iShares Global Energy ETF: I Love Buying Corrections (Rating Upgrade)

Summary

- I turned cautious on Energy when March got underway. Even with that backdrop, I'm surprised how quickly (and by how much) the sector has dropped.

- The good news is this opens up a buying opportunity. Crude has sold off, and that often suggests the time is ripe for building positions.

- This will continue to be a volatile sector as global macro conditions remain challenged. But I like the sector as a hedge against the S&P 500.

- This is especially true for iShares Global Energy ETF, since it is a global play. The fund is less top-heavy than its domestic-only counterparts.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

JackF/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the iShares Global Energy ETF (NYSEARCA:IXC) as an investment option at its current market price. This is a passively managed sector fund with an objective "to track the investment results of an index composed of global equities in the energy sector."

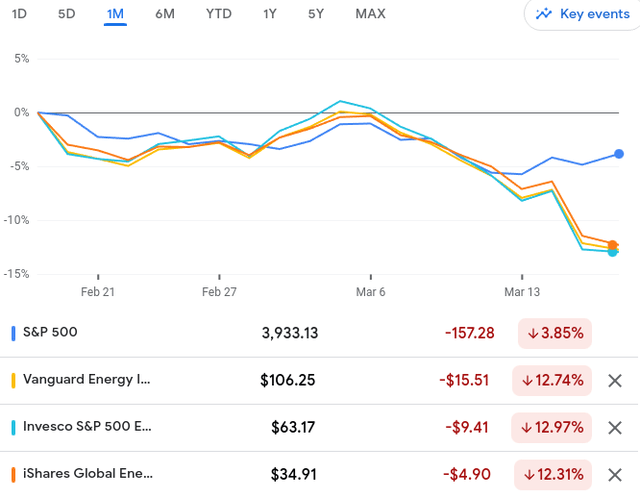

This is one of three Energy funds I own, and I'm going to focus this review on why I choose to add this one recently to capitalize on the broader sector's correction. This is important because I wrote about the Vanguard Energy ETF (VDE) earlier this month, when I cautioned readers about the risks facing that fund and Energy as a whole. Needless to say, this advice was well-timed given the sharp declines in share prices of late:

1-Month Performance (Google Finance)

Clearly, this has been a rough week/month! But rather than dwell on the negative, I see opportunity here. I always have some ownership of various sectors such as Energy, Utilities, and others. But the catch is I want to add to them over time when the opportunity is ripe - and I believe it is now. Buying during corrections or bear market periods will generally bode well over time, and that is what I see playing out here. Therefore, I am putting a "buy" rating on the IXC exchange-traded fund ("ETF") and will use this review to explain why.

Crude's Drop Is Historically Large

I will now shift to why I like buying Energy at this moment. A lot of it has to do with crude's performance, which I see as a buying opportunity. But, wait, you say, crude has been performing terribly of late! Well, that is precisely the point. I like to buy sectors/funds/themes when they are out of favor. That is crude oil at this moment.

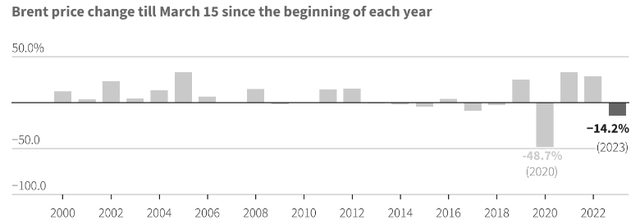

For perspective, consider Brent crude's price movement since January 1. It has lost over 14% year-to-date. If this seems like a big move, that is because it is. Looking back at the past two decades, there is only one other year (the anomaly of 2020) where crude saw a bigger drop through mid-March:

Brent Crude Annual Moves (2023 YTD) (Energy Information Administration)

Similar to the price drops in the Energy-specific ETFs I hold, this type of correction screams "buy" to me. Is more volatility on the way? Most likely. Can crude see further losses? Of course - and I never suggest I have perfectly timed a bottom. Readers need to understand this. But I view disproportionate losses and corrections and bear markets as obvious buys.

Why IXC?

As I stated earlier, IXC is not the only Energy ETF I own. But I view it as a good relative buy here for a key reason. This reason is diversification, which is generally lacking in my other big ETF holding of VDE.

