Natural Resource Partners: Royalties With Protected Downside

Summary

- Natural Resource Partners is an MLP that owns the mineral rights to roughly 13mm acres in the Appalachia Basin and Wyoming.

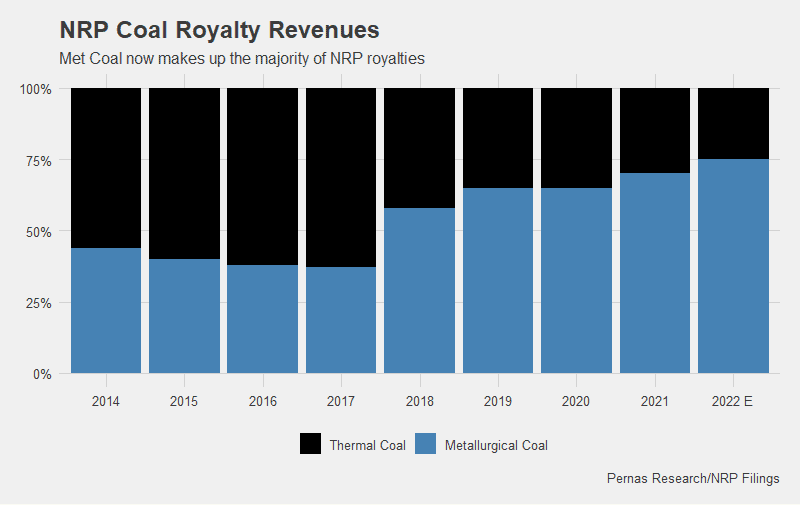

- The majority of Natural Resource Partners' coal revenue comes from metallurgical coal, a much more resilient revenue stream than thermal coal.

- Given the low-cost business of collecting royalties with a protected downside along with potential growth drivers, we believe Natural Resource Partners has an upside of at least 30%.

Andrzej Rostek

Natural Resource Partners (NYSE:NRP) is an MLP that owns the mineral rights to roughly 13mm acres in the Appalachia Basin and Wyoming. Currently, their primary natural resources are thermal and metallurgical coal. Given the low-cost business of collecting royalties with a protected downside, an ownership stake in a low-cost producer of soda ash, and potential upside in carbon capture, we believe NRP is undervalued by at least 30%.

Although coal is a dying industry, there are pockets of resilience that should prove durable for the near term, namely metallurgical coal production. Almost 80% of NRP’s coal royalties come from metallurgical coal lessees. For more background on the metallurgical coal industry, view our industry analysis here. Due to years of underinvestment in the industry, as pressure from regulators has handicapped the financing of coal exploration and production, and labor shortages, the supply side has been unable to respond dynamically to demand. This came to a head with the recent energy shortages due to embargoes on Russia. Even with coal prices surging more than 100%, aggregate US production of coal has only increased by 10%. Other ESG-guided countries such as Australia are also faced with similar constraints. NRP’s FCF went from $130mm in 2019 to almost $260mm in 2022 and yet NRP has seen little change to lessee supply except for adding one new lessee in Q3 2022.

It is important to distinguish between thermal coal and metallurgical coal. Thermal coal generates energy via coal-fired power plants. Thermal coal has seen heavy regulation as it generates heavy CO2 emissions. At least in developed countries, the writing is on the wall for thermal coal, as natural gas is a cheaper and cleaner energy alternative. Metallurgical coal has a more prolonged existence as it is used to produce steel, although the threat of technological obsolescence still looms. The demand for metallurgical coal for the next several years will be declining but at a slow rate. The portion of NRP’s royalty revenues that come from metallurgical coal has been steadily growing and now makes up about 75% of coal royalty revenues, a much more resilient revenue stream than from thermal coal. As NRP does not break out the percent of their coal used for domestic consumption versus exported, we use the base rate of the US met coal industry- about 70% of aggregate US met coal is exported and 30% is used domestically. This 30% supplies the USA with the majority of its met coal needs.

