Gibraltar Industries: Good Growth Prospects At Attractive Valuations

Summary

- Revenue should benefit from good demand in the Renewable, Agtech, and Infrastructure segments in the coming quarters.

- Margins should benefit from easier Y/Y comparisons and stable price costs in the renewable segment.

- Valuation is lower than the historical average.

Kameleon007

Investment Thesis

Gibraltar Industries (NASDAQ:ROCK) is expected to benefit from strong demand in the Renewable, Agtech, and Infrastructure segment, which should more than offset a subdued performance in its Residential segment. This should help the company post marginally positive revenue growth in 2023. With recent development in the banking sector, I expect the Federal Reserve to become less hawkish in its stance, which should lead to cyclical recovery in the residential sector as well in FY24. So, the company's medium to long-term prospects look good. The company's margin improvement prospects, especially in the Renewable segment, also look promising, and the valuation is attractive, making it a good buy.

Revenue Analysis and Outlook

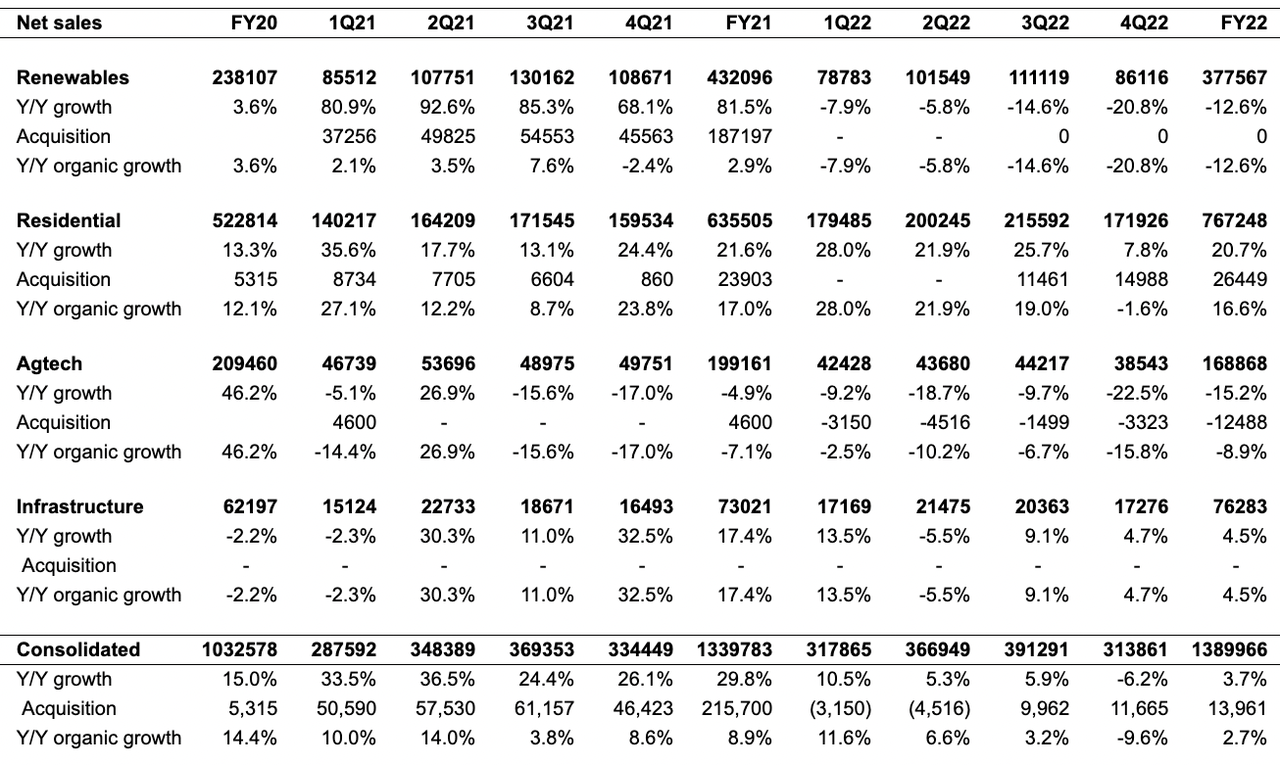

Last year, Gibraltar Industries posted 3.7% Y/Y revenue growth driven by strong demand in the residential segment, partially offset by weakness in the Agtech and Renewable segment. The Agtech segment has seen a decline in the last two years due to supply chain issues and delays in licensing and permits for cannabis projects. Meanwhile, the Renewable segment faced headwinds in 2022 due to the Uyghur Forced Labor Prevention Act (UFLPA).

ROCK's historical revenue growth (Company data, GS Analytics Research)

Looking ahead, while the Residential segment is expected to see some pressure in 2023, the Renewable and Agtech segments are expected to turn positive, offsetting its impact.

