VYM: Offers High-Dividend Stocks With Stable Income Stream

Summary

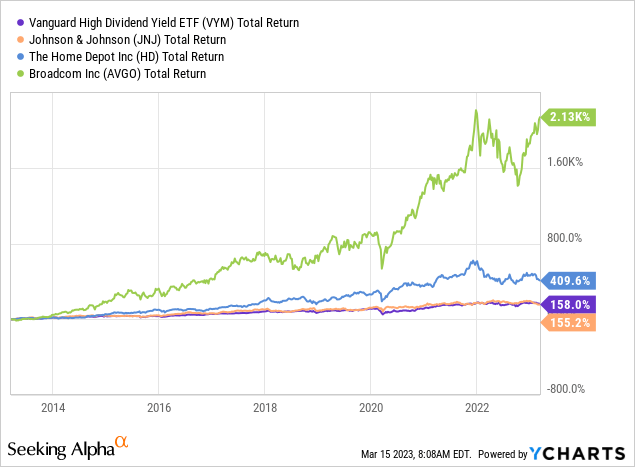

- Investors seeking lower risk yet excellent returns choose dividend stocks of high quality companies.

- The Vanguard High Dividend Yield ETF offers a stable income stream as well as potential growth in stock prices.

- This ETF contains 3 interesting high-dividend stocks: Johnson & Johnson, Home Depot and Broadcom.

- All stocks currently have a dividend yield of 2.9%. And Home Depot's dividend is expected to grow the fastest at a whopping 7%.

- The risks are already embedded in the low stock prices, and investors may see strong growth if the risk is unfounded.

We Are

Introduction

Due to the recent bank run last weekend, 3 banks were closed: Silvergate (SI), Silicon Valley Bank (SIVB) and Signature Bank (SBNY). This also affected other bank stocks; First Republic (FRC) fell more than 60%, as did many other regional bank stocks. Investors can now buy bank shares cheaply at extremely low prices, prices not seen since the 2008 financial recession. Yet there is a huge risk involved, as regulators may close banks and investors will lose their money.

Alternatively, the Vanguard High Dividend Yield ETF (NYSEARCA:VYM) offers high-dividend stocks that have undergone a correction and are now quoting at attractive equity valuations. In this article, I pick 3 stocks outside the banking sector that are good value plays today, which are: Johnson & Johnson (JNJ), Home Depot (HD) and Broadcom (AVGO).

Pick #1 Johnson & Johnson

Johnson & Johnson is known as a company active in the healthcare industry. It supplies well-known products such as Aveeno, Clean & Clear, Listerine, Tylenol, Sudafed and the like. Johnson & Johnson is also well known for eye care with their Acuvue brand. Finally, the pharmaceutical segment offers a wide range of products for various diseases. This business segment is the largest with annual sales of $53 billion.

Johnson & Johnson is a large company with revenues of $95 billion and a solid net profit margin of 19%. It is a true dividend compounder that has consistently raised its dividend for 60 years straight. JNJ currently offers a dividend yield of 2.9%. The dividend per share has risen an average of 6% per year over the past 5 years and analysts expect the dividend to rise 5.3% next year.

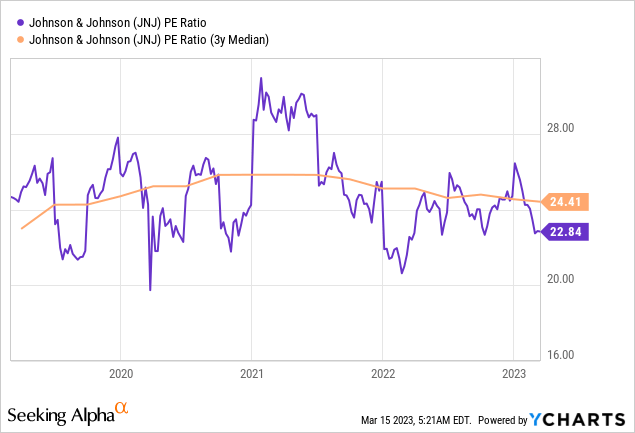

Earlier I wrote an article on Johnson & Johnson, in which I mentioned that the stock's valuation is on the high side. Currently, their valuation seems favorable.

The non-GAAP P/E ratio is currently 14.6, and the GAAP P/E ratio is 22.8. Unfortunately, YCharts does not show a historical chart of the non-GAAP P/E ratio. But we can still make a good comparison with the historical stock valuation of the GAAP P/E ratio. According to the chart, the stock appears to be about 7% undervalued.

