The All-Weather Dividend ETF Portfolio

Summary

- In this article, we discuss a dividend-focused ETF portfolio aimed to provide consistently satisfying returns with subdued volatility.

- We start by assessing the theory behind ETF diversification, using some background of Ray Dalio's all-weather portfolio.

- I then present a 5-ETF portfolio with an average yield of 2.4%, high safety, subdued volatility, and consistent average annual returns close to 7.5%.

Liia Galimzianova

Introduction

It's time to talk about ETFs. Over the past few months, we have discussed a wide variety of (model) portfolios, diversification strategies, and everything related to that. One of the things people kept bringing up is building a low-risk ETF portfolio for dividend investors. In this article, I am going to discuss an interesting low-risk all-weather portfolio with you. As the title suggests, the aim is to provide a portfolio that comes with high safety in tough times, yet not without long-term capital gains. It's a portfolio that can, technically speaking, be used to invest high sums of money thanks to its low-volatility profile.

Moreover, we'll discuss alternatives and the rationale behind the picks, so there's a learning aspect for people looking to build their own (ETF-focused) portfolios.

Needless to say, this is one of many articles on this topic. We'll cover a wide variety of strategies and purposes in the weeks and months ahead. So, don't hold back in the comment section if you have suggestions or requests!

Now, let's get to it!

ETF Portfolio Construction

The big asset-allocation puzzle & things to keep in mind

Whether we're talking about individual stocks or ETFs, the process of building a portfolio is truly captivating. With a vast array of stocks and ETFs to choose from, each one possessing unique characteristics, the possibilities are endless. Some investments may be more volatile, while others may be non-cyclical. Certain options may offer high yields, while others may cater to specific niches.

With that said, there are a wide number of things to keep in mind when building a portfolio.

Asset allocation: Determine the asset classes you want to invest in and the percentage of your portfolio that should be allocated to each asset class. This one is the most tricky and the reason why I like writing articles like the one you're currently reading.

Risk tolerance: Understand your risk tolerance and construct a portfolio that aligns with it. This sounds easy, but it's very tough. One reason is that most (inexperienced) investors underestimate risks. They buy assets they don't fully understand and do not know what to do when the market turns against them. In 2020 and 2021, for example, investors went overweight in growth stocks. A lot of these picks fell more than 70% in the decline that followed.

Cost: Choose ETFs with low expense ratios to minimize costs and maximize returns. Expense ratios are often underestimated. While most major ETFs have low expense ratios, some smaller ETFs come with expense ratios of up to 1%. That adds up over time.

- Liquidity: Choose ETFs that have sufficient liquidity, so you can easily buy and sell them in the market without incurring significant bid-ask spreads. This issue isn't extremely important when managing your personal portfolio. However, major funds need to take this into account. The reason why I still kept it in is that I don't want people to buy ETFs with low liquidity. Often there's a reason why liquidity is low.

With that said, let's start with the initial all-weather portfolio.

The Original All-Weather Portfolio

Essentially, all-weather means that a portfolio makes money in all macroeconomic situations. For example, in high growth and low inflation, low growth and high inflation, and so forth.

Bridgewater

Let's say you find a portfolio mix that comes with these qualities. You could technically leverage it until there's no tomorrow (don't do this, this is just an example). After all, the biggest risk of using leverage is encountering (unexpected) drawdowns. A portfolio without drawdowns can be leveraged until interest expenses are too high, technically speaking.

So far, there is no passive portfolio that comes with these benefits, and if there is, it's probably kept a secret.

This portfolio, however, comes very close!

As discussed by the Lazy Portfolio ETF, a Dalio all-weather portfolio can consist of the following holdings:

