Plains All American: Take Advantage Of Growing Utilization

Summary

- Plains All American is enjoying a strong recovery in volumes as demand continues to grow. That's especially true as Russia's volumes are replaced.

- The company has a 9% dividend yield from its core assets and it has $600 million in additional capital it can use for whatever it wants, including debt paydown.

- We expect the company to be able to continue generating double-digit direct and indirect shareholder returns, making the company a valuable investment.

- We're currently running a sale for our private investing group, The Retirement Forum, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

dszc/E+ via Getty Images

Plains All American (NASDAQ:PAA) is a $8 billion midstream company, with an impressive portfolio of assets. However, more important than the current cash flow is the company's spare capacity and continued volume growth. As we'll see throughout this article, we expect that the company's continued cash flow growth will enable strong shareholder returns.

Plains All American Overview

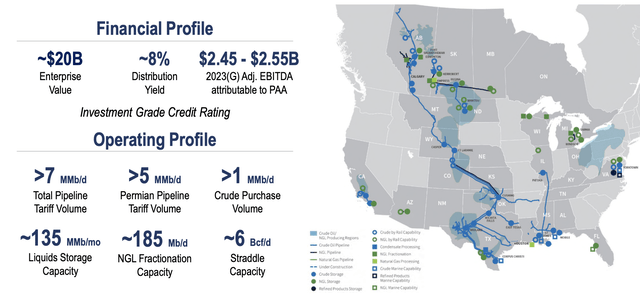

Plains All American has a unique portfolio of assets.

Plains All American Investor Presentation

Plains All American Assets - Plains All American Investor Presentation

The company has an enterprise value of ~$20 billion with $8.4 billion in debt. The company's average rate on its notes is 4.6%, meaning it pays ~$400 million in annual interest expenditures. As debt drops that should help both its FCF and its shareholder returns to increase. The company has the FCF to continue allocating cash to debt pay down.

The company's operations are substantial. It has 135 million barrels / month of storage capacity, something that's helped it substantially in the past. It also has >7 million barrels / day in pipeline volume including >5 million barrels / day in the Permian. Lastly, the company also has substantial NGL fraction capacity, an easy to way to increase its margins.

The company's EBITDA forecast is $2.5 billion.

Plains All American U.S. Volume

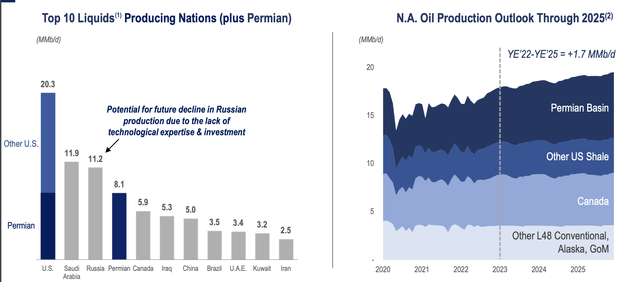

In the U.S., volumes are expected to grow steadily.

Plains All American Investor Presentation

Plains All American U.S. Volume - Plains All American Investor Presentation

Plains All American doesn't care about a decline in global volume. The company's strength comes as U.S. volumes increase regardless of what global volumes do. If global volumes decline on a shift away from oil products but U.S. volumes remain strong because they replace Russian volumes, then the market is great for Plains All American.

We expect Russian production to decline substantially and we think that'll help U.S. production strength.

Plains All American Volume Spare Capacity

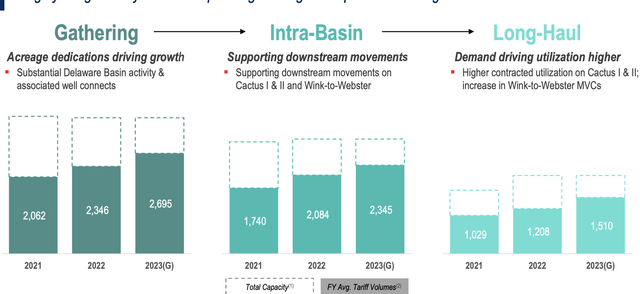

Supporting Plains All American much more in our view is the company's spare capacity.