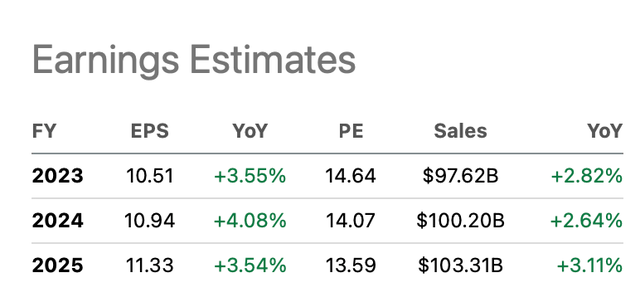

Looking at Johnson & Johnson's outlook, about 20 analysts expect earnings per share to rise about 4% in the near future. This offers the certainty of a growing dividend despite a looming recession.

This strikes me as an excellent buying opportunity, and Johnson & Johnson has weathered recessions well. The company is performing strongly on profitability and is growing steadily. In addition, management is very shareholder-friendly as it returns cash to shareholders in the form of dividends and share repurchases.

JNJ earnings estimates (Seeking Alpha JNJ ticker page)

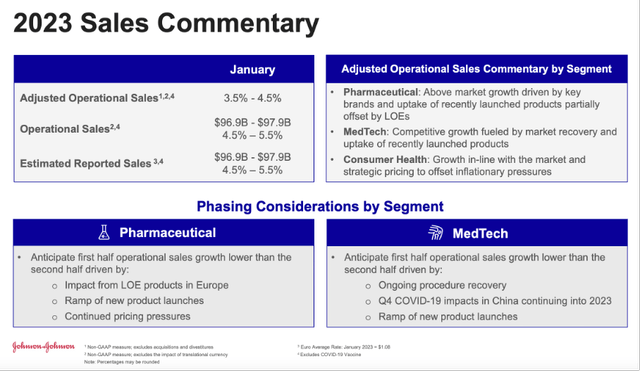

The outlook is based on new product launches, price increases and continued growth in the MedTech business unit.

CFO Joe Wolk discusses Johnson & Johnson's growth prospects in their transcript for the fourth quarter of 2022, and said the following about their pharmaceutical business unit (which is their largest revenue contributor):

We expect to again deliver above-market growth in 2023, driven by key assets such as DARZALEX, ERLEADA, TREMFYA, INVEGA SUSTENNA and UPTRAVI as well as continued uptake of recently launched products, such as CARVYKTI, SPRAVATO and TECVAYLI. This growth is despite lower Pharmaceutical market growth than experienced in recent years and considers the STELARA loss of exclusivity, which we anticipate occurring in late 2023 in the U.S.

JNJ's 2023 Sales commentary (JNJ fourth quarter investor presentation)

Pick #2 Home Depot

My second stock pick is Home Depot because it can take advantage of the high inflation environment by raising prices.

Home Depot is the largest home improvement retailer in the United States. The retailer recently experienced strong growth because many people upgraded their homes after the rapid increase in real estate purchases in 2020 and 2021. With sales of $157 billion and a net profit margin of 11%, it has been a highly profitable retailer for years. Home Depot experienced strong earnings growth with an average annual growth of 14% in non-GAAP EPS over the past 4 years.

The dividend yield is also currently 2.9%, and dividend growth has averaged 16.4% over the past 5 years. Looking forward, 15 analysts expect that the dividend will grow by 7% next year.

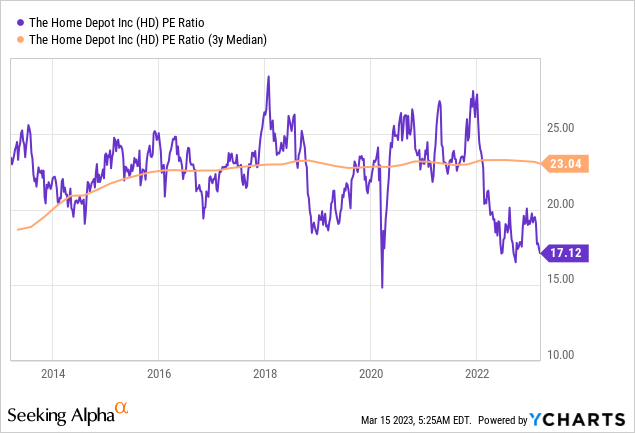

The non-GAAP P/E ratio notes 18, slightly higher than Johnson & Johnson, but at a steep discount to its historical valuation. YCharts' chart shows that the 3-year average GAAP P/E ratio is 23. So the stock is trading at a 26% discount.

Looking ahead, 30 analysts expect a small decline in earnings per share for 2023. After 2023, they predict that earnings per share will rise in the mid-teens for years to come. The company seems favorably valued as the forward 2026 P/E ratio is only 16. Which is low compared to its historical P/E ratio of 23.

However, there is still risk looming: Home Depot's growth may be slowed by a weak housing market.

But after the bank run last week, government bond yields are heading lower. As a result, investors expect the Federal Reserve to cut interest rates as early as the end of this year. This would benefit real estate sales as well as Home Depot.