- US large cap stocks (VTI) - 30%

- US long-term government bonds (TLT) - 40%

- US intermediate-term government bonds (IEI) - 15%

- Gold (GLD) - 7.5%

- Diversified commodities (GSG) - 7.5%

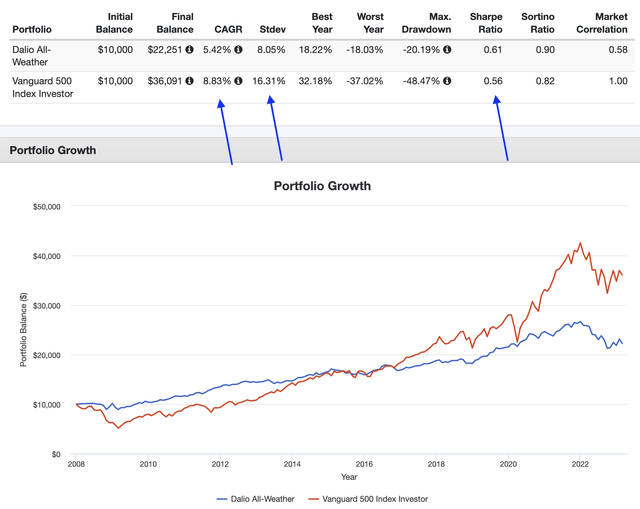

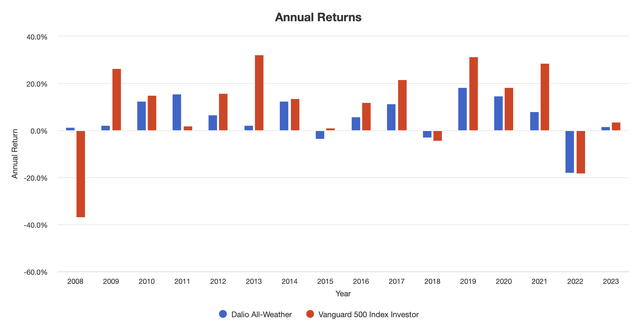

As the graph below shows, this portfolio has returned 5.4% per year since January 2008. This underperformed the market by roughly 340 basis points per year. That's a lot.

However, the all-weather portfolio had a standard deviation of just 8.1%. That's half as volatile as the market! The result is that the risk-adjusted return is better compared to the market.

Needless to say, the total return was lower. However, investors who bought this all-weather portfolio didn't go through a lot of trouble. The biggest drawdown was 20%. The worst year was negative 18%. However, that happened in 2022, not in 2008!

In 2008, this portfolio returned 1.3%. The only reason why the risk-adjusted return isn't higher is because of the massive headwinds for bonds in 2022. In 2022, both bonds and stocks sold off, in one of the worst years for the traditional 60/40 portfolio in many years. Needless to say, it was a huge drag on this bond-heavy model portfolio. It barely outperformed the market in 2022.

So, overall, this is a great portfolio to invest a lot of money in. However, only if investors prioritize safety over returns. This portfolio is a great way to slowly but steadily accumulate wealth without high risks. Retail investors who invest in this portfolio and consistently add to their holdings will still make a decent penny but nothing wild.

Needless to say, one major issue is that we cannot backtest past 2008 due to the age of most ETFs. However, going back to 2008, we still have a number of different economic cycles.

The Better All-Weather Portfolio?

So, let's discuss my version of the all-weather portfolio.

While there are countless alternatives, I constructed a portfolio that mainly consists of dividend-paying stocks with support from bonds and commodities.

I wanted to construct a portfolio that came with a higher (expected) total return than the all-weather portfolio we just discussed, without sacrificing the benefits of low volatility.

Moreover, as a dividend-focused investor, I wanted to highlight the income part a bit more. However, I did not go overboard when it comes to finding a good yield. That was not possible in combination with my low-volatility goals. For example, I played a bit with preferred stock ETFs, senior loan ETFs, and related tools, but none of them were able to improve the risk/reward.

That said, in the next few weeks, we're likely going to do a high-income ETF portfolio. So, don't hold back if you have suggestions or requests!

Based on this context, here's the portfolio:

| Weighting | Name | Category | Yield | 3Y Dividend CAGR | Exp. Ratio | Comment |

| 40% | Vanguard Dividend Appreciation ETF (VIG) | Dividend growth | 2.0% | 11.7% | 0.06% | Steadily rising dividend income |

| 20% | iShares US Aggregate Bond ETF (AGG) | Bonds | 2.5% | N/A | 0.04% | Government and corporate bonds |

| 20% | SPDR S&P Dividend ETF (SDY) | Dividends (aristocrats) | 2.7% | 6.6% | 0.35% | Higher-yielding dividend stocks |

| 10% | Vanguard Real Estate ETF (VNQ) | Real estate | 4.0% | 5.8% | 0.12% | Additional yield |

| 10% | SPDR Gold Shares (GLD) | Gold | 0% | N/A | 0.40% | Defensive commodity exposure |

- Essentially, this portfolio has an average yield of 2.4% with decent dividend growth from its dividend and real estate ETFs.

