Cannabis REITs: Separating The Weed From The Chaff

Summary

- Some investors (like me) may be wondering if it’s time to cut their losses and focus on safer sectors, or perhaps wait it out for sunnier days ahead.

- To better that question, we decided to provide an update on all of the primary players among cannabis REITs: IIPR, NLCP, AFCG, and REFI.

- We find NLCP the most appealing right now, given the juicy 11.2% dividend yield.

- We also think it’s likely that REFI becomes a more dominant lender in the cannabis mREIT sector.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

PLG

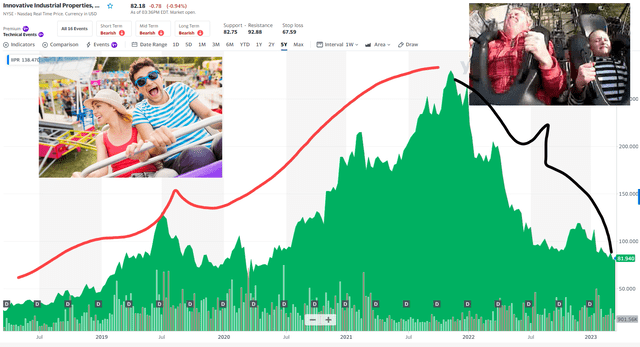

Since my inaugural article on Innovative Industrial Properties, Inc. (IIPR) in 2018, shares have returned an average of 5% annually. The best way I can describe the adventure of the last five years is that it’s been one heck of a rollercoaster ride – all the way to the top – and then I lost my lunch on the way down.

Heck, I even got the T-shirt for the experience.

But in reality, I got much more than a T-shirt, because I’ve learned a lot about cannabis real estate investing and the rapid evolution of the real estate investment trusts, or REITs, that own weed-based properties.

These days it seems as though we’re still in the fear mode, and perhaps you’re feeling a lot like the above (if you own one or more of these cannabis REITs).

Take a look at how these cannabis REITs have performed year-to-date:

- AFC Gamma, Inc. (AFCG): -21%

- Innovative Industrial Properties, Inc. (IIPR): -19%

- NewLake Capital Partners, Inc. (OTCQX:NLCP): -13%

- Chicago Atlantic Real Estate Finance, Inc. (REFI): – 13%

- Vanguard Real Estate (VNQ): 0%.

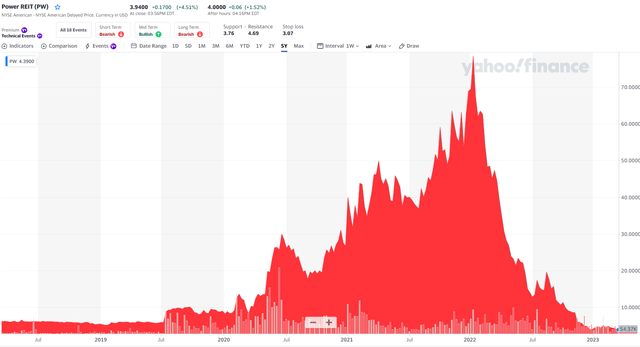

Note: Nano-cap Power REIT (PW) is down just -.25% YTD, but look at the 5-year chart (below):

Just take a look at the entire REIT sector (below) and can see cannabis REITs are now the highest-yielding equity REIT sector, with one of the lowest P/FFO multiples.

Some investors (like me) may be wondering if it’s time to cut the losses and focus on safer sectors, or perhaps wait it out for sunnier days ahead. And to better that question, we decided to provide an update on all of the primary players: IIPR, NLCP, AFCG, and REFI.

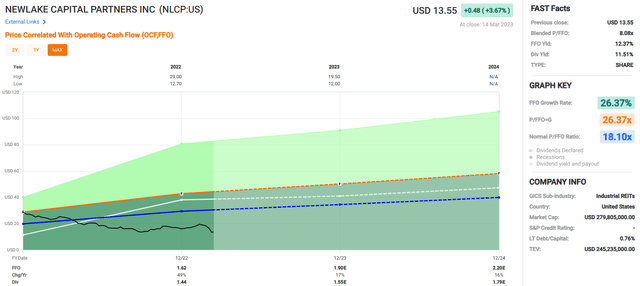

NewLake Capital: Yielding 11.5%

NewLake Capital Partners, Inc. is an internally managed equity real estate investment trust (“REIT”) that acquires and owns cannabis cultivation facilities and dispensaries through sale-leaseback transactions.

