High Yield, Low Price: CME Group Is A Buy

Summary

- Markets are in turmoil, caused by high inflation, declining economic growth, and the tricky position of the Federal Reserve in this situation.

- A bear market comes with opportunities, which include the Chicago-based CME Group, which benefits tremendously from above-average volatility in all major asset classes.

- The company has an asset-light business model allowing it to pay a steadily rising quarterly dividend and an additional annual special dividend.

- The valuation has become attractive, and longer-term stock price outperformance is likely.

JHVEPhoto

Introduction

Markets are in turmoil. On the one hand, that's annoying, as it comes with lower stock prices and declining economic indicators. On the other hand, it offers opportunities that can have a significant impact on investors' long-term returns. After all, buying high-quality assets at great prices is what causes long-term outperformance - if done correctly.

In this article, we'll discuss CME Group (NASDAQ:CME), one of my all-time favorite financial stocks. Not only is CME trading at an attractive price, but it is also benefiting from ongoing market woes, paving the way for yet another juicy special dividend announcement at the end of this year.

So, without further ado, let's dive in!

CME Group - High Yield, Wide Moat

Earlier this month, I wrote an in-depth article on the struggles (and outlook) of the stock market. One of the most important things I explained is the tricky situation for the Fed. On the one hand, it needs to be careful not to overtighten to avoid a steep economic recession. On the other hand, the bank needs to be hawkish to get inflation down to 2%. Even harder, it needs to prevent that monetary easing in the future allows inflation to accelerate again.

In this case, speed isn't just important for the economy as a whole but especially for the government. As I wrote in the aforementioned article, roughly 40% of government debt matures within the next 12 months. This translates to $8 trillion. One year ago, it cost $64 billion to finance this debt load. Currently, it's $400 billion.

So, in order to protect discretionary spending, the Fed better act quickly.

Unfortunately, the situation just got harder as banking woes are undermining investor confidence, leading to high volatility.

The VIX Index moved to its highest level since 4Q22 after going sideways close to 20 in the first months of this year.

