Klepierre: Trading At Just 10x FFO And A 7.5% Yield

Summary

- Klepierre is one of the largest mall operators in Europe.

- The balance sheet has improved as the LTV ratio is less than 38%, although I expect the capitalization rate used to value the properties will have to increase.

- In this article, I will have a closer look at what the increasing interest rates mean for the REIT.

- Klepierre will pay a 1.75 EUR dividend this year, of which about half will be tax-free.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

MGPhotos/iStock via Getty Images

Introduction

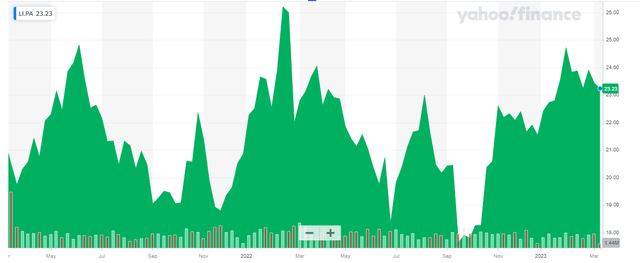

Klepierre (OTCPK:KLPEF) (OTCPK:KLPPY) is a French REIT focusing on commercial real estate. The REIT has done a good job in reducing its leverage, and as of the end of 2022, its LTV ratio stood at less than 38% despite having hiked the average capitalization rate of the assets by about 20 basis points. As several European REITs are plagued by the increasing interest rates (which weigh on the financial results and the value of the assets), I will focus on how Klepierre manages this exposure.

Klepierre has its primary listing on Euronext Paris where it's trading with LI as its ticker symbol. The average daily volume is currently approximately 800,000 shares per day, so the Paris listing clearly offers superior liquidity compared to the secondary listings. I will use the EUR as the base currency throughout this article.

The corporate website contains a few download-only links but all relevant data related to the results can be found here. The most recent corporate presentation can be found here.

2022 was a successful year for the REIT

As my focus in this article will be on balance sheet management and the impact of increasing interest rates, I will be relatively brief when it comes to the REIT's financial results in 2022.

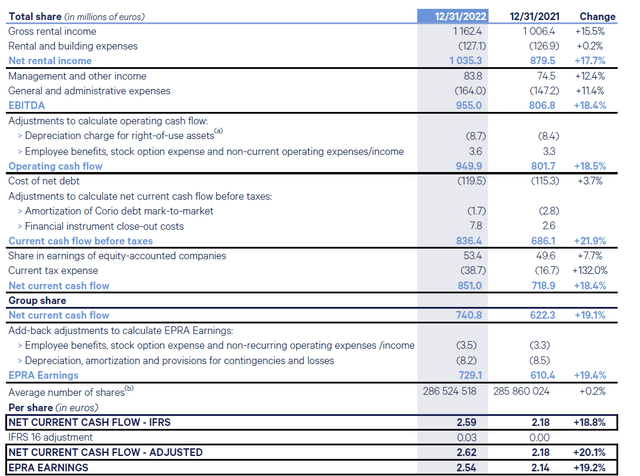

The REIT reported a net rental income of 1.04B EUR which is a substantial increase compared to the 880M EUR in 2021 as Klepierre was able to hike the rent while the COVID-related lease incentives rolled off throughout the year.

The EPRA earnings and net current cash flow are obviously more important for a REIT than the net income is. As you can see below, the total amount of net current cash flow was 741M EUR or 2.59 EUR per share. This was however adjusted to 2.62 EUR due to an IFRS addition.

While 2.62 EUR per share sounds great, let's not forget this includes two non-recurring items. First of all, there was a reversal of provisions and the reported current cash flow also includes the contribution from assets that have since been disposed of. The underlying net current cash flow was 2.24 EUR per share which means Klepierre is currently trading at about 10 times the underlying cash earnings.

As 2022 was a good year, the REIT will also pay a very attractive dividend of 1.75 EUR per share. A first interim distribution of 87 cents will be paid on March 30 followed by an additional payment of 0.88 EUR with a payment date in July. That second portion of 88 cents will consist of a 4 cent 'normal' REIT distribution and 84 cents that will qualify as an equity repayment under the French tax system. This means that 91 eurocents will be subject to the standard French dividend withholding tax (12.8% if you complete the paperwork with your broker) while the remaining 84 cents should be tax free as it is a capital repayment.

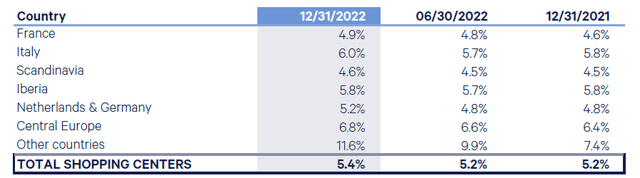

As of the end of December, the reported LTV ratio was just under 38%, and that's a pretty good result considering the REIT has started to slowly increase the capitalization rate of its assets. I think there's more work to do and additional cap rate increases are likely but I don't mind the gradual approach.

