EWD: A Rocky Path For Sweden

Summary

- The iShares MSCI Sweden ETF offers investors low-cost exposure to a quality portfolio of Swedish large-caps.

- Given the country’s worsening economic backdrop and the potential for a stagflation scenario, the path for earnings revisions is likely lower.

- Despite the deteriorating fundamentals, the fund still trades at a relatively high valuation and could underperform this year.

rarrarorro/iStock via Getty Images

The iShares MSCI Sweden ETF (NYSEARCA:EWD) holds quality Nordic companies within its industrials-heavy portfolio, but the unfavorable near-term setup means investors would do well to exercise caution. Thus far, Sweden hasn’t navigated the global inflationary shocks as well as its Nordic neighbors, and the need for more monetary policy tightening poses a significant risk to a fragile housing market. While the economic data has been weak, with business surveys and GDP tracking lower, consumer inflation has shown little sign of slowing down. Net, the prospect of a stagflationary environment in Sweden and real household income declines, along with ongoing pressures on the SEK, creates a less-than-ideal setup here. And with the EWD portfolio still at a relatively high underlying P/E valuation despite the headwinds, I would remain neutral for now.

Low-Cost but Concentrated Exposure to High-Quality Swedish Large-Caps

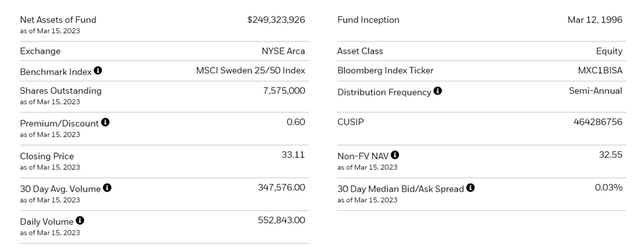

The US-listed iShares MSCI Sweden ETF seeks to track, before fees and expenses, the performance of the MSCI Sweden 25/50 Index, an index composed of the large and mid-cap segments of the Swedish equity market (~85% of the free float-adjusted market cap). The ETF held ~$249m of net assets at the time of writing and charged a 0.5% expense ratio, making it a cost-effective option for US investors looking to access Swedish equities. A summary of key facts about the ETF is listed in the graphic below:

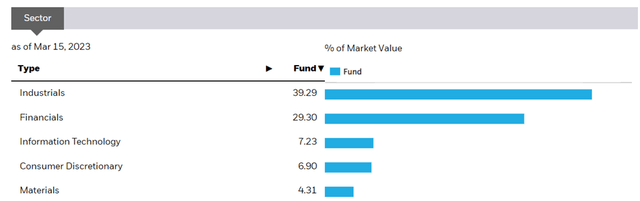

The fund is spread out across 45 holdings, with the Industrials sector maintaining the largest allocation at 39.3%. Financials also have a particularly large weightage at 29.3%, followed by the Information Technology (7.2%), Consumer Discretionary (6.9%), and Materials sectors (4.3%). On a cumulative basis, the top five sectors accounted for a highly concentrated ~87% of the total portfolio, with the top two (Industrials and Financials) contributing the lion’s share at 68.6%.

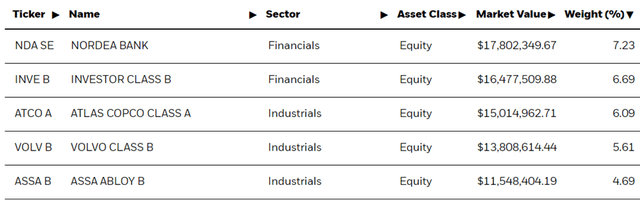

In contrast with the concentrated sector exposure, the single-stock allocation is more spread out, with the top holdings Nordea Bank (OTCPK:NRDBY) at 7.2% and Swedish conglomerate holding company Investor AB (OTCPK:IVSXF) at 6.7%. The rest of the top five comprise major names in the Industrials sector, led by Swedish industrial tools and equipment manufacturer Atlas Copco (OTCPK:ATLKY) at 6.1%, Volvo Cars (OTCPK:VOLVF) at 5.6%, and door access solutions leader Assa Abloy (OTCPK:ASAZY) at 4.7%. In total, the top five holdings account for ~30% of the overall portfolio.

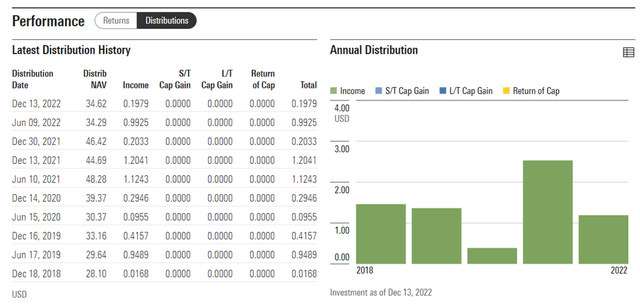

On a YTD basis, the ETF has risen by 2.6% and has compounded at an impressive 7.5% rate in market price and NAV terms since its inception in 1996. Outside of last year’s double-digit % drawdown, the fund has generally seen an uptrend in recent years, with the three, and five-year annualized returns at 2.8% and 2.9%, respectively. Distribution, on the other hand, has been volatile, reflecting the cyclicality that comes with an industrials-heavy portfolio. The trailing twelve-month yield currently stands at 3.4%, but with profits down in 2022 and another challenging year on the horizon, the distribution could trend lower.

