High Yield Stocks Are Crashing, But These 2 Are Soaring

Summary

- The high-yield sector has crashed recently over fears of a banking sector crisis turning into a broader economic meltdown.

- However, several of our high-yielding positions proved to be antifragile in the midst of chaos.

- We discuss two of the stocks that helped us outperform the high-yield sector so far in March.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

JuSun

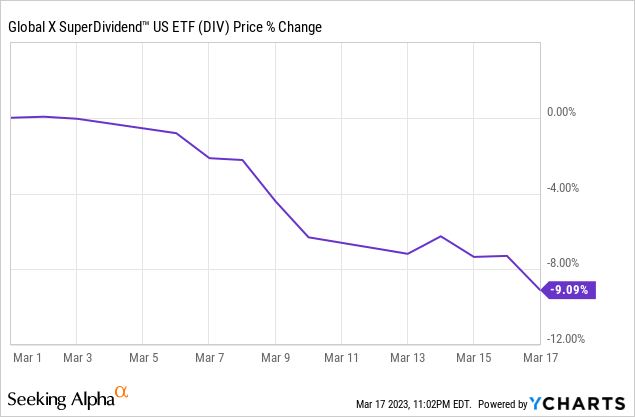

The high yield sector has crashed recently over fears of a banking sector crisis turning into a broader economic meltdown. For example, the Global X SuperDividend U.S. ETF (DIV) is down by over 9% already in just the first half of March:

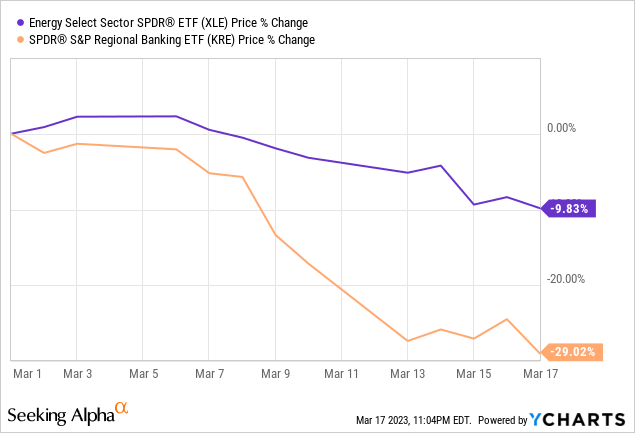

Two of our largest sectors by exposure at High Yield Investor - Energy (XLE) and Banks (KRE) - are down by even more so far this month:

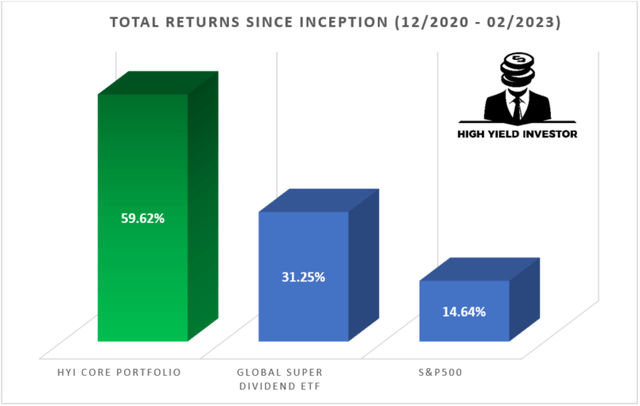

Yet, despite this, our portfolio is outperforming DIV month-to-date. How is this possible when over 40% of our portfolio is allocated to the financial and energy sectors? A big reason is that we have sizable allocations to other stocks that have proven to be antifragile in the face of market chaos and growing macroeconomic uncertainty. Two of them that we will discuss in this article are Virtu Financial (VIRT) and Newmont Corporation (NEM).

#1. VIRT Analysis

As a market maker, VIRT's underlying profitability generally enjoys strong correlation to market volatility (VIX). As a result, whenever the market is making dramatic moves to the upside or downside (such as in more traditional, rapid market selloffs like in 2008 and 2020), VIRT generally sees its profits soar. For example, during the COVID-19 crash, its stock massively outperformed the market by soaring 60% even as the S&P 500 (SPY) pulled back sharply.

Given the growing geopolitical risks across the globe, the rising interest rates, the raging inflation, and declining GDP, now seems to be as good of a time as any to hold such a stock in our portfolio.