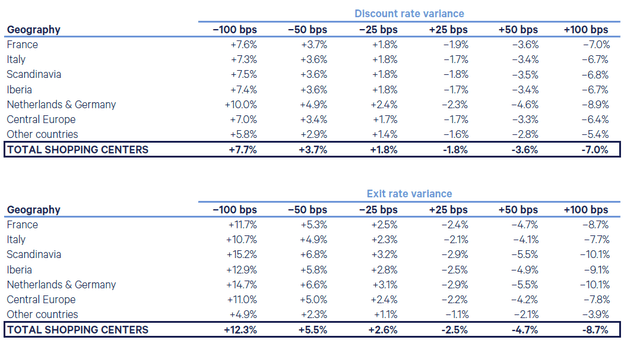

And as you can see below, even a sudden 100 basis point shock to the discount rate and exit rate used to value the properties, the impact should be manageable.

The outlook for 2023 is pretty positive as well

Klepierre obviously also already released the guidance for 2023. The REIT expects to generate a net current cash flow of 2.35 EUR per share which would be about 5% higher than the 2.24 EUR generated in 2022. That's a pretty optimistic view in an investment climate where most REITs have to reduce their expectations for 2023 and beyond due to the increasing interest rates.

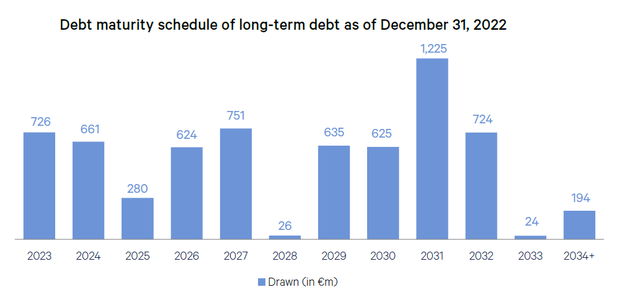

This rather upbeat outlook (compared to peers) is caused by Klepierre's excellent financial management and debt management. As you can see below, the maturity dates of the existing debt is well-spread out over the next decade. This means that the average cost of debt will only gradually increase as existing debt has to be refinanced. So rather than seeing a 'shock' when for instance 2B EUR of debt would have to be refinanced, Klepierre has the luxury to see a gradual refinancing schedule.

So even if the average cost of debt for the 2023 and 2024 refinancings increases by 400 basis points, that's still an increase of just 56M EUR. Sure, that is an impact that will be felt further down the road as this represents approximately 20 cents per share but let's not forget the NOI of Klepierre's assets was about 1.04B EUR in FY 2022 with about 1.06B EUR per year if we would annualize the H2 results.

This means that if Klepierre can hike the rent by on average 3% per year in 2023 and 2024, the entire impact of the interest rate increases will be covered. Of course that assumes there will be no sudden spikes in the other operating items. But in general, Klepierre's NOI and pre-financing recurring result will likely increase in line with the anticipated increase in interest expenses.

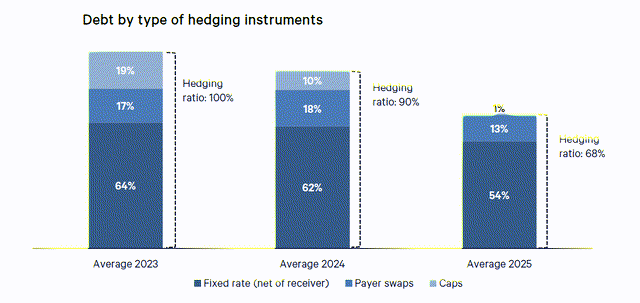

And let's also not forget that the majority of the existing debt has been hedged. 100% of this year's exposure is hedged and even for 2024 the 90% hedge ratio provides excellent visibility going forward. And while the hedging ratio drops to just 68% by 2025, Klepierre will likely take additional action by then.

And let's not forget that considering the recurring cash flow in 2022 was approximately 2.24 EUR per share, Klepierre is retaining about 50 cents per share per year. This means that - assuming the recurring earnings remain stable - Klepierre will be able to hoard about 400M EUR in earnings in the 2022-2025 era which provides the REIT with yet another tool: repaying a portion of the debt so the total amount of principal outstanding decreases. This won't really help the cost of debt (unless lenders see a substantial decrease in the LTV ratio) but it will help to keep the interest expenses (expressed in an absolute number) down.

Investment thesis

While a lot of REITs in Europe are now finally realizing the era of almost-free debt is over, Klepierre is actually in a good position. A large part of its debt has a fixed interest rate and seeing how the maturity dates are staggered, the refinancing agreements should not result in a sudden interest expense shock. Sure, the earnings will be under pressure the next few years as the increase in rental income and NOI will be needed to cover the higher interest expenses but I don't anticipate a massive earnings decrease in the next few years.

The dividend is pretty attractive, not in the least because about half will be paid on a tax-free basis. Unless you think the entire commercial real estate space will collapse in the next few years, Klepierre still is attractive at the current valuation.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Disclosure: I/we have a beneficial long position in the shares of KLPEF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.