They lease to single tenants that are state-licensed cannabis operators on a triple-net basis which makes ongoing property expenses the responsibility of the tenant.

In addition to sale-leasebacks, NLCP also provides capital to operators to fund build-to-suit projects. NLCP receives interest income from the loans provided, although this is a much smaller portion of their revenue than the revenue they receive from rental income. In 2022, NLCP received 94.58% of its revenue from rental income and 5.42% from interest income.

NLCP was founded in 2019 before going public in August 2021. At the end of 2022, NewLake had a portfolio of 32 properties, consisting of 17 dispensaries and 15 cultivation properties. They are located in 12 states, covering 1.7 million square feet, and have 13 tenants.

They are 100% leased and have 100% rent collection* with a weighted average remaining lease term of 14.6 years and 2.7% annual rent escalations as of December 31, 2022.

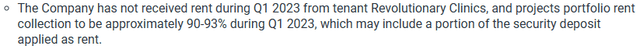

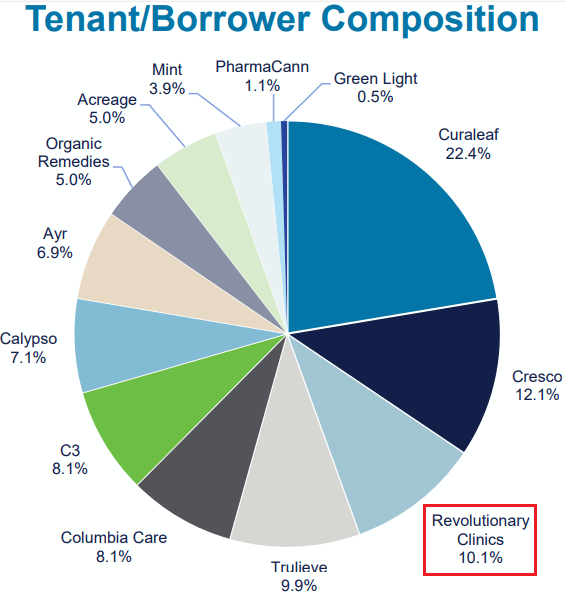

*After year end 2022, NLCP disclosed that it has not received rent from its tenant Revolutionary Clinics during the first quarter of 2023. Out of their 13 tenants, Revolutionary Clinics, makes up 10.1% of NLCP’s committed capital.

NewLake has high tenant concentration with only 13 total tenants. Its largest tenant based on committed capital is Curaleaf Holdings, Inc. (OTCPK:CURLF) at 22.4%, followed by Cresco at 12.1%, Revolutionary Clinics at 10.1%, and Trulieve Cannabis Corp. (OTCQX:TCNNF) at 9.9% of committed capital. In total, NLCP’s top 4 tenants make up 54.5% of NewLake’s committed capital.

NLCP - Investor Presentation

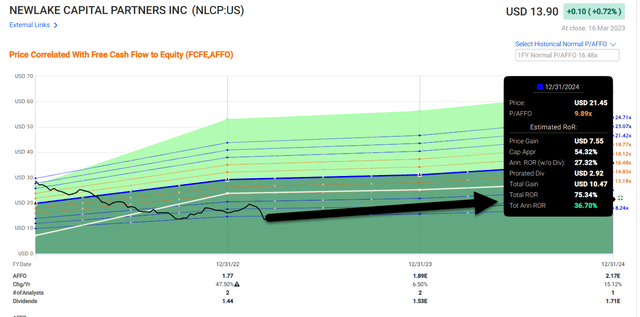

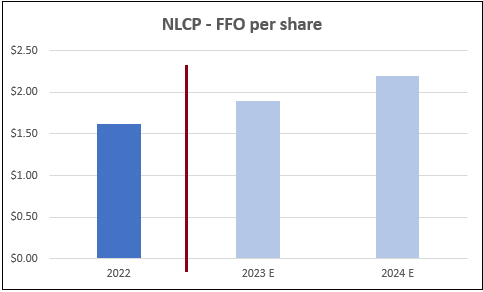

Since NLCP is a fairly new public company, we don’t have many reported numbers to look at in order to make a good judgment on earnings and growth. Another complicating factor is that cannabis is a very fast-growing industry, and that is reflected in NewLake’s growth in its funds from operations (“FFO”) of 49% in 2022.