Balancing Monetary Tightening with a Fragile Economy

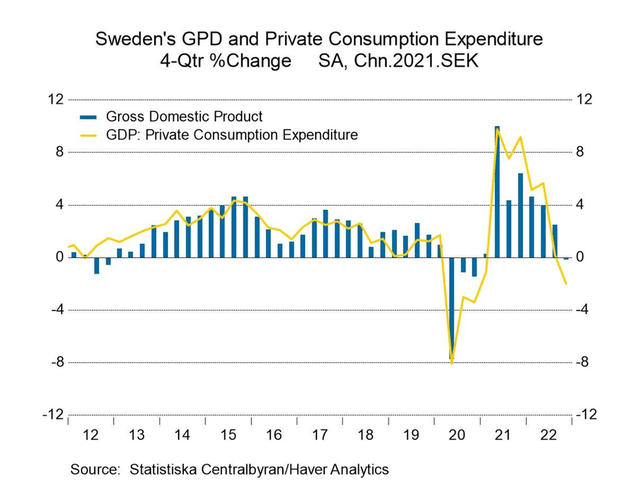

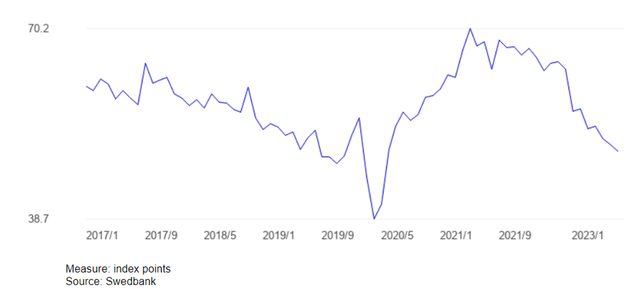

Swedish economic data hasn’t been encouraging, with Q4 GDP down by 0.9% and high-frequency data (e.g., the bi-annual Riksbank survey) supporting the case for more consumer weakness ahead. Unlike its neighbor Norway, Sweden hasn’t been as insulated from the energy inflation pressures throughout Europe either following the Russia/Ukraine conflict. Labor market conditions also remain tight, with job openings still elevated. This leaves the Swedish central bank (the ‘Riksbank’) facing a difficult tradeoff – tighten monetary policy to prevent inflation ‘stickiness’ or slow down to protect the faltering growth and consumer sentiment.

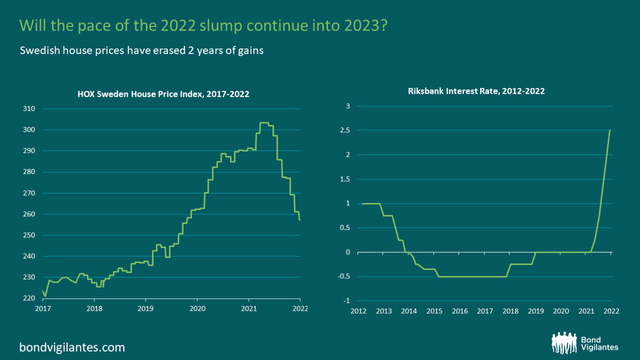

The biggest tail risk, however, is the housing market, which has already seen double-digit % declines (per the Valueguard HOX index) following the shift toward a tighter monetary policy. As debt servicing and construction costs rise alongside the higher rates, adding to the elevated Swedish household debt burden (as a % of net disposable income), consumer and investor sentiment could still weaken from here. So the Riksbank is limited in its monetary tightening, in my view, leaving a stagflationary outcome very much on the table. Either way, expect more downward revisions to corporate earnings in the coming quarters, with equity valuations also likely to be pressured by ‘higher for longer’ rates.

Efforts to Support the SEK May not be Enough

For EWD investors, exposure to more FX downside is also a concern. On paper, a hawkish Riksbank is supportive of the SEK, with the ‘quantitative tightening’ announced at its most recent meeting set to strengthen the currency near-term. Yet, investor confidence is lacking, and with growth in Sweden suffering from the rate hikes, it’s not entirely clear that the Riksbank’s added tightening will support the SEK over the coming months. Plus, rate hikes thus far have done little to stop consumer inflation, which has only accelerated this year; with the housing market looking increasingly fragile as well, the Riksbank’s runway may be shorter than the rest of the Euro area. The external balance could also emerge as a surprise FX headwind this year – the Swedish composite PMI has fallen to <50 levels on more services weakness and declining new orders across the developed world. All in all, the near-term setup is far from ideal, and the country could well emerge as a relative underperformer vs. its European peers this year.

A Rocky Path for Sweden

With the Riksbank forced into a hiking cycle despite the underlying fragility of Sweden’s economy, it’s hard to get bullish on EWD here. Leading indicators point to more growth weakness beyond the Q4 GDP disappointment, while consumer inflation continues to be stickier than expected, accelerating to >9% YoY per the latest print. Owning Swedish equities heading into a stagflationary environment doesn’t seem appealing to me, particularly with the housing market also vulnerable to further declines and already driving knock-on effects on consumer confidence and real household wealth. While the EWD portfolio screens highly on the quality side, the industrials sector concentration and the high-teens earnings valuation remain exposed to further markdowns; I would remain on the sidelines here.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.