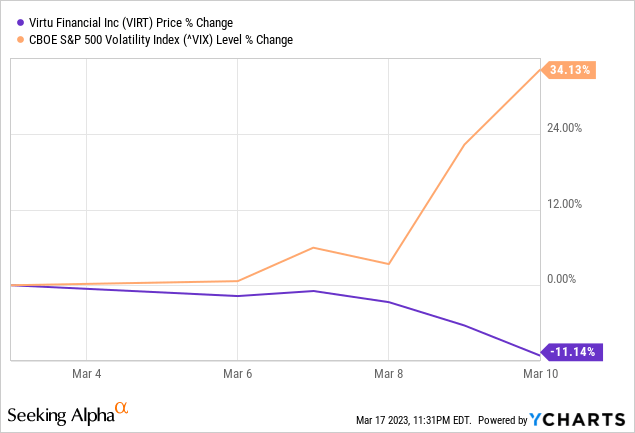

Furthermore, VIRT's stock price had also gotten pummeled in the early days of March along with the broader financials sector. However, this sell-off made no sense to us since VIRT's underlying profitability as a market maker is strongly correlated with the VIX. During that same time period, the VIX had soared due to a spike in market volatility, yet VIRT was down sharply:

Furthermore, VIRT has been buying back stock hand-over-fist, so the suppressed share price serves as a major catalyst for further per share value accretion as it makes VIRT's buybacks that much more attractive.

As a result, we added to VIRT opportunistically this past Monday. The reasoning behind this trade was simple: VIRT is - in addition to paying out a substantial and safe dividend alongside aggressive buybacks in its own right - also serves as an important portfolio diversifier for us. When market volatility spikes its underlying business generally sees profitability spike as well. That is why earlier this week we added shares of VIRT when we noticed a clear disconnect between spiking market volatility and the plunging VIRT share price.

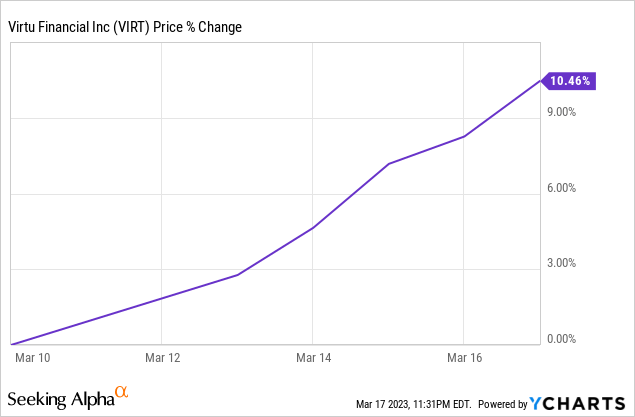

Since then, the stock price has recovered strongly. In a matter of days, the stock price has shot up by double digits:

As one of the largest positions in our Core Portfolio, this strong outperformance enabled our portfolio to hold up fairly well in the face of sharp declines across most of the rest of the high yield sector.

Moving forward, we believe that VIRT should continue to shine for our portfolio even if the high yield space continues to be plagued by massive volatility.