However, that rate of growth is unsustainable and not a good representation for future growth. Analyst project FFO growth rates of 17% and 16% in the years 2023 and 2024 respectively, but there is a lot of uncertainty on what legislation will be passed and how that will impact the industry.

FAST Graphs (compiled by iREIT)

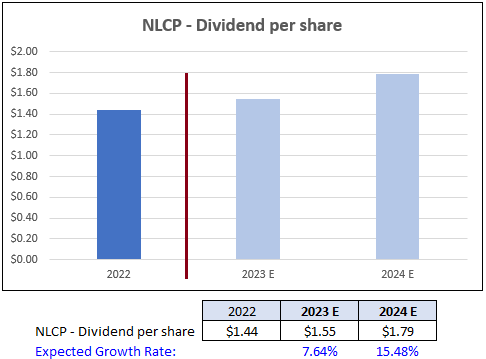

The same holds true for their dividend. With such little information, it’s hard to get a good fix on growth rates. Analysts expect the dividend to go from $1.44 per share to $1.55 per share in 2023 for a 7.64% increase, and then to go to $1.79 per share in 2024 for 15.48% increase, but these are just projections.

FAST Graphs (compiled by iREIT)

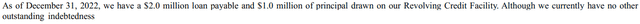

NewLake only has $3.0 million in total debt. This gives them a debt to EBITDA of only 0.3x. Additionally, they have a good amount of liquidity with $45.2 million in cash and cash equivalents and $89.0 million available to them under their revolving credit facility for total liquidity of $134.2 million.

NLCP currently pays a 11.51% dividend yield that is covered by a 2022 AFFO payout ratio of 81.36%. In their short existence as a public company NLCP has delivered strong results in FFO and dividend growth and are trading at a P/FFO of 8.08x which is well below their normal P/FFO of 18.10x.

This is a small-cap stock in a young industry, so one should expect volatility, but there is also a lot of potential in the cannabis space, so this could provide an excellent entry point at the price it is currently trading at. We rate NewLake a Spec BUY.

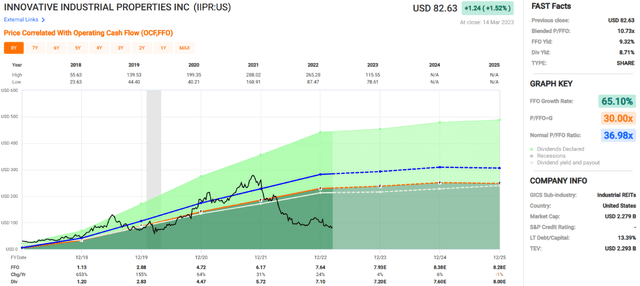

Innovative Industrial: Yield is 8.7%

Innovative Industrial Properties, Inc. is an internally managed equity REIT that acquires and owns specialized industrial properties for the cannabis industry through sale-leaseback transactions with state-licensed operators. They target triple net lease structures that make the tenant responsible for reoccurring property expenses.

