Federal Reserve: A Stability Dilemma - Quick Takes On Capital Markets

Summary

- Just over a week ago, a materially more hawkish narrative from FED Chair Powell at his Congressional Testimony had convinced financial markets that the Fed could revert to a 50 basis point hike in March.

- However, a wild week of volatility marked by the collapse of three U.S. banks suggests the policy arithmetic for the Federal Reserve has likely changed.

- February’s CPI report confirms that the inflation problem is still very present, and, on its own, would likely have cemented a 50 basis point hike at next week’s FOMC meeting.

manassanant pamai

Recent banking sector volatility, coupled with a February CPI report that shows inflation is still running hot, means the Federal Reserve now has a stability dilemma: Cut rates to alleviate market angst and risk spurring inflation higher; or, alternatively, persist with aggressive rate hikes to avoid reinvigorating inflation, but risk accelerating contagion to the broader financial system. Their decision to favor either price stability or financial stability will be instructive for the crisis outlook moving forward.

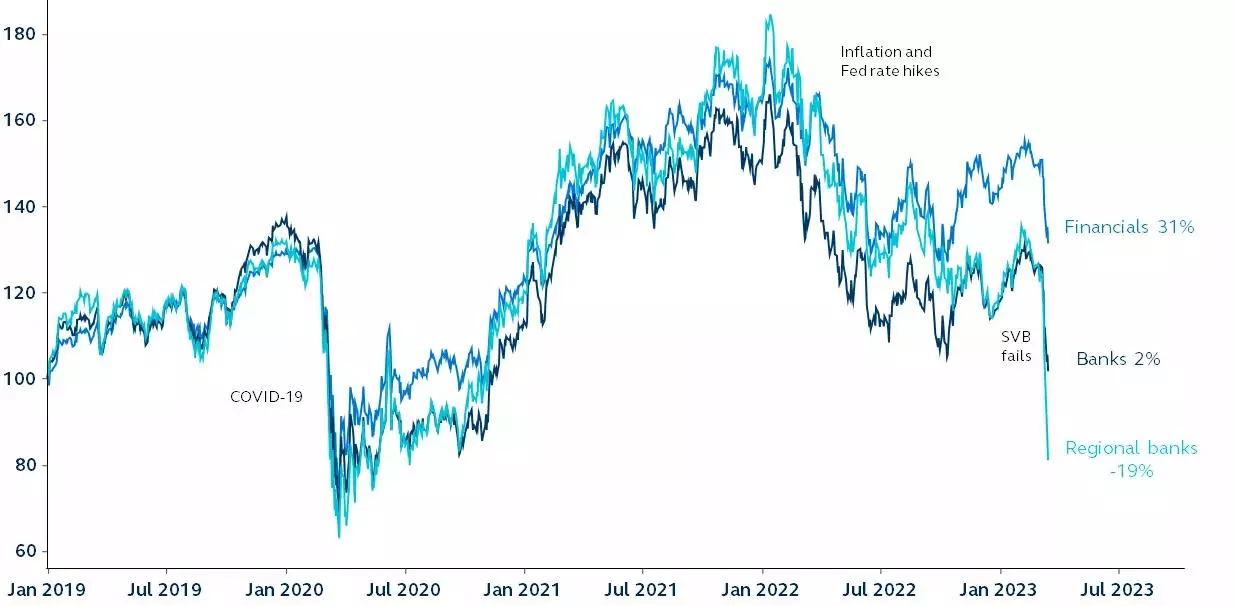

Financials sector performance

S&P 500 financials sector, banks industry group, and regional banks sub-industry, price returns, indexed to 100 at January 2019

Clearnomics, Standard & Poor's, Principal Asset Management. Data as of March 15, 2023.

Just over a week ago, a materially more hawkish narrative from Federal Reserve (FED) Chair Jerome Powell at his Congressional Testimony had convinced financial markets that the Fed could revert to a 50 basis point hike in March. However, a wild week of volatility marked by the collapse of three U.S. banks suggests the policy arithmetic for the Federal Reserve has likely changed.

February's CPI report confirms that the inflation problem is still very present, and, on its own, would likely have cemented a 50 basis point hike at next week's FOMC meeting. However, with the recent bank failures sending the financial sector into disarray, and unless the Fed's new Bank Term Funding Program (a lending facility which will provide additional funding to banks that run into liquidity problems) can successfully sooth market angst, the Fed will likely need to put extra focus on the financial stability side of its mandate. As a result, a 25 basis point hike is the most likely outcome from the FOMC meeting next week. If market turmoil deepens over coming days, even a pause is possible.

Ultimately, financial conditions will tighten further - either via additional central bank tightening as they try to tame inflation or via a deterioration in the current banking crisis. High-quality, defensive assets should be sought out, while diversification will be increasingly important in the volatile period ahead.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by