- 70% of the fund consists of equities. 20% consists of bonds. 10% consist of commodities. In this case, non-cyclical gold exposure.

- The Vanguard dividend growth ETF was added as it comes with a higher yield than the S&P 500. It also has high long-term dividend growth, a low expense ratio, and high diversification.

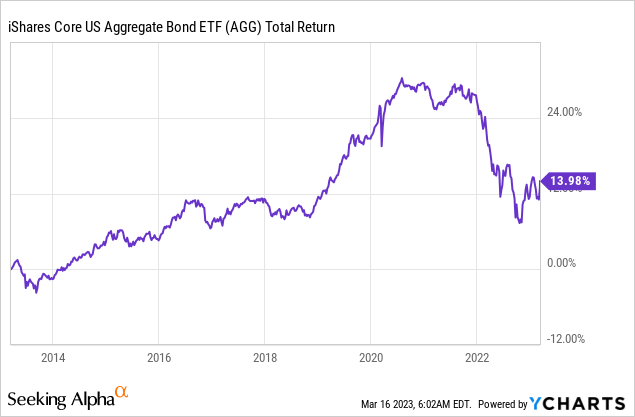

- The iShares aggregate bond ETF AGG was added as a proxy for bonds. This ETF has a low expense ratio, a decent yield, and a portfolio of high-quality bonds. 42% of its holdings are US treasury bonds. 27% are mortgage-backed securities. Industrial and financial companies account for another 23%. 72% of all bonds are AAA rated (the highest rating available). Just 13% of bonds are BBB rated. While the ongoing hiking cycle hasn't been great for bonds, AGG has a history of high total returns and subdued volatility.

- The VNQ real estate ETF was added to offer diversified real estate exposure with a decent yield.

- The dividend ETF SDY was added to provide a slightly higher yield and companies with great track records. This ETF follows the S&P High Yield Dividend Aristocrats Index. This index screens companies that have hiked their dividend for at least 20 consecutive years. The unofficial rule is 25 years, but it's not a game-changer.

- The GLD ETF does not come with a yield. It simply follows the price of gold. In this case, it protects the portfolio against inflation (long-term), and certain Fed policy changes, as it tracks short-term rate expectations.

- This portfolio has a very low survivor bias. After all, we only discuss ETFs.

Now, before we discuss the performance, let me share a few more notes with you.

- As I said in this article, this is purely experimental. The purpose of this portfolio is to generate ideas. There are multiple ways to copy or even improve this portfolio.

- Why do I say improve? Well, let's say you own private real estate, in that case, there's no need to add real estate to this portfolio. The same goes for gold. I would even make the case that holding physical gold is a better option than buying the GLD ETF. The 45 basis points expense ratio is very high and makes it hard to compete with a vault at your local bank.

- The 35 basis points expense ratio for the SDY ETF is high. Essentially, I would have liked to go with the Schwab High Dividend ETF (SCHD), which I discussed in this article. However, because SCHD only goes back to 2011, I decided to go with an ETF that allowed me to backtest a bit further back, without having to incorporate stocks that come with more risks.

- This portfolio is aimed to provide safety over high returns. It won't make you rich. However, it will get you far. Even small amounts invested in this portfolio will (more than likely) allow investors to build a low-risk nest egg.

While I hold a 22 single-stock dividend growth portfolio, I would consider a construction like this if I were required to invest a large sum of money in a low-risk portfolio with decent returns.

