Evercore's Last Leg Of Corporate M&A Will Likely Give Out

Summary

- Evercore has been seeing relative strength in its advisory business thanks to a large Europe franchise and expertise in healthcare, tech, and industrial markets.

- M&A volumes were generally resilient, although dollar value has already fallen, but we don't think this will last, and other sponsor and ECM-related businesses will stay down.

- In the earnings call, there was a lot of implicit expectations on the public credit and LevFin markets to restore the industry a bit as they recovered from the initial rate hiking. Won't come to fruition.

- While Evercore is cheap on an LTM PE basis, that's just because the market knows that bad things are coming. Current levels are not sustainable in price despite relative value angle.

- The strong markets in industrial and energy may not stay that way, and corporate M&A is going to see declines as boards become conservative in a recessionary environment.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

naphtalina/iStock via Getty Images

Evercore (NYSE:EVR) is one of the more respected shops out there. They did a decent showing for 2022 despite pressures, and managed to keep the ship afloat while M&A volumes plummeted from the relatively high levels in 2021. The problem is credit tightening will mean a delay in already depressed sponsor activity, and public credit may get worse too that will hit corporate M&A and especially in some of EVR's better markets like energy and industrials. Advisory was their strong leg thanks to decent corporate M&A but also other advisory business like takeover defense, where ECM and sponsor facing placement businesses have been decimated, so a hit to advisory is going to be an incremental problem. There's a long way to fall from what was still a pretty decent 2022 for the M&A markets, despite the ugly look from comp effects, a recession will do just that to Evercore - unless restructuring and other countercyclical businesses do the trick.

FY 2022 Earnings

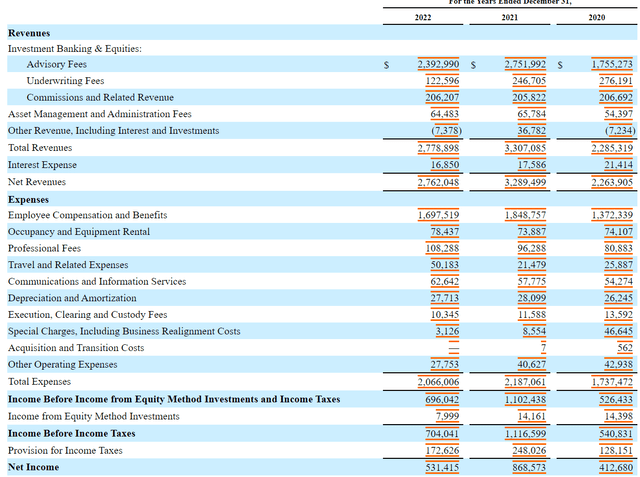

Volumes for M&A were pretty good, and this is about 2/3rds of the Evercore business. There were 9% declines in announced transactions for EVR, and the situation broadly in M&A markets is around 36% decline. The relative strength shows in the revenue which is only down 26% YoY for the Q4, which isn't too bad relative to other companies and is mainly being brought down by issues in ECM (activity levels down 80%) and LP and GP facing businesses in placement. EVR has quite a lot of larger-cap business, and the declines in dollar value of deals as megadeals ended with 2021, is the other main drag on the Q4 and the annual results which are down 16% in revenues.

But there is a decent amount of resilience in corporate M&A, and EVR is reasonably well exposed to the mid-market. Moreover, advisory activity outside of M&A, including takeover defense and other businesses, have been of help. Restructuring is beginning to pick up as financial issues at companies are becoming too difficult to handle for CFOs, and firms like Evercore are now needed. In general Europe has been a point of resilience, which is about 30% of the company's revenue

Revenues are still substantially ahead of 2020 levels, and the 2022 FY is still the second best in the company's history. A lot can go wrong considering the situation in credit markets.

Outlook

There is a lot implicit in the earnings call that leads us to believe that management was not ready for what happened in banking over the last week.

We've seen that the investment grade public market has opened up on the credit side. And I think that -- so, certainly, there is a beginning to see some liquidity in the market for strategic transactions. But I think that a lot of the boards and management teams are still standing back and waiting because there are so many exogenous things that could happen, and I think they're watching to see what happens in the Fed today and the messaging from the Fed.

John Weinberg, CEO of EVR

Firstly, while high level corporate credit might be opening up a little, if the boards are really the bottleneck in terms of deal activity, they are unlikely to become more excited as crimping on households by banks, which is likely where we'll see some of the initial meaningful credit tightening go on as loan volumes come under real pressure in 2023, causes the economy to become much more deflationary due to a real destruction in household wealth. Then there's the matter of whether top level corporate credit will really be that available after all.

There's also the matter of LevFin, which matters a lot for the higher ticket sponsor activity. LevFin is still seriously restricted from the initial round of rate hikes. It will continue to remain just as restricted as default rates actually start to rise. So far, the real economic hits to employment and corporate profits haven't really been seen yet. They are coming, and LevFin will dislike that just as much as they've disliked the volatility in the high-yield secondary markets caused by the repricing from higher prevailing rates. This will affect both the placement businesses but also the direct exposure to advising on the PE deal flow.

ECM will not perform well is equity markets continue to keep IPO activity quiet, and we see things just getting worse for the IPO market as some of the biggest IPO targets in tech and healthcare are still looking at pretty depressed markets that are likely to continue to turn down as lower sales velocity turns into a lack of new engagements, which is something that tech hasn't yet seen.

Finally, some of the more active areas have been industrials and energy. While energy still benefits structurally from the dislocation in energy markets, oil prices and other energy commodities are down a lot on demand speculation. It started with China, but now other major consumers will be a concern too, including the US. Furthermore, we haven't seen a real depression yet in industrial activity in any economic indicators in any geography. With CAPEXing and industrial investments being one of the more levered metrics to an economic recession, pressure on industrial companies is likely to develop.

Restructuring is highly regarded at EVR, but the headcounts aren't so high on the dedicated teams. There are other types of advisory that should be more countercyclical, including private credit which may grow now that regional banking is likely to pull-back lending in markets where private credit could really step in as well as takeover defense, but at least 70% of the revenue is going to be very exposed to further credit tightening (all of M&A and all of underwriting, AM and placement). While a <9x PE on TTM earnings reflects a degree of caution, the direction of EVR should still be pretty bad. It trades at the same levels as Lazard (LAZ) on TTM income. Lazard is the better pick, since they have much less cyclicality due to the large AM portion in the LAZ mix. While both will decline, M&A is more cyclical and both have restructuring franchises.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Valkyrie Trading Society seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.