Southern Company Is Preparing For Our Future

Summary

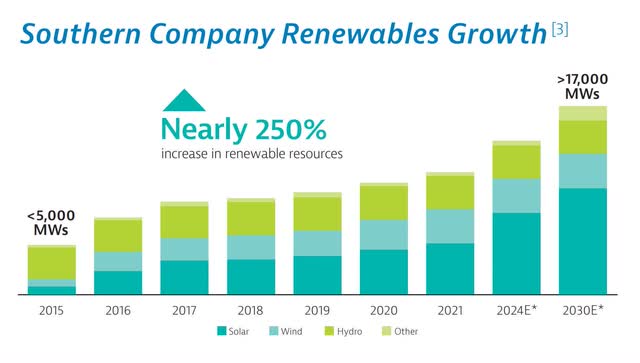

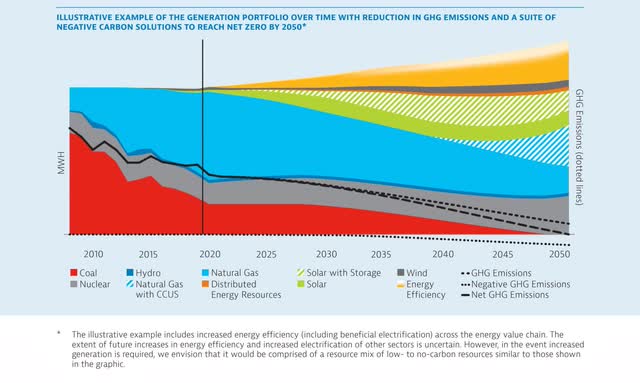

- Southern Company is transitioning its portfolio into one that is carbon-neutral.

- Although they vary seasonally, the company has growing revenues and improving margins.

- The company offers steadily increasing dividends and has a better-than-average PEG of 0.43.

imagedepotpro

Thesis

The inflation reduction act has incentivized utility providers across the country to modernize. Southern Company (NYSE:SO) has decided to take advantage of the offer and is in the middle of a major portfolio update. I am recommending a Buy for Southern Company because they look like they are setting themselves up for long term success.

Company Background

Southern Company is an American gas and electric utility holding company based in the southern United States. Southern Company supplies electricity and natural gas to over 9 million customers and already includes wind, solar, and nuclear in their portfolio. They are on track to meet their goal of reducing their greenhouse gas emission to 50% of 2007 levels by 2030; and plan to be net zero by 2050.

2022 Year In Review (Southern Company)

2020 Implementation and Action Toward Net Zero (Southern Company)

Southern Company has a history of innovation and has joined GE in a joint project where they are developing carbon capture technology. They have also began development of a molten chloride reactor.

The company is working toward getting units 3 and 4 of the Vogtle nuclear plant operational, with unit 4 completing hydro testing in December 2022, and unit 3 reaching initial criticality in early March of 2023.

They have initiated a program to lower waste and losses from natural gas leaks. Their overall attitude has earned them high marks for environmental transparency.

Long-Term Trends

When looking at the expected CAGR for all the separate energy sources the company employs, they are all projected to see varying amounts of growth over the next several years. For the U.S. power market overall it's 5.6%. For solar it's 25.7%. For Natural Gas its 7.2% globally. For Hydrogen as a fuel it's 5.2%. Nuclear is 4.8%, and coal is projected to have a CAGR of 1.97%.

I have been bullish on the long term prospects of hydrogen as a fuel for over twenty years and this company has entered into a coalition with several other utility providers to build a hydrogen infrastructure. Several auto manufacturers are planning on creating demand that the utility providers plan to meet with supply.