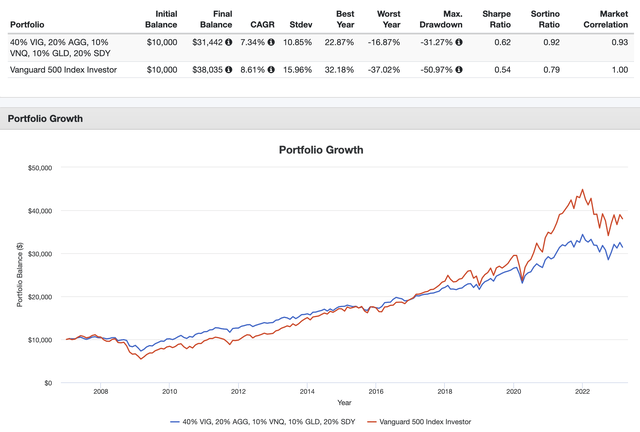

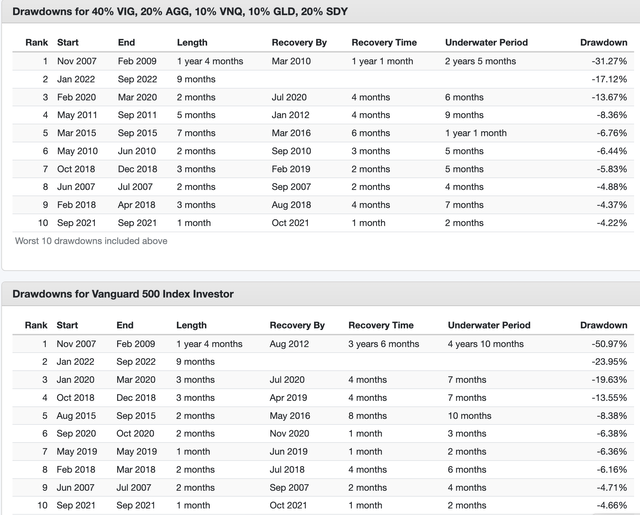

The Portfolio Performance

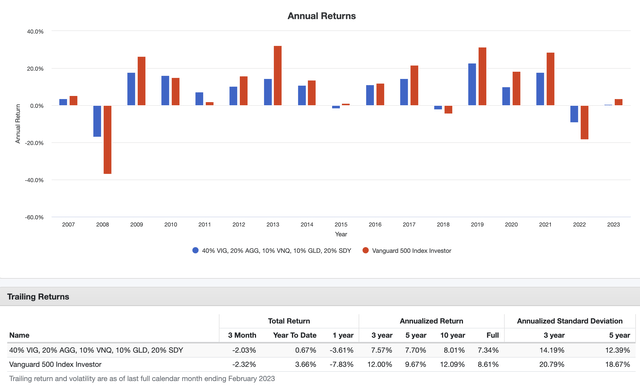

With that said, the portfolio did well. Since January 2007, this portfolio has returned 7.3% per year. The S&P 500 returned 8.6% per year. However, while investors sacrificed 130 basis points per year, they got a standard deviation of just 10.9%, more than 500 basis points lower than the market. This ended up providing them with a Sharpe Ratio (risk-adjusted performance) of 0.62. Since January 2008, that Sharpe Ratio is 0.66. The first all-weather portfolio we discussed had a lower score. So, essentially, we're dealing with a slightly better risk/reward here. That's on top of a higher total return.

Looking at the table below, we see that this performance was very consistent. Whether we use a three, five, or ten-year time interval, we see that this portfolio returned close to 7.5% per year. Needless to say, it consistently underperformed the S&P 500, albeit with a standard deviation that remained consistently 600 basis points below the market's standard deviation.

Moreover, the upper part of the graph above shows that the portfolio shows recent returns in bull markets - just not enough to beat the market. Hence, a big part of its decent return is downside protection during bear markets.

The table below elaborates on the model portfolio's ability to outperform during large drawdowns. Especially during the Great Financial Crisis, this portfolio was underwater for just two years and five months. The market was underwater for twice as long.

Needless to say, the low volatility is a huge benefit.

Let's say you invest a huge sum of money in this portfolio, or you are in a position where you may need to liquidate your investments for whatever reason. In that case, it makes even more sense to go with low volatility. The odds are much higher that you can liquidate at decent prices compared to an investment that has a high total return yet steep and regular sell-offs.

Final Thoughts

In this article, we did things a bit differently. For the first time, we discussed an ETF-only portfolio. In this case, I went with a low-volatility portfolio that protects investors in most economic environments. While drawdowns cannot be avoided, they tend to be limited and accompanied by decent returns in bull markets.

The result is a satisfying long-term total return that comes with high consistency.

A portfolio construction like this can be used to invest large sums of cash, due to the low-volatility aspect. However, it can also be used to create wealth. However, the process is slow, which means investors seeking higher returns have to add more risk to this portfolio.

Moreover, as I already said in the article, we'll discuss a wide range of other options in the weeks and months ahead. This portfolio can be adjusted in a million ways to accommodate different investment strategies.

So, let me know in the comment section if you have suggestions and what you think of the portfolio presented in this article! I look forward to your comments!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice