VTES: New Muni Fund From Vanguard Hits The Right Notes

Summary

- Municipal bonds are extremely popular due to their tax advantages.

- While yields are low today, they are higher than what we saw in 2020 and 2021.

- VTES, the newly launched fund from Vanguard, aims to take low duration and credit risk while giving you tax advantages of Municipal bonds.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

Andrii Dodonov

While not backed by the federal government, Municipal bonds provide income in a relatively low risk manner. These are issued by the local government to meet their operational needs or fund capital projects like building bridges, schools, libraries, parks, community centers, you get the picture. Depending on the fundraising purpose, they can be designated as a general obligation or a revenue bonds. General obligation bonds are issued to finance the day to day operations of the governing body, while a revenue bond are issued to fund specific projects. The issuer while non sovereign, is still a governing authority and the income (not capital gain) from these securities is generally exempt from federal taxes. State tax exemption is also likely if the bond is issued by your state of residence.

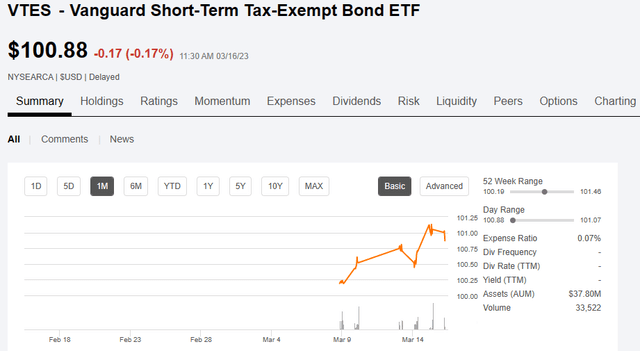

Taking advantage of the prevailing interest rates, Vanguard Short-Term Tax-Exempt Bond ETF (NYSEARCA:VTES) rang its opening bell earlier this month. Due to its only recent debut, you will not find a whole of lot data on the fund page of the Vanguard website. This $37.80 million fund has 302 holdings at last count.

We go over the fund's finer points based on its summary prospectus and will then talk about our outlook for it.

Methodology

Listed on NYSE Arca, this ETF aims to track the performance of the S&P 0-7 Year National AMT-Free Municipal Bond Index. Accordingly VTES invests in fixed rate, investment grade municipal bonds maturing between one month and seven years. Higher quality bonds provide safety from default risk, that is, the risk that the issuer will fail to meet the interest and principal obligations due to financial difficulties. While historically the municipal bond default rates are very low, it is not unheard of since not all local governments have the same financial strength. Cutting expenses and pension costs are also contentious in difficult times and some do fold when the going gets tough. With recession in the front view, the investment grade securities provide a good buffer for this ETF as the more likely outcome is a downgrade to junk during this period, rather than an outright default.

Sampling is employed while selecting securities from the benchmark index, with at least 80% of the ETF's assets made up of securities from it. Additionally, at least 80% of VTES assets will comprise bonds whose income is exempt from federal taxes. The average maturity of the portfolio is expected to be 4 years or less. While not noted in the prospectus, the duration or interest rate risk will come in lower than 4 years.

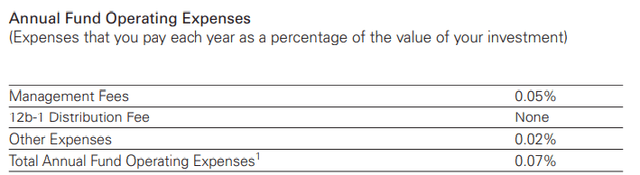

Expenses

The annual expenses are expected to be around 0.07% and are in line with other Vanguard offerings.

With Vanguard come economies of scale and one would be hard pressed to pass on this investment based on the expenses alone. Their impact on the total returns will be negligible.