Plains All American Investor Presentation

Plains All American Spare Capacity - Plains All American Investor Presentation

The company's strength is the substantial spare capacity built into its assets. That'll enable substantial cash flow growth with minimal additional capital requirements for the company. The company's volume recoveries from 2022 to 2023 will enable significant cash flow cost with minimal additional capital requirements for the company.

That'll reflect in the company's bottom line. The chart above also gives an idea of how much additional spare capacity the company has, spare capacity that could lead to further cash flow growth at minimal cost.

Plains All American Shareholder Returns

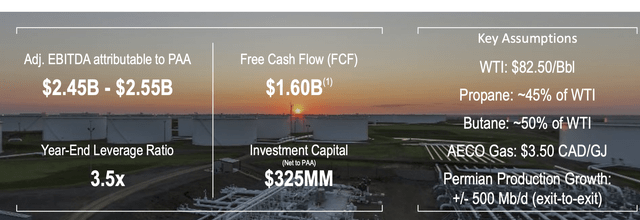

The company has the cash flow to generate substantial shareholder returns for its investors.

Plains All American Investor Presentation

Plains All American Shareholder Returns - Plains All American Investor Presentation

The company is expecting to earn roughly $2.5 billion in adjusted EBITDA, which it expects to turn to $1.6 billion in FCF. It's worth noting that without the debt that the company's FCF would be $2.0 billion. The company's year-end leverage ratio is expected to be 3.5x, meaning $8.75 billion in net debt. The company is also spending $325 million on growth.

The company expects to spend $1 billion on common and preferred distributions. That's reflective of one of the highest dividend yields in the industry at roughly 9%. The company also has $600 million in additional capital which can be utilized for debt reduction. The company's target is a significant $0.15 in annual distribution growth.

The company's debt due dates enable it to pay down the debt as it comes due without needing to pay a premium.

Thesis Risk

The largest risk to the thesis is a decline in U.S. volumes and its resulting impact on the company's cash flow. The company's debt is maintainable and we like to see the company continuing to pay it down. However, if the company's volumes were to decline so too would its EBITDA and its ability to drive shareholder returns. That can happen in a variety of scenarios.

Conclusion

Plains All American has a unique portfolio of assets. The company's FCF yield in 2023 is expected to be almost 20%. The company has a strong 9% dividend yield and a manageable financial position, although we expect it to continue using its cash for debt pay downs as well. Some opportunistic share repurchases could provide significant returns.

Overall, Plains All American has a unique portfolio of assets. The company has significant spare volume capacity which could result in its cash flow growth faster than forecast if demand picks up. The U.S. will continue to play an integral role in the global energy markets. Regardless of how the company spends its cash it's a valuable long-term investment.

Let us know your thoughts in the comments below.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don't miss out because you didn't know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.

This article was written by

#1 ranked author by returns:

https://www.tipranks.com/experts/bloggers/the-value-portfolio

The Value Portfolio focuses on deep analysis of a variety of companies across a variety of sectors looking for alpha wherever it is to maximize reader returns.

Legal Disclaimer (please read before subscribing to any services):

Any related contributions to Seeking Alpha, or elsewhere on the web, are to be construed as personal opinion only and do NOT constitute investment advice. An investor should always conduct personal due diligence before initiating a position. Provided articles and comments should NEVER be construed as official business recommendations. In efforts to keep full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The majority of trades are reported live on Twitter, but this cannot be guaranteed due to technical constraints.

My premium service is a research and opinion subscription. No personalized investment advice will ever be given. I am not registered as an investment adviser, nor do I have any plans to pursue this path. No statements should be construed as anything but opinion, and the liability of all investment decisions reside with the individual. Investors should always do their own due diligence and fact check all research prior to making any investment decisions. Any direct engagements with readers should always be viewed as hypothetical examples or simple exchanges of opinion as nothing is ever classified as “advice” in any sense of the word.

Disclosure: I/we have a beneficial long position in the shares of PAA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.