S&P 500 Earnings Update: Earnings Almost An Afterthought Now/Corporate Credit Spreads

Summary

- S&P 500 earnings don’t start for another 3 – 4 weeks and are almost an afterthought now.

- The forward 4-quarter estimate slid this week to $221.49 from last week’s $221.55.

- Looking at companies like Meta (META) and Federal Express (FDX), you can make a case that expense reductions and cost cuts can have a big impact on the stock price.

mixmotive

With the drop in the 2-year Treasury yield this week and the resultant frenzy around next week's FOMC meeting and what the FOMC and Jay Powell might do, the US Treasury market and the financial sector have captivated everyone's attention.

S&P 500 earnings don't start for another 3 - 4 weeks and are almost an afterthought now.

Both the S&P 500 and the Barclay's Aggregate (AGG) increased about 1.5% this week.

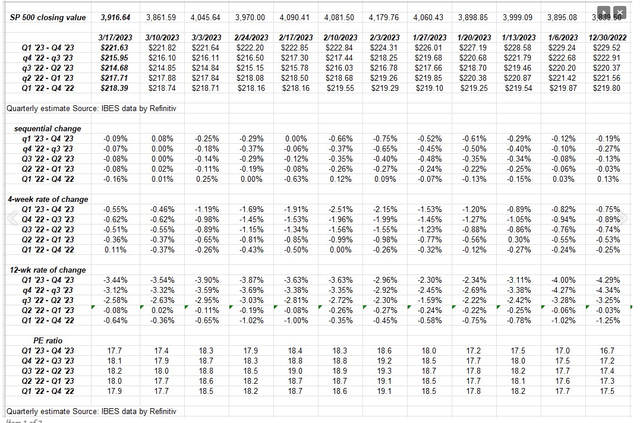

S&P 500 data:

- The forward 4-quarter estimate (FFQE) slid this week to $221.49 from last week's $221.55. With two more weeks left in the quarter, and Nike and a few other companies reporting next week, it doesn't seem like we should expect any significant change in the pattern;

- The PE ratio on the forward estimate is 17.7x, vs 17.4x last week;

- The S&P 500 earnings yield is 5.66% vs 5.77% last week;

- When 2022 S&P 500 earnings end in two weeks, the calendar year-estimate is expected to be $218'ish. What's weird is that if you add the sum of the 4 quarters of 2022 quarterly earnings, the sum of the 4 quarters adds to $221.67. Refinitiv needs to be quizzed about this - the $3 and change difference isn't going to come from the last one or two components reporting for Q4 '22. The current 2022 full-year calendar estimate as of today is $218.39.

Rate-of-change:

Since late February, the negative revisions being seen in the "12-week-rate-of-change" have slowed, but to be frank, I think the analysts pay a lot of attention to market action. Note how in January '23 with the strong market returns, note the revisions, versus most of February '23.

Summary/conclusion:

Looking at companies like Meta (META) and Federal Express (FDX), you can make a case that expense reductions and cost cuts can have a big impact on the stock price. Personally, I prefer to see upward revenue revisions to be more confident in single-stock picks, but EPS increases via expense reductions works too. If you have a company cutting costs, and EPS still falls, particularly over a period of time, that's when you have to start to question the business model.

JPMorgan, Dr. David Kelly and the JPMorgan team come to the Chicago area next week and one area of interest will be corporate credit spreads and getting an update on the volatility since Silicon Valley Bank started.

As a former analyst for a group of bond fund managers in a former life, one of whom I still talk to regularly, the bond fund manager told me this morning that high-grade credit spreads had widened by 25 bp's while high-yield credit spreads had widened by 50 bp's or so, but he also said "pretty shaky too" in terms of the market as a whole.

After finishing above the 200-day moving average last night, the S&P 500 closed below it again tonight. Credit spreads can be the early warning system for the stock market. The spreads widening mentioned above isn't too onerous yet, but that's a big "yet", so watch credit funds and their price behavior this week.

With the news of the gigantic discount window borrowing this week, the Fed is removing all the "QT" or quantitative tightening of the last year. That discount window borrowing is needed liquidity to the banking system.

It's hard to say what Powell does next week with the Fed funds rate - the Fed is notoriously late to raise and lower - but I'd guess it's a matter of "when" not "if" in terms of a Fed funds rate reduction.

Take everything here with substantial skepticism. Past performance is no guarantee of future results. This is all an educated guess, with the exception of the cold, hard, earnings data. The FOMC meeting is critical this coming week. The announcement comes Wednesday, March 22nd. Just in time for a quarter-end rally. (That's a bit of a tongue-in-cheek on my part.)

Thanks for reading.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by