Financials

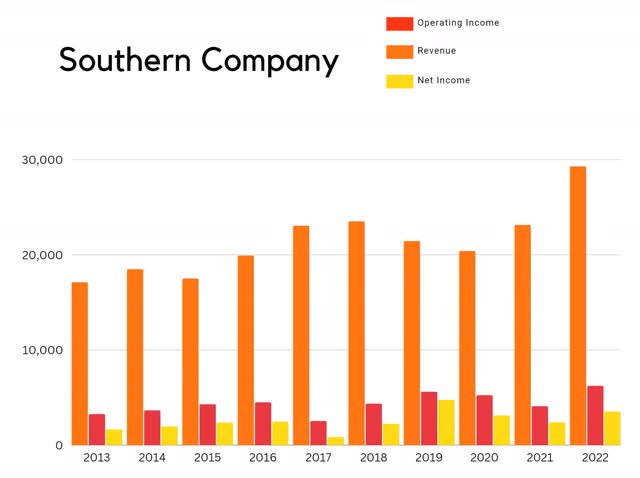

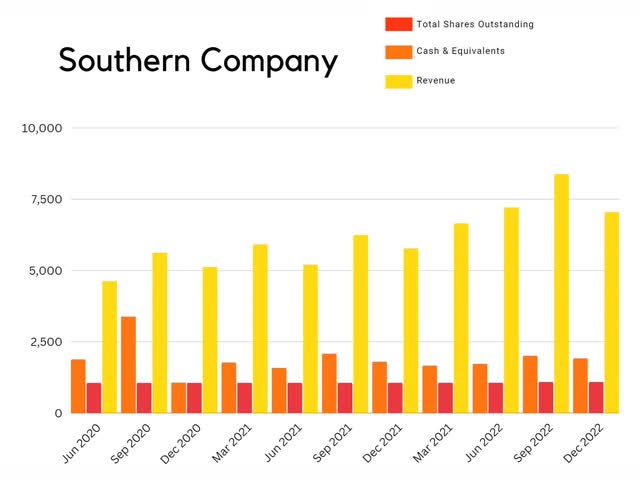

As of the Q4 2022, the company had $1,917M in Cash and Equivalents, and generated $1285M in quarterly revenue. Looking over the last several years of revenue makes it clear that this company has been growing.

SO Annual Revenue (Blake Downer)

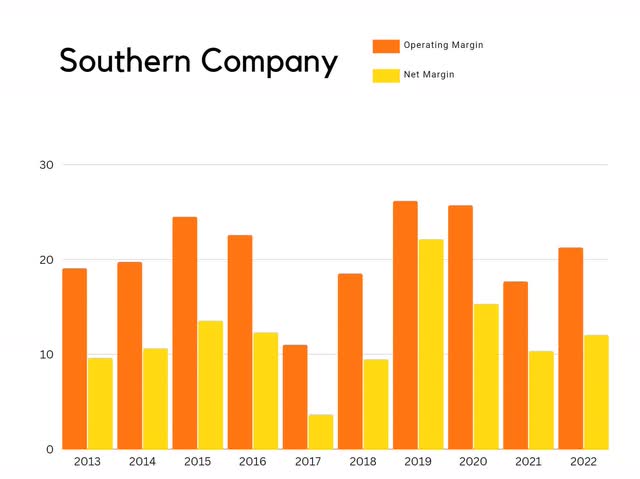

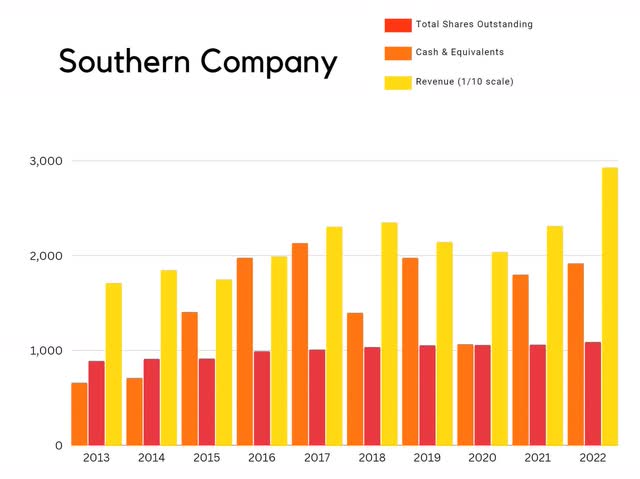

With the exception of outlier years in 2017 and then 2019, their annual margins have been slowly expanding. While inconsistent, net margins grew from 9.62% in 2013 to 12.04% in 2022.

SO Annual Margins (Blake Downer)

I also like to look at the relationships between share count, cash, and revenue; to see how those trends have been playing out. The share count has been slowly increasing, in 2013 it was 887.9M, by 2022 it had grown to 1.0889B. This represents a 22.64% increase in share count. The company also announced in February of 2023 an offering for another $1.5B. Since this company is net income positive, and the cash drawdowns look to be followed by revenue rises in following quarters, they likely represent the purchase of new assets. Revenue rose from $17,087M in 2013 to $29,279M in 2022, representing a 71.35% increase. Although the 22.64% dilution rate is a concern, it has come with a 71.35% increase in revenue, a 2.42% net margin expansion, and a steadily increasing dividend, so this dilution has been accretive.

SO Float - Cash - Revenue (Blake Downer)

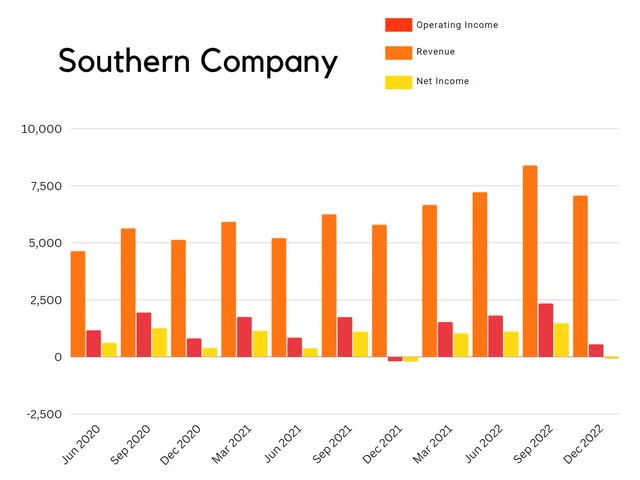

And now a looking through their quarterly reports shows that Southern Company regularly has poor Q4's. When I look over their financial reports, every Q4 they are hit with both a tax burden, and a temporary increase in Operations And Maintenance. Also note, Q3 traditionally has a higher revenue than either quarter next to it, it's a fair assumption that this seasonality is related to increased air conditioner use during the summer months.

