LVMH: How Quality Outperforms In A Downturn

Summary

- Over a year ago, I started buying LVMH at cheap valuations. My objective with buying LVMH was always crystal-clear - the capital invested should grow and be "protected".

- Yield is secondary, but I've nonetheless been able to harvest a yield from the company as well. However, the main advantage is RoR.

- I'll show you why for 2023, LVMH will remain one of my largest positions and why I'll keep an eye on the share price to make sure I buy cheap.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

_laurent

Author's Notice: This article was published on iREIT on Alpha back in February of 2023.

Dear readers/followers,

2022 was about quality above quantity/dividends, and about protecting your capital from downturns. My way of doing this was to make sure that I invested in quality names. Companies with high quality and tradition generally come with fewer dividends. 2022 was a year where much of my capital went into investments with yields less than 2.5% - and LVMUY was one of the largest investments, one which I filled up "first".

LVMH (OTCPK:LVMUY) has delivered some impressive returns - especially if you paid a bit of attention to the valuation - and now we'll see where it goes for 2023.

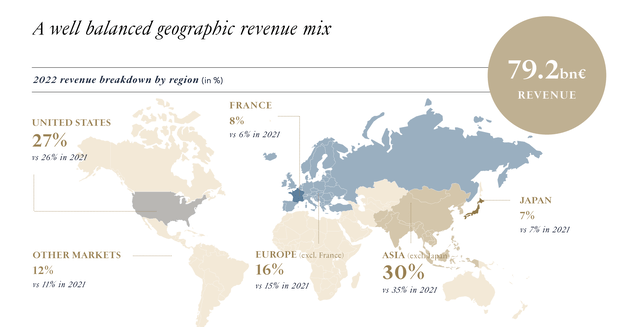

LVMH - Updating for 2023

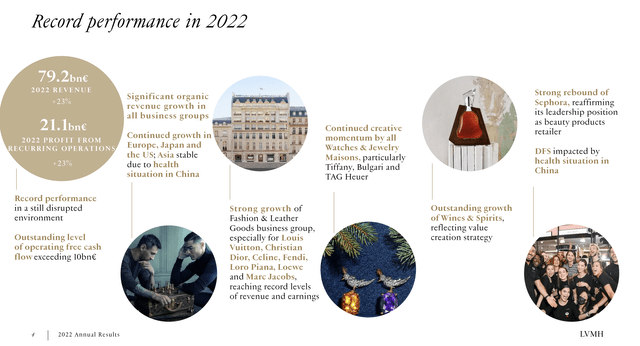

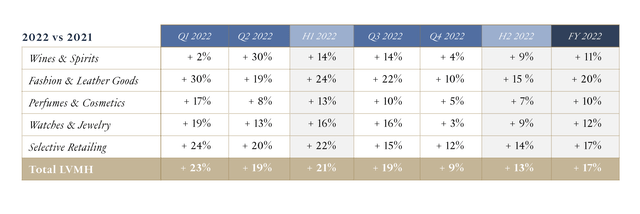

So, LVMH outperformed any estimate that analysts made for the company, including my own estimate. A 7.5% estimate, or around 7% average for the market, turned into nearly a double-digit top-line growth for the quarter. The year also showcased the international profile of the company, with Japan seeing a nearly 30% YoY growth, with Europe at 22% for 4Q22. It also showcased that China can drop, and LVMH won't be as affected as some of the bears would suggest.

The results are still impaired by ongoing SCM and inflation impacts, as well as pretty much markets being shut down - that's part of what makes these results impressive. Because for the year, top-line results are up 23%, 17% even with normalizing FX.

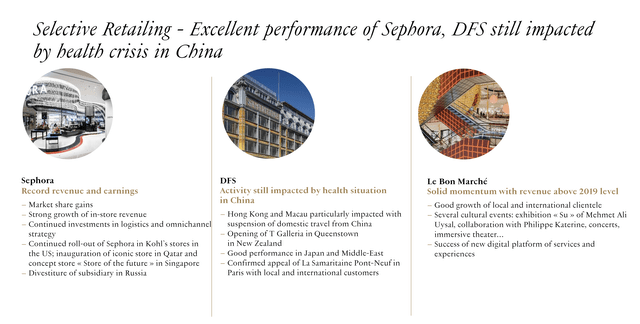

The company is also, already, seeing ongoing normalization in China, with stores in Macau and across the rest of the country starting to open up. In terms of Russia, which is a question I've fielded quite often since the war began, LVMH has shuttered all of its stores - but Russia was less than 1.5% of the company's entire global sales, which makes me consider the sales impact trivial, especially in the light of these results.

Because, again - record performance.

There really wasn't any one specific segment or area that did poorly. Champagne and Wines grew by 24% and even Cognacs and Spirits were up double-digit in terms of revenue.

