DXJ's Yen Hedge Isn't Desirable Right Now

Summary

- DXJ has taken a hit due to the pretty meaningful exposure to financial companies in Japanese markets. Moreover, consumer discretionary has similarly traded down.

- What's done is done, but the issue is that the events we've seen in banking have a probability of changing the rate landscape, which should support the monetarily accommodated Yen.

- The lack of leverage to the Yen in the DXJ is not desirable since we believe it will be a source of return.

- Moreover, Japan is a pretty inefficient market. We oppose Japanese ETFs when there are so many good single stock selections you can make.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

StockByM

The WisdomTree Japan Hedged Equity ETF (NYSEARCA:DXJ) is a way to play the Japanese market without Yen risk. The problem is a bet on the Yen isn't such a bad idea right now, as it's still low and there are catalysts. Moreover, we don't see any need for broad-based Japanese exposure, especially considering that several of its industries will be levered to the situation in household credit, which will tighten after the bank fiascos. There's really nothing appealing about DXJ ETF right now, although there are plenty of nice individual ideas in Japanese markets, a country where rates are still low and markets are inefficient in the mid and small-cap space.

Quick DXJ Breakdown

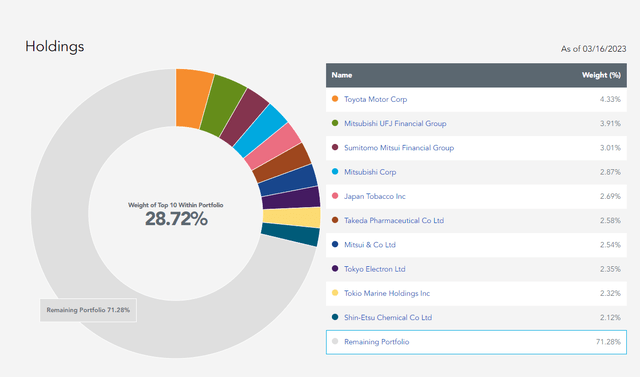

The top holdings are some of the typical ones you'd expect for the Japanese markets, and show the importance of financial and consumer discretionary for the Japanese economy.

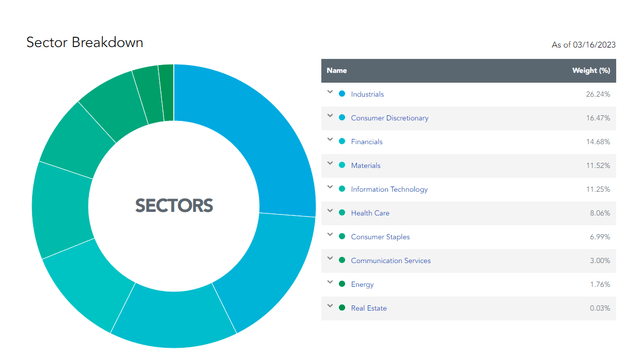

Holdings (WisdomTree.com) Sectors (WisdomTree.com)

A lot of these businesses have innate Yen hedging in that their markets are meaningful abroad, especially the consumer discretionary companies. But plenty have meaningful Japanese exposures, as well as exposures to the activity in companies like China. The financials businesses are pretty Japan focused, as are consumer non-discretionary products sold by companies like Japan Tobacco (OTCPK:JAPAF).

Considering the significant local exposures to DXJ, where business would be denominated in Yen but is going to be hedged by the ETF, a 0.48% expense ratio seems pretty reasonable considering that additional service.

The Yen

The trouble is we'd happily take the risk on the Yen. The ECB signaled less about future moves in its recent rate hike, causing speculation that peak rates are incoming as signs that the recession should start in earnest with unemployment increases and weaker household wealth might do the trick for bringing down inflation. Expectations of less future rate hikes, and the possibility of even a policy reversal by monetary authorities to deal with a recession, which comes with its own death spiral of profit declines-unemployment that are almost as bad as the wage-price spiral, should stop the outflows from Yen-based yield and contribute to FX appreciation. Where the USD's appreciation has been so heavily based on a risk-off attitude plus the rate hikes by the Fed which are ahead of other countries, giving back some relative value to the Yen is to be expected.

DXJ hedging this risk is not helpful.

Bottom Line

Moreover, a value-weighted ETF for the Japanese markets is not super desirable either at the moment. While the immediate crisis with banking has been averted, the top 3 sectors are all pretty undesirable in DXJ:

- Industrial exposures are typically capitally intensive or rely on capital investment by others, and are hurt in periods of credit crunches more sharply than other industries. Moreover, the China reopening isn't going as well as hoped, harangued by COVID.

- Consumer discretionary exposures in Japan are primarily automotive. They have a lot of foreign markets and are going to suffer on the demand side as financing for vehicles crunches down. Also, effects like pent-up demand from the semi shortage was likely to become exhausted soon anyway, since there's been enough time for semi inventories to start bloating again.

- Financials are clearly exposed to the situation we've been having in credit markets. Japan isn't going to have a deposit beta problem because they still have low rates, but the economy is going to contract and there'll be less loan growth as households get put under pressure from the other global economies seeing direct credit crunches. Also, they hold a decent amount of foreign securities which have seen eroded value. They're not in as much explicit trouble but there is little going for Japanese banks.

The 8.7x P/E is very low, and gets you some earnings yield, but that's only at current run-rate earnings which are likely to peak. Still, Japanese businesses have the benefit of not having to refinance at much higher rates compared to other economies, where incoming maturities are going to rollover horribly for corporates. Nonetheless, we find that the Japanese mid-market and small-cap space still have so many dirt cheap opportunities that it would be a sham to not hunt for single-stock positions given the chance.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Valkyrie Trading Society seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.