Occidental Petroleum: Even Buffett Bought Too Soon (Rating Downgrade)

Summary

- OXY has fallen below $60 again leading to Berkshire Hathaway purchasing more shares.

- Energy prices have fallen to levels consistent with Q3'21 levels when the company earned far close to a $3 to $4 EPS stream.

- The stock isn't priced for lower earnings leaving OXY trading at ~20x '23 EPS targets.

- Looking for a helping hand in the market? Members of Out Fox The Street get exclusive ideas and guidance to navigate any climate. Learn More »

Paul Morigi

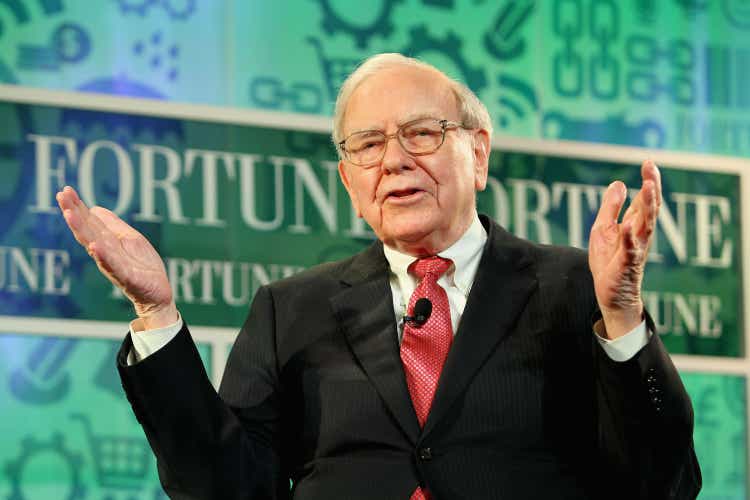

After multiple warnings to investors that one shouldn't overpay for Occidental Petroleum Corporation (NYSE:OXY), even Warren Buffett and Berkshire Hathaway (BRK.B, BRK.A) overpaid for the stock. The independent energy company now faces plunging energy prices that normally occur during weak economic periods. My investment thesis is more Bearish on the stock until oil prices shake out at lower prices.

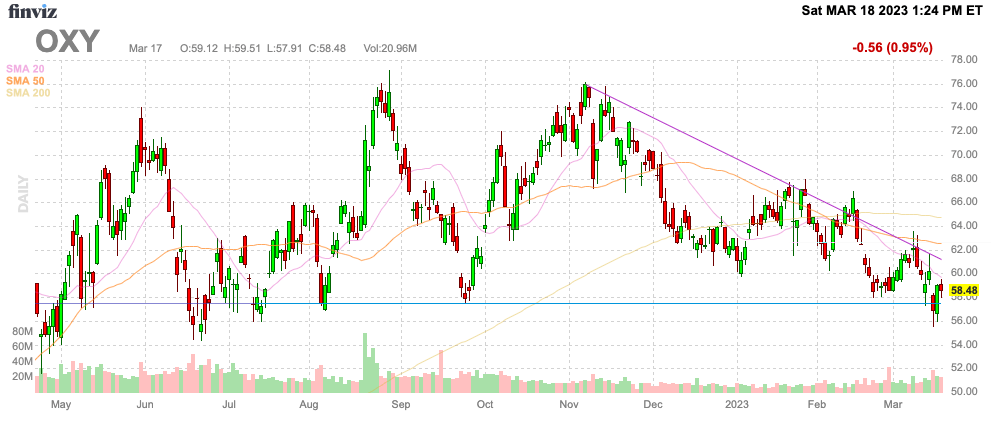

Source: Finviz

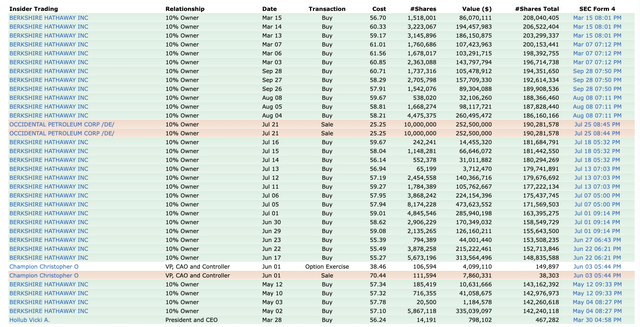

Buffett Still Loading Up

My original warning on OXY was for investors to not chase the stock into the $60s and especially the $70s due to Buffett not buying many shares above $60. Berkshire Hathaway didn't purchase any shares for over 5 months after the stock spent the Winter mostly trading above $60.

