Corporate Access To Capital Is Seizing Up

Summary

- We have just left an era of easy access to capital resulting in rampant speculation and excess investment.

- The pendulum is swinging the other way and corporate access to capital is seizing up especially for weaker companies.

- Capital is harder to get and/or more expensive from IPOs, bank lending, bonds, venture capital, private equity and the government.

- How this plays out and what to do as an investor is discussed.

wildpixel/iStock via Getty Images

Capital is at the heart of capitalism. Corporations need capital to grow, buy other companies, buy fixed assets, fund liabilities, innovate and fund research and development. When capital becomes hard to come by, it has a major impact on the economy and stock market.

The good news is that stronger companies with good balance sheets or solid cash flow usually continue to have access to capital in weak economic times. The impact is more on weaker companies. These include high growth but money losing companies, startups, overleveraged established companies and established companies experiencing difficulties.

Recently, the deterioration in the capital markets has been across the board. It has impacted IPOs, venture capital, private equity, bank loans, bonds, fiscal and monetary stimulus and SPACs. More detail on each is below.

Specific Markets That Are Seizing Up

A discussion of each of the capital markets that are seizing up or slowing down is below.

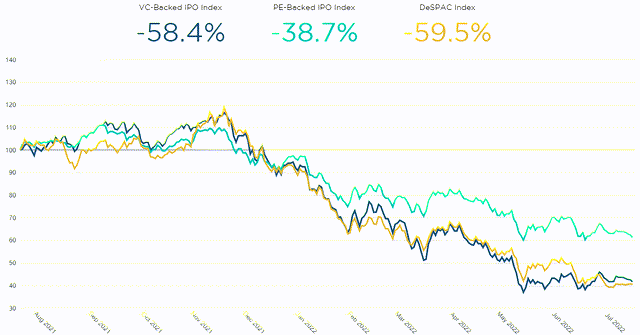

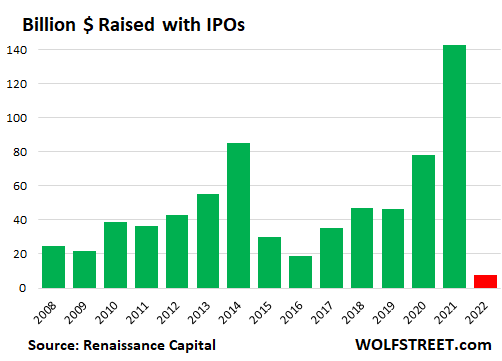

1. IPOs - The number of IPOs declined as 2022 went along and that activity is almost entirely closed down right now. Secondary issuances remain steady. But for money losing companies, they are at much less favorable terms.

Wolfstreet.com

2. Venture Capital and Private Equity – The IPO market is vital to these two industries, especially venture capital. They need IPOs as an exit from their investments once they are far enough along. They then redeploy into new earlier stage companies. They also need capital to fund losses of newer high growth portfolio companies. Without capital from IPOs, the industry cannot operate normally. The fear and disruption in the industry played itself out last week with the collapse of Silicon Valley Bank (SVB) (SIVB). SVB catered primarily to the VC and PE industries with 56% of all loans to them and probably an even higher percentage of deposits directly or indirectly to them. The collapse of SVB on top of the shutdown of the IPO market has put massive pressure on the VC and PE industries. Startups, pre-revenue, and private corporations will have a harder time accessing capital from them for a while going forward.

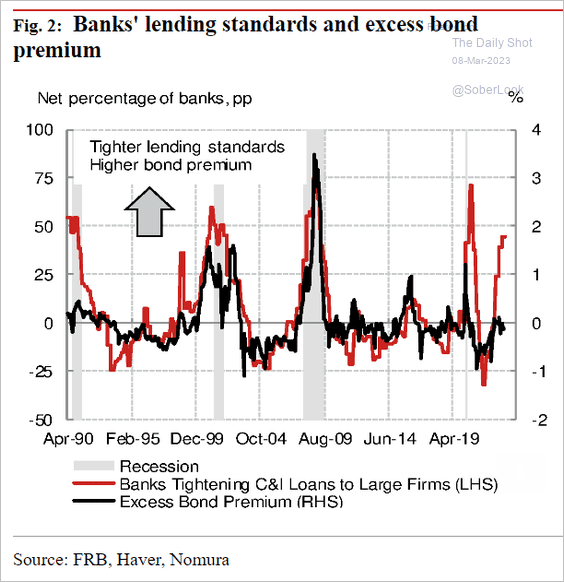

3. Banks tightened underwriting and loans are more expensive – The chart below showing banks tightening lending standards is from a recent survey by the Federal Reserve. Banks normally tighten in recessions but it is a bit unusual to do so before one. Banks rarely stop lending though, unless forced to by regulators. It is in their DNA to lend. But many weaker companies will be shut off. Also, higher interest rates mean credit is more expensive for anyone with an adjustable rate loan and those needing new loans or to refinance older loans. Look at the red line in the chart below.