SO Quarterly Revenue (Blake Downer)

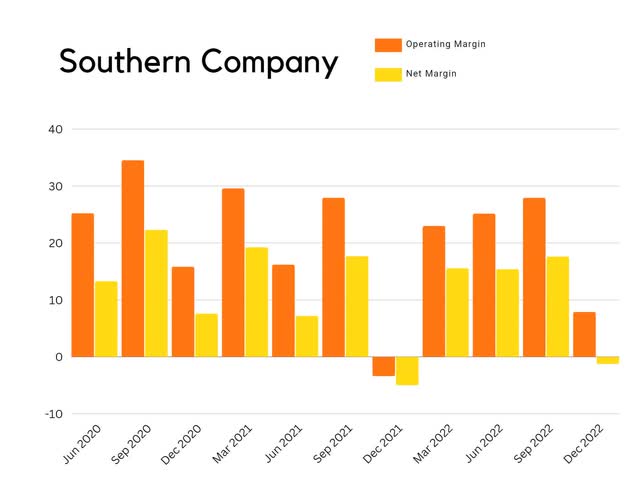

The seasonality that affects their quarterly revenue chart also shows up in their quarterly margins. Q3 is traditionally strong, and Q4 is traditionally weak.

SO Quarterly Margins (Blake Downer)

The company is showing significant gains in revenue while cash remains relatively flat.

SO Quarterly Float - Cash - Revenue (Blake Downer)

When looking at how all these trends are likely to play out over time, it seems clear that adding renewables means the company should experience a revenue rise as a result of the portfolio update. It's hard to say by how much the addition of renewable will affect their margins, but I expect to see margin improvement as units 3 and 4 become operational at the Vogtle nuclear facility. The financial burden that it's construction represents will switch to a boon once it's fully operational.

The timeframe on these are a bit further out, but the widespread adoption of hydrogen infrastructure, and the eventual success of its molten chloride reactor project both represent potential additional revenue streams.

Valuation

As of March 13, 2023, Southern Company was trading for 65.15 per share and had a market capitalization of $69.62B. When compared to other utilities its valuation metrics are not as attractive as they could be. Its price to book and price to sales ratios have it trading above the industry average. Its significant growth is producing a better than average PEG of 0.43.

SO Valuation (Seeking Alpha)

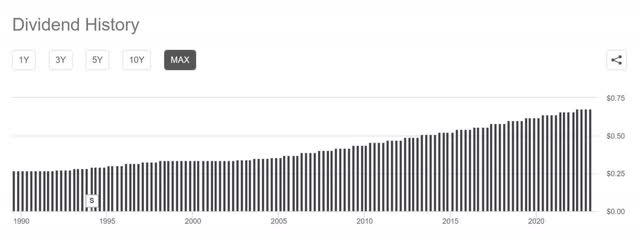

Because this company offers a steadily increasing dividend, discounted cash flow models produce clear areas where long term investors will step in and buy the company purely for its dividend value. The company has an ascending zone of liquidity going all the way back to 2001.

SO Previous Zone Of Liquidity (TradingView via Seeking Alpha)

However, around 2005 they began dividend rate increases and this caused the slope of dividend growth to inflect upwards.

SO Dividend History (Seeking Alpha)

When looking at the post-inflection lows on the chart, the new dividend growth rate is producing an even steeper zone of ascending liquidity. If you scroll back up and take a look at how profits and margins were doing in 2017 and then 2019, it becomes clear why price was allowed to fall below fair value, and then shot well above it.

SO Current Zone Of Liquidity (TradingView via Seeking Alpha)

Risks

This company is in the middle of slowly transitioning its portfolio and there is a chance that they experience unexpected difficulties during the asset update, or that their resulting portfolio may not be as lucrative as they anticipate.

The Inflation Reduction Act is providing substantial support to utilities that are attempting to modernize. It is unlikely, but if it were repealed or parts of it were revised, the support all these separate utilities are depending on could go away.

Natural disasters and malicious intent both perpetually threaten our energy grid. Most disruptions will be temporary and have very little chance of causing permanent damage to the company.

Catalysts

This company has been steadily increasing its dividend since about 2005. It is possible that restructuring their portfolio improves revenue and margins to the point that they increase their rate of dividend growth.

If the planned Hydrogen infrastructure becomes a reality, it will provide Southern Company with an additional revenue stream. While I doubt news of its completion will cause a significant move in share price, it will provide long lasting tailwinds for the company.

Conclusion

This looks like a solid company with a bright future. The attitude the company had adopted around innovation has lowered the risk that they lose their edges and slowly slip away into irrelevancy. I do not have any plans to buy Southern Company stock in the immediate future, but the next time price finds itself trading at or below its fair value area I will take a fresh look at the company and seriously consider becoming a long term investor.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.