Yield

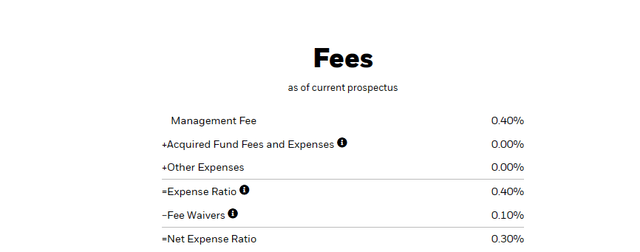

With low duration risk and mild credit risk, this fund should be appealing to conservative investors aiming to dodge a bit of tax hits. Among existing ETFs, BlackRock Intermediate Muni Income Bond ETF (INMU) is possibly a closely related one that investors can compare against. A notable difference is in fees where INMU is still at 4X the levels compared to VTES, despite the fee waivers in place.

The same fund also tells us where the yield on VTES is likely to land. INMU is currently sporting about 3.07% yield and that drops to 2.96% on an unsubsidized level.

INMU has a duration of about 4.25 years. Based on the lower duration, lower average maturities and the lower fee structure from VTES, we think that VTES could offer a very similar number.

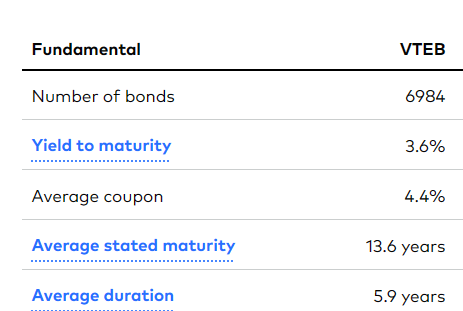

VTES will also sport a lower duration compared to its own Vanguard Municipal Bond Funds - Vanguard Tax-Exempt Bond ETF (VTEB).

Vanguard-VTEB

VTEB has a similar small expense ratio of just 0.05% and will appeal more to those that are bearish on interest rates.

Verdict

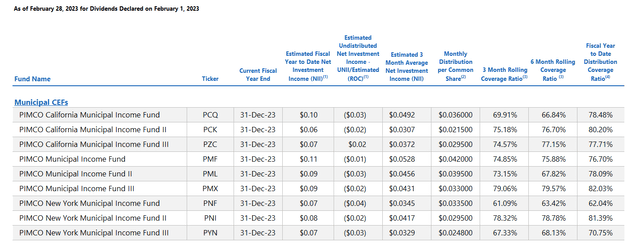

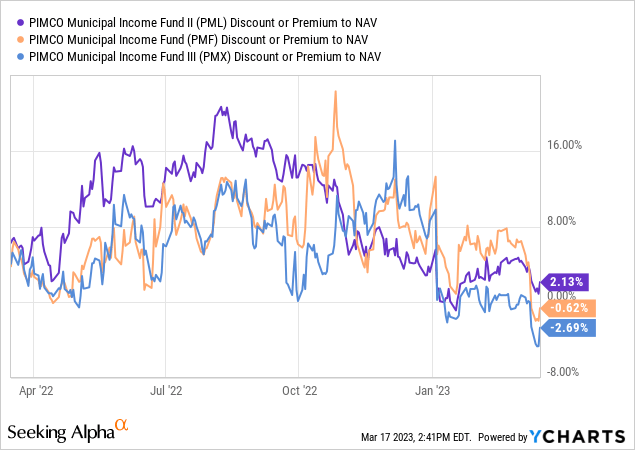

At these low yields, it all comes down to expense control. Nobody does that better than Vanguard and the gauntlet has been thrown down to BlackRock Inc. (BLK). INMU was already waiving fees and now we think that will become permanent and will likely increase. In the interim, VTES becomes an interesting choice for a municipal bond holding giving you low duration risk. We also prefer VTES over all armada of PIMCO closed end Municipal bond funds. The 3 month rolling coverage ratios for the PIMCO Municipal Income Fund (PMF), PIMCO Municipal Income Fund II (PML) and PIMCO Municipal Income Fund III (PMX) are averaging 75%.

The pricing on these funds has improved, but we think another round of distribution cuts likely happens and then will trade at a big discount.

So VTES, to us is preferable over VTEB, INMU and the closed end funds in this space that we follow. VTES is extremely tiny at present and liquidity may be of concern to investors. Average daily volume in VTEB for example, is more than 15X that of VTES. So if you are planning on a quick "in and out", VTES may not be the best choice for you due to slippage. We rate the fund a hold/neutral at present.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility?

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.