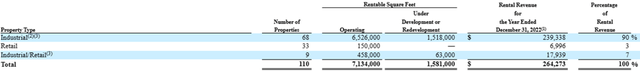

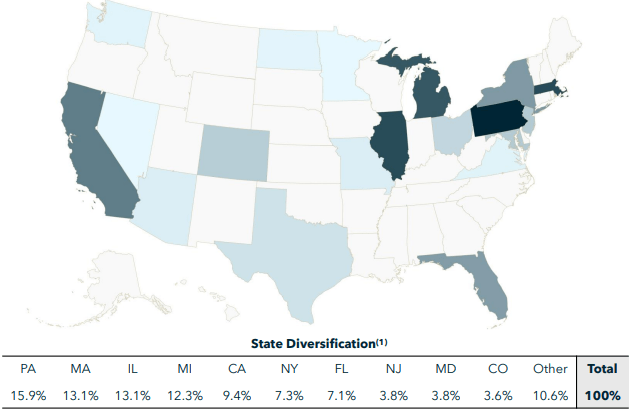

Generally, IIPR’s lease terms are 15-20 years and are normally subject to parent company guarantees. IIPR has a total of 110 properties covering 8.3 million rentable square feet located in 19 states with a weighted average lease term of 15.3 years. Additionally, no leases expire before 2029 and the vast majority of their leases don’t expire until after 2032.

IIPR - Investor Presentation

Out of their 110 properties, 68 are industrial, 33 are retail, and the remaining 9 are described as industrial/retail. The majority of their revenues are derived from their industrial properties, with 90% of total revenues coming from this category.

IIPR has high tenant concentration with a total of 29 tenants. Their largest tenant, PharmaCann, makes up 13.1% of their invested capital, followed by Parallel at 8.7% and Ascend Wellness Holdings, Inc. (OTCQX:AAWH) at 8.7%. In all, their top 10 tenants make up 73.5% of their invested capital.

IIPR - Investor Presentation

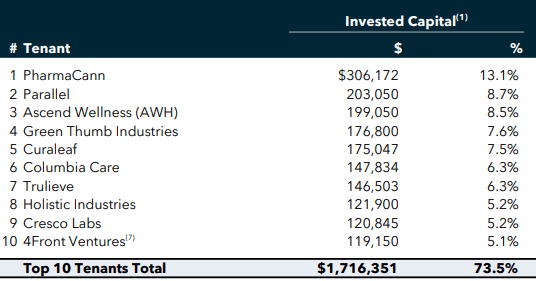

Innovative Industrial Properties has seen tremendous growth in their funds from operations (“FFO”) over the last several years. Since 2018 they have an average annual growth rate of 65.10%.

Much of that high growth rate is due to the growth of 653% between 2017-2018, and then 155% between 2018-2019. Growth rates have steadily been normalizing with growth rates of 64% in 2020, 31% in 2021, and 24% in 2022. Analyst estimates call for FFO growth of 4% in 2023 and 6% in 2024.

FAST Graphs (compiled by iREIT)

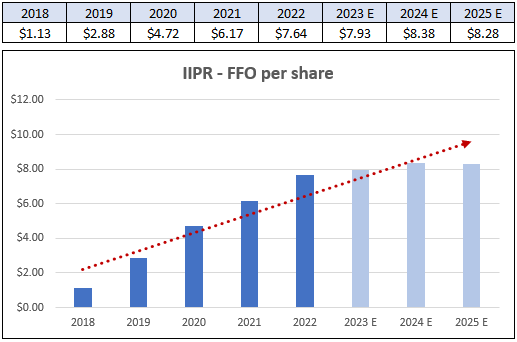

Similarly, IIPR has delivered outstanding growth in their dividend since 2018. In 2019, IIPR increased their dividend by 135.83%, then they increased it by 57.95% in 2020. In 2021, they increased their dividend by 27.96% and in 2022 they increased it by 24.13%. Over the last 5 years, they have a dividend compound growth rate of 66.79%

Currently, IIPR has an 8.71% dividend yield that is covered by a 2022 AFFO payout ratio of 84.02%. IIPR’s AFFO payout ratio has been improving since 2018.

The company paid out close to 90% of their adjusted funds from operations in 2018, and has steadily improved this metric over the last 5 years. The payout ratio of 84.02% in 2022 shows marked improvement and is the lowest payout ratio they have had since 2018.

