Arena REIT: Consistently Grows Its Dividends Annually

Summary

- Arena REIT has been growing its dividends annually for 10 years while also making new acquisitions each year.

- Rising interest costs have eroded its profits slightly but the REIT continues to make a profit.

- It has a low debt structure, so there is ample capital to fund its development and acquisition pipeline.

Daria Nipot/iStock via Getty Images

In the publicly traded REIT sector, the most common REITs are retail, commercial, and industrial, and then there are the niche REITs such as hotels, health care, and senior homes. In the past decade, several new REITs in various real estate sectors have appeared. One of them is Arena REIT Ordinary Stapled Units (OTCPK:ARFSF) or Arena REIT.

Arena REIT is an Australian early learning-focused real estate investment trust. The trust first IPO in 2013 and owns more than 260 childcare and healthcare centers across Australia. It follows a steady strategy of acquiring and developing new healthcare centers and early learning centers.

The company provides an essential service making it a very defensive REIT. Its reliable dividends make it a good investment for risk-averse investors.

Arena REIT Operates in the Childcare and Healthcare Space (Both Defensive Sectors)

- Early learning or childcare centers

- Healthcare such as medical centers, diagnostic facilities, hospitals, and senior care

- Education - including schools, colleges, and universities

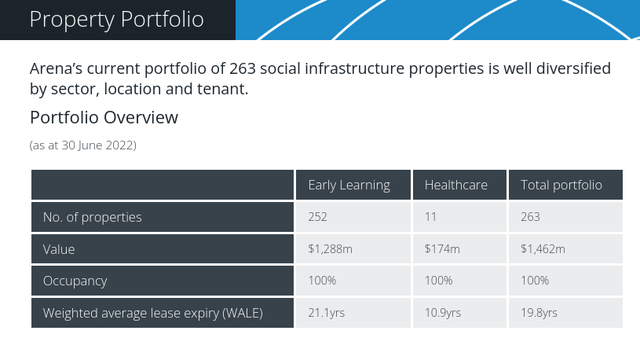

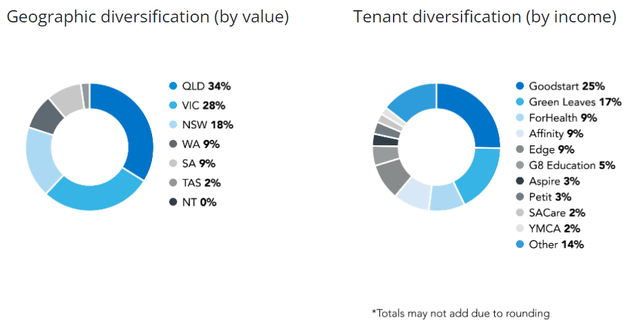

Currently, the REIT owns the following assets at the end of June 2022:

Arena REIT: Property Portfolio (Property Portfolio)

Arena REIT: Property Portfolio (Arena REIT: Property Portfolio)

The weighted average lease terms are almost 20 years making tenant rollover risk low. Also, early learning centers and childcare centers rarely relocate since it could be disruptive to young families.

Another way to look at early learning centers, daycares, and health care centers is these are need-to-have services. No matter how technology changes or consumer trends evolve, there will always be a need for healthcare, education, and daycares. This makes Arena REIT a very defensive asset, no matter how badly the economy performs, Arena REIT should still be able to produce a steady cash flow.

Arena REIT Has a Steady Balance Sheet

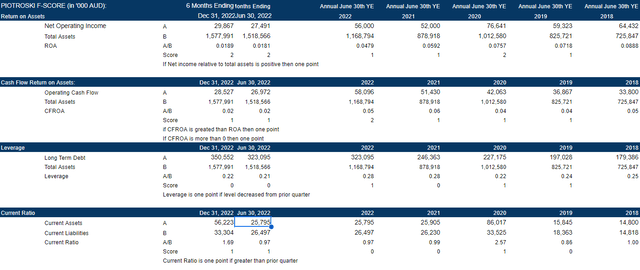

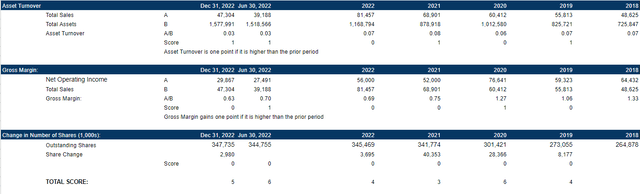

Arena REIT's financial statements are decent. Certain profit matrices have fallen but it remains a financially viable REIT. In looking at the F-Score to assess Arena REIT's financial healthiness, the company has averaged a score between 4 to 6 in the past 4 years. An F-Score of 9 implies a healthy firm and a score of 0 shows a financially weak company:

