Ferrari: Magical Pricing Power

Summary

- Demand for Ferraris never seems to falter the way it does for other luxury cars.

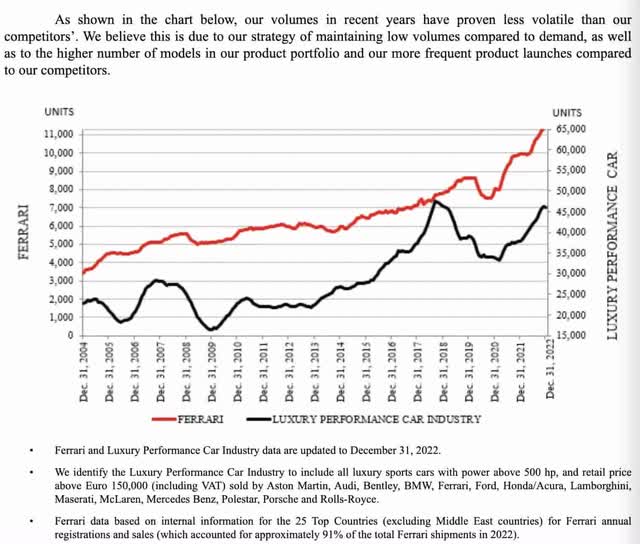

- Volumes for Ferrari are less volatile than what we see from competitors.

- There may be better times to purchase the stock in the future as one could argue it is priced for perfection right now.

zodebala/iStock Unreleased via Getty Images

Introduction

My thesis is that Ferrari (NYSE:RACE) has magical pricing power that sets them apart from other carmakers. The fact that they're among the world's leading luxury brands is not always appreciated such that their stock always seems expensive based on traditional metrics used to value other car companies.

At the time of this writing, €100 equals $107.

The Numbers

A recent writeup from Morgan Stanley (MS) says Ferrari has the best order backlog in the sector; their brand is always strong - even during recessions. Different companies appeal to unique customers that have non-uniform spending habits. If a person with a net worth of $100,000 is offered a guarantee of $1 million or a 50-50 coin flip for a chance at $3 million then the person may well take the guarantee as it will vastly change the person's life. If a person with a net worth of $25 million were to be given the same proposition then that person would likely take the 50-50 coin flip for $3 million because its expected value of $1.5 million is higher than the $1 million expected value of the guarantee. This example shows that sometimes there are economic factors that need to be considered outside of the raw math calculations. In a similar manner, Ferrari doesn't have the scale to compete with cars that are apples to apples but they have magical pricing power such that they can charge 3 to 4 times more for a car whose quality is only twice as nice. Few companies have this power and they always look expensive based on shortcut metrics like the P/E ratio.

There are luxury cars and then there are Ferraris; this is a car that is more expensive and exclusive than other luxury brands. Per Ferrari's 2022 20-F, the cars and spare parts segment brought in revenue of €4,341 million which averages out to €328 for each of the 13,221 cars shipped during the year (although much of the parts component came from cars shipped in previous years). The point is Ferraris can be extraordinarily expensive. A January 2023 Barron's article mentions the $260,000 F8 Tributo, the $225,000 Roma and the $421,000 Purosangue.

Ferrari's 20-F has a graphic showing one of the ways Ferrari is different from other luxury vehicles. The order book for Ferrari goes out further in time; demand for Ferraris is sticky:

The unflattering demand for Ferraris goes beyond traditional racecars. Boosting the Range portfolio, the four-door V12 Ferrari Purosangue was launched in September 2022 and customers lined up with alacrity. Despite the high demand for this new vehicle, the Barron's article mentioned earlier reminds us that Ferrari will protect their brand by capping output of the Purosangue at 20% of annual production. Answering a question about the Purosangue's impact on the gross margin during the 4Q22 call, CEO Benedetto Vigna points out that one of Ferrari's key assets is the stability of their product development process.

Valuation

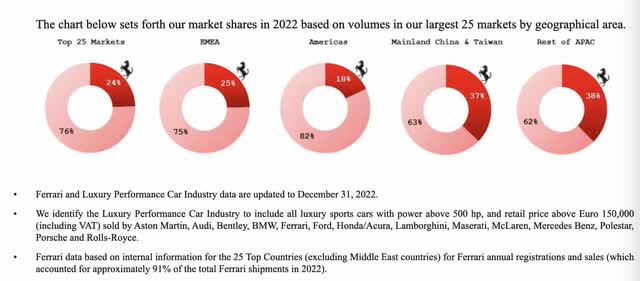

Looking at luxury performance car market share, Ferrari is well represented in Europe, the Americas and Asia per the 20-F. I expect Ferrari to continue to make more money in Asia during the next decade as the economy of that region grows:

Luxury performance car share (2022 20-F)