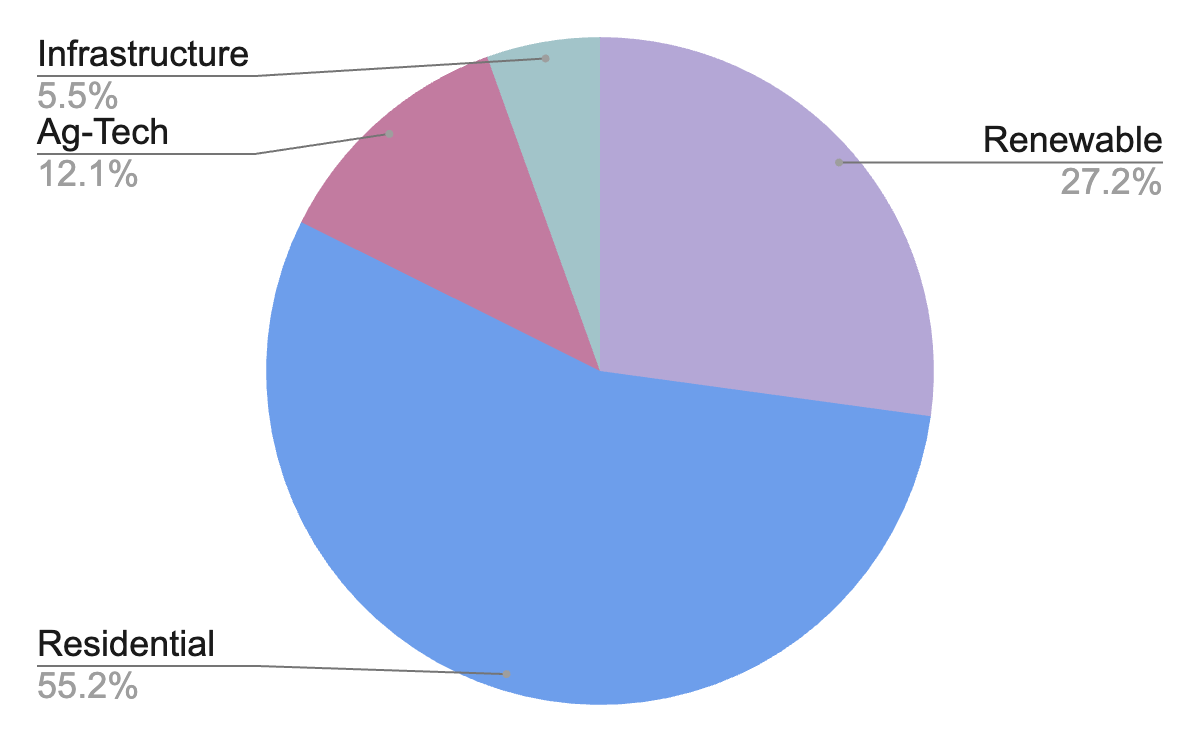

Segment's share in ROCK's revenue in FY2022 (Company data, GS Analytics Research)

The Renewable segment was heavily impacted by the Uyghur Forced Labor Prevention Act (UFLPA), which affected solar panel supply in the US and demand for racking projects. In June 2022, the UFLPA was enacted, requiring the traceability of components of imported goods to validate that they are not sourced from areas in the Xinjiang region of China. Consequently, solar panel shipments were held at US customs until importers could prove that they had not been sourced from Xinjiang province. Despite customer project planning and pipeline activity remaining firm, the restriction on the supply of solar panels resulted in fewer projects, impacting the segment's topline growth, which declined by 14.6% and 20.8% Y/Y for 3Q22 and 4Q22, respectively. In January 2023, one of the largest solar panel suppliers cleared the importation process for some of its shipments, and more suppliers are expected to clear the process in 2023 as they learn to navigate the process. As a result, management expects solar panel supply in the US to start normalizing as the year progresses. Therefore, there should be steady growth in this market throughout the year.

Similar to the Renewable segment, the Agtech segment is expected to experience demand recovery in 2023. The segment had faced supply chain issues related to glass and delays in demand due to licensing issues earlier. In 2023, the company is expected to witness order growth from cannabis projects, where license approvals are now moving forward. Additionally, the Infrastructure segment is anticipated to benefit from the Infrastructure and Jobs Act (IIJA) in 2023 and beyond.

While all other segments are expected to perform well in 2023, the Residential segment is expected to remain subdued due to weakness in the new construction market. However, the impact should be limited as the segment is more exposed to the R&R end market (75% to 85% of segment revenues) than new construction.

Also, with the Federal Reserve expected to become less hawkish in the aftermath of recent events in the banking sector, FY23 should be a cyclical bottom for new residential construction, and we should see a recovery in this market as well from 2024. Furthermore, the Renewable segment is expected to perform incrementally better in 2024 than in 2023 due to the better availability of solar panels. Therefore, the medium to long-term revenue outlook for Gibraltar Industries is positive.

