Dufry: Strong Travel Demand

Summary

- Autogrill revenues exceed €4.1 billion thanks to air traffic recovery.

- Consob (the Italian regulators) requests additional information on Dufry's public acquisition offer documentation.

- No dividend for both Autogrill and Dufry.

- Autogrill has no debt obligation, while Dufry's debt is at the lowest level since 2015. Positive momentum continues, and so our valuation is confirmed.

noel bennett

Last week, both Dufry (OTCPK:DUFRY) and Autogrill (OTCPK:ATGSF) (OTCPK:ATGSY) released their Q4 and Fiscal Year 2022 updates.

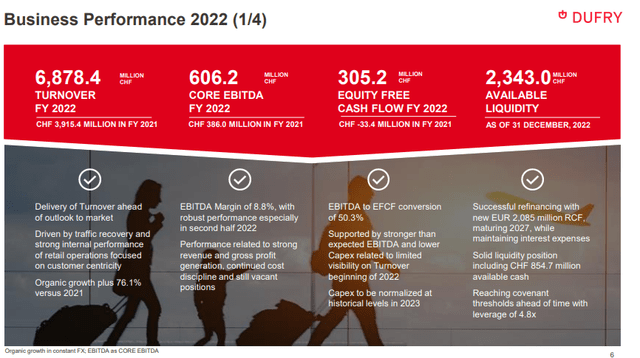

Starting with the Swiss global travel retailer, the company ended 2022 with revenue of CHF 6.87 billion, up by more than 75% thanks to travel recovery, including the international routes. The company was also affected by an unfavorable currency effect which weighed 0.4% on sales. Despite new concessions decreased by 1.8%, the company delivered gross margin improvements to 61% from 56.5% and as a consequence, core EBITDA grew to CHF 606.2 million and net profit reached CHF 58.2 million compared to the loss of CHF 385.4 million in the same period of the previous year.

Dufry Financials in a Snap

Source: Dufry Q4 and FY results presentation

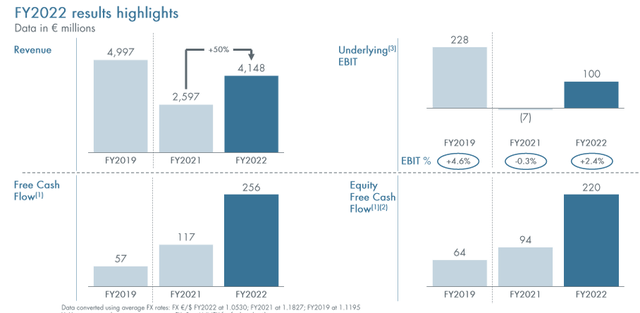

Looking at Autogrill, the company also recorded organic growth of 60% at current exchange rates with €4.1 billion in revenues, equal to approximately 88% of the pre-pandemic sales level. Performance was supported by international air traffic recovery, which increased revenue from airports by almost 70% to €2.8 billion. To a lesser extent, highway restaurants also contributed to the group's revenue, rising by 20% to €1.06 billion. However, looking at the geographical areas, it is evident that, despite an overall positive trend, Italy has grown less than the others. Compared to Dufry, Autogrill won new orders for €1.3 billion and renewed old contracts for an additional €2.2 billion with an average duration of 6 years. These new concessions involve the airports of Rome (Fiumicino), Salt Lake City, Bangalore, and Doha, while the renewals are for Fort Myers, Miami, Honolulu, and Arlanda hubs. Versus Dufry numbers, the Italian group benefited from the dollar run against the euro for approximately €165.1 million. Despite that and going down to the P&L analysis, Autogrill closed 2022 with a growing loss but manages to almost eliminate its net debt position (now at €7.8 million from €197.4 million). The company decides to not distribute a dividend. Net income reported a loss of €53.7 million (compared to last year's end at €37.8 million).

Autogrill Financials in a Snap

Source: Autogrill Q4 and FY results presentation

Business combination update

Dufry has indicated that it will begin consolidating the Italian Autogrill company starting from March 2023, following the transfer of the Edizione stake and the closing of the mandatory exchange offer expected towards the end of the second quarter of 2023. However, regarding Dufry's offer, the Italian regulator (Consob) requested supplementary information and this business consolidation might be delayed. Here at the Lab, we have always been positive about this merger starting from our initial publication called: Dufry And Autogrill Is Finally Happening.

This transformative merger is an integral part of Dufry's long-term strategy commented CEO Xavier Rossinyol. The company is well on track to close the transaction towards the end of the second quarter, and in the mind time, it is rapidly advancing in the implementation of the strategic plan called "Destination 2027" with the combined synergies integration.

Conclusion

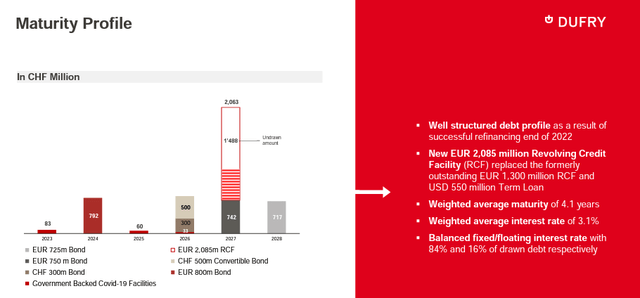

Important to report is the company's net debt evolution which amounted to CHF 2.8 billion at the end of December 2022 versus CHF 3 billion in December 2021. Dufry debt obligation is at the lowest level since 2015. Having already analyzed Deutsche Lufthansa, we positively view this development. The German flight operator "decided to maintain a liquidity range between €8 to €10 billion to better protect itself against future crises".

Ahead of the 2023 shareholders' meeting, the Board proposes to not distribute the DPS for the 2022 financial year. The company aims to focus on strengthening its financial position and closing the business combination with the Italian Autogrill. However, it will consider resuming its dividend payments, in line with Dufry's capital distribution policy, taking into account deleveraging and growth opportunities.

Dufry debt profile

Valuation

Dufry expects an attractive generation of shareholder value from the success of its "Destination 2027" plan and confirmed its medium-term objectives. Therefore, we reiterated our valuation of CHF 50 per share ($5.3 in ADR) released in our last analysis called Positive Momentum.

This positive momentum was also emphasized by the Dufry management team, in detail, the company said that net sales increased by 71.3% in the first two months of the year (at constant currency) and confirmed that "there are positive trends in all key indicators". Risks are included in our initiation of coverage.

Mare Evidence Lab's previous publication

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DUFRY, DFRYF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.