Arena REIT: F-Score (Arena REIT: F-Score) Arena REIT: F-Score (Arena REIT: F-Score)

In recent months, its current ratio has improved from 1.56 to 1. In 2021 and 2022, its current ratio was below 1.0 implying that its current assets could not completely cover the short-term liabilities. This shows the company is fixing its balance sheet to cover short-term liabilities. Its leverage also remains low. Arena REIT's long-term debt ratio is below 0.25 and has been in this range for the past 5 years. A low long-term debt ratio shows the company has a lean operating structure and can keep interest costs low. Also, there is flexibility if Arena REIT chooses to take on more debt for its acquisitions.

On the profitability front, its gross margins have fallen from 2019 when it was above 1.0. The last 2 years and its most recent quarter show it's trending below 0.75. Likewise, its return on assets and cash flow return on assets has fallen from a few years ago but it's still positive. One of the reasons is rising interest rates is increasing its finance costs.

Overall, its balance sheet has improved but its income statements have shown a drop in profit.

Its Acquisition Pipeline is Likely to Continue

Arena REIT has an active development and acquisition pipeline. This is likely to continue in midst of rising interest rates because of the following:

- Dec 2022, Arena REIT refinanced its syndicated facility limit to $500MM, an increase of $70MM.

- There is $148MM of undrawn capacity available to fund the development and purchasing of new properties

- Debt to equity remains low (sub 30%) so Arena REIT can still take on further debt

- Arena REIT is fully compliant with its bank facility covenants so its lenders are not worried.

Conclusion: Arena REIT is a BUY

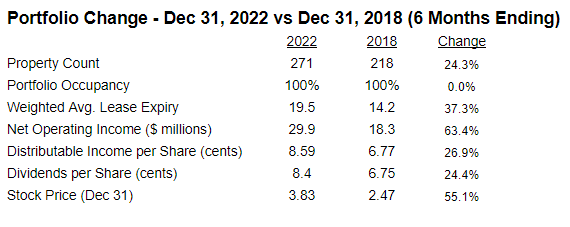

There are a lot of things to like about Arena REIT. The first one is its growth record, comparing the REIT in 2018 to 2022, Arena REIT has grown substantially:

Arena REIT: 2022 vs 2018 Comparison (Arena REIT: 2022 vs 2018 Comparison)

(Source: Arena REIT Financials and Google Finance)

Arena REIT had increased its property portfolio by 24.3% while also lengthening the lease term expiries from 14.2 years to 19.5 years. Comparatively, the NOI had increased by 63.4% but the stock price had only grown by 55%. This means the stock price is slightly undervalued when compared to the NOI growth.

On the acquisition front, Arena REIT has actively kept its debt costs low by locking in interest rates using swaps, and meeting lender debt covenants. Although rising interest rates will be a risk to Arena REIT, there is flexibility if management decides to pursue an even more active growth strategy.

The one risk factor is its dividend payout ratio. Arena REIT pays out close to 100% of its distributable income. In 2018 it had paid out about 99.7% and in 2022 it paid out 97.8%. This doesn't leave much room for conserving cash from its income-producing properties. However I will note, the REIT does have a large credit facility to draw on.

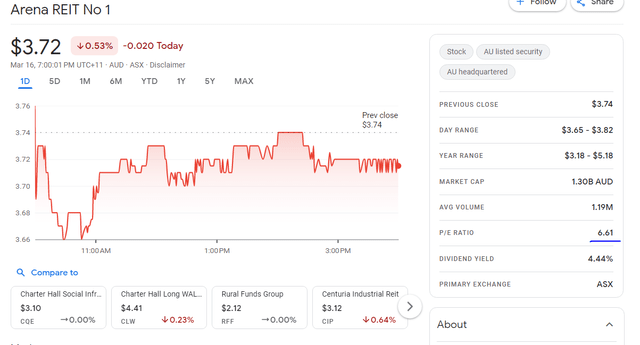

Arena REIT pays an annualized dividend of $0.168 per year (and has been increasing it annually for the past 10 years). Based on a market price of $3.72, the dividend yield is approximately 4.52% which may seem low based on today's inflation, but it is reasonably priced when the PE ratio of 6.61 is factored in:

Arena REIT: Stock Price (Google Finance)

Another big reason dividend investors should consider this stock is the annual dividend growth. Even during Covid, Arena REIT had continued increasing its dividends, not a small feat for REITs looking to acquire.

All this taken together, Arena REIT is a well-run cash flow-producing REIT. It has the capital to grow, and its stock price to its earnings make it relatively well valued. I'm bullish on Arena REIT stock.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.