Foreign Investment-Grade Bonds Rallying, Time To Diversify With BNDX

Summary

- With the recent plunge in global interest rates, foreign fixed income has attracted risk-conscious buyers.

- Unlike the past, a strong starting yield today makes BNDX a better risk/reward play from a duration point of view.

- And since the ETF only holds high-quality issues, there's just modest credit risk.

- With improved technicals, I am bullish BNDX.

DNY59

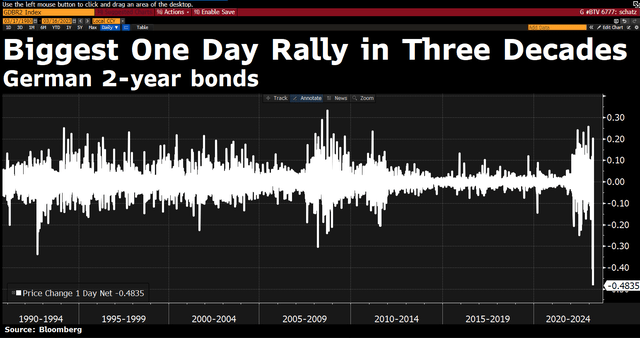

Major risk-off price action has worked to the benefit of high-quality bonds. Earlier this week, we witness the biggest one-day rally in German 2-year notes in three decades, according to Bloomberg. Moreover, global ex-US fixed income finally offers investors a decent yield after years of near-zero rates.

With bullish momentum, upside price action, and a stronger yield to maturity, I am a buyer of BNDX right now.

Big Buying in Foreign Treasuries

According to the issuer, the Vanguard Total International Bond ETF seeks to track the performance of the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). The fund employs hedging strategies that seek to mitigate uncertainty in exchange rates while the broader portfolio is managed passively through an index sampling approach. BNDX’s objective is to remain fully invested, offering investors access to the non-US fixed-income market.

The ETF has a low annual expense ratio of just seven basis points and features a yield to maturity of 5.5% as of February 28, 2023, with an average coupon rate of 2.0%. With an effective duration of 8.9 years, there’s significant interest rate risk, so the recent drop in global yields has been a boon to the fund, and I will outline what price action looks like now and what may lie ahead later.

BNDX is a large fund with $48 billion in assets under management, and liquidity is also strong as the ETF boasts a median 30-day bid/ask spread of only two basis points. The 50-day average volume is more than 3 million shares, so tradability is strong with BNDX.

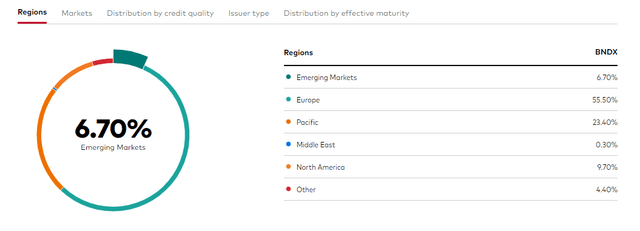

Digging into the portfolio, corporate and sovereign debt out of Japan, France, and Germany make up 38% of the fund. 56% of total fixed-income positions are from governments and firms in Europe while 23% are from Asia, so following geopolitical risks in those spots is important, while currency risks are minimized through hedging processes.

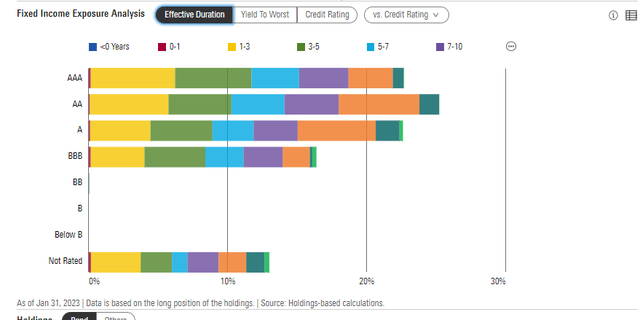

Holding only investment-grade debt with at least one year remaining to maturity, credit risk is somewhat low – the portfolio is oriented into government bonds at around 80%, high compared to its peers, according to Morningstar.

BNDX: Mainly A Developed Markets Portfolio

With all bonds being high-grade, I urge investors to weigh the duration risk of the portfolio. Notice in the graphic below that, unlike some US bond funds, BNDX does not have a large allocation to issues that may turn into fallen angels, or companies that fall from IG to high yield. That is largely a result of the high government debt position.

BNDX: Effective Duration Profile

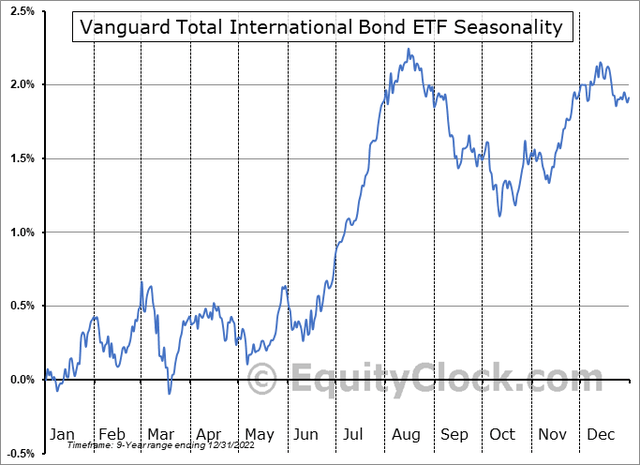

Seasonally, now is an ideal time to own BNDX as it tends to bottom in mid-March before a June through August jump in its 8-year history, according to data from Equity Clock.

BNDX Tends To Make A Low in Mid-March

The Technical Take

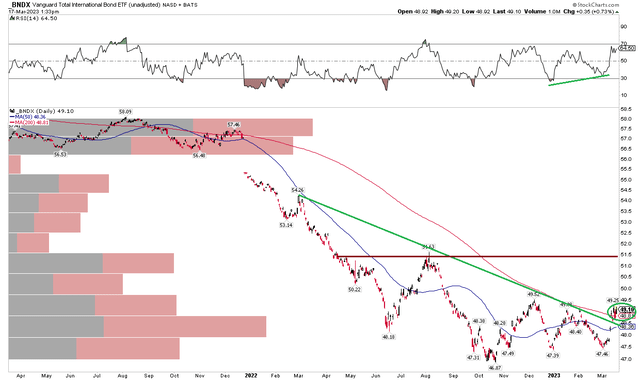

With significant duration risk and modest credit risk, what risks are seen in the chart? Notice in the graph below that shares are climbing above a pair of key resistance points. First, the downtrend line off the early 2022 peak has been breached as the bulls aim to take charge. Second, BNDX is now above its falling 200-day moving average for the first time since late 2021.

The near-term pattern is indicative of a bull flag which would have a target of just above $50. I see more important resistance at the August spike high at $51.60. Overall, long here with a stop under the $46.87 October low looks like a favorable risk-reward. What’s more, investors are collecting a much higher yield today compared to two years ago.

BNDX: Bullish RSI Momentum Divergence, Shares Rally Above Resistance

The Bottom Line

I am a buyer of BNDX here. The recent drop in rates suggests a bullish turnaround may be unfolding in non-US investment-grade fixed income. The chart also supports the upside fundamentals.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.