Pernas Research

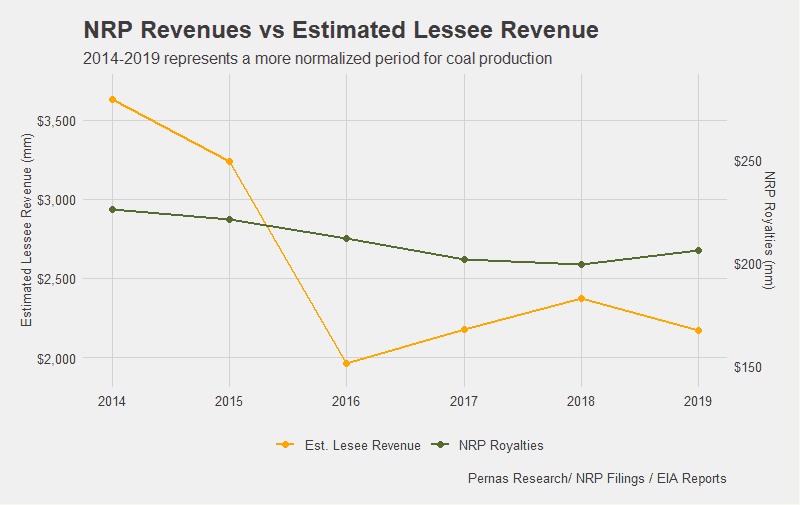

NRP collects a royalty on the value of the coal mined by lessees. The prices and the volume of the mined coal are determined by the coal miner with their customers and NRP simply takes a cut (estimated at around 5%) of the revenue generated. These contracts have stipulations such as minimum payment obligations (payments that are based on the greater of either the percentage of lessee revenue generated or fixed royalty dollars per ton of coal mined) that offer some downside protection when coal prices drop. In a majority of their contracts, even if no mining occurs the lessee is still subject to minimum payments. These minimum payment obligations are then credited against future revenues. NRP also generates significant revenues from ancillary services it provides lessees such as transportation etc. This averages to about 35% of NRP’s coal royalty revenue. The result of these factors is that NRP’s FCF is stable even when coal prices fluctuate, as shown in the figure below.

Pernas Research

Soda Ash

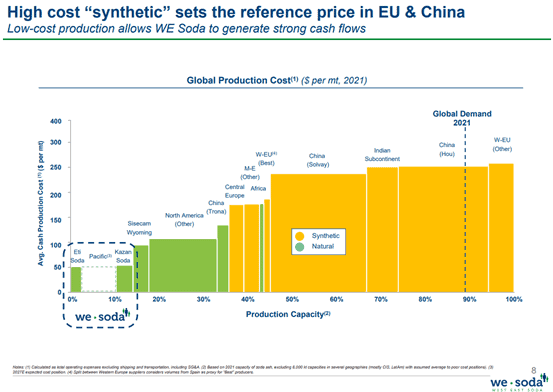

NRP has a 49% equity stake in Sisecam Wyoming LLC ("SW"), which produces soda ash in the trona fields in Wyoming, some of the lowest-cost areas in the world. This is depicted in the figure below. SW supplies the USA with 90% of its soda ash needs. Soda ash demand has grown consistently at an annual rate of 3-4% for the last 20 years with demand driven primarily by glass manufacturing. We can estimate the value of this asset as the publicly listed company Sisecam Resources (SIRE) owns the other 51% of SW. SIRE is valued at an EV of $500mm, putting the 49% equity stake owned by NRP at around the same level. This $500mm valuation is supported by a bid made in July 2022 by Sisecam. Sisecam is a Turkish conglomerate that is one of the largest glass manufacturers and soda ash producers in the world.

We Soda Investor Presentation

Disregarding the valuation of the 49% stake as a benchmark, Sisecam Wyoming LLC pays NRP $60mm/year in distributions. For a low-cost producer of an ever-growing and needed chemical, an 8x multiple is a conservative valuation. Sisecam Resources has spent roughly $50mm in the last few years to expand production however this growth capex has been halted due to COVID and the subsequent takeover bid. It appears that the intention of Sisecam for the near term is to use the cash from SW to fund the expansion of an even lower-cost Soda Ash, named ‘Atlantic’ and ‘Pacific’. Pacific is depicted in the lower left-hand portion of the bar graph above. Given the incentive match, the odds of distributions being swept to pursue growth projects for SW seem minimal.

