IHI: Valuation Still Rich Despite The Decline In 2022

Summary

- IHI invests in large-cap medical devices stocks in the United States.

- The fund has a long run way of growth thanks to long-term growth trends in the medical devices industry.

- IHI’s decline during the past recessions is comparable to the S&P 500 index, and its valuation is still quite elevated despite the decline last year.

- Therefore, we think investors may want to wait for a better entry point.

Caiaimage/Martin Barraud

Introduction

Healthcare sector is often perceived as a defensive sector and should be more resilient in an economic recession. Is this perception correct? In this article, we will analyze iShares U.S. Medical Devices ETF (NYSEARCA:IHI) and provide our insights and recommendations on how to invest in IHI.

ETF Overview

IHI owns a portfolio of large-cap medical devices stocks. It has outperformed the S&P 500 index since its inception and should continue to outperform in the long run thanks to long-term structural trend. However, it also has substantial downside risk especially in an economic recession. In addition, its valuation appears to be rich despite over 20% decline since the beginning of 2022. Therefore, we think investors may want to wait for a better entry point.

YCharts

Fund Analysis

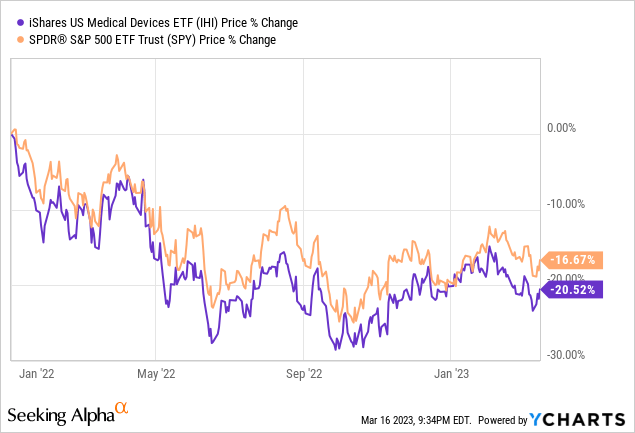

IHI delivered negative return in 2022

IHI had a challenging 2022. In fact, the fund has declined by over 20% since the beginning of 2022. In contrast, SPDR S&P 500 ETF (SPY) which tracks the S&P 500 index only declined by about 16.67%. This difference is likely because IHI has slightly outperformed SPY during the pandemic in 2020. Since the trough reached in March 2020 to the peak reached in the second half of 2021, IHI delivered a return of 120%. This was slightly better than SPY's 115%.

YCharts

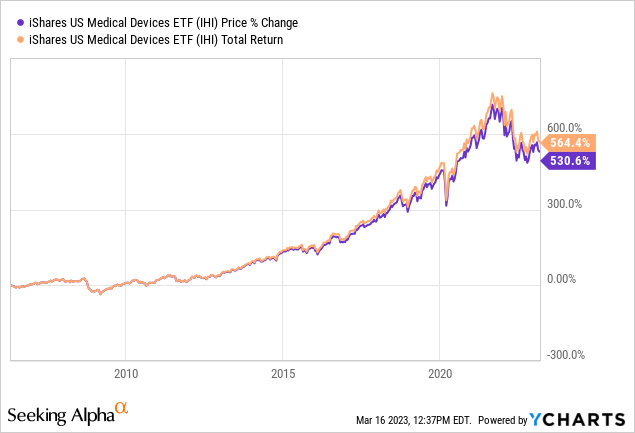

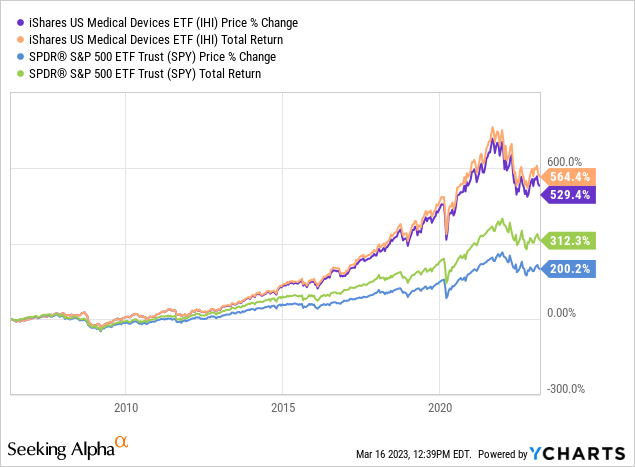

IHI has outperformed the S&P 500 in the long run

Let us now look at IHI's performance in the long run. As can be seen from the chart below, the fund has delivered a total return of 564.4% since its inception in May 2006. This performance was much better than SPY's total return of 312.3%.

YCharts

IHI should benefit from long-term structural growth in the medical devices market

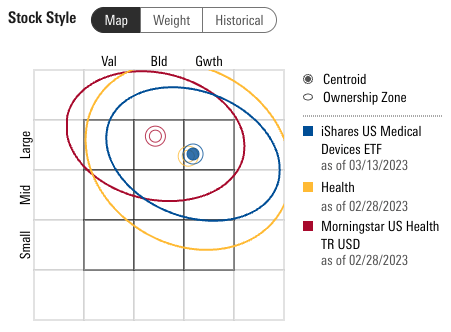

The reason for IHI's outperformance was likely due to its strong growth characteristics in its portfolio. As can be seen from the chart below, IHI's portfolio is tilted towards large-cap growth. This means that most of its stocks belong to the growth category. On the other hand, the S&P 500 index is categorized as large-cap blend. Therefore, S&P 500 index may have a slightly weaker growth profile than IHI.