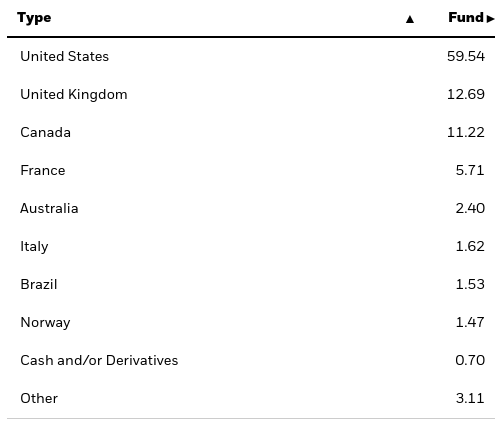

What I mean is, when a sector is seeing enhanced volatility, I want to stay less exposed to a handful of big names. Spreading the risk out in what is already a heightened riskier sector makes a lot of sense to me. In that regard, IXC fits the bill because it is "global" and has some of the big majors from the U.K., Canada, Australia, and other Western nations:

IXC's Geography Breakdown (iShares)

I view this positively because it helps take away some concentration risk and also remains light on central/eastern European exposure. There are some French and Italian holdings, but they represent a small portion of the fund. With the Russia-Ukraine conflict showing no signs of letting up, I am generally cautious on the Eurozone. But the U.K. is outside of that bloc, as are Australia and Canada, of course.

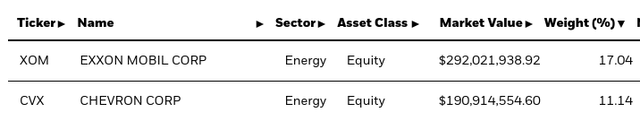

Beyond geography, IXC is not as top-heavy as VDE. Both funds are dominated by two of the biggest players in the sector: Exxon Mobil Corporation (XOM) and Chevron Corporation (CVX). But it is to a different degree. While these companies make up over 38% of VDE, they are roughly 28% of IXC by comparison:

VDE's Top Two Holdings (Vanguard) IXC's Top Two Holdings (iShares)

I would note that both funds are certainly quite beholden to these names. So a shift to IXC is not a "cure-all." But I do like its diversify in comparison to VDE and how it is not as heavily tilted towards XOM and CVX. For this reason, coupled with the general short-term uncertainty regarding crude oil at the moment, I view IXC as the better buy for the time being.

OPEC Expects China To Fill Demand Void

Shifting back to a broader focus, I want to emphasize I see the current weakness as likely to be short-lived. The drop strikes me as too large, too fast, and a rebound likely is going to occur in the next month.

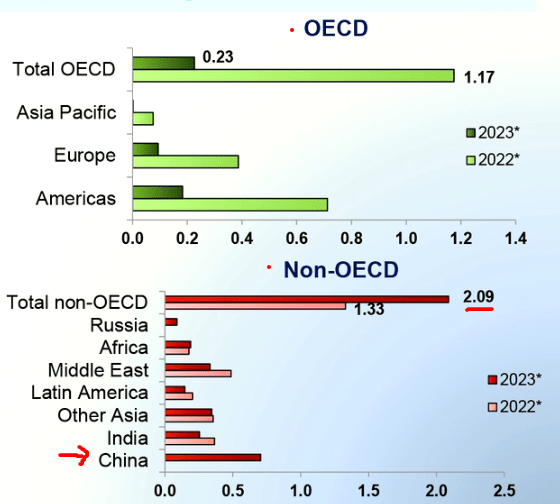

Key to this thesis is the demand forecast from China. I see China's economy rebounding sharply this year, which makes it a nice hedge against potential slowdowns in the U.S. and western Europe. This is a view shared by OPEC+ as well. In OPEC's March Oil Report, the group raised its forecast for economic growth in China while lowering it in the U.S. (and elsewhere). The logic that follows is crude demand will similarly rise and fall based on these projections:

OPEC's Demand Forecasts (OPEC March Report)

The demand forecast this week and a monthly report from the International Energy Agency (IEA) on Wednesday flagged an expected boost to oil demand from resumed air travel and China's economic reopening after abandoning its zero-COVID policy.

We have to remember that projections are not always accurate (and can change quickly). This is a monthly report from OPEC, so I will be monitoring it closely in April and May to see if I should adjust my short-term view. But for now I concur. I see Asia - India and China in particular - as picking up the slack for the rest of the world. These are oil-guzzling countries that are likely to take advantage of the recent drop in prices. If I am right, the bodes well for a crude rebound and the underlying share prices that make up IXC.

Energy Isn't Where The Pain Is

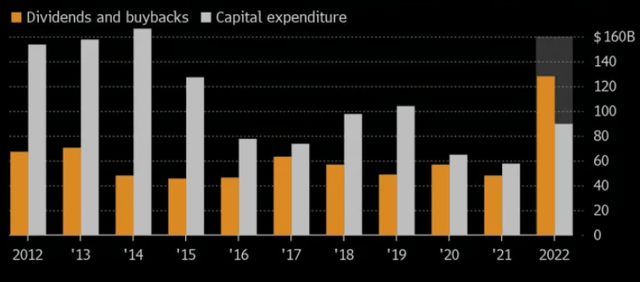

Another reason why I like the Energy sector has to do with their more prudent management over the past few years. With oil getting slashed during 2020, Energy companies had to make due with less. They limited investment and managed cash efficiently, to the point where they were well-capitalized compared to other "flashier" sectors.