The real star of the show was the fashion segment though - which some readers expected to not do as well during a crisis like the one we're seeing. I've studied past recessions and downturns, however, and this hasn't really been a thing. Yes, consumer interest can go down in discretionary sectors, but luxury brands and purveyors like LVMH are somewhat more resistant, some would say almost immune to these trends - this quarter was a great example of that.

The example is that well-known quality keeps selling. Because the successful brands were things like Louis Vuitton, Christian Dior, and other well-known brands. The company's perfume brands also did extremely well. I've published before, about how I actually use some of their brands - my current favorite is Guerlain and MFK. Even if my absolute favorite perfume - which is Creed - isn't under their umbrella, they still have excellent products catering to a variety of tastes. Now, where I am personally less of a fan is watches. I do have a Zenith watch, but that's the only one of their watch brands I'll really touch (well, I have a TAG as well). The jewelry business and watches did strong in sales though, so I'm a minority here, and it's good to see that their products here are well-liked. However, I feel it important to point out that the perceived luxury of their watches isn't even close to the level of perceived luxury in their other brands, like leather and spirits/wines.

The company doesn't have the ability to buy the brands of watches they would need though (such brands aren't for sale, they're usually administered as trusts, like Rolex, or in the iron hands of a family/organization that won't let them be sold), so it's up to LVMH to build these up more. Tiffany and Bvlgari did well though, and in terms of jewelry, things are good.

Retailing had another strong quarter, and this is yet another segment I've been keeping a very close eye on.

Nearly €80B in sales, with an operating margin of 26.6% - which I call on competitors to try and beat, mixing this with a gearing ratio of less than 16.5%, and over €10B in operating free cash flow for the year. This company is a well-oiled luxury machine with the ability to handle any potential downturn or challenge. The mix is attractive, though I would like to see Asia reduced in overall size to improve the mix and see less impacts from downturns there.

Once China normalization comes more into play, it's likely we'll see further advance and improvements both to the top and the bottom line, and it's hard to argue with trends like these, with profit from recurring operations over €21B, up 23% on a YoY full-year basis.

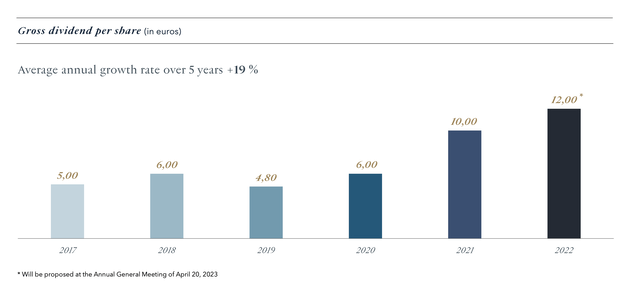

Gearing levels are even up slightly, from record-lows of 11% in 2020, but aren't worrying to any real degree. Because we have 4Q22, we also have the company's new dividend, which is up 2 euros, and part of a fairly impressive overall trend of making the company more appealing as a dividend investment.

This also means that the current yield is around 1.5%, which isn't bad, and my current YoC is just above 2% on a position-wide basis. I'm also up 42% in my position year-over-year, and that was when I started buying more in the company, adding slowly and steadily as the company went close to, or below €600/share.

So you can see that the performance I've had out of LVMH is absolutely superb. I've beaten the market, and 2% dividend yield is no longer "bad", especially as the results and trends for LVMH are expected to grow going forward, not go down.

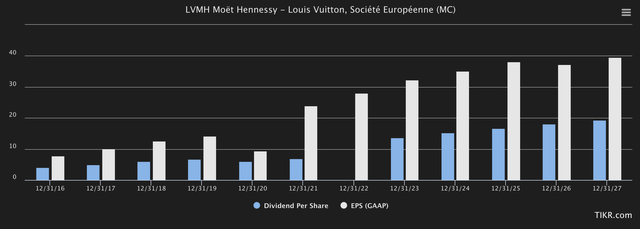

Here is the current set of S&P Global forecasts and estimates for GAAP and for the dividend.

If we take the estimates at face value, then by 2027E the yield on today's share price of €800 would be around 2.25%, and for myself would be closer to 2.6%. Again, the dividends here won't make you rich - but the growth of the company could very well double your invested money (I'm already up 40% including dividends and FX), while at the same time keeping you extremely safe.

The one risk or concern I see as the company expands is the commoditization of its products, which is something LVMH needs to avoid. The entire idea of the brand is that it's an exclusive products that most people do not have access to easily, but rather work their way up to. If the company starts undermining this to increase revenue, we may see a similar decline in premiumization as we've seen in brands like Maserati (though cars), and to some extent, I'd argue Jaguar and Lamborghini (though the latter isn't that bad yet).