Morningstar

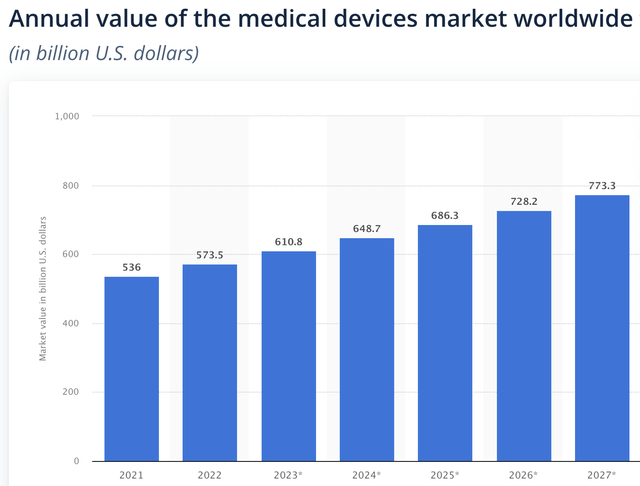

Looking forward to the future, IHI should benefit from the long-term structural growth in the healthcare industry. In fact, as can be seen from the chart below, the worldwide medical devices market should grow from $536 billion in 2021 to over $773 billion in 2027. This represents a compound annual growth rate of 6.16%. Therefore, stocks in IHI's portfolio should benefit greatly from this trend.

What will happen to IHI in an economic recession?

Since 2023 is full of macroeconomic uncertainties and the Federal Reserve's aggressive rate hike last year and its determination to keep the rate elevated throughout 2023 has a high probability to tip the economy over to a recession. It has not yet happened because monetary policy usually takes 6~12 months to ripple through the economy. But our base case is that there will be a recession coming up in the second half of 2023.

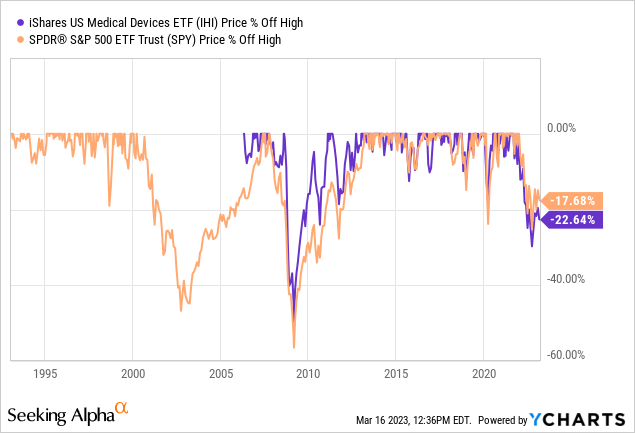

Now, let us look at how IHI performed in the past few recessions. Since IHI's inception was in 2006, we do not have any historical data before that. However, as can be seen from the chart below, IHI's decline during the 2008/2009 Great Recession and the 2020 global pandemic was comparable to the S&P 500 index. It has dropped over 50% during the Great Recession and over 20% during the outbreak of the COVID-19 in 2020. Therefore, it appears that IHI has substantial downside risk in a recession.

YCharts

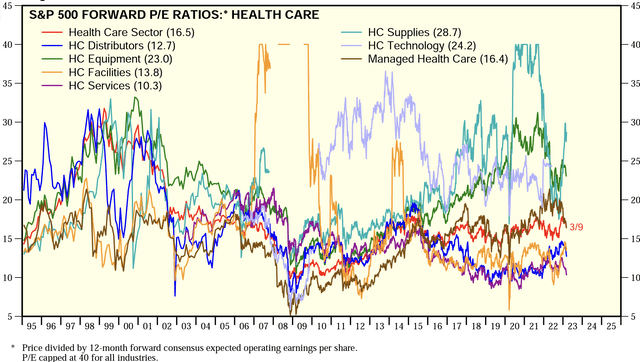

Valuation is still rich despite the decline last year

Let us look at IHI's downside risk from another perspective, its historical valuation. Since we do not have the historical valuation of IHI, we will look at the valuation of the healthcare equipment stocks in the S&P 500 index. This should be a valid method because both stocks in IHI's portfolio and stocks in healthcare equipment subsector in the S&P 500 index are large-cap stocks and there is a high overlap between the two. As can be seen from the chart below, the current average forward P/E ratio of healthcare equipment stocks in the S&P 500 index is 23x. While its forward P/E ratio has declined significantly from the cyclical high reached during the pandemic, its current forward P/E ratio is still quite elevated. Between 2010 and 2015, the average forward P/E ratio of healthcare equipment stocks in the S&P 500 index is in the range of 13x and 17x. In the midst of the Great Recession in 2008/2009, this forward P/E ratio even dropped to below 13x. Therefore, there may be substantial downside risk if a recession arrives.

Investor Takeaway

While IHI may have a long run way of growth in the next 5 years, there can be substantial downside risk in a recession. Given its elevated valuation, we think investors may want to wait on the sidelines for a better entry point.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.