Federal Reserve Watch: Protecting The Banking System

Summary

- This past week, the Federal Reserve has moved to "back up" the commercial banking system and keep it afloat.

- During the week the Federal Reserve has continued to reduce the size of its securities portfolio and to keep the effective Federal Funds rate constant.

- But, Chairman Jerome Powell and the Federal Reserve face an increasingly uncertain future as pressure to stabilize the banking system and the fight against inflation must go on.

- The investment community waits.

crbellette

This last banking week, the Federal Reserve had to act quickly to keep the commercial banking system afloat.

Still, quantitative tightening continued as the Fed oversaw a reduction in its securities portfolio of $8.3 billion.

Today, one year after the Federal Reserve began its quantitative tightening, on March 16, 2022, the securities portfolio has declined by almost $600.0 billion.

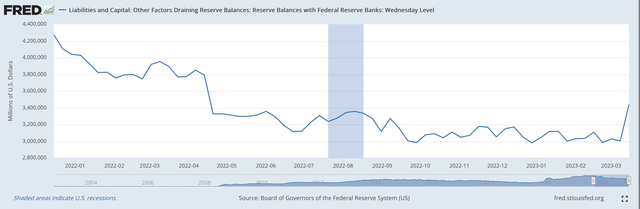

However, due to the disruption in the commercial banking system, Reserve Balances with Federal Reserve Banks, a proxy for excess reserves in the banking system, rose in the last banking week by $440.5 billion.

The effective Federal Funds rate in the last banking week was 4.57 percent on March 9 and 10 and was 4.58 percent for the rest of the banking week. The weekly average came out to be 4.57 percent, the same as it has been since the last Fed movement of the rate.

So, the Federal Reserve continued to oversee the reduction in its securities portfolio during this past week of financial stress. How did it achieve the rise in bank excess reserves?

Rise In Commercial Bank Reserves At The Fed

As was well-reported in the newspapers and on TV, the Fed opened up its "loan" window and oversaw a $302.9 billion rise in loans.

Secondly, the Federal Reserve oversaw a $137.3 billion decline in Reverse Repurchase Agreements.

These two movements resulted in an addition of just over $440.0 billion in the "excess reserves" of the commercial banking system in the past banking week.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

Apparently, for the time being, this was a sufficient increase in these reserves to get the banking system through the last banking week and keep the effective Federal Funds rate stable.

We'll have to wait until next week to see how the Fed's response to the banking disruption works out.

Moving On

The big question is where does the Federal Reserve go from here?

I have written all this past week about the current situation, the policy dilemma that Jerome Powell, chairman of the Board of Governors of the Federal Reserve System, faces, the situation in the banking system, and the state of the United States economy.

Yesterday, I wrote about my view of the situation and my opinion on what Mr. Powell should do, going forward.

My conclusion was that Mr. Powell and the Federal Reserve should continue the efforts of quantitative tightening to battle the high rate of inflation that now exists within the United States.

I argued that Mr. Powell has lost a substantial amount of credibility during his tenure as the chairman of the Federal Reserve and that, because of this, a lot of members of the investment community believe that he will quickly "bailout" the quantitative tightening effort and will "pivot" to a much easier monetary stance.

Mr. Powell and the Fed need to "keep on, keeping on."

At least Mr. Powell did not immediately cease the effort to reduce the size of the Fed's securities portfolio.

Furthermore, the response of the banking system to provide support to banks that have shown some financial weakness, like First Republic Bank, is helpful to the Fed as it tries to maneuver between a banking system showing some financial weakness and an economy facing a 6.0 percent, year-over-year, rate of inflation.

The policymakers, in my mind, must continue to fight inflation. Both the inflation rate and the weakness in the banking system are actually the consequences of earlier central bank behavior. The Fed is faced with the problem of cleaning up from its own earlier, expansive actions.

Mr. Powell and the Federal Reserve must fight through this disruption in the banking system and keep their eyes focused on the problem of rising prices.

The ultimate reality is that someone, sometime is going to have to do it.

Let's just hope that Mr. Powell and the Fed are not satisfied to just "kick the can a little further down the road."

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.