FAST Graphs (compiled by iREIT)

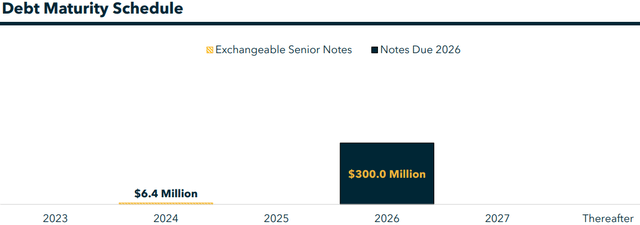

IIPR debt metrics are exceptional with a Debt to Gross Assets at ~12% and a Debt Service Coverage ratio of 15.5x. All of their debt is unsecured, and all debt is fixed rate.

They have $306.4 million in total debt with a weighted average interest rate of 5.46% and a weighted average until maturity of 3.4 years. No debt matures until 2024 and the majority of their debt matures in 2026. As of the fourth quarter of 2022, they have a BBB+ credit rating by Egan Jones.

Like NewLake, Innovative Industrial Properties is a small cap stock in a very young industry so investors should expect increased volatility. Additionally, IIPR has experienced several tenant defaults recently and there is general uncertainty in the cannabis space.

On the flip side, the industry has enormous growth potential and IIPR has delivered very strong growth in both its earnings and dividend. Over the last year the stock has lost nearly 60% in market cap which puts it at a P/FFO multiple of 10.73x which is a significant discount to its normal P/FFO of 36.98x.

With growth rates normalizing I don’t expect IIPR to get back to a 37x multiple, but I also think it’s worth more than a 10.73x multiple. At iREIT, we rate Innovative Industrial a Spec BUY.

Chicago Atlantic Real Estate: Yield is 14.4%

Chicago Atlantic Real Estate Finance, Inc. is an externally managed mortgage REIT (“mREIT”) that originates senior secured loans to state-licensed cannabis operators that are backed by commercial real estate.

For underwriting, they use a “credit-first” approach with criteria based on operator performance, collateral, regulatory environments, and other factors impacting the credit profile of the borrower.

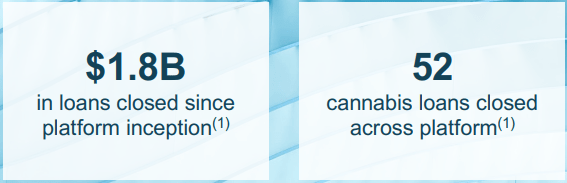

Since 2019, they have closed on 52 loans to cannabis operators totaling $1.8 billion. REFI’s stated investment objective is to deliver risk-adjusted returns to shareholders primarily through dividends and secondarily through capital appreciation.

REFI - Supplemental

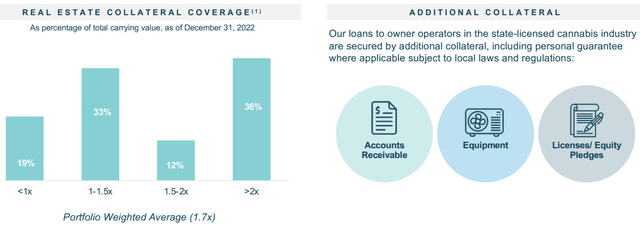

REFI has reasonable real estate collateral coverage with a portfolio weighted average of 1.7x. Somewhat concerning is that 19% of their overall portfolio has collateral coverage of less than 1x, meaning that if the borrower defaulted, the collateral backing their loan is less than the principal owed.

On a positive note, 36% of their portfolio has collateral coverage of over 2x. Along with the physical properties collateralizing REFI’s loans, they have additional collateral in personal guarantees and the operator’s account receivables and equipment.

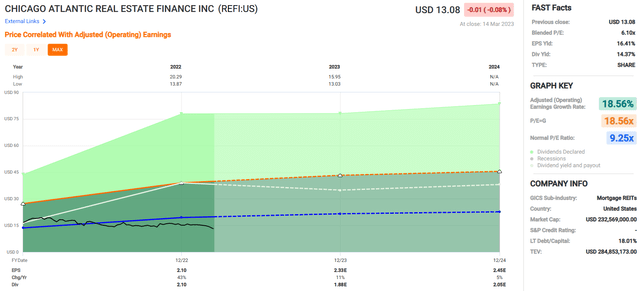

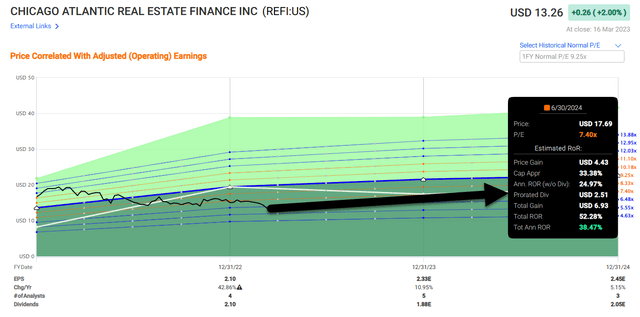

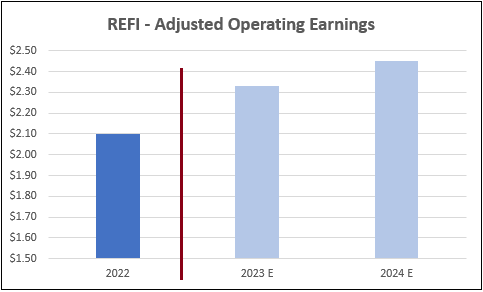

REFI was publicly listed in December 2021, so we only have one year of data to review. Operating earnings came in at $2.10 in 2022 and are expected to increase 11% in 2023 to $2.33 per share. In 2024, analysts expect operating earnings to come in at $2.45 per share, representing a 5% year-over-year increase.

FAST Graphs (compiled by iREIT)

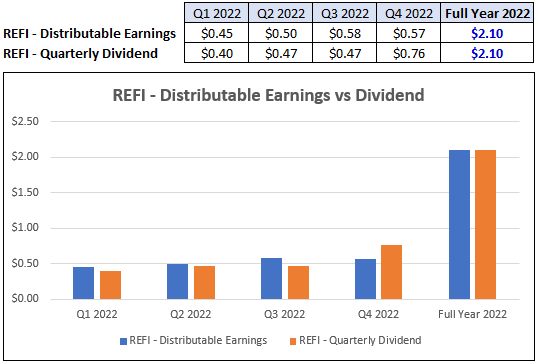

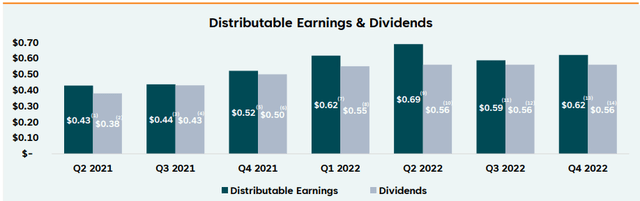

REFI currently pays a 14.37% dividend yield that is covered by their distributable earnings. On a per quarter basis, REFI’s distributable earnings exceeded their dividend payout in each period except the fourth quarter. For the full year, REFI paid out 100% of their distributable earnings, which is common for mortgage REITs.

FAST Graphs (compiled by iREIT)

Currently, REFI is priced at a discount, trading at a P/E of 6.10x which favorably compares with its normal P/E ratio of 9.25x. They have a very high dividend yield of 14.37% and an earnings yield of 16.41%.

This is a young company in a young industry so increased volatility should be expected, but the discount this company is trading at could provide an excellent entry point. At iREIT, we rate Chicago Atlantic a Spec BUY.

AFC Gamma: (Sucker) Yield is 18.2%

AFC Gamma, Inc. is an externally managed commercial mortgage REIT that originates, invest in, and manages secured loans and other types of loans for commercial real estate. They specialize in lending to operators in the cannabis industry, but have recently branched out to originate loans backed by commercial real estate outside of the cannabis space.

Under their new investment guidelines, AFC Gamma now invests in mortgage-backed securities and issues first and second lien mortgage loans to owners and operators of commercial real estate that are not related to the cannabis industry. Additionally, they provide bridge loans and direct loans that range between $5 million to $100 million or more and now lend across multiple real estate sectors.

AFCG was founded in 2020 and went public in March 2021. The company started out with an investment strategy that focused primarily on cannabis related properties.

Two years later, when they filed their 2022 Form-10K, AFC Gamma detailed a strategic shift in their investment guidelines to include additional property sectors, other debt instruments such as mortgage-backed securities, other loan types including bridge loans and second lien mortgage loans which are subordinate to first mortgage loans.

This change in investment strategy only 2 years after going public is somewhat concerning. What exactly is this company now? Do they specialize in the cannabis space, and does that expertise apply to other real estate sectors?

Just a couple of days ago, I announced that we downgraded AFCG from a Spec Buy to a SELL. From the looks of it, AFCG has no “real” strategy. In its latest earnings call, AFCG disclosed that they “have not originated any new cannabis debt investments that met its risk-adjusted return thresholds over the past 9 months.”

So a company that started a couple of years ago as a lender to the cannabis industry hasn’t issued a loan in that space in the last 9 months? This is a big red flag for me, which is why we downgraded the company to a sell.

When a company goes public with an business model, but then has to change it just a few years later, it reflects poorly on management and makes me think of the saying “measure twice and cut once.”

AFCG currently yields 18.14%, but this looks like a “suckers yield” to me and is currently on our dividend watch list. AFCG has a dividend payout ratio of 91.02% when based on operating earnings. It improves a little to 88.5% when based on distributable earnings, but at the high payout rates, AFCG will have to maintain or grow earnings to sustain their dividend.

The company appears to be in disarray to some extent since it felt it necessary to change its investment strategy, and from my perspective this does not bode well for future earnings.

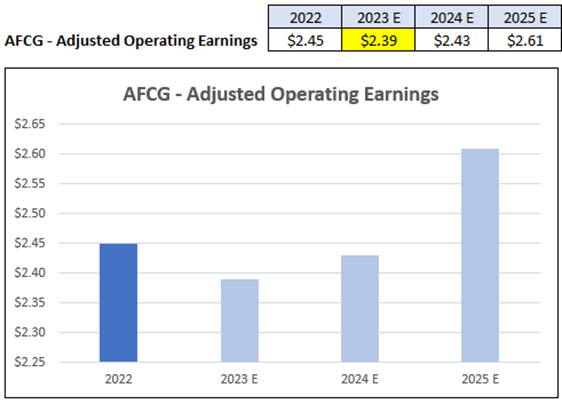

Analysts expect earnings to decline from $2.45 per share to $2.39 per share in 2023. They expect earnings to resume growth in 2024, but they don’t expect earnings to exceed their 2022 levels until 2025. If analysts’ projects hold up, AFCG will be challenged to sustain its dividend.

AFCG - Form 10-K AFCG - Investor Presentation

AFCG is priced at a discount right now, currently trading at a P/E of 5.07x vs its normal P/E of 9.36x, but in this case the discount may be warranted. The company has transformed from a specialized cannabis lender to a “jack-of-all” trades which makes me question management's original planning and strategy.

Additionally, it seems likely that earnings will be under pressure, which could lead to a dividend cut. At iREIT, we rate AFC Gamma a SELL.

In Closing…

There’s little doubt that the cannabis sector is volatile and that operator defaults are ramping up. Thus far, IIPR has done a decent job mitigating defaults, but time will tell if they can continue to deliver growth as leases are re-negotiated.

One major advantage that the company would like to have is a New York Stock Exchange ticker. However, NewLake made it clear on the latest earnings call that it wanted to move away from the OTC listing,

“…we continue to receive questions about uplifting to a major exchange. While I have nothing new to report, we understand the importance of this and will be relentless in our pursuit of a path to uplifting.”

In terms of value, we find NewLake the most appealing right now, given the juicy 11.2% dividend yield. Certainly, a listing (on major exchange) would provide support for the stock, and we like the limited license states that NLCP operates in.

On the mortgage REIT side, as I said earlier, we downgraded AFCG to a SELL, and we really like REFI – that now yields 14.2%. Given the fact that AFCG is pivoting to other sectors, we think it’s likely that REFI benefits and becomes a more dominant lender in the cannabis sector.

As always, thank you for reading and for the opportunity to be of assistance.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 15,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Disclosure: I/we have a beneficial long position in the shares of IIPR, NLCP, REFI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.