HD earnings estimates (HD ticker page on Seeking Alpha)

Pick #3 Broadcom

My third stock pick is Broadcom, this chip company includes Broadcom (obviously) and Avago. Avago focuses on RF filters and amplifiers in smartphones like the Apple iPhone and other end markets. Broadcom specializes in broadband solutions, WiFi and Bluetooth chips and the like. The possible deal with cloud software company VMWare further expands their product portfolio.

Broadcom has not only grown very strongly, but the profit margin is also huge. The net profit margin of 37% is unprecedented and the free cash flow margin is even higher at 49%. The semiconductor industry is more volatile than any other industry, but with such high margins, earnings have a lot of wiggle room before the company suffers a loss. So these high margins could provide shareholders and the company safety.

Also here is one caveat. Broadcom may lose Apple as a customer because Apple wants to develop its chips itself. Still, I don't think Apple will develop all of its chips itself because certain chips require specific knowledge and experience. In fact, Broadcom's RF chips are very complex in their design. I wrote an article about this before.

Broadcom returns part of its profits as dividends and also buys back its shares. The buybacks increase the dividend more than the profits by reducing the number of shares outstanding. Also here, the dividend yield is 2.9% and the dividend per share grew at an average annual rate of 28.6% over the past 5 years. Analysts expect the dividend to rise 6.2% next year.

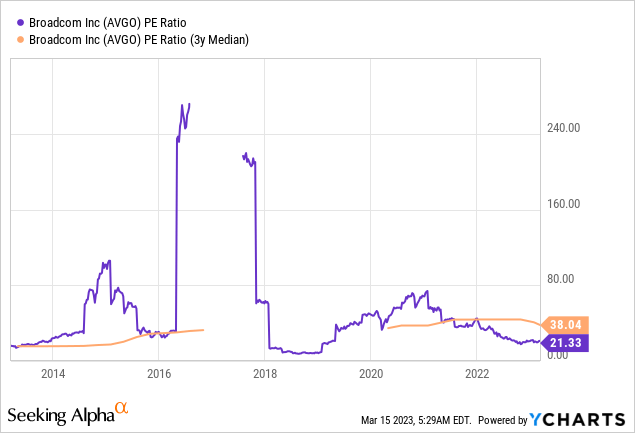

Also here, I look at the P/E ratio to see a non-GAAP P/E ratio of only 15.3. YCharts charts the GAAP PE ratio and this ratio notes 21.3, which is much lower than their three-year average of 38. However, a PE ratio of 38 is unlikely in this high interest rate environment. The GAAP PE ratio of 21.3 gives an earnings yield of 4.7%, which is high compared to the 10-year Treasury bond yield of 3.5%. Broadcom is valued favorably.

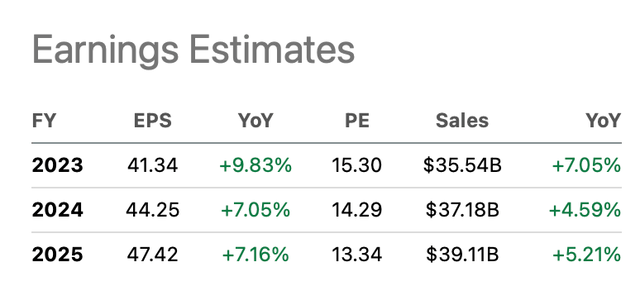

27 analysts expect earnings to rise by single to high single digits annually over the next few years. Non-GAAP EPS is expected to rise by high single digits. The projected P/E ratio for 2025 is only 13.3, and because the profit margin is huge, I see little risk, a cheap valuation and thus a good buying opportunity.

Broadcom's earnings estimates (AVGO ticker page on Seeking Alpha)

Key Takeaway

Investors seeking lower risk yet excellent returns choose dividend stocks of high quality companies. The Vanguard High Dividend Yield ETF offers a stable income stream as well as potential growth in stock prices.

This ETF contains 3 interesting high-dividend stocks: Johnson & Johnson, Home Depot and Broadcom. All stocks currently have a dividend yield of 2.9%. And Home Depot's dividend is expected to grow the fastest at a whopping 7%. Next comes Broadcom with an expected dividend increase of 6% and then Johnson & Johnson with an expected dividend increase of 5%. Earnings per share of these stocks are expected to rise sharply in the coming years. And the stock's valuation looks favorable. Broadcom is historically the most undervalued and trades at a steep discount. Home Depot is also trading favorably. Still, these stocks carry risks, such as the risk of stagnation in the housing market at Home Depot, and the possible loss of its customer Apple at Broadcom. The risks are already embedded in the low stock prices, and investors may see strong growth if the risk is unfounded. Both the ETF and these 3 companies offer strong growth and are worth buying.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.