First Republic: Common Shares Remain A Relatively Poor Choice

Summary

- First Republic Bank has crashed and the dividend halt has put blood on the streets.

- The white knights have ridden to the rescue but whether the common equity can be saved is questionable.

- A direct investment in common shares looks to be a bad choice from a risk reward perspective.

- We tell you why and look at other plays.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

Spencer Platt/Getty Images News

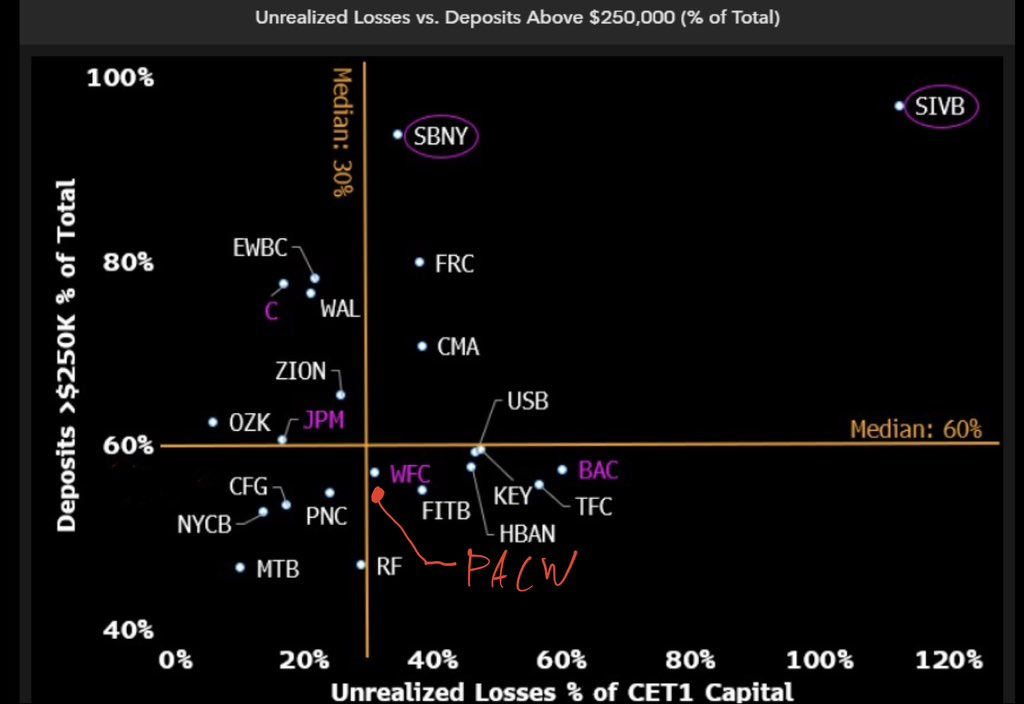

If you are not confused, you don't know what is going on. That quote probably summarizes the current situation in regional banks today. Just 4 weeks back everyone believed that inflation would be the biggest issue of 2023 and we ramped up expectations for the terminal Fed funds rate. Since then Silicon Valley Bank (SIVB) and Signature Bank (SBNY) have become skidded off the equity exchanges and First Regional Bank (NYSE:FRC.PK) has become the proud recipient of 80 headlines. FRC is our topic of discussion today and we will summarize the key events to date and go over your investment choices.

Duration Risk

As far back as March 2021, we had warned investors about the stupidity of buying extremely long duration assets for a paltry return. We dodged all the landmines in the bond sector and anticipated the aggressive Federal Reserve moves. What we did not see coming was the brutal bloodbath in regional banks. This was a clear failure on our part as the trend of paying retail deposits 0.00% interest with Treasury rates near 5% was clearly unsustainable. We saw this as compressing bank earnings as they ramped up deposit rates, but missed that it could create a crisis. Mea Culpa.

FRC while not the worst of the bunch, is certainly on the wrong side of the median lines for two items. Unrealized losses as a percentage of CET1 ratios and uninsured deposits are both a bit high for comfort.