Federal Reserve, Haver, Nomura

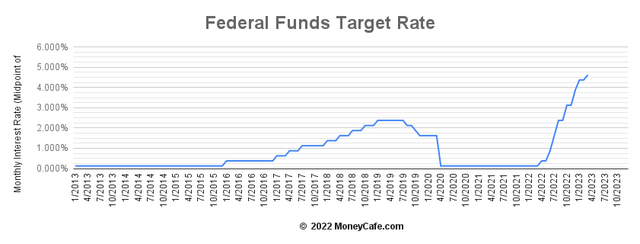

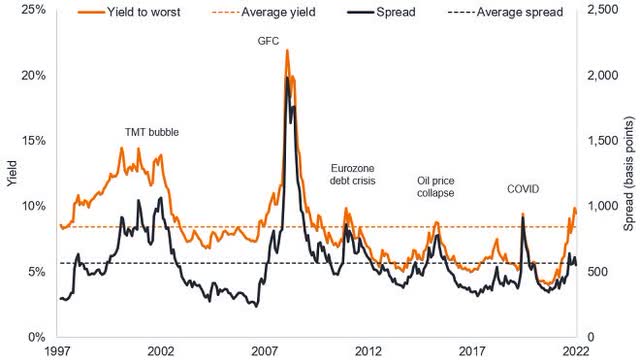

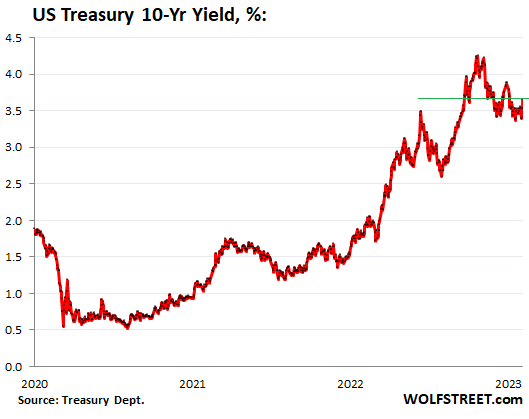

4. Bonds are more expensive – The first chart shows how much longer-term interest rates have gone up. The second shows the sudden rise in short-term rates (Fed Funds) which affect adjustable rate loans tied to the Prime rate or SOFR (the successor to LIBOR). The third shows that for weaker (junk bond rate) companies, the impact of higher rates is magnified.

Wolfstreet.com

5. Unlikely new fiscal stimulus with a Republican House of Representatives – The Federal government created the current inflation followed by high interest rates with its excessive $5 trillion in fiscal stimulus in 2020 and 2021. I have written a number of articles about this including this one. A few months ago, the Republicans took control of the House of Representatives and have vowed to reduce the deficit. The combination of damage caused by last stimulus and a changed political landscape makes any new fiscal stimulus difficult. There were new stimuluses approved in 2022 such as the Inflation Reduction Act, but it is much smaller and spread out over a longer term.

6. Federal Reserve tightening – While the Fed appears to be close to a slowdown or end to tightening, it is still actively increasing interest rates and reducing money supply. That means less money out there for capital.

7. SPACs – While SPACs were historically a small source of capital for corporations, that changed in 2021 when they exploded in popularity. This source of capital has dropped off as fast as IPOs. However, unlike IPOs, SPACs are unlikely to return in size any time soon as it is now clear they are much less beneficial to shareholders than IPOs. Most SPACs that acquired another company over the past 2 years did very poorly.

Fallout

I expect a recession soon, and have written 4 articles in the past year explaining why. This includes one published on March 10, 2023 titled 20 Reasons A U.S. Recession Is Coming Soon And 10 Reasons It Isn't.

When things start breaking down, it usually means a recession is near. Recently, two major banks (SVB and Signature (SBNY)) were taken over by the FDIC. A large crypto firm [FTX] also collapsed. People fear recessions because they result in job losses, investment losses and economic weakness. But recessions are actually needed to stop excesses and rampant speculation. We have been in an era of massive bubbles that are only partially burst. Things need to break down before we can build up from a stronger more stable base. We’ve been here before. In fact, it seems to happen every decade or so.

Takeaway

Stronger established companies will still get loans and have access to secondary stock issuances, just at a higher interest rate for a while. There will be a shakeout of weaker companies with high leverage or continued losses especially in newer industries. This has always eventually happened in exciting new industries. Everyone wants to start companies or invest in the hottest new thing which leads to distorted markets and too much competition.

Avoid or reduce exposure to stocks in weaker companies and highly competitive newer markets, especially if leveraged. Consider stocks that hold up better in a recession such as utilities and consumer staples. There is probably a relatively short window to lock in investment grade bonds with 5-30 year terms at the current 4-6% yields. They should appreciate in value once the Fed starts lowering rates, something they almost always do when a recession is apparent.

One counter cyclical stock I recently purchased is Heritage Global (HGBL). Heritage has two primary businesses; auctioning off industrial equipment and providing a marketplace for charged-off loans. Both of those markets do very well in a recession. It does not currently need capital. The charged-off loans that go through their marketplace are primarily unsecured consumer loans. These have exploded in popularity recently with the emergence of Fintechs like Upstart (UPST), Curo (CURO), SoFi (SOFI) and LendingClub (LC). Problem loans don’t usually get close to peak until 1 to 2 years after the start of a recession. That bodes well for 2024 and 2025 as charge-offs are quite low right now. Meanwhile, the lack of capital will lead to many pre-revenue biotechs running out of money and going under. Heritage specializes in auctioning off lab equipment.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of HGBL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.