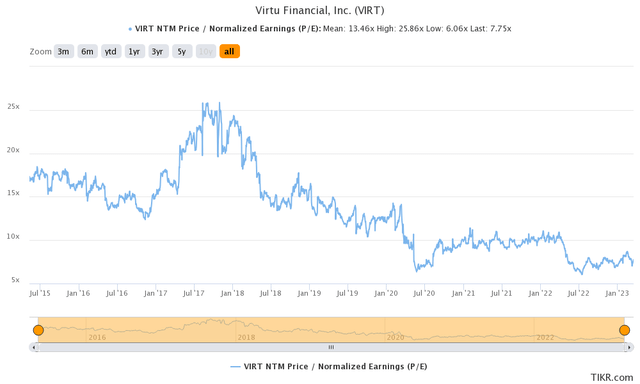

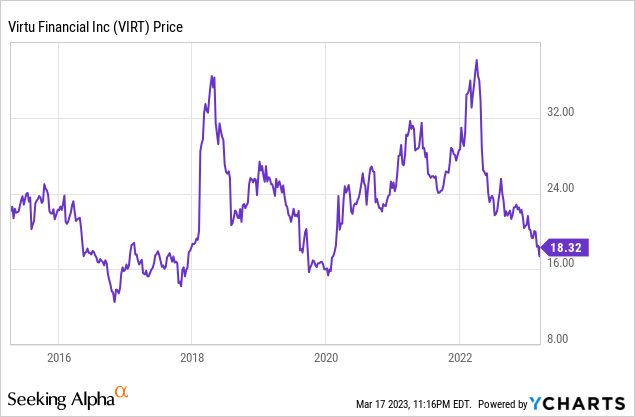

This is because - in addition to its diversification benefits - VIRT remains compellingly undervalued. The fist symptom is that, despite substantially reducing its share count over the past few years and successfully advancing numerous growth initiatives in businesses like options, ETFs, and crypto, its share price is trading near all-time lows:

Another symptom is that its price to earnings ratio is trading far below its historical average despite earnings also being at the low end of its historical range:

On top of that, insiders remain heavily invested in the shares themselves and it is still run by one of its original founders, who clearly has a deep emotional investment in the firm as well. The company is buying back shares hand-over-fist instead of empire building, in a clear statement that they believe in the existing business and that the stock is significantly undervalued.

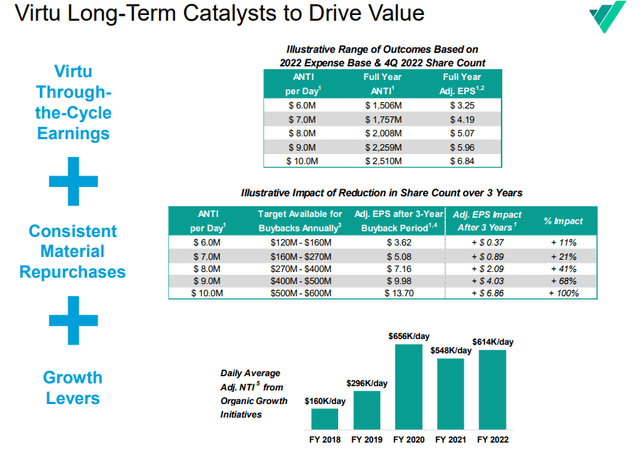

The company recently posted this slide to illustrate the benefits of its organic growth initiatives:

VIRT Organic Growth (Investor Presentation)

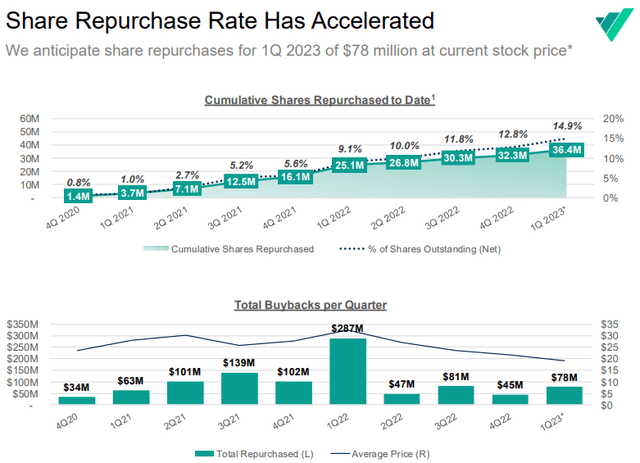

This slide illustrates how aggressively they are buying back shares:

VIRT Buybacks (Investor Presentation)

When you combine the very safe 5.2% dividend yield, the aggressive buyback cadence, and the extremely high rates of return they are receiving on organic growth investments, the total return proposition is clear here even before looking at multiple expansion potential. Furthermore, if volatility continues to rear its ugly head, VIRT will likely continue to see its stock price soar. This will enable us to trim our position and recycle the capital opportunistically into other positions that have been beaten down. As a result, VIRT's risk-adjusted total return potential is even better given the diversification benefits it provides to our portfolio

In summary, VIRT remains one of our favorite targets for new capital even though we already have a very large position in it. This simply boils down to the facts that:

- the stock is extremely cheap by a large number of metrics

- we believe the company is very well managed with fully aligned insiders

- it provides very attractive diversification benefits for our portfolio

- its capital light and recession-agnostic nature make it a great risk-adjusted investment during periods of stagflation like we are seeing at the present

Yes, there is some uncertainty about the future of the industry given the SEC Chairman's recent comments and ideas about structural reform of the public markets. However, as the CEO detailed during the latest earnings call and the company has made clear to us in our own conversations with them, VIRT believes they are well-positioned to continue generating strong profits for shareholders regardless of what happens with regulators. Ultimately, such changes would be more harmful to their clients than to them, particularly over the long-term. Given how wide the margin of safety is in the current stock price, we believe that right now VIRT provides an exceptional risk-reward profile to patient long-term investors. It remains a STRONG BUY and we would be happy to add more shares depending on market conditions and our own capital availability.