Bloomberg

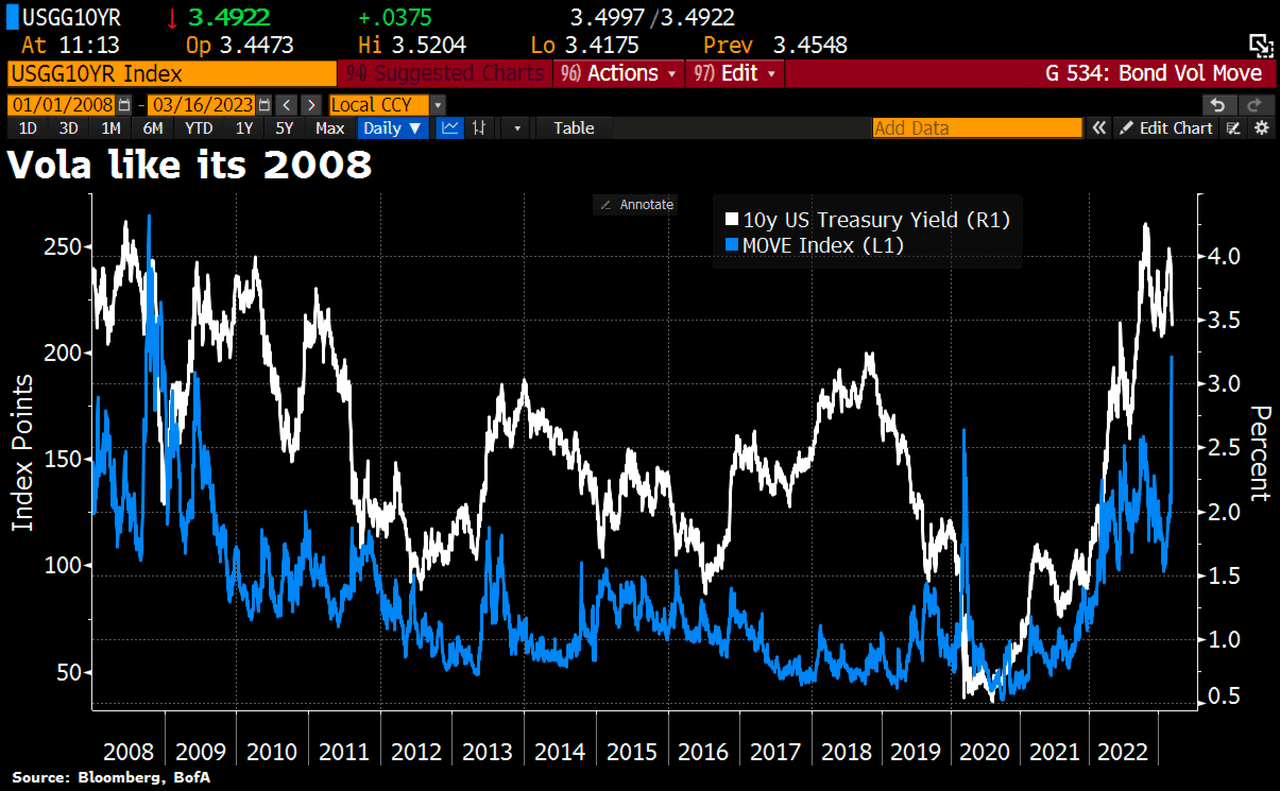

Not only are equities volatile, but the bond market is also extremely volatile. The MOVE Index, which tracks bond market volatility, is at its highest level since the Great Financial Crisis after the failure of SVB Financial Group (SIVB).

Do you know who benefits from this?

CME Group does.

This Chicago-based financial corporation isn't like its peers in banking. It makes money every time someone places a transaction, buying one of its many futures and/or options. As I wrote in December, the company's massive footprint in this industry was one of the reasons why I wanted to include the CME ticker in my portfolio.

Buying CME was based on buying a company with a dominant position in an important industry. This lowers competition risk, and it makes it very hard to replace CME Group.

[...] The company owns agriculture futures like CBOT corn, wheat, and soybeans, which are key global benchmark futures. The company owns COMEX gold, silver, and copper futures, which are the most traded global metal futures. Moreover, the company owns the world's most liquid and traded indices futures, including the e-mini contract (S&P 500), which you may be familiar with.

[...] close to a third of total revenues are generated in the interest rate space. While this includes swaps clearing and BrokerTec, a platform that facilitates electronically traded US and European fixed-income contracts, it makes a lot of money from products like Fed Funds futures, SOFR (the euro-dollar replacement), and all US treasuries across the curve.

Last year, the company benefited from high volatility in all major asset classes, including equities, bonds, currencies, and commodities. Even better, it lasted almost the entire year.

Now, this is set to continue.

Unless a recession takes so long that market participants retreat from the market, causing volumes to drop on a longer-term basis, this company is perfectly protected against shorter-term market mayhem. After all, it causes transaction volume to increase.

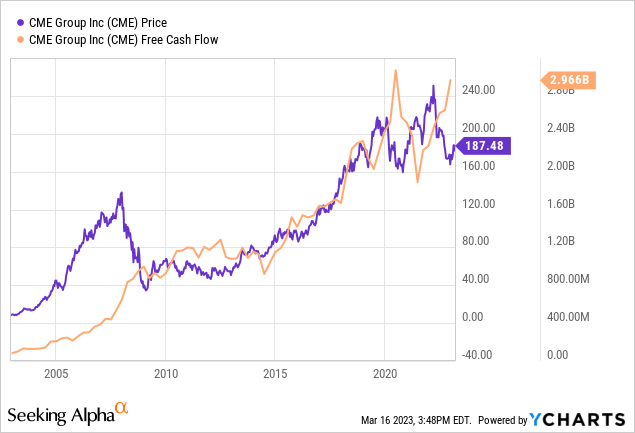

As the chart above shows, the company's stock price usually falls in times of distress. It happened during the Great Financial Crisis, during the pandemic, and in 2022 when global markets weakened again. However, every time this happened, free cash flow accelerated, thanks to higher volumes.

While growth usually weakens quite significantly after these volatility spikes, the stock price tends to recover along with the market.

We're now, once again, at such a point.