Other than that, let's move on to valuation.

LVMH - The valuation for 2023

When I first started writing on LVMH, the company wasn't exactly dirt cheap. I bought anyway, and I kept slowly loading up over the entirety of the year. At €800/share native, the company isn't cheap here either, truth be told. Under €600 is "cheap" for LVMH with these numbers, but at today's price, the company is nonetheless still below analyst averages.

Current S&P Global averages come from 30 analysts calling from a range between €590 to €1000. Granted, this is a massive range. What I will say is that this company goes into "STRONG BUY" Territory at below €600. If we do end up seeing a four-digit native share price, I would be looking at potentially rotating some profits to see if I can get in cheaper - but this would also depend very closely on the multiples we'd see at that time.

Current average targets come to €815/share. That means that there's still a 1.5% upside to LVMH, if we go by analyst targets. Out of 30 analysts, 27 of them are either at a "BUY" or an "outperform", showcasing just how positive the industry is on the business - and unlike with some companies, these analysts have changed their targets even when the company dipped 20%.

I consider the target range of €750-€850 a very good range for the company in its current state. My PT in my last article for LVMH was €760/share, coming to the lower end of that range. Due to very impressive targets, which confirms the longer-term upside thesis now that we're seeing China open back up, I'm slowly raising the bar for the company to deliver on the growth. I'm now willing to pay that €800/share for the company, but I do so knowing that our potential RoR here is capped.

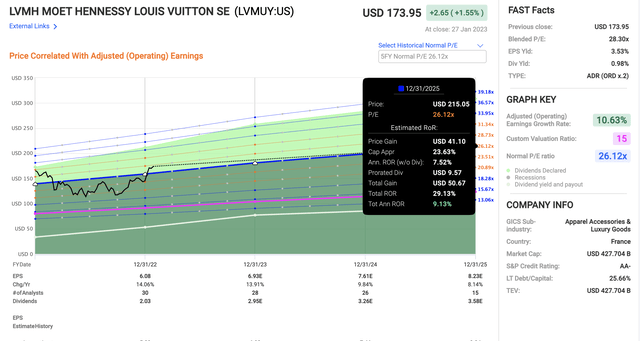

Namely, I believe it capped at roughly 9-10%.

The dip we saw in 2022 was an opportunity. I hope you took advantage, as I tried to point out 3 articles during the year. The opportunity we're presented with here is much, much reduced. However, I would not be doing my job if I didn't emphasize the quality of this company even at this stage in valuation. Because frankly, even at 27-28x P/E, LVMH isn't trading as high as some premium companies that I also own stock in.

LVMH is one of the companies in the entire market where in my valuation I allow for a significant premium to peers and the market. LVMH is profitably generating vast amounts of cash flows. I expect an EBITDA growth rate of around 9%, up from 7-8%, restoring my previous impairment due to macro.

For the terminal period, I'm adjusting my growth rate to around 2.5-2.75%, allowing for the above-GDP growth rate for its native geography. Based on a WACC of 9.5%, flat EBITDA margins of 35% and a relatively flat CapEx/sales of around 5% as well as the aforementioned high single-digit sales increases, my current models range between a DCF of around €740-€820/share at this time - and this is also where the current expectations and results from either other analysts and the company do come in.

We've been through peers before - they are Hermes International, Kering, Richemont (OTCPK:CFRUY), Pernod Ricard (OTCPK:PRNDY), Remy Cointreau (OTCPK:REMYY), Swatch (OTCPK:SWGAY), and Prada (OTCPK:PRDSY). Depending on how you view it, you could arguably include things such as Ferrari (RACE) and others as well. But none really command the premium or the quality that LVMH's various Maison's do. Furthermore, the attractive mix found in the company means that it will likely always be my #1 luxury brand choice.

In the end, this is one of the very, very few companies where I see a long-term premium of around 20-33X P/E as valid.

So, for 2023, this is my thesis.

Thesis

- LVMH is the best luxury investment potential, at the right price. The company's mix of segments, maisons, ownership, and potential for growth is unrivaled across its peers, and I view it with great confidence, which is why it's my largest luxury position, despite the fact that I don't much invest in consumer discretionary otherwise.

- The company has been on a good ride, returning over 35% in 2022 if bought at overall appealing prices, and also bumped the dividend. I expect more good results and more dividend bumps coming in the next few years.

- Despite the company essentially at my share price target of €800/share, i still consider LVMH a "BUY" until it goes clearly above here, with a conservative RoR potential of 9-10% annually until 2025E.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The only issue is that LVMH is not cheap - other than that, it's a rock-solid investment here.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have a beneficial long position in the shares of LVMUY, CFRHF, PDRDF, PPRUY, REMYY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment, and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding of the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.