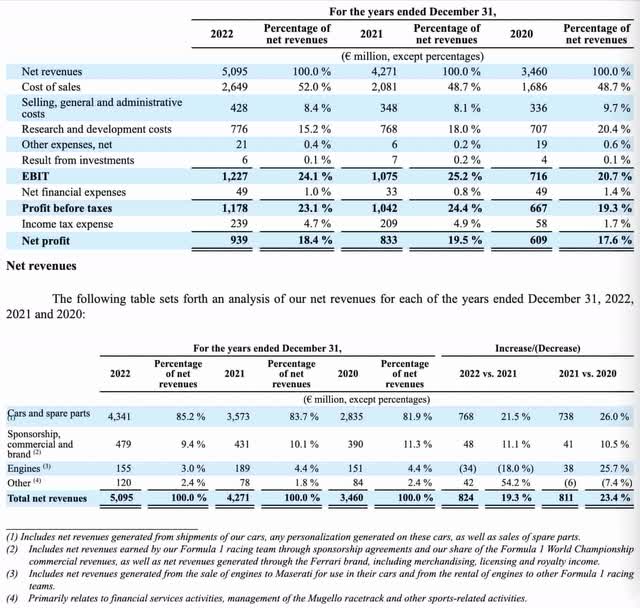

The gross margin for Ferrari is absolutely unheard of in the automobile industry! The latest 20-F shows they had a gross margin of over 51% in 2020 and it was 48% in 2022:

Ferrari income statement (2022 20-F)

The $155 million above from engines isn't a large percentage of overall revenue but I think it says something about Ferrari's expertise that they build engines for Maserati (STLA).

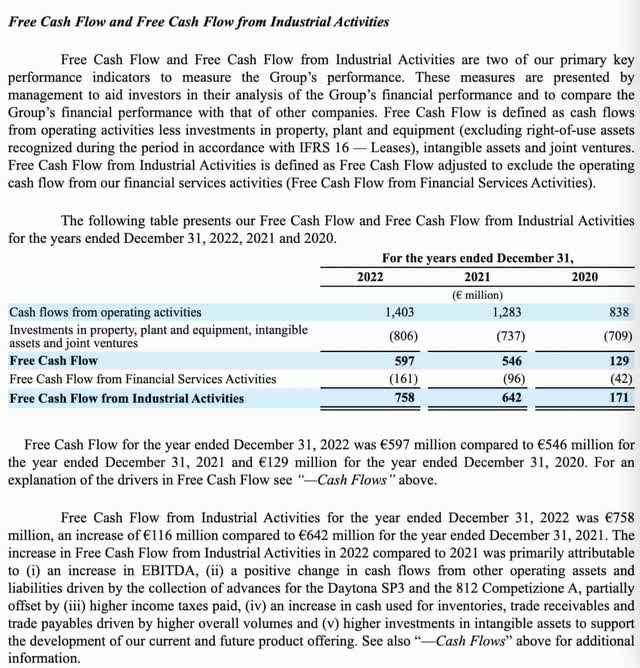

Free cash flow ("FCF") from industrial activities is one of the numbers I like to hone in on from a valuation perspective. Per the 20-F, it went up from €642 million in 2021 to €758 million in 2022 as they made collections in advance for the Daytona SP3 and the 812 Competizione A:

Ferrari has been around for 75 years and I think they'll be around another 75 years. They are changing with the times; hybrids have increased from 2% of engine type in 2020 all the way up to 22% in 2022.

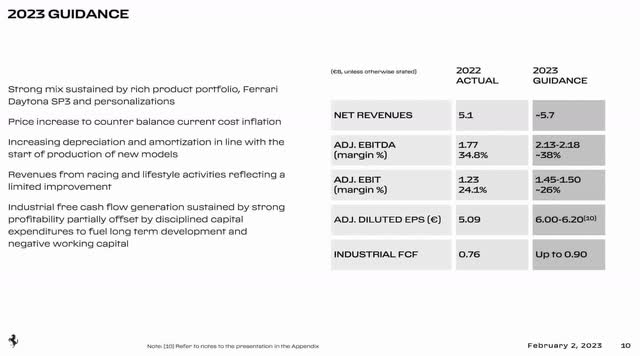

Per the 4Q22 presentation, 2023 industrial FCF guidance is up to €900 million:

2023 guidance (4Q22 presentation)

At the June 2022 Capital Markets Day, CFO Antonio Picca Piccon went over a slide showing cumulative 5-year industrial FCF of €4.6 to €4.9 million from 2022 to 2026. If it reaches the upper end then that averages out to about €1 million per year.

There may be better times to purchase the stock in the future as one could argue it is priced for perfection right now. Given the magical pricing power and the growth ahead, some investors are willing to pay nearly 60x the €758 million industrial FCF which comes to about €45.5 million or nearly $50 billion. This seems very rich, even for a company as wonderful as Ferrari. Per the 2022 20-F, there were 181,953,498 shares outstanding at the end of the year. Multiplying by the March 15th share price of $256.29 gives us a market cap of nearly $47 billion. The enterprise value is €1,433 million more than the market cap due to debt of €2,812 million and non-controlling interests of €10 million which are partially offset by cash and equivalents of €1,389 million.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of STLA, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.