Pilgrim's Pride: Downgrading On Weakening Technicals, Shares Still A Long-Term Value

Summary

- Chicken prices weakened in Q4, and that trend could persist in 2023.

- Gross profits on Pilgrim's Pride were dinged, and earnings could be at risk in the coming quarters.

- With a less favorable chart and still attractive long-term valuation, I'm downgrading shares.

- I outline key price levels to watch.

SimonSkafar

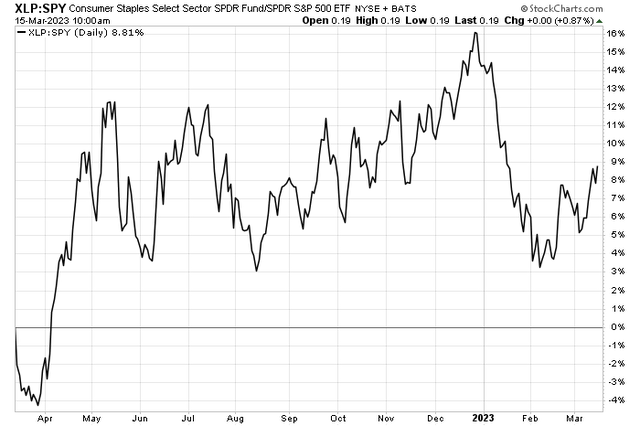

Consumer Staples stocks have climbed relative to the S&P 500 lately. Turmoil cascading across the Financials sector has caused a risk-off atmosphere. Staples companies often outperform in such a time, and that has been the case lately.

I continue to like the valuation of Pilgrim's Pride, and moderating trends in chicken prices should lead to less volatile earnings looking ahead. Unfortunately, the technical situation has worsened.

Staples Stocks Showing Strong Relative Price Action Lately

According to Bank of America Global Research, Pilgrim's Pride Corp. (NASDAQ:PPC) is the second largest, vertically integrated broiler (chicken) producer in the US with an estimated 17% share of processing capacity according to Watt Poultry. The company also maintains chicken operations in Mexico and the UK. In the US PPC maintains a diversified portfolio of big bird (30%), small bird (30%), tray pack/retail (30%), and prepared foods (10%) operations within chicken.

The Colorado-based $5.6 billion market cap Food Products industry company within the Consumer Staples sector trades at a low 7.7 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

Back in February, PPC reported large earnings miss though it did beat on the top line. Shares declined modestly and have been largely consolidating since Q4 last year. Falling chicken prices is a key risk for PPC as the avian flu eases and supply chains are back to normal, but that can be offset by lower grain costs. In its Q4, a decline in big bird pricing dinged gross margins. This will be a key theme to watch this year.

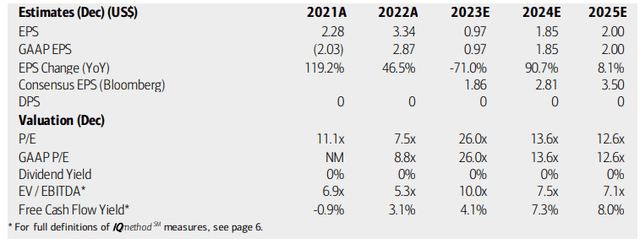

On valuation, analysts at BofA see earnings falling sharply this year, but then rebounding to a normal level of just under $2 by 2024 and at that level in '25. The Bloomberg consensus outlook is more upbeat compared to BofA's forecast. Dividends are not expected to be paid on the stock in the coming quarters. With a below-market EV/EBITDA multiple and respectable free cash flow, I continue to see shares as a solid value play.

The company trades with low teens earnings multiple if we assume normal per-share profits just below $2 while its current price-to-sales ratio is just 0.34 on a forward basis, some 23% below its 5-year average.

Pilgrim's Pride: Earnings, Valuation, Free Cash Flow Forecasts

PPC: A Price/Sales Discount

Seeking Alpha

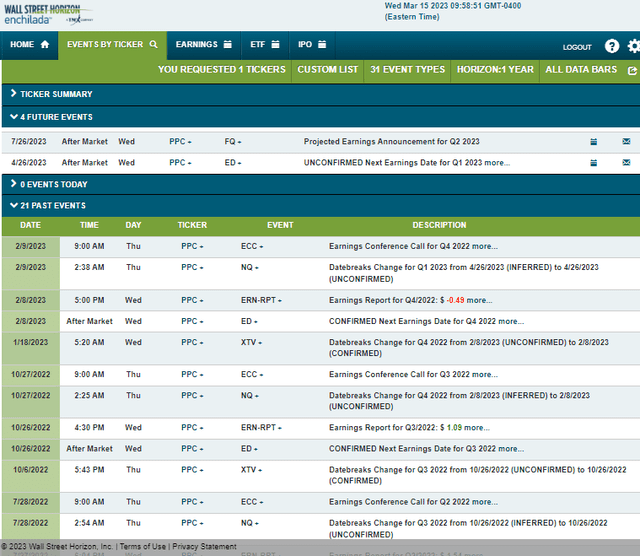

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1 2023 earnings date of Wednesday, April 26 AMC. The calendar is light on volatility catalysts aside from the reporting date.

Corporate Event Risk Calendar

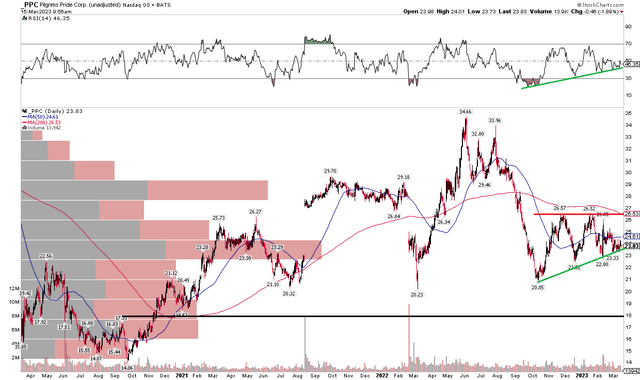

The Technical Take

The PPC chart has an emerging technical pattern coming to light. An ascending triangle pattern, seen as a continuation feature off the 2022 peak, is bearish in this case. Investors must carefully watch the uptrend support line currently near the latest closing price on the stock. A breakdown below the $22 to $23 range would trigger a measured move price objective to near $18 based on the length of the triangle at its onset late in 2022. A bullish breakout, though, would suggest the stock could go to near its highs in the low $30s.

For now, I am cautious on the chart. What's more, shares are trading below the now-falling 200-day moving average, which is another arrow in the quiver of the bears. Still, there's possible support in the $20 to $21 range as that has been an inflection point on three occasions in the last two years.

Finally, notice the RSI momentum indicator at the top of the chart - it is precariously close to breaking trend which could be a harbinger of price action.

PPC: Momentum and Price At Support

The Bottom Line

While I like the valuation on PPC, the chart situation has turned more risky. Combining the technical and fundamentals, I am downgrading the stock to a hold.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.