“Among the investments we have announced, the Wyoming Plant has been producing since 1962 and is a completed investment. We anticipate that Pacific and Atlantic investments will come into operation gradually starting from 2025, in line with the investment plans, and foresee that the new facilities will reach full capacity in 2027.” - Dr. Ahmet Kırman Chairman of Sisecam

Sequestration

NRP may also find significant value in storing the very carbon that their mined coal emitted to the atmosphere. In July 2022 the Biden Administration, as part of the Infrastructure Act, announced a $2.6B program to capture and store CO2 for purposes of removing greenhouse gases from the atmosphere. One of these methods is carbon sequestration. Carbon sequestration is a process by which carbon dioxide is extracted from the atmosphere and stored through various methods: there is natural sequestration which means planting trees to absorb CO2, and then there is artificial sequestration which means capturing CO2 gas, compressing the gas, and finally injecting it underground. NRP intends on following the coal royalty playbook, only leasing out the mineral rights and not developing or operating any renewable energy projects. NRP has already received $14mm via natural sequestration rights. NRP also executed two leases which granted the lessee the rights to artificially sequester carbon dioxide – amounting to almost 800 mm metric tons of CO2 storage. Given the rest of the mineral rights they own, there is potential for many multiples of signed CO2 storage. We estimate that NRP’s sequestration royalty streams discounted back are worth $60mm to $500mm. Even using the lower end of the valuation range, it is a significant future income stream.

Capital Structure

NRP has $250mm of convertible preferred shares outstanding with a 12% interest rate, roughly 200mm of LT debt, and 3mm warrants outstanding with an average conversion price of $31. Management has about 15% share ownership and is intent on allocating capital to reduce debt, preferreds, and warrants. Management has historically adhered to this playbook, bringing LT debt from a peak of $1.4B in 2014 to $150mm at the end of 2022. Continuing to do this in our opinion is the optimal way to return value to shareholders.

Valuation

NRP will continue to benefit from elevated royalty revenues as lessees such as Alpha Metallurgical Resources have locked in high thermal and metallurgical coal prices for the remainder of 2023. Past 2023, we assume more draconian assumptions as continued low natural gas prices will likely hamstring the thermal coal market. Although for the next five years, the US states that generate most of their electricity through coal power plants (about 13 states) will serve to slow thermal coal decline. We estimate past 2023, thermal coal tonnage will decline at least 10% per year. Metallurgical coal consumption will likely see erosion albeit at a lesser rate as electric arc furnaces (EAFs) continue to take market share from integrated steel mills, along with natural gas being used instead of coke in blast furnaces. Although auto-grade steel is the last stronghold for integrated steel mills as it is the highest quality steel, it is likely that EAFs will continue to make inroads into this. Metallurgical coal exports will offset this decline as countries such as India and China still rely heavily on blast furnaces as they do not have the vast reserves of scrap metal that more developed countries have. We estimate FCF in 2023 will be around $200mm. Past 2023 we are forecasting that coal royalty revenues revert to 2019 levels and then decline at an annual rate of 5% (This works out to the tonnage of coal mined being reduced by about 7% per year while the $/ton NRP collects increasing 2% per year as met coal continues to make up more of the coal tonnage mined. Met coal is more expensive than thermal coal, hence a higher dollar royalty.) We assume past 2030 there are no more coal royalty revenues.

With discounted coal royalty earnings adding up to $750mm, NRP’s soda ash subsidiary being valued at $500mm, and sequestrations being worth $60mm, we arrive at a 1.3B valuation. Subtracting out net debt, preferreds, and warrants of about $400mm leaves a valuation of about $900mm or about a 30% upside.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of NRP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: INVESTMENT DISCLAIMERS & INVESTMENT RISKS

Past performance is not necessarily indicative of future results. All investments carry significant risk and all investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that our research, analysis, and forward-looking price targets will result in profits or that they will not result in a full loss or losses. All investors are advised to fully understand all risks associated with any kind of investing they choose to do.