XLE: Hang On Tight

Summary

- XLE bulls who eagerly jumped on board during the December 2022 and January 2023 highs are now being pummeled by its recent steep decline.

- Our warning to investors that XLE's strength was unsustainable has come to fruition. The recent banking crisis has proven to be the straw that broke the camel's back.

- Investors are frantically unwinding their bullish bets on oil and gas stocks as fears of a 2008-esque financial crisis continue to grip the market with unrelenting force.

- Investors rushing in now will need nerves of steel to navigate the waves of selling, expecting other dip buyers to return and stanch further downside.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

zhengzaishuru

The Energy Select Sector SPDR ETF (NYSEARCA:XLE) has underperformed the S&P 500 (SPX) (SPY) since our Sell calls in December and February, as market operators unwound their bullish positions in a hurry.

We cautioned that its price action looked suspicious in December, as the underlying oil and gas markets (CL1:COM) (NG1:COM) have weakened substantially from their June highs.

We highlighted in December that "such bifurcation is not sustainable if the underlying markets continue to weaken. Therefore, investors should be prepared to capitalize on the recent rally to cut exposure."

XLE buyers lifted the ETF to another surge in early January, but its momentum failed again at a critical juncture, corroborating the need for increased caution.

Hence, we believe astute market operators leveraged these opportunities to sell into strength, drawing in unsuspecting buyers and capitalizing on their greed and over-optimism.

The banking crisis over the past week has sent chills down the spine of more oil and gas investors/traders, who finally bailed out in droves.

The collapse of Silicon Valley Bank of SVB Financial Group (SIVB) and Signature Bank (SBNY) in quick succession rattled investors globally, worried about further contagion.

Credit Suisse (CS) also fell into a deeper crisis amid its complex restructuring but was given a lifeline by its regulator on Wednesday evening. First Republic Bank (FRC), battered over the past week, is barely hanging on as it is reportedly seeking a sale, "weighing options to improve its liquidity."

Given massive gains on the XLE since its COVID lows, investors who chased its highs at the end of 2022 shouldn't be surprised that market operators took the opportunity to cash in their gains.

SPI Asset Management argued that market operators are "drawing parallels to prior bank sector-driven recessions, especially the 2008 financial crisis." Moreover, the "lack of a 'slingshot recovery' in China's economic data" wasn't enough to inspire confidence among oil and gas investors.

Notably, China concluded its recent National People's Congress or NPC legislative conference that confirmed the expected third Presidential term of Chinese President Xi Jinping.

Economists had earlier expected China to set a higher GDP growth target of 5.3%, but Xi has other ideas, setting a target of 5%. Xi tightened his grip further in China, aligning the government's priorities closer in line with the party as geo-political tensions with the West heightened further.

As such, "Xi is sticking to his 'common prosperity' policy, which aims to drive down inequality by spreading wealth in the country."

Headwinds have also increased, as supply is expected to overwhelm demand in the near term, as Russia bolstered its exports further. However, India has remained steadfast in its support of discounted Russian crude.

Notwithstanding, we believe the steep decline in LNG prices has also drawn in Asian buyers. However, "LNG's future depends on its affordability, and the industry must make it economical for price-sensitive buyers."

Hence, the headwinds over the underlying oil and gas markets could drive further selling pressure in the near term, even though XLE's price action suggests it could have been priced in.

A leading hedge fund that aced its bet on rising oil prices has reduced its exposure significantly. Vista Capital, "the best-performing hedge fund in Brazil in the last three years," has reduced its exposure by 50% as it grew increasingly concerned over the state of the global economy.

Bullish institutional and speculative bets, which saw "the most bullish bets relative to bearish ones in four years in the week to March 7" have also reversed.

However, given XLE's recent price action, we believe they have been unwound further; as Bloomberg reported, "financial firms began dumping crude futures to limit their exposure to falling prices in the options market, leading to chaos."

Hence, XLE buyers waiting on the sidelines could be considering whether to buy the recent dip, as panic seems to have set in?

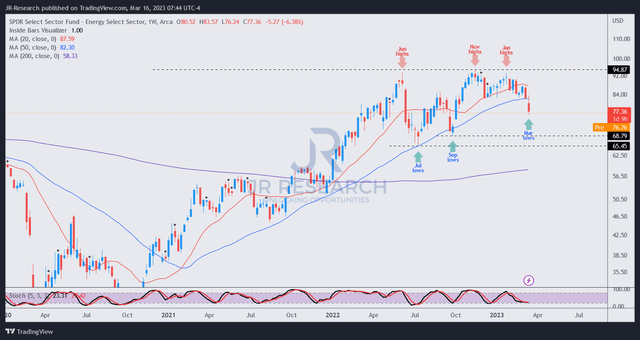

XLE price chart (weekly) (TradingView)

XLE has fallen nearly 20% from its January highs toward this week's lows as fear set in.

We believe bullish technical traders have likely capitulated as XLE broke down critical technical levels, potentially losing support above its 50-week moving average or MA (blue line).

We cautioned in our previous articles that the underlying crude oil futures have failed to regain their bullish momentum after losing key moving average support levels.

As such, the decision for these investors to take profit after the break of a critical technical level in the XLE is expected and justified.

However, XLE remains in "no man's land," and therefore, further downside volatility cannot be ruled out. That's a critical risk that investors must assess carefully.

Without a decisive bear trap or false downside breakdown, the recent collapse could open a further move downward to re-test September lows before consolidation could occur.

Hence, more conservative buyers can consider remaining on the sidelines and observing the price action before reassessing a buying opportunity.

However, we assessed that XLE had been forced into deeply oversold zones. Coupled with its rapid decline was bullish investors reversed out of their positions, an entry here looks possible for sophisticated investors/traders willing to ride through the near-term volatility.

Rating: Speculative Buy (Revised from Sell).

Note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. Our cautious/speculative ratings carry a higher risk profile. They are only intended for sophisticated investors/traders. We urge new or inexperienced investors to avoid relying on such ratings. Moreover, investors must exercise prudence and devise appropriate risk management strategies, such as pre-defined stop-loss/profit-taking targets, within a suitable risk exposure.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you'll also gain access to exclusive resources including:

24/7 access to our model portfolios

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

Access to all our top stocks and earnings ideas

Access to all our charts with specific entry points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

JR research was featured as one of Seeking Alpha's leading contributors in 2022. See: https://seekingalpha.com/article/4578688-seeking-alpha-contributor-community-2022-by-the-numbers

Unlock the key insights to growth investing with JR Research - led by founder and lead writer JR. Our dedicated team is focused on providing you with the clarity you need to make confident investment decisions.

Transform your investment strategy with our popular Investing Groups service. Ultimate Growth Investing specializes in a price-action-based approach to uncovering the opportunities in growth and technology stocks, backed by in-depth fundamental analysis. Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis. We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups. Join us and start seeing experiencing the quality of our service today.

My LinkedIn: www.linkedin.com/in/seekjo

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.