Why The S&P 500 Can Make New Lows

Summary

- The recent weakness in the banking system demonstrates just how fragile it is.

- We have yet to see the full impact of higher interest rates in the economy, but earnings have already started to decline.

- The market's earnings expectations for the S&P 500 appear to be too optimistic.

naphtalina/iStock via Getty Images

Previously, we highlighted why we think the market bottom isn't in and why a recession is on the way. We continue to believe this, especially after the drama witnessed in the banking sector recently. In addition to our previous article, we will be adding new potential catalysts to the argument while also providing updated price targets based on current market conditions.

The Banking System Is Far From Safe

Following the fast and furious collapse of Silicon Valley Bank (SIVB) and Signature Bank (SBNY)—the Federal Reserve and the U.S. Treasury took emergency measures by guaranteeing uninsured depositors and providing loans to other banks so they meet any liquidity demands without having to sell their fixed-income assets. This was essentially a bailout, and it helped ease some immediate fears. Nevertheless, the sector is far from safe.

Indeed, Moody's downgraded the entire banking system from stable to negative, citing "rapid deterioration in the operating environment." In addition, the rating agency believes that bank earnings will be negatively impacted by higher deposit costs.

Even more alarmingly, the FDIC said that banks were sitting on $620 billion worth of losses at the end of 2022, which is mostly due to rising interest rates which have decreased the value of bonds. This wouldn't necessarily be a problem if depositors didn't rush to withdraw their money from banks. However, recent events show that confidence in the banking system is very fragile and can change in an instant.

The danger here is the sheer size of the losses, as it would be very difficult for the Federal Reserve or regulators to justify massive bailouts should fear take over again and lead to more runs on the banks. From a political standpoint, the general public likely wouldn't take too kindly to another bailout of the financial elite on the backs of taxpayer dollars.

From a policy standpoint, inflation is still high, and even though it has eased up a bit, it'll still take a while to actually get to the 2% target. If interest rates are lowered prematurely, or if hundreds of billions more dollars are printed, then inflation might reaccelerate once again.

As a result, it seems that either higher interest rates with the potential of a full-scale banking crisis or increasing inflation are our top two most likely outcomes for the economy -- not exactly what we'd call a bullish setup.

The Market Is Overestimating Earnings Growth

When taking a look at earnings expectations for the S&P 500 (SPX), they appear to be too optimistic. Indeed, growth is expected in the 2023 calendar year when compared to 2022, as pictured below.

However, when breaking things down into quarterly estimates in the picture above, the market somehow believes that earnings will just magically increase in the second, third, and fourth quarters sequentially. This is quite puzzling when considering the macroeconomic backdrop.

The impact of rising rates is estimated to take 18 months to fully impact the economy. That means that the current 4.5% to 4.75% range still won't be felt until 2024. Yet, earnings fell in Q4 2022 and are expected to fall in Q1 2023. How, then, is it possible for earnings to increase in the second half of the year if the economy still has to feel the impacts of higher interest rates? This is especially true when considering the growing number of layoffs that started in 2022 when rates were still low.

In addition, the fact that banks are sitting on massive losses and Moody's (MCO) also expects bank earnings to slip certainly doesn't help the bull case. In fact, the financial sector has an approximate 10% weighting in the S&P 500, so its weakness will have a material impact on the index.

Therefore, one can conclude that the market is still not pricing in the possibility of a recession.

How Will Earnings Be Impacted During a Recession?

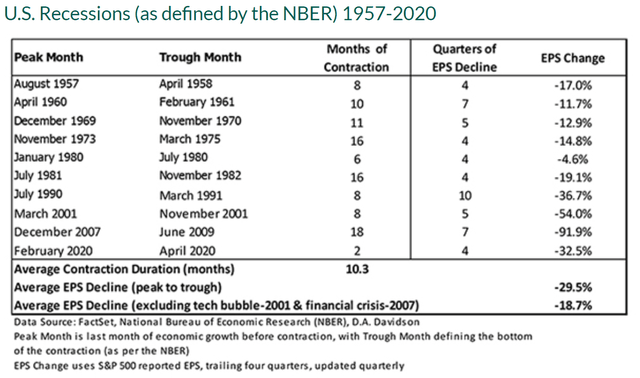

According to history, we can expect (on average) to see earnings decline by 29.5% from peak to trough.

At this point, it's not unreasonable to assume that earnings could possibly have already peaked in the 2022 calendar year for the reasons mentioned above. Using this assumption, a 29.5% decline from $218.95 equates to earnings per share of $154.36. If we assign the average 10-year trailing P/E ratio of 20.6x, the price of the S&P 500 will fall to approximately $3,179.

In our previous article, we also gave a more optimistic scenario, which was derived from looking at the declines from the 1970s and 1980s. Given that we are facing an inflation problem, it made sense to look to another time period where inflation was the main culprit behind economic volatility. The average earnings decline during those 4 recessions was 12.85%. Under this scenario, EPS would fall to $190.81, and the S&P 500 would trade at around $3,930. However, in light of the recent banking failures, we now find this scenario to be less likely and are expecting something closer to the average.

A Fed Rate Cut Won't Save The Market

The stock market rallied early in 2023 due to hopes that the Federal Reserve would maybe cut rates sometime this year. However, that would be a very dangerous sign at this point. For them to cut rates this year would signal that there is something very wrong with the banking system. After all, the Global Financial Crisis was driven by the banking system, not inflation. In addition, when considering the slow pace at which inflation has been easing, it would make sense that only something catastrophic would be able to bring it down fast enough for rate cuts to make an appearance.

Final Thoughts

Bear markets are full of vicious rallies that can cause investors to experience the fear of missing out. Nevertheless, it's important for investors to focus on the bigger picture and not rush into stocks, as we have yet to feel the full effects of higher interest rates, and the banking system isn't out of the woods yet.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.