Last week alone, the investment firm bought 7.9 million shares for nearly $500 million. Since the start of March, Buffett has bought 13.7 million shares at prices normally above $60.

The problem now is that despite Buffett prudently not chasing the stock higher, most of the purchases in the last year are actually underwater. Not only were investors harmed by chasing the stock, but also investors are now losing money by buying OXY anytime since the Russian invasion of Ukraine.

Buffett's Berkshire Hathaway recently boosted their stake to 23.1% with a position of 208 million shares. The investment firm also owns 100,000 shares of series A preferred shares and warrants for an additional 83.9 million shares at an exercise price of $59.624.

Disappearing Earnings

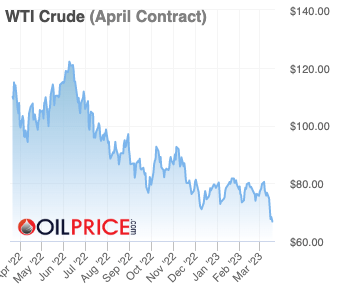

The energy company spent 2022 benefitting from elevated energy prices due to the Russian aggression. Now, the global banking crisis has WTI prices down below $70 after spending a good part of 2022 above $100.

Source: OilPrice.com

Just a couple of weeks ago, OXY reported Q4'22 earnings where EPS estimates missed analyst targets by a wide $0.22. The energy company reported a quarterly EPS of $1.61, already down nearly 50% from the Q2'22 peak EPS of $3.16.

With energy prices collapsing, investors need a big reminder of how OXY only earned $1.62 in all of 2019 when the company last reported a clean year. This year was the last one without the covid impact or the Russian boost.

In Q4'22, OXY had the following average realized energy prices:

- Crude oil - $83.64 per barrel.

- Natural gas liquids - $26.35 per barrel.

- Domestic realized Nat gas prices - $4.45 per Mcf.

Investors only need to look at oil prices trading below $70 in the case of WTI and domestic natural gas prices at only $2.52 per Mcf to see how the equation has changed.

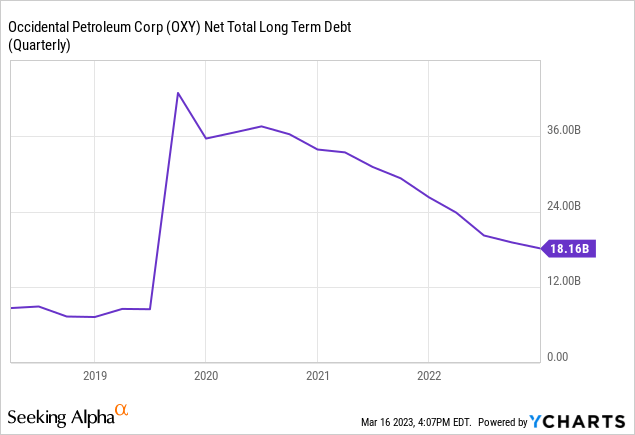

The investment story is definitely different now with the balance sheet improved from the massive earnings due to the Russian invasion sending oil prices soaring. Due to net debt dipping to only $18 billion, OXY shouldn't face the same downside risk of the stock falling into the $20s similar to the covid weakness.

OXY was a $40 stock prior to covid and the company probably shouldn't face the same downside risk. One issue is the disappearing earnings stream, though analysts oddly still forecast a $6+ EPS in 2023 only dipping to slightly below $6 in 2024.

Nothing about the current energy prices is supportive of OXY producing premium earnings going forward. A prime example of where earnings are headed was the Q3'21 quarter when the energy company generated a $0.87 quarterly profit on the following realized energy prices:

- Crude oil - $68.74 per barrel.

- Natural gas liquids - $34.01 per barrel.

- Domestic realized Nat gas prices - $3.35 per Mcf.

All of the current energy prices are either at similar levels in the case of WTI or much lower in the case of NGL and domestics nat. gas. Some of these energy prices might be at unsustainably low prices, but a domestic recession will clearly pressure WTI and domestic nat. gas prices for a while.

The stock trades at nearly $60 and OXY appears to only have an earnings stream in the $3 to $4 per share level, assuming WTI prices don't fall further. The stock is too expensive at up to 20x EPS targets. Also remember, this valuation is based on 950 million shares outstanding (up from 900 million in Q3'21) and the company has the potential for substantially more shares outstanding via converting the preferred shares and warrants.

Takeaway

The key investor takeaway is that investors can do worse than buying alongside Buffett. Unfortunately, the energy market is weak and OXY actually appears very expensive at these levels. The stock needs another $5 to $10 dip to become appealing, especially considering the market doesn't appear ready for the obvious EPS reset to lower levels.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.