Your Cannabis Portfolio Could Ascend With Ascend Wellness

Summary

- Ascend Wellness is a strong but cheap Tier 2 MSO.

- The company reported its Q4, which went okay, but the guidance for 2023 was below expectations.

- I think the stock could double over the balance of the year.

- Looking for more investing ideas like this one? Get them exclusively at 420 Investor. Learn More »

Darren415

Ascend Wellness (OTCQX:AAWH) had a terrible 2022, but the stock is up from its all-time low in December. The company just reported its Q4, which was close to expectations, but it issued guidance for 2023 that was below what analysts had forecast. The 10-K was released after the market closed on 3/15, and I discuss 2022 and the outlook for 2023 and beyond from the release and the conference call.

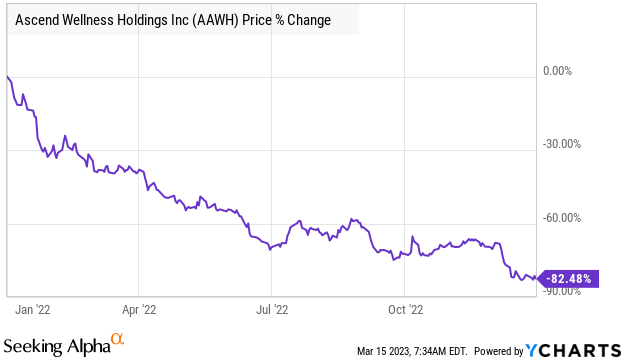

The 2022 Disastrous Price Action

Ascend did not live up to its name in 2022, as the stock descended 82.5% to $1.15. The overall market as measured by the New Cannabis Ventures Global Cannabis Stock Index fell by 70.4% in 2022, while the New Cannabis Ventures American Cannabis Operator Index declined by 65.8%.

Ycharts

One big change for the company that investors had no way to anticipate was the departure of its CEO, founder Abner Kurtin, who was accused in Florida of a crime. The charge was dropped, but he moved to Executive Chairman, with two executives taking on the CEO role on an interim basis. The company is working with a major recruiting firm to name a new CEO.

During Q4, the company had been expected to generate revenue of $114 million and adjusted EBITDA of $29 million, but it fell slightly short. The press release indicated that sales expanded 27% to $112 million with adjusted EBITDA growing 43% to $28 million. There was a slide deck that management covered on the conference call.

For the year, Ascend grew revenue by 22% to $406 million. Adjusted EBITDA gained 17% to $93 million.

You can learn more about the company from their new investor presentation.

The 2023 Outlook

The company revealed that it expects revenue to increase 15% in 2023, which was lower than the 24% gain analysts had anticipated at $508 million. It expects similar growth in adjusted EBITDA, which the analysts had expected to grow 36% to $128 million. For the full year, the company is expecting to generate cash flow from its operations and to spend $25 million on capital expenditures as it builds out its New Jersey cultivation facility and adds dispensaries. The company today has 26 operating dispensaries, and it projects that it will be operating 39 in 7 states in mid-2024.

There aren't yet complete updates to the consensus, but assuming 15% sales growth, revenue would grow to $467 million. Adjusted EBITDA at the same margin of 23% would be $107 million.

Valuation

I had a target based on previous projections of adjusted EBITDA of $155 million for 2024 at $2.79 for year-end (enterprise value of 5X, which is very low in my view). I am refining the 2024 adjusted EBITDA that I expect to be $134 million (20% revenue growth and a margin of 24%). Applying the same low multiple of 5X and adjusting for net debt of $233 million yields a new target for year-end of $2.24. Again, my multiple of 5X may be too low, as several peers currently trade higher in 2023.

I have expressed concern about AdvisorShares Pure US Cannabis ETF (MSOS) facing potential liquidation of its holdings if it keeps seeing redemptions. Investors should be aware that AAWH is not held by MSOS.

Conclusion

I think cannabis stocks are very attractive at this time, though I am not sensing that it is time for the new rally to begin. In fact, the Global Cannabis Stock Index posted an all-time low this week.

For investors interested in cannabis companies, I don't think that Ascend Wellness is the cheapest, but it is cheap in my view. Importantly, it is growing still and doesn't face any near-term debt maturities. I like that it is in just a few states currently and can expand into new ones, which is not as true for the larger operators.

In my view, the outlook for 2023, lower than expected, is still solid, and I like the company proactively guiding to run the business to be more focused on cash flow. Neither Green Thumb Industries (OTCQX:GTBIF) or Trulieve (OTCQX:TCNNF) offered guidance for 2023 at all, but analysts chopped their estimates. GTI is expected to see revenue grow just 8% and adjusted EBITDA just 9%, while Trulieve is expected to see revenue decline 1% and adjusted EBITDA to drop 7%. Ascend is expected to grow faster and is cheaper. I like the stock at $1.15, where it ended the day trading and where it ended 2022.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Alan Brochstein, CFA, was one of the first investment professionals to focus exclusively on the cannabis industry. He has run 420 Investor, a subscription-based due diligence platform for investors interested in the publicly-traded cannabis stocks that he is moving to Seeking Alpha, since 2013, and he is also the managing partner of New Cannabis Ventures, a leading provider of relevant financial information in the cannabis industry since 2015. Alan is based in Houston. He and his wife have two adult children.

Before focusing exclusively on the cannabis industry in early 2014, Alan had worked in the securities industry since 1986, primarily with the responsibility for managing investments in institutional environments until he founded AB Analytical Services in 2007 in order to provide independent research and consulting to registered investment advisors. In addition to advising several different hedge funds and investment managers, including Friedberg Investment Management, where he participated as a member of its investment management committee, Alan was also a senior analyst for the independent research firm Management CV. In 2008, he began providing a first-of-its-kind subscription-based service for individual investors, Invest By Model, which offered two different portfolios that investors could replicate in their own accounts. Alan also offered The Analytical Trader at Marketfy, where he used fundamental and technical analysis in a disciplined process to offer specific trade ideas geared towards swing traders.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: At New Cannabis Ventures, we work with several publicly-traded companies, including Ayr Strategies, Greenlane, TerrAscend and TILT Holdings, providing each of them with Investor Dashboards. Please see our disclaimer for more detail:

www.newcannabisventures.com/disclaimer/