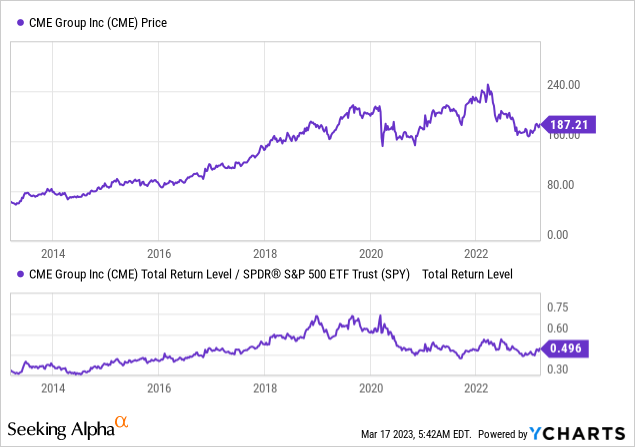

The CME stock price seems to gain momentum after a prolonged bottoming process that started in October of last year. Moreover, it comes with a rebound in relative strength, as shown by the lower part of the chart below. While financials (in general) were dragged down by banking woes, CME Group is finally catching a bid.

Needless to say, I'm not surprised.

CME Group has a number of things going in its favor.

For example, it announced improving rates per contract (how much it makes on an average contract). In 4Q22, the company generated an RPC of $0.651, which is the highest number since 3Q21.

Overall, 4Q22 futures and options RPC was 65.1 cents, up from 63.1 cents in 3Q22, primarily due to lower sequential volume leading to less incentives, a higher proportion of block trading, and product mix shifts.

Moreover, while CME Group had a successful year in 2022 due to favorable market conditions, they are cautiously optimistic for the year ahead but acknowledge the difficulty in predicting future volumes. The company is well-positioned to provide risk management solutions, which will continue to be a priority for market participants amidst high market uncertainty. However, geopolitical events and uncertainties, such as the debt ceiling issue and the Ukraine-Russian conflict, could impact the market.

So far, the company is off to a terrific start, as average daily volumes improved by 29.9% in February. Not only did the company benefit from a rebound in volumes after a decline in January, but it also benefited from 166 unique users in February, which implies a 186% growth rate.

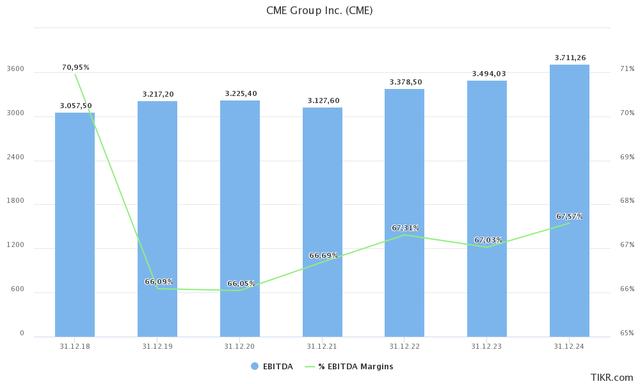

The analyst estimates indicate that the company is projected to achieve a 3.4% growth in adjusted EBITDA in 2023, building on the 8.0% growth it achieved in 2022. EBITDA margins are expected to stay stable, remaining in the 67% range.

With that said, I believe that CME Group is attractively valued.

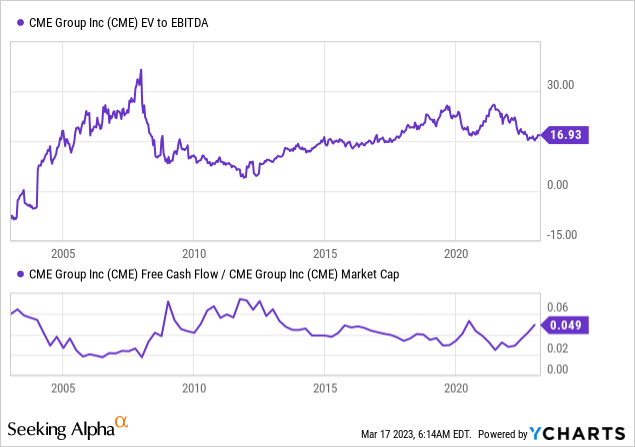

The company is expected to generate $3.3 billion in free cash flow. This translates to an implied free cash flow yield of 4.9%.