#2. NEM Analysis

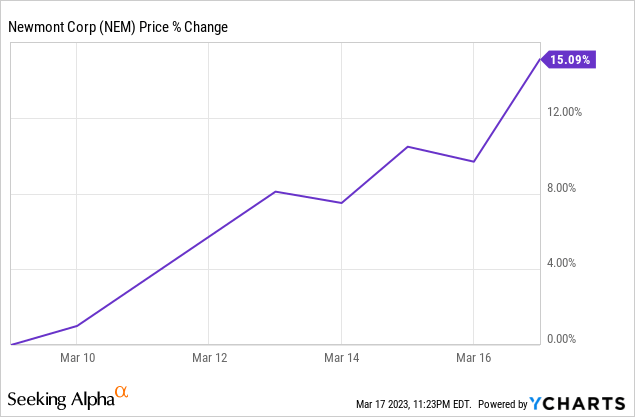

NEM is another stock that has had a great run recently even as the broader dividend stock space has suffered:

This is because, between the uncertainty posed by the crisis in the banking sector and the increased likelihood that the Federal Reserve may be forced to blunt its rate-hiking regimen in order to keep the economy from crashing, the case for gold (GLD) just got much more appealing.

Historically, gold prices have tended to rise during periods of sustained negative real interest rates. The reason behind this is that when cash loses its purchasing power at a faster rate than the risk-free yield offered for saving it, gold becomes a more appealing option for low-risk wealth storage. If the Fed is compelled to pivot before accomplishing its goals, it might indicate to the market that negative real interest rates are likely to persist, potentially driving gold prices even higher. Given that NEM as a gold miner is highly levered to the price of gold, this obviously bodes very well for NEM.

NEM reported decent Q4 results. Highlights from the quarter included:

- Production was solid, with the company producing 1.63 million attributable gold ounces during Q4 and ~6 million for the full year. NEM also generated ~1.3 million gold-equivalent ounces from other materials mined alongside gold. Production was below the mid-point of guidance, but it still managed to come in at a flattish level relative to 2021.

- Inflationary pressures drove the all-in sustaining costs meaningfully higher this year to over $1200 per ounce, while the gold price was flat over the course of the year. As a result, profit margins were squeezed.

- Combining the tightening profit margins with the company's significant capital expenditure budget, free cash flow plummeted in 2022.

- As a result of all these negative forces and the lingering impacts of inflation that have not sufficiently translated into higher gold prices, NEM management elected to revise its variable dividend framework downward, stating on the earnings call:

The expected range for dividends to be paid this year is $1.40 to $1.80 per share, and this range has been calibrated at a conservative $1,700 gold price.

- The company is also trying to acquire Newcrest Mining (OTCPK:NCMGF) in a bid to grow its production profile in Australia, which could be a growth catalyst if successful.

While this past year was a tough one for NEM, our investment profile remains intact. The company has a very impressive production profile for both gold and copper, has a stellar balance sheet, and is still paying out a substantial dividend. If/when copper and gold prices increase alongside the company's current plans to continue improving production efficiencies, its profitability could potentially soar higher, richly rewarding investors in the process.

Given recent events, we believe that NEM may be headed much higher in the coming months, enabling it to serve alongside VIRT as an excellent antifragile portfolio diversifier.

Investor Takeaway

Many high yield stocks are crashing, leading to exceptional bargains not seen since the 2020 COVID-19 crash. Thanks to our substantial allocations to stocks like VIRT, NEM, and others in our portfolios at High Yield Investor, we are in a position to trim from these positions that are soaring and buy up positions in quality high yield securities at bargain-basement prices.

That said, we remain very bullish on both NEM and VIRT with Strong Buy ratings on both as we believe that the current volatility may just be getting started and both stocks remain meaningfully undervalued.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain. There's also a $251 discount for new members who join TODAY!

Start Your 2-Week Free Trial Today!

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Disclosure: I/we have a beneficial long position in the shares of VIRT, NEM, GLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.