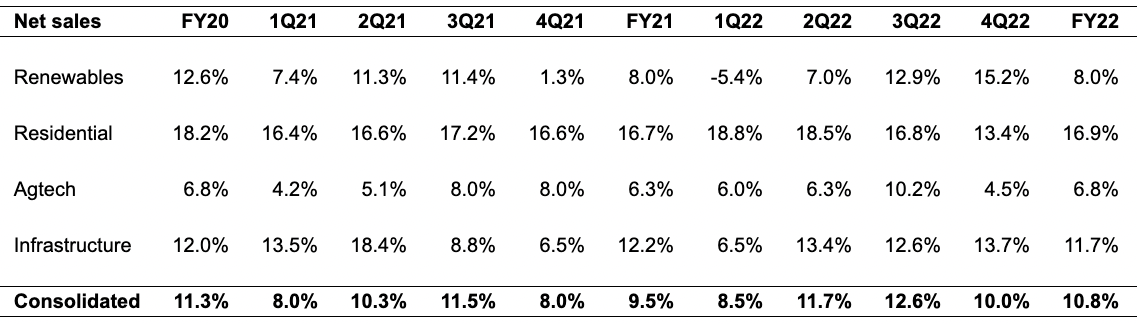

Margin Analysis and Outlook

After declining 180 bps Y/Y in FY21 due to higher input costs and supply chain challenges, the company's margins recovered in FY22 as the supply chain constraints eased, and the company implemented price increases. In 4Q22, the Renewable segment's margins saw a 1390 bps Y/Y improvement as some of the lower margin projects which impacted the margins in 4Q21 and earlier in FY22 got completed. Infrastructure segment margins benefited from higher volumes while Agtech was adversely impacted by lower volumes. The Residential segment's margins decreased by 320 bps Y/Y due to the recent acquisition of Quality Aluminum Products (QAP) and price indexation (which I have explained later in this section). Overall consolidated margins improved by ~200 bps due to significant improvement in the Renewable segment's margins.

ROCK's historical adjusted operating margin (Company Data, GS Analytics Research)

Looking ahead, ROCK's margins are expected to benefit from a Y/Y increase in margins from the Renewable segment due to easy comparison and volume leverage. In addition, the Agtech and Infrastructure segment margins should also benefit from volume leverage. While the Residential segment's margins are expected to remain subdued for 1Q23, they should also improve as the year progresses.

The Renewable segment is expected to continue posting higher Y/Y margins in the near term due to the easy comparison. The segment was significantly impacted by inflation in structural steel prices, which resulted in higher costs to complete locked-in projects, resulting in price-cost misalignment and lower margins for the segment in the first half of 2022. Now that structural steel prices are stable, the likelihood of another incident of negative price-cost misalignment is less probable. Additionally, higher order flow is expected for the segment in 2023, which should result in higher revenue and volume leverage, resulting in better margin performance for the segment.

In addition to improvement in the Renewable segment's margins, the Agtech and Infrastructure segments are also expected to witness improved margin performance in 2023. The Agtech segment's margins are expected to benefit from operating leverage from higher revenues in 2023 as the approval of licensing for cannabis projects which were stalled earlier are now moving forward. The Infrastructure segment is also expected to benefit from volume leverage as the segment is experiencing higher demand due to IIJA.

On the other hand, the Residential segment is expected to witness lower margins in the first quarter of 2023 due to the continued impact of price indexation. Since mid-2022, steel, aluminum, and resin prices have significantly corrected. The segment's price indexation policy with its customers resulted in lower product pricing linked to the decline in the price of raw materials. However, the company still has some higher-cost inventory on its balance sheet, which is resulting in negative price-cost misalignment. While the segment is working to reduce higher-cost inventory, the residual impact of high-cost inventory should be felt in 1Q23. Post 1Q23, the segment should start benefiting from lower raw material prices. The segment should also benefit from synergy benefits from the integration of the recently acquired Quality Aluminum Products, Inc. According to the management, the segment is expected to see Y/Y improvement in margins despite 1Q23 headwinds. Overall, the company should report higher Y/Y margins in FY2023.

In the long run, management targets achieving an operating margin of ~14%. The company is taking initiatives such as 80/20, automation, simplification, and digitization. Over the last three years, the company has upgraded and common-sized its ERP and CRM systems across all segments. In 2022, the company continued its go-live ERP implementation in the Residential segment and is expected to continue additional investments in the future. So, the longer-term margin outlook is also encouraging.

Valuation and Conclusion

The stock is currently trading at a P/E of 13.61x for the FY23 consensus EPS estimate of $3.56, which is lower than its five-year average forward P/E of 18.72x. Unlike many of its building product peers which are expected to post a Y/Y decline this year, the company is expected to post flattish to slightly up revenues and an increase in EPS due to its exposure to other end markets which are growing. In 2024 the revenue and earnings growth should accelerate as the residential market should see some recovery as well if the Federal Reserve eases on rate hikes. If we look at the current sell-side consensus, they expect mid-single-digit revenue growth and high teens EPS growth in FY2024. I like the company's diversified exposure, which makes it less cyclical compared to its peers as well as exposes it to high-growth end markets like renewables. Given its reasonable valuation and good medium to long-term growth prospects, I believe it is a good buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written by Pradeep R.