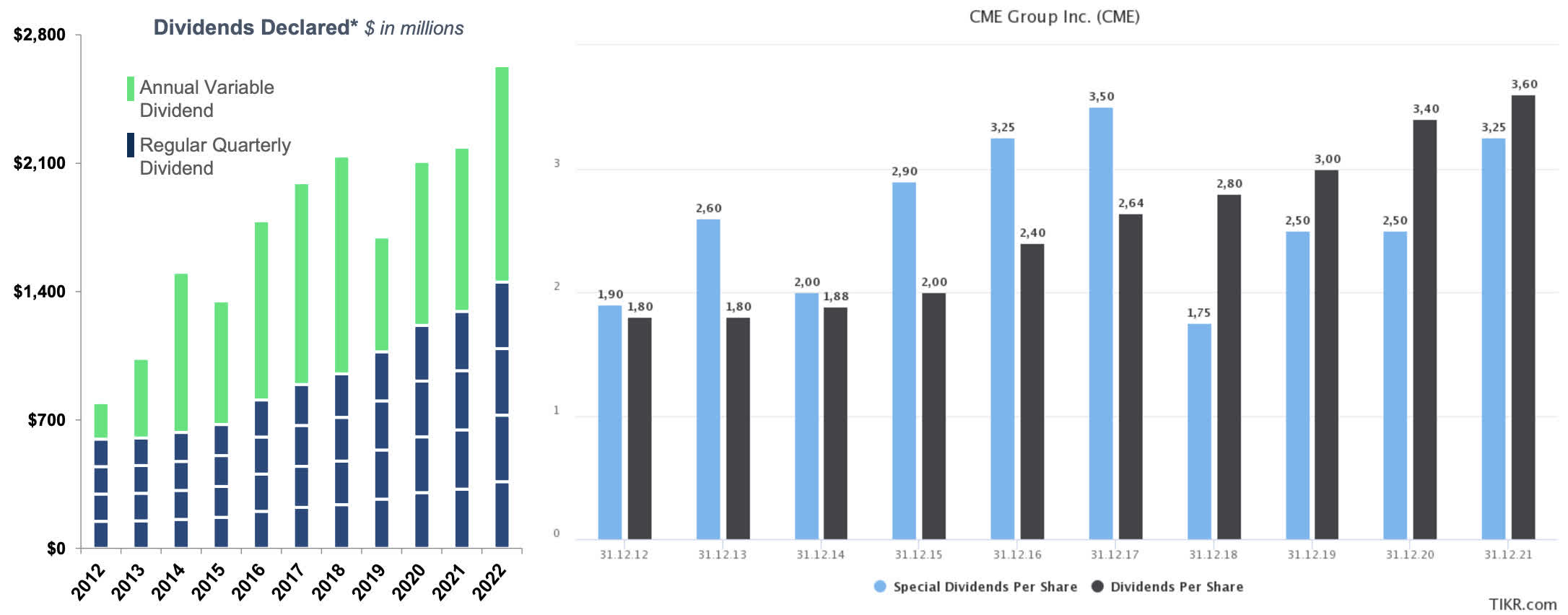

The best thing about this is that CME has a history of distributing almost all of its free cash flow through its regular quarterly dividend and one (often) juicy special dividend.

CME Group, TIKR.com (Combined by author)

The regular dividend was hiked by 10% on February 2 to $1.10 per share per quarter. This translates to a 2.4% dividend yield.

Over the past ten years, the average annual dividend growth was 8.9%. Again, that's the regular dividend. We can assume that the full-year dividend yield, including its special dividend, could be close to 5.0%. Needless to say, that number is prone to market uncertainty.

So, when I say that CME is attractively valued, I mainly make the case that free cash flow is trading at attractive levels. The implied free cash flow yield of 4.9% is the highest number since 2014.

If I hadn't aggressively bought CME last year, I would be a buyer at these prices.

The company currently has 4.0% exposure in my portfolio.

Takeaway

Markets are in turmoil, which isn't a lot of fun when it comes to existing positions, but great news for investors looking to buy high-quality stocks at great prices.

One of these companies is the Chicago-based CME Group.

Its business model benefits from high volatility in all asset classes, resulting in high transaction fees on top of rebounding rates per contract. Additionally, the company generates excess cash quickly, which is used to pay a steadily rising quarterly dividend and a special dividend at the end of the year. Combined with its attractive valuation, CME Group is a great investment for income-seeking investors looking for growth.

On top of that, I expect relative strength to last, causing CME shares to outperform the market on a prolonged basis.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of CME either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.