That has paid off to a point. While many large-cap companies have announced massive layoffs to curb costs in both 2022 and early 2023, we can see that Energy companies haven't (generally) been a part of this trend:

Headline Layoff Announcements (S&P Global)

Of course, it is a positive trend to see these companies reduce costs. But it also spells trouble about their current position and future growth prospects. In short, it can be a short-term win with negative longer term implications if not done properly. Energy companies, on the other hand, have been managing their investment at a historically low level and working instead to return cash to shareholders. That is a trend I can get behind!

Metrics for Energy Sector (Yahoo Finance)

This is precisely the kind of management action I want from the companies I own stock in. These are indeed the companies that make up IXC, so I view this backdrop as support for my bullishness for the sector.

A Key Risk Not To Ignore - Debt Ceiling

My last topic touches on a risk that I view very seriously for both equities as a whole and the Energy sector. This extends to IXC and is a risk I hope we will avoid, but I'm planning ahead in case we don't.

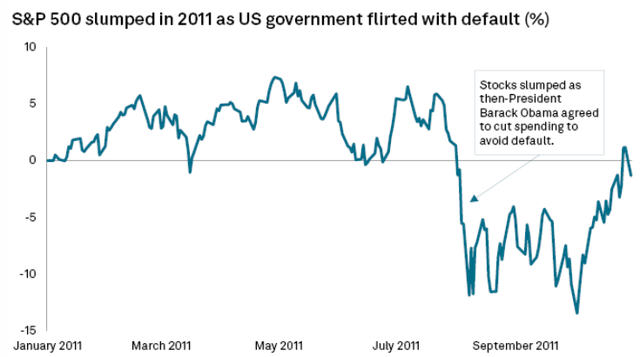

What I am referring to is the debt ceiling debate shaping up for later this year. Now that Republicans have control of the house, it is unlikely to go smoothly in that they will be demanding spending cuts that Democrats and the Biden administration may be unwilling to give. This back and forth is something we have seen before and, unfortunately, it is not likely to be kind to equity markets.

For perspective, let us think back almost twelve years ago to 2011. At this point, House Republicans took a hard line on demanding spending cuts to then-President Obama before agreeing to raise the debt ceiling. For those of you, like myself, who were investors during that time, we remember it was a volatile time period. To remind us just how volatile, consider this graphic:

S&P 500 Performance (S&P Global)

As you can see, the S&P 500 (SP500) saw sharp swings in both directions, but trended in double-digit decline territory on multiple occasions (from where the index started prior to the government shutdown over the debt ceiling).

This graphic refers to the S&P 500 as a guide, and not IXC specifically. I am aware of that, but readers should be aware that IXC was not a play to hide during this turmoil, either. To see why, let us consider the fund's return from July 1 - September 29th, which covered this period:

| IXC Share Price (7/1/11) | IXC Share Price (9/29/11) | % Change |

| $42.17/share | $33.88 | (19.7%) |

Source: Yahoo Finance.

The conclusion I draw here is IXC was a worse place to be during this crisis, so readers need to take care. I would have thought that the international holdings would have leveled performance out a bit, but the cyclical nature of Energy took it on the chin regardless.

This serves as a useful reminder that Energy can be volatile and see swings in both ways. I see a strong argument for buying now, but caution my followers to stay within their risk tolerance limits and monitor the happenings in D.C. very closely going forward.

Bottom Line

iShares Global Energy ETF looks ripe for a rebound. This ETF has been pushed into correction territory, and that typically is a buy signal. The large drop in crude is unsettling, but history suggests this is temporary. With international exposure and less reliance on the two biggest names, I think the iShares Global Energy ETF is a good buy to complement my other holdings. Therefore, I think the bullish rating has merit, and I encourage readers to consider new positions in iShares Global Energy ETF at this time.

Consider the Income Lab

This article was written by

I've been an investor since 2008, which was an invaluable and humbling experience. This is central to my strategy of looking for quality, value, and diversification - generally staying away from risky/over-hyped ideas. I won't pump any investment nor discuss a topic I don't genuinely follow / research. In that spirit, I list my portfolio here for transparency.

I'm a native New Yorker and I work for a major U.S. bank. I escaped to North Carolina for graduate school and I don't see myself ever leaving. I was a D1 athlete in college (men's tennis) and compete competitively to this day. My Bachelor's and MBA are both in Finance.

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU / BUI; VDE, RYE; KBWB; XRT

Non-US: EWC; EWU; EIRL

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, PCK, VCV, PML, BGT, PDO

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 30%

Disclosure: I/we have a beneficial long position in the shares of IXC, VDE, RYE, VOO, RSP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.