Michael Burry-Twitter

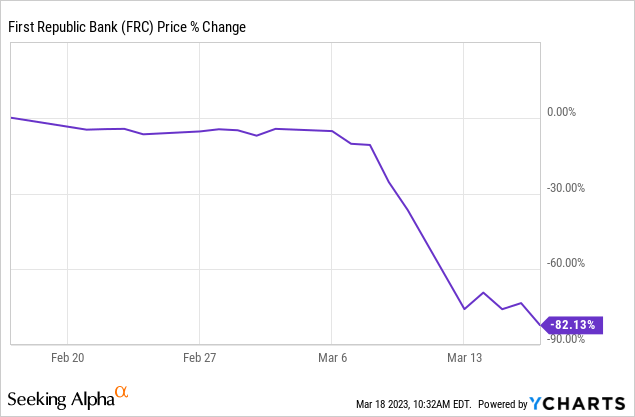

Of course that is putting things mildly as FRC stock has declined by 82% just in the last month.

A continued capital flight got no less than 10 mega banks to provide support for FRC.

The largest banks, including JPMorgan (JPM), Bank of America (BAC), Citi (C) and Wells Fargo (WFC) will contribute $5 billion of deposits each, while Goldman Sachs (GS) and Morgan Stanley will provide $2.5 billion each, according to a statement on Thursday. PNC Financial (PNC), Bank of New York Mellon (BK), Truist (TFC), U.S. Bancorp (USB) and State Street (STT) will each contribute $1 billion.

Source: Seeking Alpha

It is interesting that these have been structured uninsured deposits rather than interbank loans. At this point the bulls are rightly contending that such a big move by the mega-cap banks would be under the "too big to fail" umbrella. The repercussions if these institutions lose money on this gamble would be catastrophic for the viability of the system. The bull play is that this is a "whatever it takes" moment. If $30 billion needs to become $100 billion, it will become $100 billion.

What's Wrong With Just Buying FRC Common Shares?

Readers should note that we are not making any argument here that FRC is going to zero. Neither are we suggesting that FRC is not going to go up. What we are suggesting is that bulk of the losses from the peak are not coming back. Our thinking here is that while the banks are lined up to help, they are only here to prevent contagion and get FRC to fix its own problems quickly. Hence FRC suspended their dividend. Capital retention is key. So if the shares rally on any "good news", like expansion of FDIC insurance, or commitment of "unlimited support" from these same banks, guess what will that be followed by?

If you said "a massive equity raise", you nailed it. Combined with selling some assets that have appreciated with this bond rally, FRC is likely to de-risk its position rapidly on any positive developments. In all likelihood, this equity raise will come close to the lows. So for the risk you are taking, that is the potential of severe losses from even here, your upside is relatively poor.

How To Play

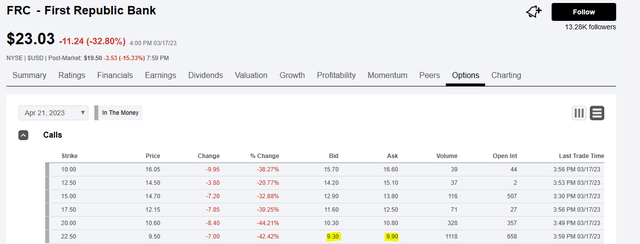

When the risk-reward does not make sense you have to either choose to not play or to use tools to bring the risk-reward in your favor. In this regard, options do a great balancing act. We go over some choices which investors might find appealing.

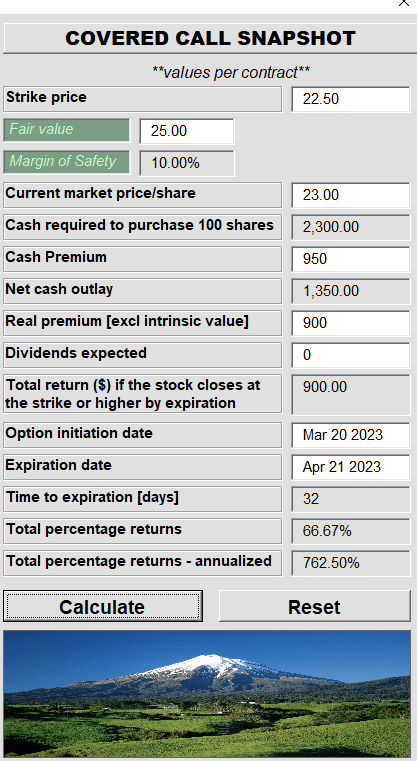

First up is the April 2023, $22.50 Covered Call.

