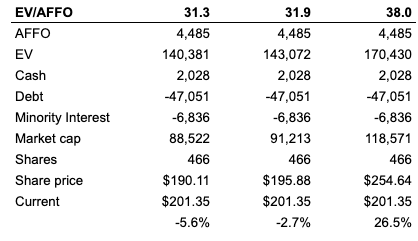

In my opinion, the current share price is a bit inflated compared to the company's performance, historical multiples, and peer comparison. To support this, I looked at historical data and noted that over the past ten years, the shares have been trading at an average of 31.3x AFFO. Currently, the shares of SBA are trading at 31.9x AFFO.

Seeking Alpha & 10-Q reports

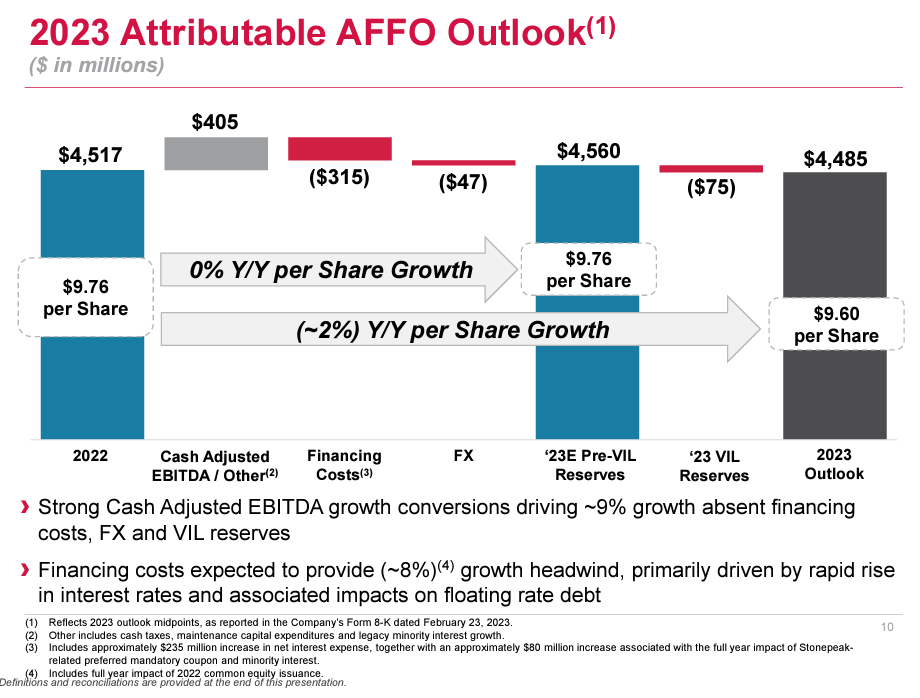

Given the company's guidance of a slight shrinkage in AFFO, I see a downside risk of around 2% to 5% if the shares trade at the same multiple as SBA or historical levels, respectively.

Company presentation

For the shares to trade above $250, the multiple needs to trade at 2019 levels. But I don't see any clear catalyst to justify such an increase in the multiple. As such, I think this scenario is unlikely.

Author estimates

Risks

The telecom industry is subject to heavy regulation, which poses a risk to AMT. Nonetheless, the company has a skilled management team that has dealt with similar challenges before, and its widespread presence and diverse customer base help reduce risks associated with any particular region or market.

AMT's leverage has risen slightly after its acquisition of CoreSite. However, the company has a track record of effectively managing its finances, including its debt.

Conclusion

I believe AMT is a well-run company with a solid growth outlook. The increasing demand for wireless infrastructure and data centers, combined with AMT's global footprint and diversified customer base, provide a strong foundation for long-term growth. However, at current levels, I see AMT shares as slightly overpriced.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.