That based on closing prices (do note the after hours quote is pretty wild) creates an annualized yield of 762.50%.

Author's App

The fair value above is a required input in the calculator and not necessarily a reflection of what we think this is worth today. This return if it does pan out, gives you a solid return for the risk. We will note that this level of option volatility generally does not last. It is like a 105 degree fever. Either it responds to ice baths and antipyretics or the patient is done. It does not ever become steady state.

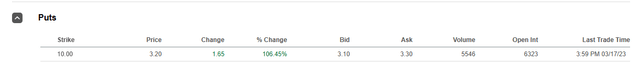

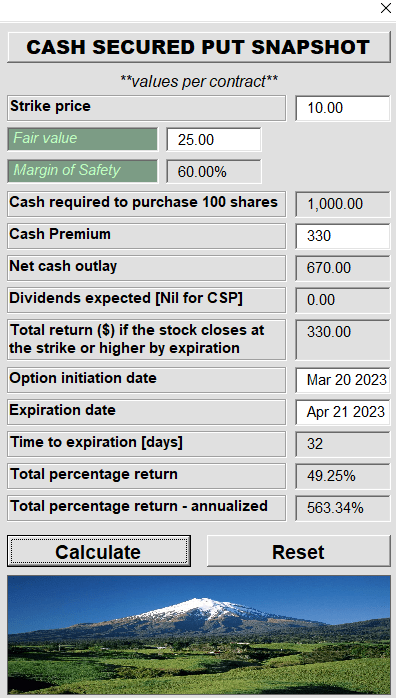

A more defensive choice, shown from the other side, would be to sell the $10 cash secured puts.

The annualized yield is a bit lower but the breakeven point ($6.70) is half as much.

Author's App

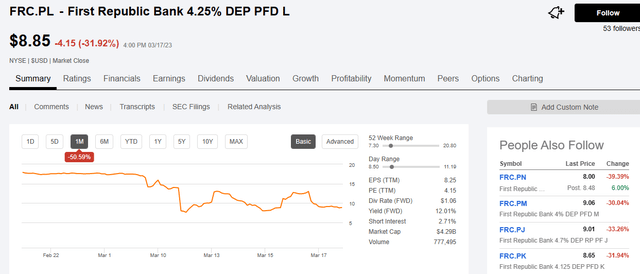

Preferred Shares

FRC has a legion of preferred shares trading.

1) First Republic Bank DEP SHS RP PFD H (NYSE:FRC.PH)

2) First Republic Bank 5.5% NON CUM PERP REP SER I (NYSE:FRC.PI)

3) First Republic Bank 4.7% DEP RP PF J (BOIN:FRC.PJ)

4) First Republic Bank 4.125 DEP PFD K (NYSE:FRC.PK)

5) First Republic Bank 4.25% DEP PFD L (NYSE:FRC.PL)

6) First Republic Bank 4% DEP PFD M (NYSE:FRC.PM)

7) First Republic Bank DEP SHS REP 1/40TH PERP PFD (NYSE:FRC.PN)

They have all been beaten down relentlessly.

Our take on these is that they are a reasonable viability play, but investors need to keep in mind that par value of these preferred shares is very close to the market value of the common equity. We generally are hesitant to jump into preferred shares when the equity thickness protecting them is weak. So while there are scenarios where preferreds can do better (a brokered marriage with a larger bank), they are almost as risky as the common shares.

Verdict

Buying and holding the common shares looks like a poor play on the situation. You might get upside but it will be capped. Wipeout risks still exist and we think near term options offer the best risk-reward for those bullish on the company, or just bullish on its continued existence. Preferred shares are still paying their dividends and only the common dividend has been suspended, so far. We still think that option moves on the common have a slightly better risk profile than a long position on the preferred shares. Of course the adventurous could try a long position on the preferred shares with a naked, out of the money, call on the common. Let us know in the comments.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.